In the 2023, insurers specializing in commercial and personal lines experienced an enhancement in their underwriting outcomes compared to the previous year. In this analysis, Beinsure will delve into the principal trends shaping the U.S. commercial and personal insurance sector during the 2023-2024 period.

This improvement was primarily due to increased pricing, especially noticeable in the personal auto sector, coupled with a reduction in catastrophe-related losses, according to S&P Global Report.

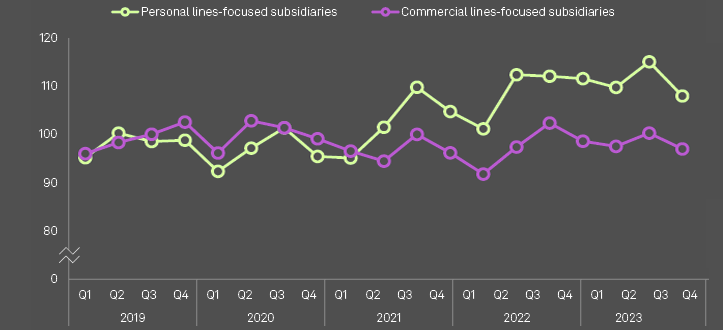

An analysis of insurance subsidiaries, which allocate at least 70% of their direct premiums to personal lines such as personal auto, homeowners, and farmowners insurance, revealed a notable improvement in their net combined ratio.

This ratio declined by 4.1 percentage points, settling at 108% in the third quarter of 2023, down from 112.1% in the same period of the previous year, as per the data from quarterly regulatory statements.

However, when juxtaposed with their counterparts in the commercial insurance sector, these personal lines insurers are still lagging in terms of performance.

The U.S. commercial auto insurance segment to remain unprofitable in 2024, with rising claims severity from inflation and burgeoning litigation risk despite continued price increases and underwriting changes.

The U.S. commercial auto insurance line has regularly underperformed, posting a CR above 100% in 11 of the last 12 years.

A recovery in economic and driving activity has gradually moved commercial auto claims volumes back to pre-pandemic norms, pushing the CR to over 105% in 2022 (see U.S. Auto Insurance Performance & Underwriting Results).

Pandemic-related economic lockdowns led to a 25% decline in reported commercial auto liability claims in accident year 2020 and associated declines in judicial activity and reserve development led to a rare segment underwriting profit (99% CR) in 2021.

According to U.S. Auto Insurance Market Review, negative effects of higher loss severity on commercial auto performance which is expected to continue, driven by higher general inflation levels, supply chain and skilled mechanic labor shortages and rising used vehicle costs. The average statutory closed claim payment in commercial auto liability increased by 18%

Insurers focusing on U.S. commercial insurance lines demonstrated underwriting profitability, with their combined ratio registering at 97% in the same quarter.

This figure is approximately 11 percentage points more favorable than that of the personal lines insurers.

