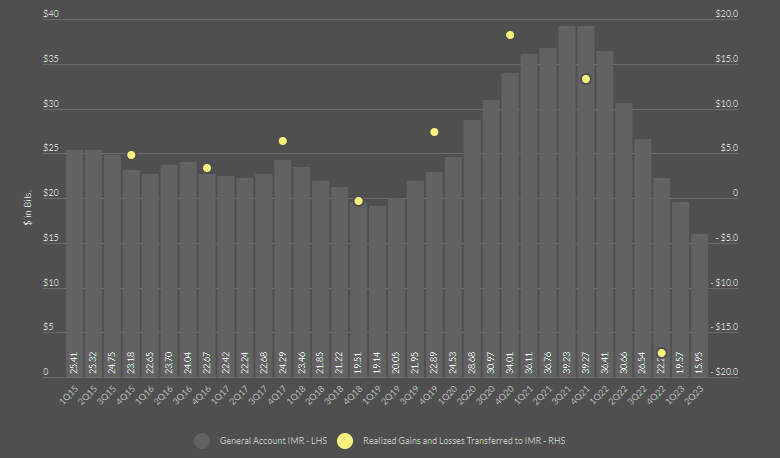

Rising interest rates are expected to continue to reduce investment maintenance reserve (IMR) balances for U.S. life insurers. However, stable investment portfolios, strong liquidity and effective asset-liability management will mitigate the negative effects on statutory capital and cash flows, according to Fitch Ratings research.

Amid persistently low rates, the industry’s total IMR reserve reached a peak of ~$39 billion at 4Q2021.

Realized losses transferred to IMR in 2022 totaled $17.3 billion, with reserve balances down $6.3 billion YTD through 2Q2023 to $16 billion.

As of 2Q2023, it has plummeted 59% since then, amid Fed tightening, asset repositioning and widening spreads.

The world economy is now likely to grow

The world economy is now likely to grow a bit faster in 2023 than Fitch Ratings expected in its June Global Economic Outlook but the deepening slump in China’s property market is casting a shadow over global growth prospects, just as monetary tightening increasingly weighs on the demand outlook in the US and Europe.

Fitch have raised 2023 world growth forecast by 0.1pp to 2.5% reflecting surprising resilience so far this year in the US, Japan and emerging markets excluding China.

Analitics have revised up US growth by 0.8pp to 2.0%, Japan by 0.7pp to 2.0% and EM ex. China by 0.5pp to 3.4%. This has more than offset a 0.8pp cut to China – to 4.8% – and a 0.2pp cut to the eurozone, to 0.6%.

But Fitch have cut 2024 world growth forecast by 0.2pp to 1.9% with widespread downward revisions and reduced 2024 US forecast by 0.2pp to 0.3%, the eurozone by 0.3pp to 1.1%, and China and EM ex. China by 0.2pp to 4.6% and 3.0%, respectively.

Life Insurance Industry Aggregate Interest Maintenance Reserve Balances

Favorably for the industry, the NAIC recently adopted guidance allowing for the statutory admittance of net negative IMR balances, according to US Life & Non-Life Insurance Market.

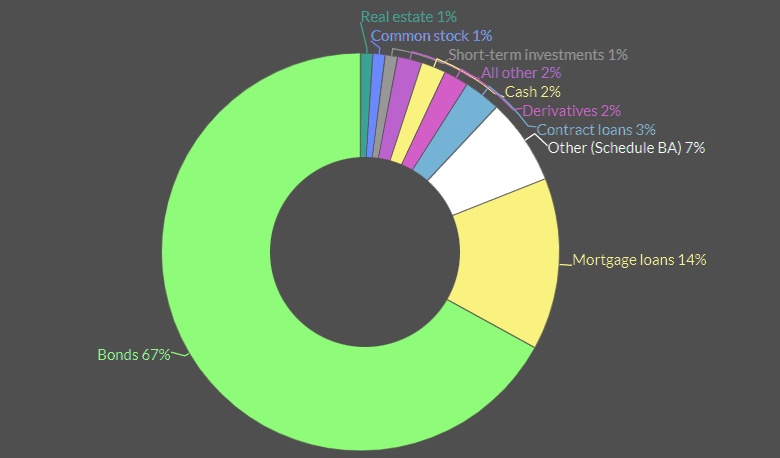

Amid high inflation pressuring loss costs, life insurers have increased liquidity, with cash and short-term holdings at 7% of industry invested assets.

