The Taiwanese regulator’s latest adjustments to the new solvency framework will ease the burden on local insurers by reducing the capital charges on several asset categories and extending the phase-in periods, according to Fitch Ratings.

Economic growth, rising government spending, technological innovations and increased consumer awareness about insurance products are key market drivers in Taiwan. The government’s policy of insuring the uninsured has progressively pushed the insurance penetration in Taiwan and the proliferation of insurance schemes.

Many insurers still face high pressure to build capital in the near to medium term to meet the more stringent interest rate charges under the framework and a new accounting standard.

The increasing number of digital distribution channels is favoring the insurers to easily obtain insurance policies. Insurtech, messaging platforms, and online sales channels are contributing to the insurance landscape in the country.

Through different distribution channels, insurance companies in Taiwan are providing a wide variety of products with varying levels of complexity that are designed for different groups of businesses, individuals and other organizations. This will provide ways to meet the emerging demands of every end-use customer and propel net sales.

Local market players in the country are focusing on marketing their competitive edge by rolling out more plans customized to diverse sectors and developing more innovative digital features.

New insurance solvency framework

The Financial Supervisory Commission on 25 July 2023 provided guidance on the localisation adjustments and transitional measures for asset risks under the new insurance solvency framework, which was first introduced in 2020 to align the sector more closely with the Insurance Capital Standards 2.0 issued by the International Association of Insurance Supervisors. The implementation date remains 1 January 2026.

The reduced risk weights and additional phase-in periods for equity and real-estate investments will give companies more time to adjust their asset allocations and narrow potential capital gaps.

They now have another 15 years to phase in the risk weights on the two asset categories after the implementation date. Equities and real estate constitute a sizeable portion of Taiwan insurers’ investment portfolios. Insurers still face higher interest-rate charges under the new framework.

Fitch estimate that, for the major insurers, the more stringent requirement will likely translate into interest-rate-related capital charges that are three to four times that under the current regime, largely due to the savings-type products with high guaranteed yields they sold in the past.

In 2021, the regulator updated the interest-rate risk charge methodology under the current regime to gradually reduce the interest-rate risk charge gap between the two standards.

Fitch believe the regulator is likely to provide clarity on any localisation adjustments and transitional measures for interest-rate risks, suitable for local business characteristics and conditions in the near term, as Taiwanese insurers are now running calculations under the current regime as well as the new framework for 2022-2024.

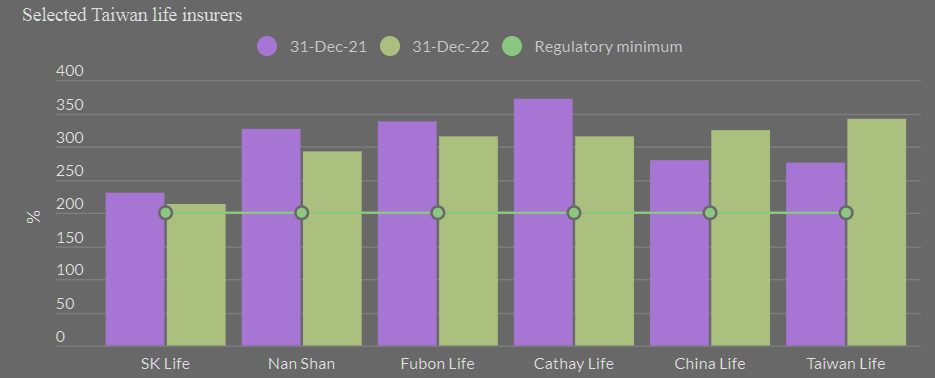

Risk-Based Capital Ratios

As such, we expect them to continue raising capital – in the form of equity and subordinated debt – and cutting investment risks. Several major life insurers have issued or announced the issuance of subordinated debt totalling around TWD100 bn so far this year.

