In the era of digital transformation, the insurance sector has observed a paradigm shift in the creation of value. Intangible assets, particularly digital data, now form a significant part of the economic value, introducing new risks that the insurance industry must manage.

According to Swiss Re Institute recent research, the advent of digital technology has paved the way for remarkable operational efficiencies within the insurance industry. However, the full extent of this digital revolution, similar to the productivity paradox seen in the global economy over the past two decades, is yet to be fully realized in insurance.

New Insurance Digitalization Index reflects this scenario, showing that no country’s insurance sector has fully tapped into the economic potential offered by digital technology. This suggests there is more growth and transformation to come.

Digitalization opens a new dimension to tackle the risks facing society. While the benefits of digitalisation are undeniable, it comes with its own risks that must be mitigated and insured against if these benefits are to be fully realised (see How Digital Transformation Accelerating the Insurers Growth?).

The roles of trust and governance can’t be overemphasised if digitalisation is to achieve its full potential in closing protection gaps and making society more resilient.

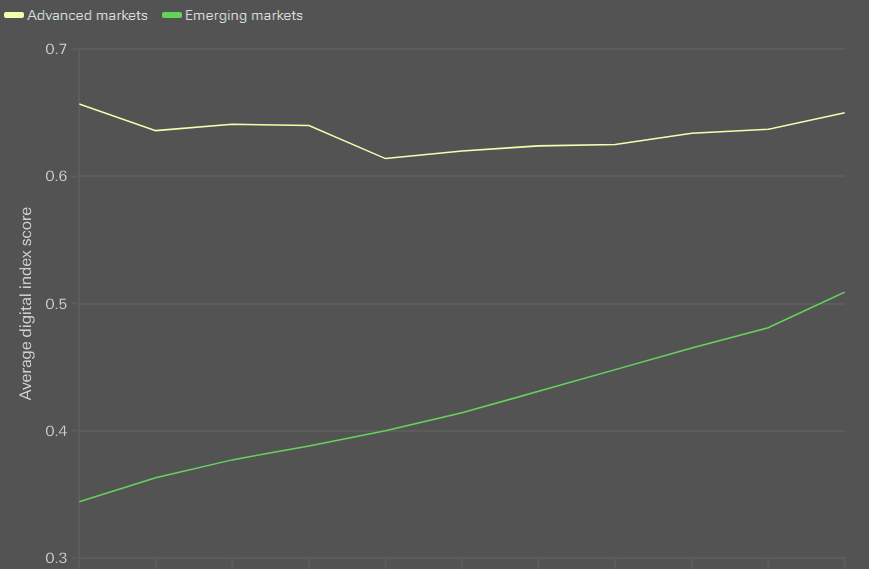

According to the index, more advanced markets, characterized by robust physical infrastructure and widespread internet access, have made significant strides in digitalizing their insurance sectors.

On the other hand, emerging markets exhibit the greatest potential for catch-up in digitalization.

For instance, more than 40% of consumers in advanced markets and 50% in emerging markets have bought insurance online.

