From cryptocurrencies to Non-Fungible Tokens (NFTs) – the crypto assets market is growing. From an underwriting perspective, crypto assets may lead to unexpected losses and opportunities for new forms of insurance coverage.

Insurance covers damage inflicted by unpredictable events, and cryptocurrency insurance is no different.

Highly volatile cryptocurrency often makes headlines as the target of multimillion-dollar hacks, leading to investors losing millions and the sector shedding billions.

Understanding the Crypto Market

A cryptocurrency is a digital or virtual currency. The currency is encrypted (secured) using cryptography to secure financial transactions, create additional units, and verify the transfer of assets. In contrast to fiat currency and central banking systems, many cryptocurrencies are decentralised systems based on blockchain technology.

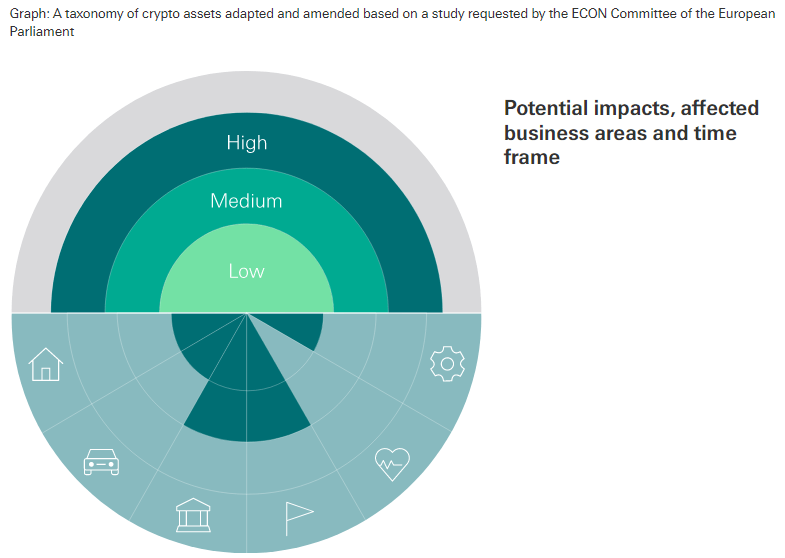

Cryptoassets represent a seismic shift in the financial markets and, in recent years, have grown in popularity. The technological advancements behind cryptoassets have come a long way and have the potential to disrupt the financial system as we know it.

Central banks and other financial institutions can play a key role in shaping this landscape. However, this global phenomenon is creating confusion on multiple levels i.e. how individual cryptoassets differ from one another and the role of the major participants in the cryptoasset ecosystem. With the buzz around bitcoin, altcoins, cryptocurrencies and tokens, a whole new financial ecosystem has been created.

As more and more institutions operating across the capital markets grapple with the implications of cryptoassets, the fees and regulatory uncertainty remain a concern for traders as cryptoasset marketplaces continue to broaden the range of fiat currencies to support. This whitepaper explores the taxonomy of cryptoassets, market participants and the current capital market landscape.

