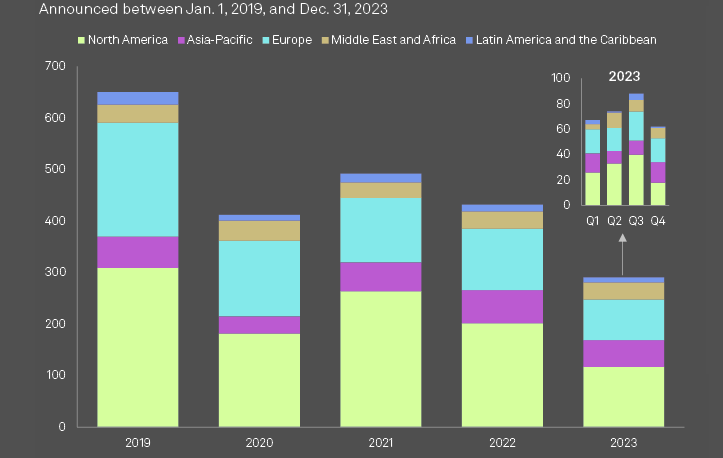

In 2024, the North American market for mergers and acquisitions (M&A) continues its lackluster performance, largely attributed to persistently high interest rates that dampened corporate enthusiasm for deal-making for the second year in a row.

Data compiled by S&P Global Market Intelligence reveals a notable contraction in the sector’s activity.

The aggregate value of M&A transactions in the United States and Canada plummeted to $1.222 trillion, marking a 15.3% decrease from the revised figure of $1.442 trillion in 2022.

Furthermore, the frequency of deals experienced a significant downturn, with the total number of transactions falling by 23.7% to 16,695, down from a revised total of 21,871 in the preceding year.

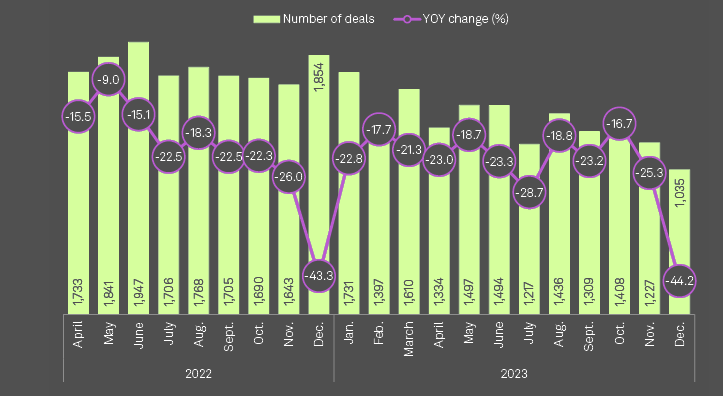

An analysis of monthly deal volumes throughout 2023 exhibits a consistent trend of decline when juxtaposed with the corresponding months in 2022, with December registering the steepest annual decline of 44.2%.

The main trends of American M&A activity

Early 2023 saw a continuation of the robust M&A activity from 2022, driven by factors such as technological advancements, market consolidation, and strategic realignments across various sectors.

Deal activity has been at such lows that many sectors should start seeing some increased M&A activity in 2024.

Greater clarity in the economic outlook and the end of the rate-hiking cycle would foster more M&A growth, while antitrust scrutiny remains a potential barrier.

Certain sectors were particularly active in M&A. Technology, healthcare, and finance were among the leading sectors.

The tech sector, especially, saw numerous deals as companies sought to enhance their digital capabilities. Healthcare M&A was driven by the need for innovation and expansion in biotech and pharmaceuticals.

M&A deals in the global insurance and banking sector

Insurers received a boost from hardening property-casualty rates in 2022, but the growth outlook for the insurance sector in the 2023 year appears to be a mixed bag.

The effects of the on-going Russia-Ukraine conflict on global insurance business are still being felt – from greater complexity around war and cyber risk exposures, to increased costs of doing business from inflated energy and commodity prices.

According to S&P Global, mergers and acquisitions deals in the global banking sector hit the lowest level for at least five years in 2023, a year marked by high-profile bank failures and high interest rates.

The deal count, which includes whole bank deals, asset sales and minority investments, fell 32.6% year over year to 291.

The steepest decline was in North America, where deals totaled 117, 42.1% fewer than the previous year. The year saw three of the largest US bank failures ever, which had a chilling effect on M&A activity, while higher interest rates also had an impact.

Concerns about more liquidity-related failures are now subsiding. The US Federal Reserve held interest rates steady in the past three Federal Open Market Committee meetings and signaled rate cuts in 2024, which is boding well for a return to dealmaking.

In Europe, M&A deal volume dropped by 33.6% year over year to a total of 79. A lack of progress in Europe’s banking and capital markets unions lessened the appeal of cross-border consolidation in addition to higher interest rates.

Deal volume in Asia-Pacific fell 18.8% to 52. A challenging fundraising market and geopolitical uncertainties all weighed on dealmaking in the region, as did higher interest rates, according to analysts, with these conditions likely to remain in early 2024.

There was a mix of both large and mid-sized deals. Large deals were often driven by strategic acquisitions, while mid-sized deals were more common among private equity firms and smaller companies looking to consolidate or diversify.

