S&P Global Ratings’ insurance industry and country risk assessment (IICRA) for the global marine protection and indemnity (P&I) sector. The assessment is comparable with that of other sectors, notably the global property/casualty reinsurance (P&C Reinsurance) and global trade credit sectors.

As a mutual insurance association, P&I clubs provide risk pooling, information and representation for members. P&I insurance covers risks that are not typically placed in the traditional insurance market.

Typical P&I cover can include a carrier’s third-party risks for damage caused to cargo during carriage, war risks, and risks of environmental damage such as oil spills and pollution.

Clubs should adopt an analytical approach when seeking increases, rather than a unilateral approach. When working with organizations a more detailed analysis of each member’s risk profile hand-in-hand with the context of club performance and the marketplace is encouraged.

Global Marine & Cargo insurance market

Global marine insurance premiums in 2021 reached USD 33 billion, up 6.4% on 2020. Premiums have been lifted by increased global trade volumes, a stronger US dollar, increased offshore activity, higher vessel values and a reaction to deteriorating results in previous years. Insurers in Europe and Asia, in particular, saw premium growth.

The positive trend for the ocean hull business, starting in 2021, continued into 2022. Premiums grew 4.1% in 2021, reaching USD 7.8 billion.

There was continued rapid growth in the Nordic region and China, but much weaker in the UK (Lloyd’s) market, where the decline of recent years continued. The extraordinarily benign claims impacted both the frequency and the cost in recent years and could achieve the recovery of previous years’ adverse results.

The cargo market saw an increase in premiums for 2021 to USD 18.9 billion, driven by increased global trade volumes. Also, in this segment, claims impact was comparably benign in 2021 and loss ratios in most markets improved.

The offshore energy sector saw an increase in overall premiums, reaching USD 3.9 billion in 2021, representing a 6.9% increase in 2020. This is the second year of rise after six years of decline (2014 to 2019).

The demand for offshore energy insurance typically tracks oil prices as projects become viable. Historically, there is an 18-month time lag between improved oil prices, authorised offshore expenditure, and unit reactivation. Loss ratios kept in recent years a fragile balance with significant loss events being absent, but with a long backlog in claims reporting, the youngest years still have to mature. With the oil price rally in 2022, more activity and, thus, demand for offshore energy insurance may be expected.

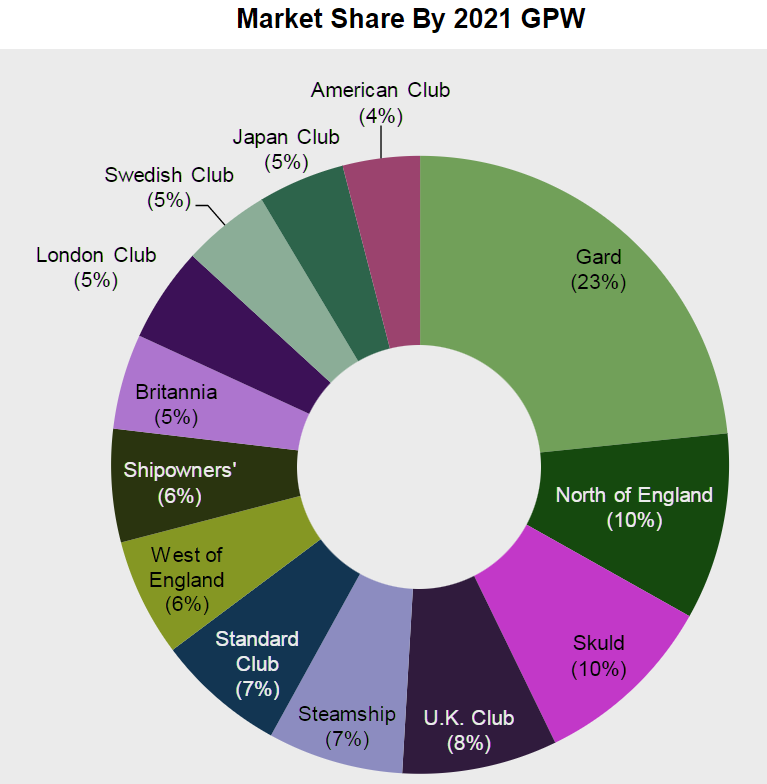

P&I market share by premiums

S&P base assessment on analysis of the 13 P&I members of the International Group (IG), together representing over 90% of global owned tonnage.

The marine and cargo insurer analyzed more than 240,000 marine insurance claims worldwide between January 2017 and December 2021, worth approximately €9.2bn in value, and has identified a number of claims and risk trends that are driving major loss activity in the sector.

Inflation is another key concern for marine insurers and their policyholders as recent increases in the values of ships and cargos mean losses and repairs are becoming more expensive when things go wrong (see Aviation, Marine & Cargo Global Insurance Market Forecasts)..

Country Risk

All P&I clubs are based in developed jurisdictions and source a significant amount of their business from these markets. Despite an increase in business from China and other less developed nations, notably emerging Asia-Pacific markets, we believe that country risk for the sector is still geared toward Western Europe, the U.S., and Japan. Therefore, our country risk assessment for the global P&I sector is low (see Marine & Cargo Insurance Market Outlook).

