The aviation, marine and cargo transit (MAT) Global Insurance Industry is estimated to grow at a compound annual growth rate (CAGR) of 6.4% from 2023-2026, supported by increasing trade activities, recovery in flight services, and demand from renewable energy infrastructure projects.

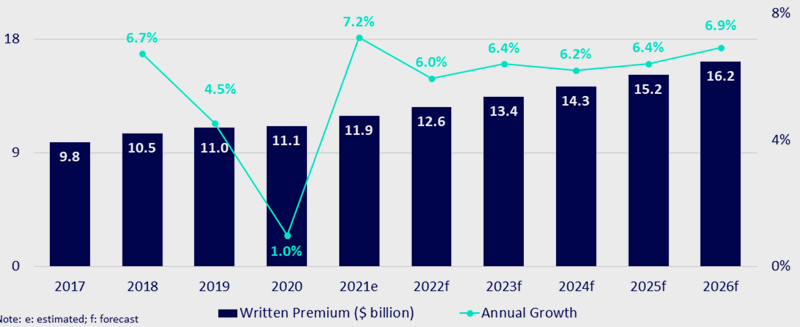

GlobalData forecasts that the MAT insurance industry in Asia-Pacific is estimated to grow to $16.2 billion in 2026 from $12.5 billion in 2023.

MAT insurance is estimated to have recovered in 2023 with 7.2% growth after remaining almost flat in 2020 as the COVID-19 pandemic adversely impacted air travel, and caused supply chain issues.

The ongoing Russia-Ukraine crisis will be a prime focus area for the regional MAT insurers, and it is expected that policy wordings might be revised, and premiums will be increased at the time of renewals to re-assess the insurers’ exposure to war risks.

Deblina Mitra, Senior Insurance Analyst at GlobalData

GlobalData says that the establishment of the Regional Comprehensive Economic Partnership (RCEP) is one of the major developments that is expected to create new business opportunities for insurers in Asia-Pacific (see our Global Insurance Report).

Involving 15 regional markets including China, Japan, and South Korea, RCEP aims to remove up to 90% tariff on goods.

RCEP is expected to increase trade among the member nations by $42 billion, out of which 40% will be from new trade creation, according to the United Nations Conference on Trade and Development (UNCTAD).

The increased foreign trade through road, maritime, and air facilitated by RCEP will create new business opportunities for the MAT insurance industry.

GlobalData predicts that MAT insurers will benefit from the ongoing shift towards clean energy in the Asia-Pacific region.

The construction of offshore energy plants to replace fossil fuels, such as wind power projects, has gained traction in the region creating demand for marine renewable insurance lines within MAT insurance. China, India, Australia, and South Korea are among the major markets for wind and hydro energy in the region.

Lloyd’s Market Association (LMA) announced the high-risk status for all of Russia’s territorial waters.

Before that, the Joint War Committee assigned high-risk status to the Sea of Azov and the Black Sea waters. These straits are a prominent gateway for crude and agriculture transport between the Asia-Pacific and European countries.

Vessels crossing these straits will be required to inform their insurer/ broker beforehand to negotiate their policy terms.

Marine, aviation and transit insurance – written premiums

The Asia-Pacific MAT insurance industry will present expansion opportunities for domestic insurers, as many foreign insurers, especially from Europe, are either reducing their presence in the region or exiting from the market due to unsustainable natural hazard losses.

Also, their withdrawal from coal-related underwriting, to comply with ESG targets, enhances opportunities for domestic insurers.

The profitability of insurers, however, remain exposed to enhanced security threats posed by geopolitical tensions, supply-chain issues, volatility in oil prices, and extreme weather repercussions.

Market dynamics in global MAT insurance

COVID-19 led business closures, reduced demand, supply chain disruptions, and financial market volatility added pressure on MAT insurers. COVID-19 severely impacted the marine and aviation industries, from decreased demand and delayed shipments to increased risks for crew and passengers. A slowdown in business activities and the global economic recession impeded the industry’s growth, which has declined in 2022.

Marine and transit:

The shipping industry grappled with the sharpest downturn due to the COVID-19 crisis, following a slump in 2019 owing to the slowdown in China’s economy and rising political tensions, and thus reduced trade between the US and China – the 2020 pandemic exacerbated this.

According to the International Union of Marine Insurance, the pandemic led to a loss equivalent to 1 billion tons of trade globally. Moreover, marine liability claims could increase due to the outbreak led illness or death of crew and passengers, repatriation and substitute expenses, and quarantine costs.

Aviation:

Following the first wave of infections in March 2020, most airlines halted operations of commercial passenger and private aircraft, although cargo flights continued operating. Despite the reopening of borders, air traffic is expected to remain fragile (see Outlook for Global Aviation Insurance Market). Owing to subsequent waves of infection, international travel demand is expected to remain low. IATA estimates that demand for air travel is only expected to return to pre-pandemic levels by 2024.

Climate change and renewable energy developments:

Global warming led to an increase in sea temperatures, with the upper few meters of the ocean experiencing an increase of 0.13 degrees Celsius per decade over the past 100 years this has resulted in unfavorable events impacting trade and marine insurance claims. According to a survey by Willis Towers Watson, climate change is one of the key concerns for the aviation industry, with airports being majorly exposed to natural catastrophe events such as floods and tornadoes, creating significant damage.

The lines of business in the global MAT insurance market

Transit Insurance remained the largest line of business followed by marine insurance, aviation insurance, and other MAT insurances.