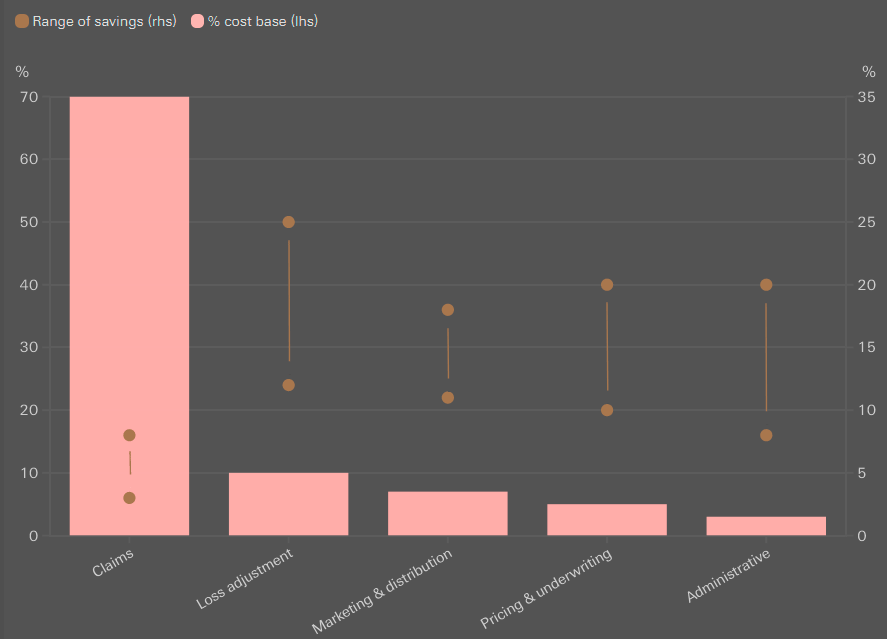

According to Swiss Re research, more and more standardized tasks like data collection or even post-sales customer engagement are being automated. As our ability to incorporate new data sources into our underwriting increases, insurers are also deploying digital tools to wring savings from across their value chains, everything from claims and marketing to distribution and administration.

For society, digitalization is a force for giving more people access to insurance and thereby closing protection gaps. For insurers, gains from better underwriting, risk mitigation and risk measurement from digitalisation of insurance improve the quality and efficiency of their work.

Jerome Haegeli, Group Chief Economist, Swiss Re

Over the past decade, these markets have been rapidly closing the gap. Intriguingly, our sigma research indicates a correlation where economies that are more digitally advanced tend to exhibit greater resilience to various risks, including largest natural disasters.

This finding underscores the strategic importance of digitalization not just in enhancing operational efficiency but also in building economic resilience.

Average Insurance Digitalization Index

The index suggests that advanced markets with relatively strong physical infrastructure and where more people have access to the internet, have made most progress in digitalising their insurance sectors (see How Digital Trust, AI & IoT Technology Can Help Insurance Business?).

Average Insurance Digitalization Index rankings over time, advanced and emerging markets

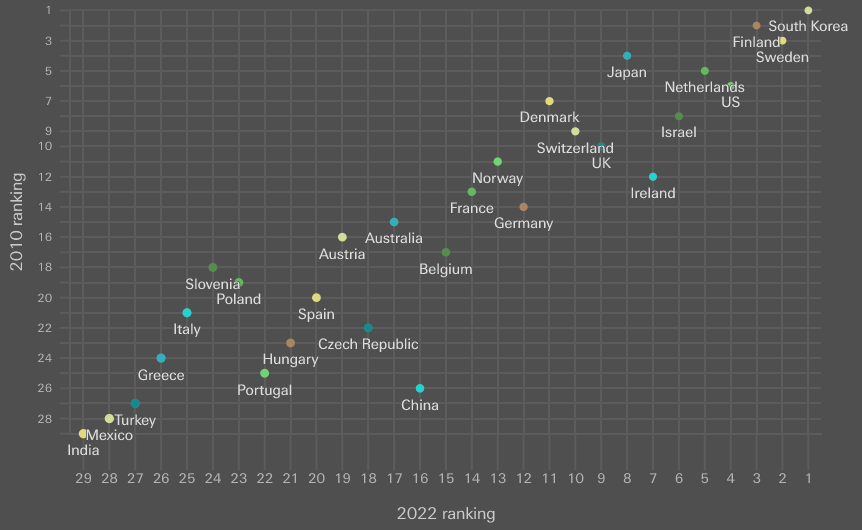

South Korea tops the index, coming in first across the different variables most frequently and scoring consistently in the top three countries over 10Y. This outperformance is due to consistently high scores across the access, use and innovation dimensions.

The greatest room for improvement is in market openness, with much to be gained if the country could catch up in share of digitally deliverable services in commercial services trade.