The industry is exposed to economic risks that are generally specific to developed markets.

In analytics view, the sector’s diversification mitigates the effects of economic downturns. In addition, the low country risk reflects the sector’s exposure to well-established and transparent institutions and developed banking systems, together with strong payment cultures and minimal rule-of-law risks.

Industry Risk

Our assessment of industry risk reflects the sector’s weak profitability prospects, with potentially material product risks, notably the exposure to large claims.

The P&I sector’s product risk is similar to that of global P/C Reinsurance, where volatility in the latter typically comes from natural catastrophes.

However, these risks are more limited for P&I clubs because vessels can navigate away from tsunamis and cyclones.

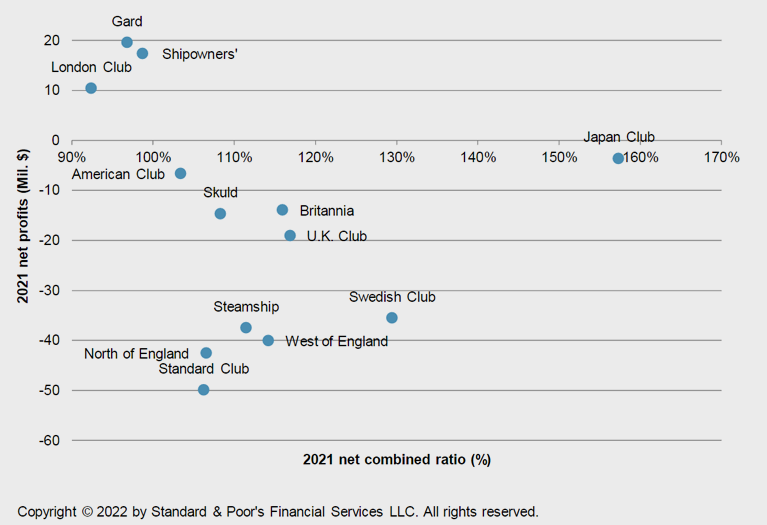

The P&I sector has suffered from technical losses resulting from large claims, bringing combined ratios to 116%-117% in the 2019-2020 financial years.

The poor performance continued, but in the latter part of the year the frequency of these large, pooled claims moderated. In fact, we calculate a net combined ratio for the sector of 108%.

Even for mutual companies that do not target profit maximization, we consider this performance to be poor, both absolutely and relative to clubs’ own targets. The positive trend in operating performance has continued into 2022, with pool activity being low to date this year.

While we still view the sector’s profitability as weak, it should show an improvement over last year. Prospectively, we believe the sector’s operating performance will continue its improving trend over the next two years, with combined ratios expected to decrease to around 105%-107% over 2022-2023.

The shipping sector is also having to deal with many other challenges including a growing number of disruptive scenarios, supply chain issues, inflation, time-pressured crew members and employees, increasing losses and damages from extreme weather events, implementing new low-carbon technology and fuels, as well as Russia’s invasion of Ukraine (see Lloyd’s and Insurers Support to EU & UK Govt on Ship Insurance Ban for Russian Oil).

A few factors support this expectation, including:

- At the February 2022 renewals, most clubs announced general increases on P&I rates of 5%-15%, with an expectation that we will also see some rate increases in the February 2023 renewals, albeit at lower levels than in 2022. In our opinion, higher rates should also help clubs weather the current inflationary environment.

- On top of the general increases, clubs continue to revise the terms and conditions of their covers, increasing the deductibles applied in the event of a claim and consequently limiting the losses they pay.

- P&I clubs have not had any material exposure to the Russia-Ukraine conflict. Indeed, hull and war risks are not covered under P&I policies.

- P&I clubs have been increasingly diversifying their premium base into the better performing fixed-premium and charterers lines, which help offset the P&I lines’ poor performance.

- Finally, we believe that tighter underwriting discipline, enhanced risk management frameworks, and increased investments in loss-prevention programs should help control the technical performance in the longer term.

In terms of return on members’ funds, P&I clubs traditionally benefitted from investment returns to offset the underwriting losses and result in overall net profits. However, because of the volatility in investment results, notably toward the end of the 2021 financial year, we estimate returns to be around -3.9% in 2021.

The volatility in investment results continued in 2022. We therefore assume a return on members’ funds at around breakeven, though this could be negative should investment returns remain volatile.

Factors limiting profitability

- The nature of the P&I business exposes the clubs’ operating performance to volatility, notably because of the unpredictability of large claims frequency. This has been evident recently–for example the net combined ratio of 116% in 2021 compared with 88% in 2015.

- In addition, the sector is exposed to unpredictable claims settlements in less-developed jurisdictions. Nevertheless, the IG pooling arrangement is a key mitigating factor, where claims above a certain limit (currently $10 million) are ceded to a pool, allowing the P&I clubs to share the losses and reduce the volatility in combined ratios.