Insurers’ ratings are likely to be resilient to a moderate fall in commercial real-estate (CRE) values, Beinsure says in a report, although a systemic crisis would put greater pressure on individual issuers with larger exposures.

This could increase total adjusted capital, as qualifying insurers would be allowed to admit net negative IMR up to 10% of adjusted capital and surplus.

Insurers with risk-based capital (RBC) ratios over 300% can utilize limited admittance of net negative IMR.

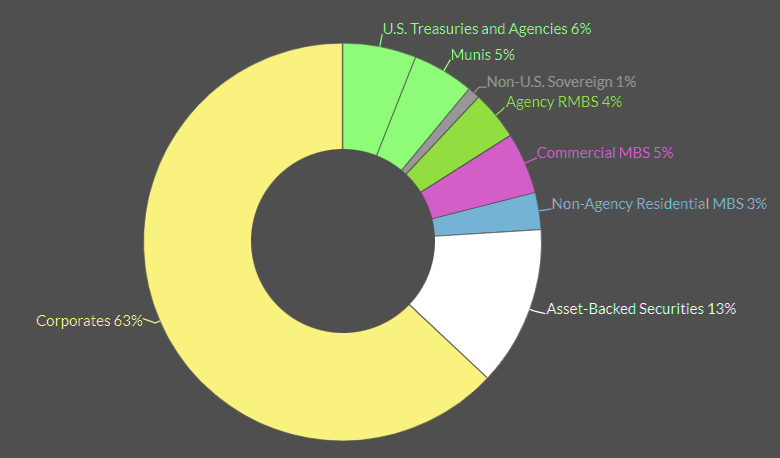

U.S. life insurers’ commercial real estate (CRE) exposure is predominantly via commercial mortgage loans, with more modest exposure to commercial mortgage backed securities (CMBS) at less than 5% of cash and invested assets, with equity real estate not a meaningful allocation.

IMR balances are down 28% and expected to further decline

Under the prior accounting treatment, negative IMR balances were recorded as non-admitted liabilities, which reduced capital and RBC ratios for insurers with negative IMR balances, even if portfolios generated greater yields amid rising rates.

However, some insurers’ respective state regulators allowed for the admittance the negative balances.

IMR statutory accounting treatment smooths net income, as it requires realized fixed income gains or losses correlated to changes in interest rates to be amortized into income over the remaining term-to-maturity of the investments sold (including related hedging programs) instead of being reflected in income.

The estimated 2Q23 calculated IMR balance is $7 billion. Approximately 28% of companies had negative balances as of 1H2023, up from 23% at YE22 and 8% in 2021.

Realized losses transferred to IMR were $15 billion in 2022, versus a gain of approximately $8.8 billion in 2021 and gains of $15.3 billion in 2020.

At YE22, the effect of lower/negative IMR to our aggregate RBC ratio on earnings and capital was well within ratings expectations, but was material for certain insurers, although not a ratings constraint.

US Life Insurer Investment Allocation Expected to Remain Generally Consistent

Adjusted to reflect negative IMR balances as admitted liabilities, RBC ratios for Fitch’s rated universe increased 3 percentage points to 450% on an aggregate basis.

Insurers most affected at YE2022 were Prudential Financial, OneAmerica Financial Partners, Principal Financial Group, and Massachusetts Mutual Life Insurance Company.

US Life Insurers Total Investments

We do not expect the change in accounting treatment to have a meaningful effect on the composition or risk profiles of investment portfolios of life insurers, which are largely comprised of stable, high-quality fixed income investments.

US Life Insurers Bond Investment Breakdown

Credit fundamentals remain strong, with interest coverage and leverage at pre-pandemic levels, though market volatility is substantial, and the industry has material unrealized loss positions on fixed-income portfolios.

Impairments for issuers are expected to rise modestly in 2023, but losses should remain benign across most asset classes.

Derivative-related losses have accumulated for some issuers, but generally this is more of an accounting phenomenon, as statutory reserves are generally recognized at book value, but would decline on an economic basis.

Insurers are benefitting from reinvesting in a rising rate environment on reinvestments, and can generally benefit from opportunistic sales of fixed income securities prior to maturity.

…………………..

AUTHORS: Jamie Tucker – CPA, CFA, Senior Director, Life Insurance Fitch Ratings, Jack Rosen – Director Fitch Ratings, Laura Kaster – CFA, Senior Director, Fitch Wire (North and South American Financial Institutions)