Another noticeable trend is how South Korea is falling behind in fixed broadband coverage, despite leading in this indicator at the beginning of the index period.

Insurance Digitisation Index – country rankings

The US too performs well, ranking 4th in the index, and with access, use and market openness dimensions all showing rising scores. The US’s overall ranking is dragged down due to it failing to close the gap on innovation, with the gap between the leader and US widening in business R&D expenditure in information industries as a percentage of GDP.

The potential for further digitalisation of insurance highlighted by the index will take time to show through and will differ by region.

Industry digitalisation is to some extent constrained by the digital progress of countries at the macro level, but insurers can nonetheless play their part.

For a start, going digital requires the building and operating of various infrastructure assets, which entail various risks, including construction and operational risk. Insurers can provide risk transfer solutions for these risks, working together with businesses and governments to achieve their digital goals.

Intangibles and new risk pools

Digitalisation has fundamentally reshaped the corporate sector. As firms have shifted from producing physical goods to providing information and services, the composition of their balance sheets has changed too (see 4 Ways Digital Transformation for business sustainability).

The so-called intangible assets represent a main growth opportunity for the insurance industry. The global value of intangibles of listed companies has increased fivefold over the last 20 years, and close to 80% of that value is uninsured.

Intangible risks

The growth and expansion of digital ecosystems are opening new avenues in the insurance sector, particularly in the realms of business interruption and cyber risk. The global cyber insurance market has witnessed remarkable growth, with an increase of approximately 60% in the past two years. Looking ahead, we anticipate this market to expand by over 50% in the next five years.

First, digitalisation in isolation isn’t sufficient. But used thoughtfully, it can form the basis of powerful enabling tools to collect, organise and analyse data.

This can be used to provide insurers with fresh insights into their customers’ broader protection needs, while helping make their clients and partners’ digital journeys more rewarding and robust.

Looking across the tech-enabled insurance space in 2024, I see many companies at a common juncture. There’s a sharper focus on taking the lessons learned from a decade of digitalisation and applying them to specific areas where technology is best suited to help solve our industry’s historic challenge: protecting more people with the right products at the right price.

Digitalization is revolutionizing the efficiency of insurance operations

The use of digital data allows for more comprehensive underwriting processes, leveraging granular data from diverse sources, including wearables. This leads to significant operational improvements, particularly in underwriting processes, where insurers are aiming for a reduction in loss ratios by 3-8 percentage points.

Digital technology is projected to yield cost savings of 10-20% in various other aspects of the insurance value chain.

These developments highlight the transformative impact of digitalization on the insurance industry, enhancing both risk assessment capabilities and operational efficiency.

Savings potential from enhanced digital capabilities

Mitigating risks

New technologies also can be used to improve risk mitigation processes. The increased use of data and data analytics, in particular of sensor technologies and the networking of factories, buildings, machines and other physical objects can reduce the frequency and severity of accidents, for example with smart home applications and the adoption of sensors in plants and equipment.

One challenge, however, is that the lack of explainability that comes with the use of artificial intelligence in innovations such as Advanced Driver Assistance Systems, could raise challenges for liability attribution.

