The U.S. commercial auto insurance segment to remain unprofitable in 2024, with rising claims severity from inflation and burgeoning litigation risk despite continued price increases and underwriting changes.

Fitch Ratings expects the segment combined ratio (CR) to exceed 106% in 2023, as the YTD direct loss ratio in commercial auto liability increased to 72% in 1H2023 from 69% in 1H2022, with further potential for recognition of reserve deficiencies (see 6 Major Types of Car Insurance in U.S.).

The U.S. commercial auto insurance line has regularly underperformed, posting a CR above 100% in 11 of the last 12 years.

Pandemic-related economic lockdowns led to a 25% decline in reported commercial auto liability claims in accident year 2020 and associated declines in judicial activity and reserve development led to a rare segment underwriting profit (99% CR) in 2021.

A recovery in economic and driving activity has gradually moved commercial auto claims volumes back to pre-pandemic norms, pushing the CR to over 105% in 2022 (see U.S. Auto Insurance Performance & Underwriting Results).

Claims incidence is also affected by other fundamental issues, including a lack of trained drivers in a tight labor market and risks tied to distracted driving given individual’s dependence on digital devices.

Commercial Auto Insurance Results

According to U.S. Auto Insurance Market Review, negative effects of higher loss severity on commercial auto performance which is expected to continue, driven by higher general inflation levels, supply chain and skilled mechanic labor shortages and rising used vehicle costs. The average statutory closed claim payment in commercial auto liability increased by 18% in calendar year 2022.

Similar issues are currently plaguing the personal auto line, with underwriting losses in 1H2023 amid higher losses from physical damage and bodily injury coverages.

More frequent attorney involvement in transportation claims and greater potential for outsized verdicts in several jurisdictions continue to exacerbate commercial auto loss costs, with insurers’ commercial auto litigation risk increasing amid the expanding presence of the litigation finance industry (see U.S. Auto Insurance Claims Satisfaction Study).

Ride-sharing business included in the commercial auto results of several large carriers has also produced material underwriting losses in recent years, driven by inadequately priced business for Uber and Lyft, which require high limits and have experienced increasingly heightened litigation activity.

U.S. Auto Insurer Profit Recovery Slow to Materialize

Most U.S. personal auto insurers continue to report underwriting losses despite sharper improvement in premium rates, with the first half of 2023 marked by continued unfavorable claims severity and higher catastrophe related losses, Fitch Ratings says.

Future profit improvement will continue to be hindered by unusually high loss severity (see TOP 10 Largest U.S. Auto Insurance Companies 2023).

A review of mid-year personal auto segment results from public company GAAP filings reveals that for a group of nine insurers that report quarterly personal auto segment results, aggregate written premiums were up 10% from the prior year.

The segment’s combined ratio (CR) moved down slightly to 100.4% from 101.3% in 1H22, attributable to a return to strong underwriting profit at GEICO.

In 1Q23, Allstate indicated it would discontinue coverage for ride-sharing companies unless telematics-based pricing is implemented to better manage pricing and loss costs.

U.S. Auto Insurer GAAP Combined Ratios

| Combined Ratio | 2023 | 2022 |

| Insurers Aggregate | 100.4% | 101.3% |

U.S. Auto Insurer GAAP Written Premium

| Written Premium | 2023 | Change |

| Insurers Aggregate | 67,540 | 10.2% |

All other reviewed carriers reported weaker year-over-year CRs and Progressive Corporation (PGR) was the only other carrier to report a sub 100% CR. Carriers reporting an auto CR above 110% for the first half of 2023 include: Kemper Corporation, Horace Mann Educators Corporation and The Hartford Financial Services Group.

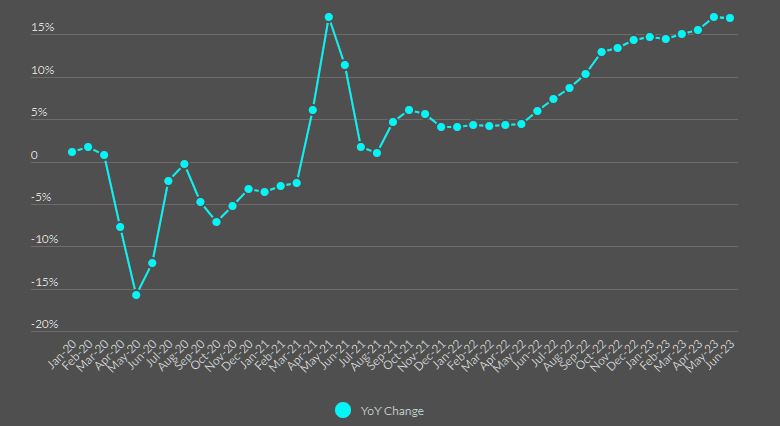

U.S. Motor Vehicle Insurance Cost Changes

Insurance Costs Were Up 16.9% YoY in June, the 10th Consecutive Month > 10% Growth.

