GameFi is one of the fastest growing segments in the video game industry. GameFi is an amalgamation of the words “Game” and “Finance”, and incorporates elements of both gaming as well as financial incentives.

Before now, video games were housed on centralized servers owned by a gaming company who had the implicit power to shut off the world whenever they felt like it. What’s more, players had no actual ownership of the items they accumulated through their character — the clothes, the weapons, the prizes. It all existed solely within the confines of the game, and had no real value in the outside world.

That’s not the case with GameFi products, thanks to its decentralized nature and reliance on blockchain technology.

Beyond direct monetary incentives, GameFi offers the prospect of digital assets ownership in virtual worlds that players devote a large portion of their time on and the potential for interoperability by bringing those assets across different virtual worlds.

According Binance Research Report, the vast potential that comes with integrating traits of blockchain technology, gaming, financialization, and NFT market, has contributed to significant interest in and growth of GameFi.

The GameFi Landscape

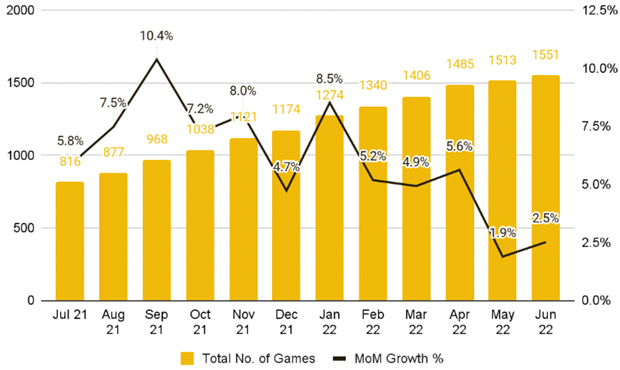

The number of GameFi projects has continued to rise and reached 1,551 games as of June 2023. However, slowing growth is evident as month-over-month growth tapered to low single-digit growth rates, clocking 2.5% in June 2023.

The broad overall negative market sentiment likely contributed to this decline as market participants take a breather from blockchain activities and the number of new game launches slow.

Number of games continue to grow but at a slower rate

Critics of Ethereum often cite its high gas fees and slow throughput as reasons for favoring alternative blockchains. Data based on GameFi market share supports such a view. While Ethereum remains the dominant blockchain with the highest number of GameFi projects built, market share has fallen steadily from over 50% in July 2021 to around 35% in June 2023.

BNB chain has been the bright spot and has taken market share from Ethereum – it has nearly 31% market share and is the second largest ecosystem based on the number of GameFi projects.

According Crypto Market Review, without diving into the details, we would also highlight that there are other considerations when evaluating this space besides looking at market share by number of games (e.g. quality of games, types of games, product life cycle etc.) for which different chains have their respective advantages.

Typically, players can earn in-game rewards by completing tasks, battling other players or progressing through various game levels. Many of the play-to-earn games on the scene right now rely heavily on what game designers call a grinding mechanic, in which players have to spend lots of time doing repetitive tasks within a game to advance or unlock prizes — or, in this case, crypto tokens.

Each game has its own model and game economy. But, for the most part, these digital assets provide some sort of monetary benefit to its players — whether that be because they won a fight and earned crypto, sold an NFT they bought in-game or charged fellow players rent for staying on their virtual land.

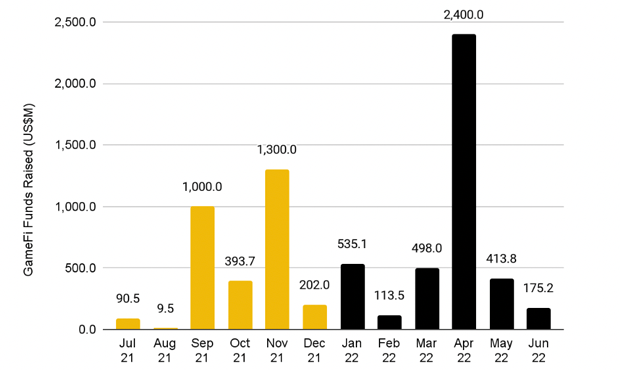

Private investments are good indicators of institutional interest and can serve as proxies to gauge the health of the space. GameFi witnessed a healthy deal flow.

Total capital investments in GameFi exceeded over $4.1B in first-half 2023, contributed by a behemoth $2B raise by Epic Games. This represents a 38% increase when compared to second-half 2022.

Overall, GameFi remains a key focus for institutions – Andreessen Horowitz launched a US$600M gaming-focused fund in May, and Immutable launched a US$500M venture fund focused on Web3 games in June.

With sufficient funding, teams are able to make the necessary investments and hires to develop better games. Hypothetically, this will lead to higher user adoption and more funding for the sector.

GameFi funds raised (US$M) remain strong

Here come the big boys on GameFi Market

The design and development of successful games come with significant complexity and typically take years from ideation to launch. Ample funding, a strong team of developers, and an experienced management team are just a few of the many ingredients for success. The difficulty associated with launching successful games makes this space a tough nut to crack, especially for new teams.

The first half of 2022 saw tangible actions taken by traditional gaming companies to enter the blockchain gaming space.

To name a few, Square Enix sold $300M worth of valuable intellectual property to fund its blockchain initiatives in May; Epic Games raised $2B to develop its metaverse efforts. Companies like Ubisoft, EA, and Tencent have also entered the blockchain gaming space, albeit to different extents.

While this means increased competition for existing blockchain game companies, it is a positive sign for the industry in terms of driving innovation.