Transit insurance market

Transit insurance, which accounted for the highest share in the global MAT insurance business, was also the fastest-growing line during the review period. Strong growth in e-commerce and compulsory transit insurance in several markets supported its growth (see P&C Insurance Pricing Trends Outlook).

Aviation insurance market

Aviation is expected to record the highest growth rate during the forecast period. Product expansion, in terms of drone insurance, and changing exposure with new models of aircraft and the transportation of essential goods is expected to drive insurance over the forecast period.

Marine insurance market

According to the AGCS, following the outbreak of COVID-19 with an increased number of vessels afloat across major sea routes, there has been almost a four-fold increase in attempted cyber-attacks. As modern vessels are more dependent on computers and software, and with increased geopolitical risks, the exposure to cyberattacks in the maritime industry is significant.

The key regions in the global MAT insurance market

North America accounted for the largest share in the global MAT insurance market, followed by Europe, Asia-Pacific, Middle East & Africa, and South & Central America.

MAT insurance market in Asia-Pacific

Japan held over one-third of the regional MAT insurance business. Japan and China together held more than 50% of the business, and the remainders were dispersed among other markets. The top 10 insurers accounted for more than 50% of the market. Regulatory developments in China and India regarding foreign ownership opened the insurance market for multinational insurers.

Aviation emerged as one of the worst-hit sectors in the region. According to Crisil, India’s domestic air passenger traffic is expected to decline by 40%-45% in FY 2023, while the decline is expected to be around 60%-65% for international lines. Market capacity erosion slowed, although selected smaller players continued to withdraw from the international marine.

MAT insurance market in Europe

Persistent soft market conditions and low oil prices impacted the MAT insurance growth during the review period. Apart from Germany, all the top five markets in the region recorded a negative CAGR during the review period. Norway’s MAT insurance business recorded the steepest decline during the review period.

The European MAT insurance market is moderately concentrated. The top 10 insurers together held more than 50% of the share.

Excess capacity in the marine and energy markets resulted in a decline in premium prices, and this impacted the growth of marine lines during the review period. However, the rates witnessed hardening at the end of 2017 with the trend continuing in 2018 and 2019-2021. The MAT industry was further challenged, with the imposition of international and domestic restrictions on trade and transportation due to the pandemic enforced lockdown restrictions forced European airlines to operate in a reduced capacity.

MAT insurance market in Middle East & Africa

The region’s review period premium trends were shaped by escalating geopolitical instability and volatile oil prices which led oil-rich gulf countries, including the UAE, Saudi Arabia, and Qatar to report flat to double-digit negative review period growths. Among the top 10 markets in the region, Iran recorded the highest growth rate during the review period.

The growth was driven by price hardening caused by the reimposition of the US sanctions in 2018 and an increase in the war risks for vessels crossing the Strait of Hormuz.

The MAT insurance market in the region is fragmented, with the top ten insurers accounting for more than 40% of the market share.

The outbreak of the COVID-19 pandemic led to a decline in fuel prices, thus adversely impacting countries that are dependent on oil exports. Sanctions have made it difficult for importing nations to find adequate

insurance, leading to a majority of the risks being written by Iranian insurers. For instance, the Indian government granted approval to two Iranian P&I clubs to offer cover to Iranian tankers, with a liability limit of IRR 66.6 trillion ($1.0 billion) until February.

MAT insurance market in North America

Hard market conditions were observed in cargo lines, however, capacity remained ample with the entry of new insurers into the US. Meanwhile in Canada, with rising losses, Lloyd’s is reported to have withdrawn from some of its marine insurance business. It was believed that 10 Lloyd’s syndicates withdrew from this line of business. The US MAT market was fragmented. The top 10 insurers accounted for more than 50% of the market.

After recording significant growth, the region’s MAT insurance declined in 2022. Rising geopolitical tensions adversely impacted trade in the region, and catastrophe losses challenged the profitability of MAT insurance in the region Supply chain disruptions adversely impacted the shipping industry, particularly after China closed its ports in the aftermath of COVID-19.

MAT insurance market in South & Central America

The accumulation of ships at the ports and stranded cargo shipments created challenges for insurers, given the persistent problem of theft, riots, and vandalism in many regional markets. Additionally, the region’s Nat Cat exposure, along with economic issues in Colombia and exchange rate instability in Argentina, increased risk exposure for insurers. The top 10 insurers accounted for more than 50% of the region’s MAT insurance business.

MAT insurance premiums in the region are expected to record the steepest decline among all regions in 2020. The maritime supply chain in the region faced pandemic led challenges in securing personnel and crew and the movement of cargo to and from ports to the mainland. However, the region’s business is expected to stabilize over the next five years, with the market likely to reach a pre-COVID-19 level of premiums.

Major players in the global MAT insurance market

The top 10 MAT insurers accounted for more than 25% of the global MAT insurance business. Among the top 10 insurers, six were US-based and three were European. Tokio Marine was the only Asia-based insurer among the top 10 insurers. The share of the top 10 insurers’ premiums in the global MAT insurance business grew during the review period, indicating an increase in market concentration during the same period.

Liberty Mutual Holding Company Inc led the global MAT insurance market, followed by CNA Financial Corp, AIG, Allianz SE, and Chubb. Several European and US-based insurers in recent years pledged to restrict the underwriting of businesses linked to the oil and gas sector, and as a result, the competitive landscape is expected to become fragmented in regional markets such as the Middle East & Africa and South & Central America.

Edited & Fact checked by