Factors supporting profitability

- The IG dominates the global P&I sector, with the 13 clubs accounting for over 90% of the global fleet as measured by tonnage. Non-IG companies have not been successful in competing with the established players, suggesting appropriate barriers to entry do exist to mitigate the impact that potential competition could have on the sector’s profitability. Indeed, Norwegian Hull Club is moving out of the P&I insurance business after 14 years. The mutual said it had been unable to establish a profitable P&I business since it expanded into the market in 2018.

- Furthermore, there are close relationships between the IG clubs and their ship-owner members, with high retention rates year after year. Strong customer loyalty makes it difficult for new players to gain meaningful market share. That said, we view regulatory barriers as low, given that the process of setting up for new entities is not cumbersome.

- In terms of M&A, the sector has been quiet for many years, notably after the 2015 talks between the UK Club and Britannia failed to result in a merger. However, one of the most significant developments earlier in 2022 is the announcement of the merger between the North of England and Standard Club, to be formed as NorthStandard. If the merger completes, the combined group would be the largest member of the IG in terms of tonnage (representing 20% of the IG) and the second largest in terms of GWP and free reserves. The clubs plan to complete the merger in February 2023, subject to regulatory approvals. In our opinion, further consolidation in the sector would be beneficial, notably as fewer and stronger clubs would likely result in improved profitability.

- We forecast real premium growth rates to remain positive and in the low-to-mid single digits. Given expected inflation of 7.2% in 2022 for the advanced economies, we expect GPW growth of 8%-10% for the P&I sector in 2022. For 2023, our inflation forecast stands at 4.1%. As a result, we expect nominal premium growth of around 6%, supported by further general increases.

- With the majority of P&I clubs incorporated in the U.K., the Nordic region, Bermuda, the U.S., and Japan, we believe the sector benefits from a supportive regulatory framework. Most P&I clubs are subject to the Solvency II regime, or a close equivalent. We have not identified any governance or transparency issues at the sector level.

Adjustment factor

Despite the weak performance in the sector overall, some P&I clubs have operated with a more stable performance. Along with our expectation of improving profitability over the current and next year, we apply a positive adjustment to maintain our overall IICRA at intermediate risk.

Global P&I Sector-Key Metrics

| 2024f | 2023f | 2022f | 2021 | |

| Gross premium written (mn $) | 5,279 | 4,980 | 4,698 | 4,350 |

| Net combined ratio (%) | 102-105 | 102-105 | 105-107 | 107.8 |

| Return on members’ funds (%) | 4-6 | 3-5 | 0.0 | (3.9) |

The sector’s metrics are based on the 13 P&I members of the International Group.

Risk trends in marine insurance

A number of risk trends in the analysis that are likely to impact loss activity in the marine sector – both today and in the future:

- Sources of disruption continue to increase: Recent years have seen a number of maritime incidents, natural catastrophes, cyber-attacks and the Covid-19 pandemic cause major delays to shipping and ports. Further disruption has also been caused by congestion, labor shortages and constrained container capacity. There are also greater concentrations of cargo risk on board large container vessels and in major ports, so any incident has the potential to simultaneously affect large volumes of cargo and companies.

- Commercial pressures are already a contributing factor in many losses that have resulted from poor decision-making. With the pressure on vessels and crew currently high, the reality is that some may be tempted to ignore issues or take shortcuts, which could result in losses.

- Climate change is increasingly affecting marine claims: Natural catastrophes is already the fifth biggest cause of marine insurance claims, by frequency and severity according to AGCS analysis. Extreme weather was a contributing factor in at least 25% of the 54 total vessel losses reported in 2021 alone, while drought in Europe during 2022 again caused major disruption to shipping on the Rhine. In the US, it dropped inland waterways around the Mississippi River to levels not seen for decades, impacting global transportation of crops such as grain.

- A more sustainable, greener approach in shipping sector is needed, but comes with risks: Efforts to decarbonize the shipping industry, which is a major contributor to global greenhouse gas emissions (GHGs) will also impact claims going forward. Reducing GHGs requires the shipping industry to develop more sustainable forms of propulsion and vessel design and use alternative fuels. As much as the introduction of new technology and working practices is needed to move to a low-carbon world, it can result in unexpected consequences – insurers have already seen a number of machinery breakdown and contaminated fuel claims related to the introduction of low sulfur fuel oil in recent years as part of the move to cut sulfur oxide emissions. Machinery breakdown is already the fourth largest cause of claims by frequency and value.

- Impact of Russia’s invasion of Ukraine: The shipping industry has been affected with the loss of life and vessels in the Black Sea, trapped vessels in blocked Ukrainian harbors and the growing burden of sanctions. Although the signing of the ‘Black Sea Grain’ Initiative in July 2022 enabled some vessels trapped in ports to move out of the conflict zone others remain. The full value of these trapped vessels is unclear, but industry reports have estimated it could be as much as $1bn. Under some marine hull and cargo insurance policies an insured party may be able to claim for a total loss after a specific time has passed since the vessel/cargo became blocked or trapped.

……………………………

AUTHOR: Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media by S&P Global Ratings Data