Crypto Asset Market is growing rapidly

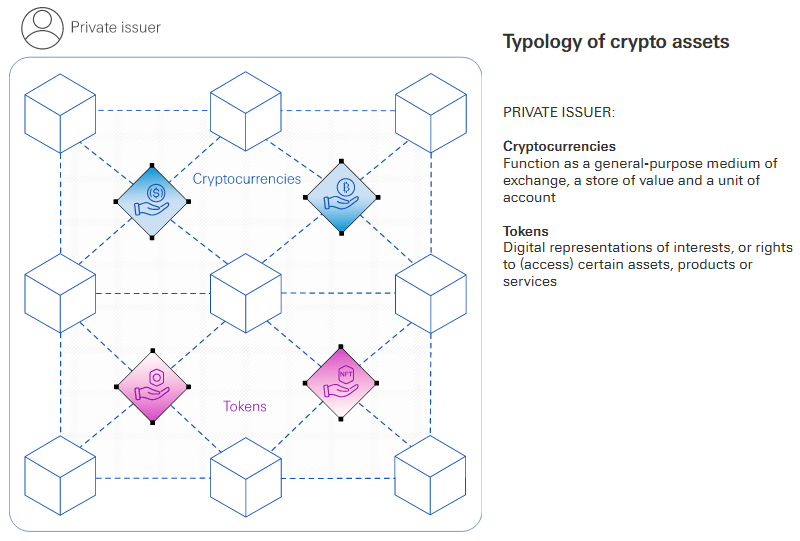

According to Swiss Re Institute, Crypto assets are privately-issued digital assets secured with cryptography. They can take the form of cryptocurrencies, which perform the role of currency. They can also be tokens, which are digital representatives of interests, or rights to (access) certain assets, products or services.

In a world where people are spending a significant amount of time infront of their screens, the ability to verify scarcity of digital assets for the very first time has the potential to spearhead a generational shift from physical to digital ownership.

According Crypto Market Review, crypto was not spared from the market downturn that also plagued traditional asset classes such as stocks and bonds. Black swan events such as the suspension of fund withdrawals by several centralized lending platforms and the collapse of the algorithmic stablecoin TerraUSD in the first half of this year contributed to further negative sentiments and worries. That said, market booms and busts are not uncommon and are characteristics of market cycles.

The cryptomarket downturn has helped to weed out excesses and the reset in valuations back to more sustainable levels is arguably a positive development for the long-term viability of the ecosystem.

Nonetheless, price action alone is not representative of the health of the ecosystem, nor does it show the full picture of the underlying developments. As such, in this report, we aim to share a holistic review of the past half-year in crypto by analyzing the latest data, trends, and outlook across different areas of the crypto ecosystem. We remain optimistic about the long-term outlook for crypto since we continue to see further adoption and innovation in the space.

According to NFT Market Review, investment tokens provide holders ownership or entitlement rights similar to dividends. Investment tokens can also provide rights to virtual assets, such as Non-Fungible Tokens (NFTs), and to physical assets such as collectibles and real estate.

Despite a sharp decline in trading volume in June, the NFT market has had an overall resilient first-half. 2022 started strong for NFTs as trading activity surged, contributed by the launch of the LooksRare and X2Y2 marketplaces and the corresponding trading rewards offered by them both.

NFT sales recorded approximately $17.7B in first-half 2022, which is similar to sales recorded in second-half 2021. This is also a nearly 10x growth on a year-on-year basis when compared to first-half 2021.

From an investment perspective, crypto assets have been referred to as a potential hedge against inflation or uncorrelated alternative assets. Notably, re/insurers have not yet made significant investments in the sector due to the high volatility of the assets and other uncertainties.

Typology of Crypto Assets

With the traditional finance sector a multi-trillion dollar industry, DeFi platforms and builders have sufficient reason and incentive to continue to build in DeFi and vie for a larger slice of the proverbial pie.

Despite scalability being somewhat limited due to high transaction fees, inconsistent liquidity and security concerns, development is consistent and growing, while fundraising in DeFi continues to hit an all-time high.

Losses for existing covers

Crypto assets theft is of growing concern. Hackers reportedly made off with several billions of dollars in virtual assets in 2021. An open question for insurers in this regard is whether certain crypto assets are implicitly covered by existing property or cyber policies.

Recently, crypto assets have also been a contentious topic in court as they may be used to hide funds from authorities. For instance, dividing a family’s Bitcoin assets has become a major source of contention in divorce cases.

There is a growing industry of forensic investigators who charge large sums to track the movement of cryptocurrencies like Bitcoin and Ether from online exchanges to digital wallets, in order to investigate whether a spouse has correctly declared the amount of crypto assets owned.