Higher litigation and settlement costs also contribute to rising claims severity. Major auto writers continued to report sharp severity increases in their latest earnings releases. PGR and Allstate Corporation each reported an 11% YTD increase in claims severity across all coverages. These more volatile, negative claims trends increase the likelihood of insurers reporting adverse development on personal auto loss reserves in the near term.

An inordinate number of convective storm events across the U.S. created substantial losses in the homeowners’ market, but also added incurred claims to auto writers. For this subject group, catastrophe losses were 2.0% of 1H23 earned premiums, compared to 0.9% in the year earlier period.

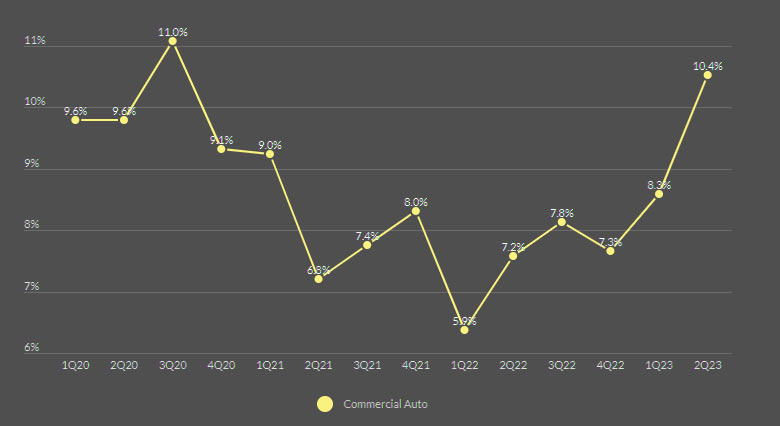

Commercial auto quarterly renewal premium rates have averaged over 8% since 2017, including a 10.4% increase for 2Q2023 according to the Council of Insurance Agents & Brokers Quarterly Commercial Market Survey

Multiple years of underwriting adjustments and increased pricing have failed to move segment results to a more profitable footing.

These actions are anticipated to foster improvement in 2024 results, but a return to an underwriting profit is unlikely in the next few years without a material tempering of loss cost trends.

Commercial auto – year-over-year quarterly rate change

Source: Fitch Ratings, Council of Insurance Agent & Brokers

Long-term, underwriting losses have also corresponded with reserve deficiencies as ultimate incurred losses exceeded original company estimates.

Commercial auto liability prior period adverse reserve development averaged approximately 7% of calendar year earned premiums from 2013-2022, including 6.5% in 2022.

Despite commercial auto underwriting woes for the P&C industry, there is widespread disparity in results for individual underwriters.

Market share is widely dispersed, with the top 10 writers holding 46% of 2022 net written premiums market share.

TOP 10 U.S. Commercial Auto Insurance Companies by Premiums

| Company | Premiums, $ bn | Market Share, % |

| 1. Progressive | 8.8 | 17.1% |

| 2. Travelers | 3.1 | 6.0% |

| 3. Liberty Mutual | 2.2 | 4.2% |

| 4. National Indemnity | 1.9 | 3.7% |

| 5. Auto-Owners | 1.6 | 3.1% |

| 6. Nationwide | 1.6 | 3.1% |

| 7. Old Republic | 1.4 | 2.6% |

| 8. W.R. Berkley Corp. | 1.2 | 2.3% |

| 9. State Farm | 1.2 | 2.2% |

| 10. Allstate | 1.0 | 2.0% |

| Rest of industry | 27.7 | 53.7% |

| P&C Industry | 51.7 | 100.0% |

Progressive is the leader in market share, as well as segment profitability, in part to a focus on smaller accounts and expense efficiencies, with an average statutory CR of 87% from 2018-2022.

Of the top 10 commercial auto writers, only Old Republic International and W.R. Berkley have a below 100% average CR for the same period.

In contrast, Liberty Mutual and State Farm have average segment CRs above 120% over the latest five years.

…………………….

AUTHORS: James Auden, CFA – Managing Director Fitch Ratings North American Insurance, Christopher Grimes, CFA – Senior Director Fitch Ratings, Laura Kaster, CFA – Senior Director Fitch Wire – North and South American Financial Institutions