The sector is also moving to adopt IFRS 17, a new global accounting standard including evaluating insurance liabilities at current interest rates rather than initial rates, by 2026.

This, together with the tighter capital rules, will accentuate the asset and liability mismatches at insurers, including a wide currency mismatch between rising foreign-currency investments and local-currency insurance obligations.

IFRS17 will give more clarity on insurers’ profitability

IFRS17 will give more clarity on insurers’ profitability, with insurance profit being reported separately from investment returns. Insurers’ efforts around Finance Transformation have mainly focused on the immediate priority of IFRS 17 compliance.

It’s time for insurers to think about the long term vision for the Finance function and make step changes to get there. And these five areas are where insurers should start.

IFRS 17 is the newest IFRS standard for insurance contracts and replaces IFRS 4 on January 1st 2022. It states which insurance contracts items should by on the balance and the profit and loss account of an insurance company, how to measure these items and how to present and disclose this information.

With IFRS 17’s anticipated mandatory effective date of 1 January 2023 moving ever closer, all types of businesses, not just registered insurance businesses, need to start evaluating the impact of the Standard now.

This has incentivised insurers to shift from savings-type products to protection-type products, which typically are more profitable and generate higher contractual service margin – which represents the unearned profit an insurer expects as it provides services in IFRS17.

Taiwan insurers increased foreign investments

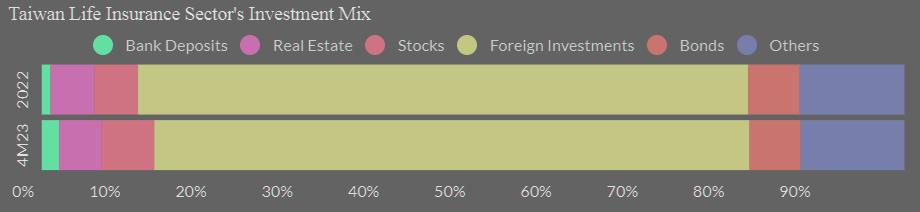

Taiwan insurers increased foreign investments in the last decade to seek better returns and support long-term liabilities amid low interest rates that prevailed until recently.

In response, they have been selling more policies in foreign currencies and setting aside foreign-exchange reserves, as mandated by the regulator, to mitigate the risk.

Foreign Investments Dominate Life Insurers’ Portfolios

The regulator also tightened regulation of savings-type products in recent years by introducing a smoothing mechanism for the declared rates of variable-rate policies, imposing thresholds of minimum ratios between death benefits and policy values, and disallowing the sale of new policies with negative contractual service margins.

This has reinforced the decline in savings-type products, helping to restrain the growth in insurers’ interest-rate risk exposure.

Taiwan non-life insurance market

The Taiwan non-life market is dominated by motor business, which accounted for 53.2% of non-life income. Property, including business interruption, accounted for 14.3%, and PA/health written by non-life insurers 12.8%.

Liability, MAT and engineering are the other main classes, but are comparatively small. Health business is restricted to non-life insurers by three-year non-cancellable policies, although the life market dominates by cross-selling with non-cancellable business as riders.

Strong demand for insurance of vehicles, property, health and other insurances across Taiwan are driving the revenues of insurance companies in the country.

Growing life expectancy, tax incentives on insurance products, favorable savings associated with insurance are further encouraging the customers across insurance segments.

On the global front, the world insurance market is dominated by vehicle insurance with the market for motor vehicle insurance is expected to register growth at a CAGR of 6.45% during the forecast period owing to increasing regulatory requirement for vehicle insurance.

Taiwan’s insurance industry is facing stiff competition as the insurance companies not only compete with each other, but also compete with the risk retention groups, government, and self-insurance. The companies generally compete mainly based on two factors including the quality of the services and price that they provide. Many large organizations self-insure for most of their employee benefits like health coverage that lowers market scope for insurance companies.