Similarly, directors and officers may hide funds by investing them in crypto assets. This can increase court costs for personal lines and D&O Insurance covers.

Billions of dollars of premiums are collected annually for D&O insurance but the profitability of the sector has suffered in previous years because of increasing competition, the growing number of lawsuits and rising claims frequency and severity. Underwriting results have been negative in many markets around the world, as event-driven litigation, collective redress developments, regulatory investigations and higher defense costs have taken their toll.

New risk pools for insurers?

With the rapid growth of the crypto asset sector, the question of insurability of such assets with new covers becomes more relevant. Digital assets, including digital artwork in the form of Non-Fungible Tokens (NFTs), cannot be insured against physical risks. However, insurers could consider providing coverage for the private key that ensures access to the NFT.

In the case of offline physical storage of such access keys – a so-called “cold wallet” – insurers could also offer cover for loss of or damage to the wallet. Similarly, online accounts on crypto exchanges are vulnerable to hacking.

Here insurers could provide cyber coverage, either for the operating entity of an exchange or to the individuals trading on it.

A relatively new development is the tokenization of material assets, from collectibles to real estate. If tokenization of collectibles such as art works or other luxury goods gains traction, an increasing number of collectibles will need to be stored and maintained at dedicated physical locations.

The storage facilities will need insurance coverage and could face accumulation risk as many valuable assets may be stored in the same location. In all cases, the lack of historical data and the dynamic nature of the crypto asset space make design and pricing of respective insurance covers difficult. In addition, a significant challenge for insurers in this space is the price volatility of such assets, as well as the challenges of verifying a loss such as a theft.

Due to the high energy consumption and resources required for server infrastructure, insurers may be reluctant to provide coverage barring improvements on emissions. Similarly, insurers would need to be able to clearly distance themselves from illegal activities associated with crypto assets.

Investing in cryptocurrency is risky. The prices of even the most established cryptocurrencies are much more volatile than the prices of other assets such as stocks.

The prices of cryptocurrencies in the future could also be affected by regulatory changes, with the possibility that cryptocurrency could become worthless. Cryptocurrency funds are also subject to cybersecurity risks including hacking and theft.

According to Report Blockchain GameFi Market, GameFi is one of the fastest growing segments in the video game industry. GameFi is an amalgamation of the words “Game” and “Finance”, and incorporates elements of both gaming as well as financial incentives.

Before now, video games were housed on centralized servers owned by a gaming company who had the implicit power to shut off the world whenever they felt like it. What’s more, players had no actual ownership of the items they accumulated through their character — the clothes, the weapons, the prizes. It all existed solely within the confines of the game, and had no real value in the outside world.

That’s not the case with GameFi products, thanks to its decentralized nature and reliance on blockchain technology. Beyond direct monetary incentives, GameFi offers the prospect of digital assets ownership in virtual worlds that players devote a large portion of their time on and the potential for interoperability by bringing those assets across different virtual worlds.

Regulatory certainty can turn the needle

Large uncertainties remain around the regulation of crypto assets. Many financial institutions have concerns about becoming directly involved in providing services such as insurance for the crypto asset segment due to the perceived regulatory risks.

The fluidity and “invisibility” of ultimate ownership make it hard to ensure compliance with regulations such as anti-money laundering (including “know your customer” requirements), international trade and economic sanctions, and “proceeds of crime” laws which would continue to apply to the financial institution counterparty.

Regulators continue to investigate ways to fill the gaps. Some countries prohibit trading in certain crypto assets, which will hold back market development.

Less restrictive but clear regulation and thus certainty would both accelerate sector growth, and open new opportunities for insurers considering investing in or providing insurance covers for crypto assets.

The collapse of some of the previously most respected blockchain companies and projects have forced investors to go back to the drawing board and reevaluate how they assess companies. While painful for many, these are the critical building blocks of any budding market and the liquidation of some of the companies today may turn out to be a necessary evil that reduces risks of further contagion down the road.

……………