Mergers and acquisitions activity at the beginning of 2023 is expected to remain somewhat muted, consistent with the environment in the second half of 2022. But looking further ahead to the second half of 2023 and beyond, deal-making is likely to accelerate, according to Morgan Stanley’s report.

Unlike past M&A down cycles, such as after the dot-com bubble of the early 2000s and the financial crisis of 2008-2009, it is the recent reduction in activity will be shorter lived. The growth in the private equity industry, sophistication of corporate clients and overall strength of corporate balance sheets and earnings should result in increased M&A activity in 2023 and beyond.

M&A activity has remained slow through most of 2023

M&A activity has remained slow through most of 2023, but various catalysts have the potential to start encouraging dealmakers to come off the sidelines in 2024. Potential stability in rates, pent-up demand and pushes to consolidate or divest in certain industries may drive an uptick in the outlook for M&A activity.

The extremely small number of transactions in 2023 will make year-over-year M&A comparisons in 2024 easy to surpass, but large deals will continue to face hurdles, especially in the US where antitrust concerns have been a focus of regulators.

Mergers and acquisitions M&A in the global insurance industry dropped sharply in the of 2023 with 300+ completed deals worldwide, down from 400+ in the 2022 and 240+ at the same point 2021 year, according to Insurance Growth Report.

According to Insurance M&A Deals Outlook, in the face of stark economic pressures – inflation, rising energy costs, and looming recession – insurers remain focused on growth opportunities. The volume of M&A in the global insurance industry reached its highest rate of growth for ten years, up 9.5% in 2023.

According to Global Insurance Sector Outlook, a lack of exit opportunities has also factored in the dealmaking slowdown for private equity. Signs of life in the IPO market would improve fundraising prospects as it would give private equity another pathway to exit investments from portfolio companies.

Private equity firms continued to play a significant role in M&A activity, using their significant capital reserves to invest in various sectors, particularly those poised for growth or transformation.

International M&A involving American companies also remained a key feature, with firms seeking to expand their global footprint or tap into new markets.

Regulatory scrutiny, particularly concerning antitrust issues and national security concerns, influenced deal-making, especially in sectors like technology and telecommunications.

US, Canada M&A activitiy – Number of deal

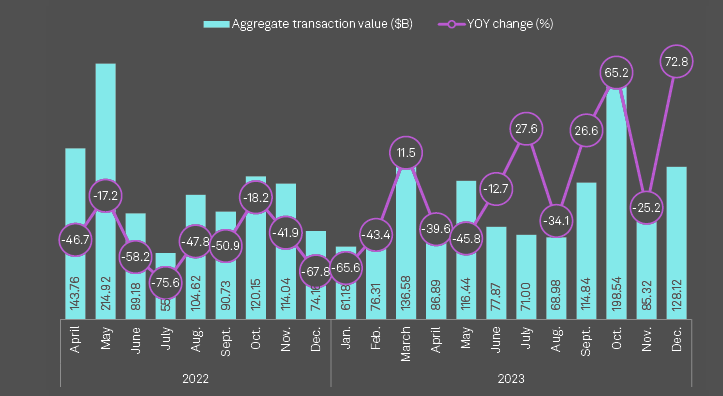

Nonetheless, there was a glimmer of resurgence in the latter half of the year; the value of transactions during this period ascended to $666.80 billion. This figure not only represents a 20.1% increase over the first half of the year but also a 19.2% improvement compared to the same span in 2022.

US, Canada M&A activitiy – Aggregate transactions

Cheap financing opportunities for M&A

Many of the same factors that depressed M&A activity in 2022 carried over into 2023, including tight monetary policy wiping out cheap financing opportunities for M&A.

Still, while they were generally smaller than the largest transactions in 2022, several large-scale deals were announced to close out 2023.

The oil and gas industry was responsible for several of the year’s largest deals amid a slew of megamergers in the fourth quarter of 2023, including Exxon Mobil Corp.’s $65.32 billion deal for Pioneer Natural Resources Co., which is expected to close in the first half of 2024. Chevron Corp.’s $60.42 billion deal for Hess Corp. was also announced in the fourth quarter of 2023.

Earlier in 2023, market conditions conducive to oil and gas deals spurred expectations of a sector-wide increase in M&A for the year.

Largest US, Canada M&A deal

In the concluding quarter of 2023, North America witnessed a notable surge in mergers and acquisitions (M&A), with the final three months accounting for four of the year’s ten largest deals.

This flurry of activity, particularly pronounced in December, signals a burgeoning trend in large-scale M&A for the forthcoming year.

December emerged as a pivotal month, recording the year’s second-highest transaction values in the materials, financials, and healthcare sectors.

However, it presented a paradoxical trend in the volume of deals, marking the lowest count across most sectors, barring real estate and energy and utilities. The industrials sector led in deal frequency, concluding 660 transactions in the quarter, closely followed by the technology, media, and telecommunications sector with 635 deals, and the consumer sector registering 430 transactions.

………..

AUTHORS: Gaurang Dholakia, Ingrid Lexova – Global Market Intelligence analysts

Edited by Oleg Parashchak