U.S. Commercial & Personal Insurance combined ratio

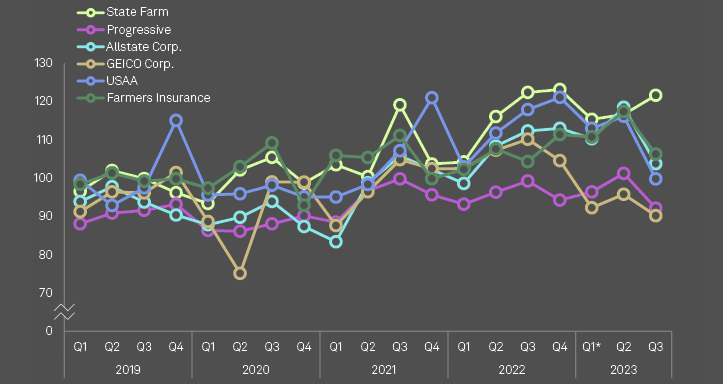

Personal lines insurer’s combined ratio

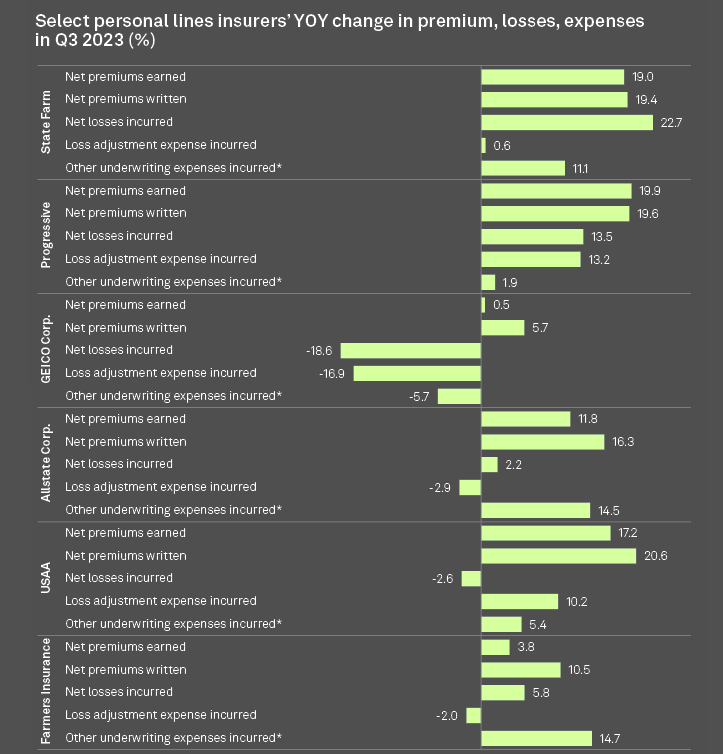

U.S. Personal lines insurer’s premium & losses

Geico

In the competitive landscape of U.S. personal lines insurance, Berkshire Hathaway’s Geico distinguished itself with the most significant annual enhancement in its combined ratio. Demonstrating remarkable efficiency, Geico’s net combined ratio sharply decreased to 90.2% for the quarter, marking a 20 percentage point improvement from the previous year. This notable advancement primarily stemmed from a substantial 18.9 percentage point reduction in the loss and loss adjustment expense ratio.

Geico attributes this to a confluence of factors: higher average premiums per auto policy, more favorable developments in revising prior-year claims estimates, and a decrease in claim frequencies. Additionally, strategic adjustments such as rate increases and a curtailment in advertising expenditures contributed to a significant reduction in the insurer’s expense ratio, which fell to 9.1% from the previous year’s 10.2%.

USAA

Services Automobile Association (USAA) in the realm of combined ratios. This insurer stands out with a significant year-over-year enhancement of 18.1 percentage points in its combined ratio. Demonstrating considerable improvement, the Texas-based insurer recorded a decrease in its combined ratio from 117.9% in the previous year to 99.8% in the third quarter of 2023. This marks a notable achievement for USAA, as it is the first instance since the second quarter of 2021 where its combined ratio has dipped below the 100% threshold.

Allstate

Turning our focus to Allstate, we observe a decrease in their combined ratio to 103.8% during the same quarter, marking a reduction of 8.6 percentage points from the previous year. This is particularly significant considering the approximate $400 million escalation in catastrophe losses. It’s important to note that the catastrophe losses for the first nine months of 2023 reached a record $5.57 billion, the highest for this period in the company’s history, in stark contrast to $2.33 billion in the prior year.

In the auto insurance sector, Allstate reported improved results, attributed in part to rate increases. Other contributing factors to this positive outcome included higher premiums earned, reduced adverse prior-year reserve reestimates, and enhanced expense efficiencies. These elements were underscored during the company’s earnings call as pivotal in driving better performance.

Progressive

Progressive stood out with an impressive near 20% year-on-year escalation in net premiums earned, outperforming its industry counterparts. This surge can be attributed to significant hikes in premium rates, alongside an expansion in the volume of active policies under its management.

In the aftermath of the substantial impact from Hurricane Ian in 2022, Progressive exhibited a noteworthy 47% reduction in catastrophe-related losses in the third quarter of 2023. This contributed to the company achieving its most favorable net combined ratio since the first quarter of 2021, registering at 92.2%, a notable improvement from the 88.5% ratio observed back then.

State Farm

State Farm Automobile faced a challenging quarter, recording the highest escalation in net losses incurred among its peers. The company’s net combined ratio worsened to 121.7%, the least favorable amongst its contemporaries. While this represents a marginal 0.7 percentage point enhancement compared to the same period last year, it marks a regression of five percentage points from the second quarter of 2023.

Farmers Insurance

In contrast, Farmers Insurance Group did not experience a year-on-year amelioration in its combined ratio, which remained at 106.3%, indicating a stable yet challenging performance in the context of industry comparisons.

A key trends for the U.S. commercial and personal insurance landscape in 2024

- Increased Digitization and Technology Adoption

- Rise of Telematics and Usage-Based Insurance (UBI)

- Impact of Climate Change on Underwriting and Pricing

- Regulatory Changes and Compliance

- Health & Liability Insurance Market Shifts

- Focus on Customer Experience and Personalization

Insurers were expected to continue investing in digital technologies to improve customer experiences, streamline underwriting processes, and enhance claim handling. The use of artificial intelligence, machine learning, and advanced analytics for risk assessment and fraud detection would likely become more prevalent.

Particularly in personal auto insurance, the adoption of telematics and UBI was anticipated to grow, allowing insurers to offer more personalized premiums based on actual driving behavior.

With the increasing frequency and severity of weather-related events, insurers were expected to adjust their risk models to account for climate change impacts. This could lead to higher premiums and changes in coverage terms, especially in areas prone to natural disasters.

Insurers were likely to face evolving regulatory requirements, particularly related to consumer data protection, climate risk disclosure, and solvency standards. Compliance with these regulations would become a critical aspect.

Emerging insurance technologies and societal trends (like the gig economy and autonomous vehicles) were poised to reshape liability insurance, with insurers developing new products to address these evolving risks.

Continued consolidation in the insurance industry, through mergers and acquisitions, was anticipated, along with strategic partnerships between traditional insurers and tech companies.

Enhancing customer experience and offering personalized insurance products based on individual risk profiles and preferences would remain a priority.

………………….

AUTHORS: Kris Elaine Figuracion – Insurance Associate at S&P Global Market Intelligence