Taiwan life insurance market

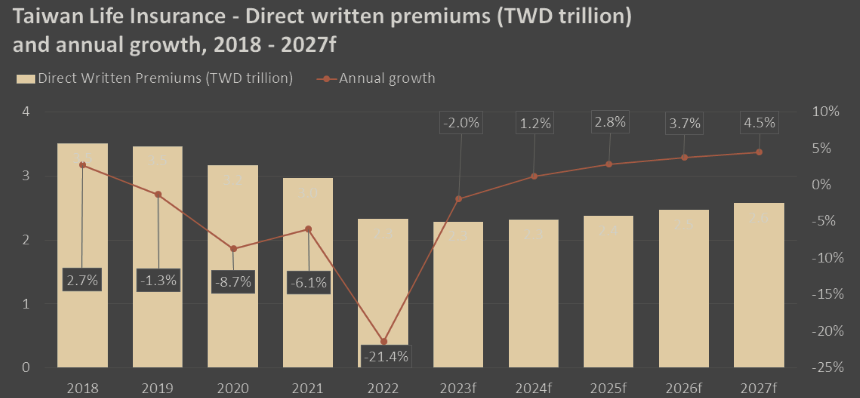

After witnessing a continuous decline since 2019, Taiwan’s life insurance market is set to make a turnaround from 2024, driven by an improvement in the global macro-economic situation, an increase in interest rates and positive regulatory developments, according to GlobalData.

The industry is forecast to grow at a compound annual growth rate (CAGR) of 3% from TWD2.3 trillion ($77.7 bn) in 2023 to TWD2.6 trillion ($91.6 bn) in 2027, in terms of direct written premiums (DWP).

Taiwan’s life insurance market is expected to decline further by 2% in 2023. This decline is due to various factors including a prolonged period of low-interest rates, a lack of innovation in product offerings, and the termination of products such as disability insurance due to the high claims associated with them (see Life Insurance Value Chain).

Taiwan life insurance direct written premiums

The Taiwanese life insurance industry witnessed an unprecedented decline of 21.4% in 2022 due to uncertain market conditions, which impacted the industry’s renewals.

Premiums from foreign-currency-denominated life insurance policies, which accounted for 46.7% of new business in 2023, declined by 32%.

This was due to the appreciation of the US dollar, which caused an increase in the prices of these policies.

Term life is the largest life insurance product, accounting for a 45.4% share of Taiwan’s life insurance DWP. It declined at a CAGR of 6.7% during 2017-2022 due to changes in customer preferences. The rise in inflation has also negatively impacted consumer disposable income and their interest in term life products.

However, it is expected to grow over the next few years, supported by positive regulatory developments. For instance, the proposal to allow neo-insurers will support term life insurance sales as neo-insurers will only be authorized to sell online term insurance. As a result, term life insurance is expected to grow at a CAGR of 3.4% over 2023-2027.

Endowment insurance accounted for a 21.6% share of the life insurance DWP. Investment-linked endowment policies are preferred insurance products in Taiwan as they provide better returns than savings products from banks. Endowment insurance is expected to grow at a CAGR of 2.3% over 2023-2027.

The current high inflation is impacting disposable income, which is supporting the demand for endowment insurance products as they offer higher returns compared to other life insurance products.

Personal Accident and Health (PA&H) is the third largest product accounting for 20.9% of the DWP.

PA&H insurance growth is supported by demographic factors such as a super-aging society and high life expectancy in Taiwan.

General annuity and other life insurance products collectively accounted for the remaining 11.7% share of DWP.

After years of decline, Taiwan’s life insurance industry is forecast to recover from 2024, supported by positive regulatory developments. Despite this recovery, Taiwan’s life insurance industry is not expected to reach its previous levels of growth in the near future.

…………………..

AUTHORS: Kanishka de Silva – Director, Insurance at Fitch Australia, Lan Wang – Senior Director, Fitch Wire, Anurag Baliarsingh – Insurance Analyst at GlobalData