Going digital to mitigate risks

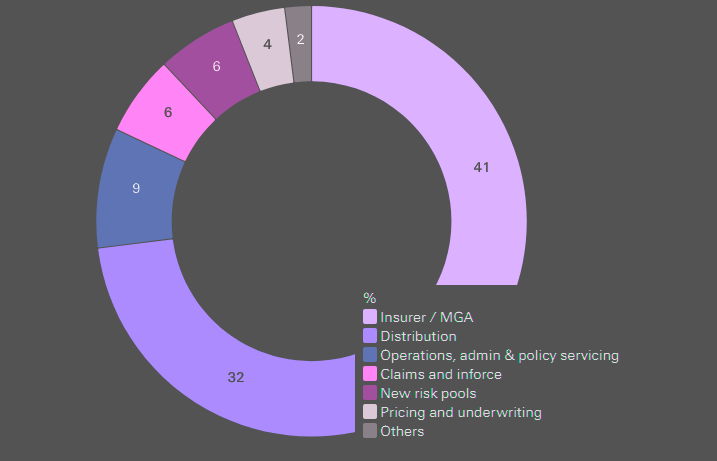

In the insurance industry, the pivot towards digital transformation remains a priority. Initially, the focus was predominantly on developing digital channels for distribution. However, the scope of this digital shift has expanded to encompass key elements of the insurance value chain, notably in the areas of pricing and underwriting processes.

The journey towards a fully digitalized insurance sector is expected to be a gradual and long-term endeavor.

At a broader level, digital transformation necessitates the creation and maintenance of various infrastructural assets. For insurance companies, the effective implementation of digital technology hinges on several critical factors, including the availability and interpretability of data, as well as the complexity of existing systems.

How can we deploy technology in the right ways?

How can we deploy technology in the right ways, so it plays a more meaningful role in engaging prospective insurance consumers?

To navigate this transition successfully, insurers must undertake a comprehensive overhaul of their workflow processes. This involves significant investment in data engineering to ensure that they can effectively harness and interpret the vast amounts of data integral to modern insurance operations.

This strategic investment in technology and processes is essential for insurers to remain competitive and responsive in a rapidly evolving digital landscape.

Investments in the insurance industry value chain

Investments within the insurance industry’s value chain are essential for sustaining growth and competitiveness in an increasingly dynamic market.

- Digital Transformation: A significant portion of investment is directed towards digital transformation. This includes not only customer-facing digital platforms but also back-end systems like automated underwriting and claims processing tools. These investments are crucial for enhancing efficiency, reducing operational costs, and improving customer experiences.

- Data Analytics and AI: Another critical area of investment is in data analytics and artificial intelligence (AI). Insurers are leveraging big data and advanced analytics for more accurate risk assessment, pricing, personalized product offerings, and fraud detection. AI algorithms are becoming increasingly sophisticated, enabling better predictive modeling and risk management.

- Customer Experience and Engagement: Insurers are also investing in improving customer engagement and experience. This involves developing more intuitive online platforms, mobile apps, and utilizing technologies like chatbots for customer service. These investments aim to meet the evolving expectations of digital-savvy customers and to enhance customer loyalty and retention.

- Regulatory Compliance and Cybersecurity: With the growing focus on data privacy and cybersecurity, investments in compliance-related technology are becoming more important. Insurers must ensure that they comply with various regulatory standards like GDPR, and invest in robust cybersecurity measures to protect sensitive customer data.

- Insurtech Collaborations and Ventures: The rise of Insurtech startups has led to increased investments in collaborative ventures. Traditional insurers are either partnering with or investing in Insurtech firms to leverage their innovative technologies and agile methodologies.

- Sustainable and ESG (Environmental, Social, and Governance) Investments: There’s a growing trend towards sustainable investing within the insurance industry. This involves incorporating ESG factors into investment decisions, product development, and corporate strategies. Such investments are not only ethically and socially responsible but are also increasingly being recognized as a means to mitigate long-term risks and generate sustainable returns.

Investments in the insurance industry are being strategically channeled to embrace technological advancements, meet regulatory requirements, enhance customer experience, and align with sustainable and ethical business practices.

……………………

AUTHORS: Jonathan Anchen – Head Market Intelligence, Swiss Re Institute, James Finucane – Senior Economist, Swiss Re Institute, Thomas Holzheu – Chief Economist Americas, Swiss Re Institute, Mahir Rasheed – Senior Economist, Swiss Re Institute, Sunnie Wang – Economist Swiss Re Institute, Diana Van der Watt – Economist, Swiss Re Institute, John Zhu – Chief Economist Asia Pacific