Nonetheless, we are still in very early stages with significantly more room for growth. More work can be done to attract traditional gaming studios to the space. Based on the Game Developers Conference (GDC) report, of over 2,700 game developers surveyed, only about 28% of respondents indicated that their studios were interested in or are using cryptocurrency. Approximately 29% said the same for NFTs.

Vertical in Focus: Move-to-Earn

An offshoot of Play-to-Earn that has received much interest over the past couple of months, Move-to-Earn projects reward users for – you guessed it right – moving. Move-to-Earn revolves around lifestyle, and users are typically rewarded for physical activity. Prominent projects include STEPN, Step App, and Genopets. Let us take a closer look at one of the most popular Move-to-Earn projects, STEPN, as a case study.

STEPN is one of the first and is the leader in the Move-to-Earn space. Users earn STEPN’s native Green Satoshi Tokens (GST) when they walk or run. Sounds too good to be true that projects are rewarding you for just moving?

There is no free lunch in the world – to earn tokens, you have to first buy a virtual sneaker which at the time of writing, costs around US$120 for the cheapest NFT. STEPN also earns royalty whenever the virtual sneakers are traded on the secondary market.

The project garnered significant attention in Q2 of this year, and interest grew since its governance Green Metaverse Token (GMT) sale in March 2022. At its peak, STEPN had over 700K monthly active users. However, recent trends exhibit headwinds in terms of retaining existing users as well as attracting new users to the game. Furthermore, the declining GST price chart suggests that current token sinks are not effective in contributing to sustainable tokenomics.

Without diving into the details, these have had a direct impact on the prices of GMT and GST tokens which have fallen by over 85% from their peak at the time of writing. In response to the community’s feedback, STEPN has released their action plan for the game economy. It remains to be seen if STEPN will be able to turn this around, or if this is just a hype train that has left the station.

Leveling up GameFi

Playing devil’s advocate, GameFi in its current form has areas to improve as the sector works towards achieving mainstream adoption. Scalability, tokenomics, and gameplay are a few of the commonly cited issues that teams are undoubtedly working on.

An aspect that we believe is critical yet difficult to get right is in terms of striking a balance between financialization and gameplay.

It is not uncommon for Play-to-Earn games to focus on the financialization aspect of the game and how users and the project teams can earn financial rewards.

When “earning” becomes the primary purpose of playing a game, long-term sustainability of the game’s ability to attract and retain users is called into question during times of market volatility (e.g. if token falls significantly in value).

Instead of a Play-to-Earn model, adopting a Play-and-Earn model might better address this. In the Play-and-Earn model, earning is an additional value proposition that enhances the gaming experience. Rather than playing to reap financial rewards (likened to a job), designing gameplay that attracts gamers who enjoy the game and as a bonus, earn financial incentives is likely a more market-agnostic model.

Teams are undoubtedly working on the above-mentioned issues, and as the ecosystem matures, we look forward to seeing a vibrant, fun-filled, and developed ecosystem.

Closing Thoughts

GameFi is changing the rules of gaming and is onboarding a new wave of players into the blockchain ecosystem.

The gaming market size is estimated to be around US$175B today , and GameFi market cap is less than 4% of that at only US$6.2B. We are still at a very nascent stage with a significant runway to grow.

While there still exists numerous areas for improvement, the sector is rapidly developing and innovating. Gaming activity has fallen alongside a downturn in the market and this might pose a challenge for projects with a weak balance sheet. On the other hand, teams that have managed to raise funding and can focus on building in this environment are better positioned to emerge from this cycle stronger.

With the best minds of the industry and even experienced traditional gaming studios working on the space, the future of GameFi is promising.

GameFi Funding and Industry Overview

The GameFi industry is seeing massive amounts of funding right now, as venture capital firms shovel millions of dollars into crypto gaming companies. Investors poured $3.6 billion into these startups last year alone, according to Drake Star Partners, with heavy hitters like Andreessen Horowitz, Coatue and Softbank leading the charge.

Game industry veterans are beginning to enter the fold as well, including Ultima Online creator Richard Garriott, who recently announced he is making a play-to-earn-style MMO (massively online multiplayer game). And prominent game studios like Blizzard and Atari have begun “tentatively dipping a toe” in the GameFi space, as Spaight put it.

They noticed that Decentraland, Sandbox, Axie Infinity all have market capitalizations in the billions of dollars. And that’s insane. They’re wondering what’s going on and how do they get a piece of it.

Plus, there’s the matter of ownership and the money-making potential tied to these games on the players’ end. This is something that’s been reiterated by some of GameFi’s most prominent proponents as well. Amy Wu, the head of FTX’s new gaming initiative, argued on a recent podcast that play-to-earn games simply formalizes an aspect of gaming economics that was “around anyway.” It also stands to “deepen the gameplay experience” by promoting a sense of ownership and compensation among not only players, but creators and developers as well, thanks to the trackability of NFTs.

Today, a lot of [game developers] stay at a company because if they leave they’ll no longer get sort of a royalty from a game that they created, like, eight years ago. But what if they can do that in perpetuity? And you’re tied to the NFTs in that game or tokens in that game, and now you’re free to go make your next project without worrying that you’re giving up financial upside.

A game that is art should not have this sort of real-world commercial activity.

But at the same time, there’s still quite a bit of “institutional conservatism,” Spaight said. Indeed, many gamers and game developers view the emergence of in-game NFTs and the play-to-earn model as little more than a cash grab. A Game Developer Conference survey from January found that 70% of respondents said they were “not interested at all” in adding NFTs to their games, citing their “potential for scams,” their “environmental impact” and general “monetization concerns.”

As someone who’s been studying game design for 20 years, and thinking about play-to-earn specifically for the better part of a decade, game design professor Castronova’s concerns are more conceptual.

……………