Legacy technology systems have long been a problem for insurance providers. The idea of moving customer data away from incumbent systems is a daunting prospect for most insurers. Something has changed in the last couple of years, however, with the pandemic forcing the hand of many companies and bringing about wholesale change in attitudes.

According to KPMG’s CEO outlook 85% of CEOs surveyed said that the pandemic had accelerated digitisation in their operations, as well as the creation of next-generation operating models. Almost 80% agreed that COVID-19 had hastened their implementation of more seamless digital experiences.

And yet, for many leaders, the biggest obstacle to digitisation was never technical – even when they thought it was.

Almost 4 in 10 CEOs cited a lack of insight into future operational scenarios as their biggest digitisation challenge, followed by nearly 3 in 10 CEOs who said it was related to difficulties in making quick technology-related decisions across their business.

The KPMG CEO Outlook offers a unique lens on evolving attitudes as the pandemic has unfolded. KPMG initially surveyed 1,300 CEOs, before many markets were beginning to feel the full impact of lockdowns. Then, in July and early August, KPMG conducted a follow-up survey of 315 CEOs to understand how thinking has evolved.

Key developments include:

- Talent and a new working reality: Businesses are looking to change their recruitment strategies as remote working has widened their potential talent pool and companies may be rethinking their office space in the short-term while also considering the future of work.

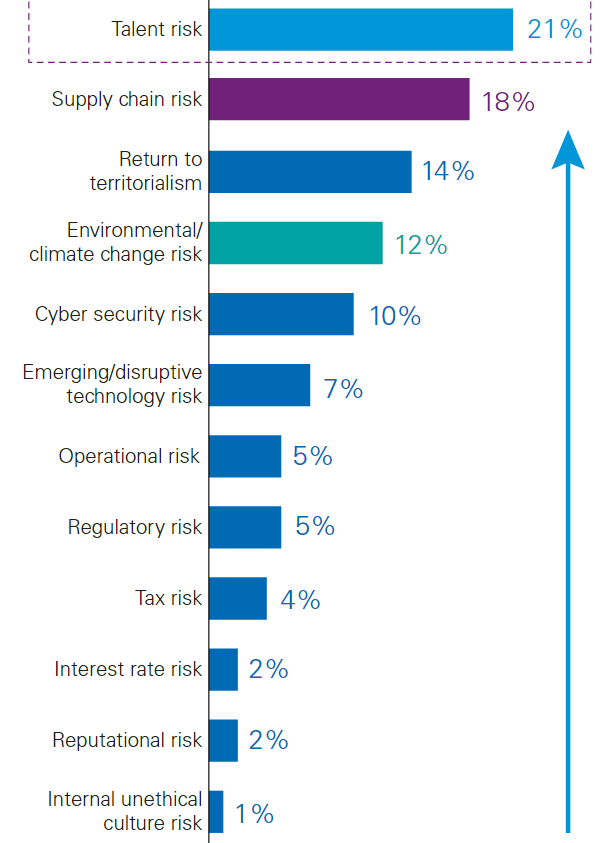

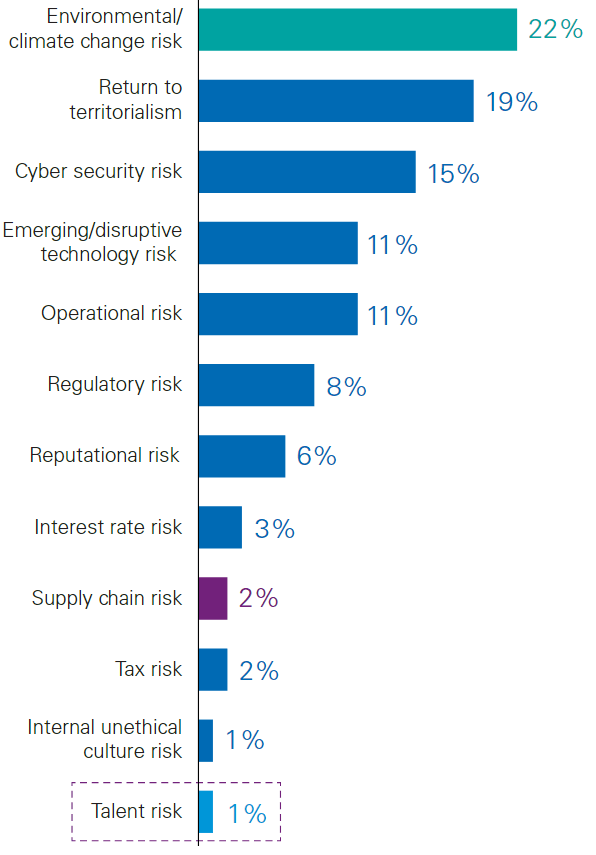

- Shifting risk agenda: Since the start of the pandemic, ‘Talent risk’ has risen to be named as the most significant threat to the growth of their businesses ahead of ‘Supply chain risk’ and a ‘Return to territorialism’.

- Digital acceleration: Business leaders are betting on major dimensions of digital transformation and the majority have seen this accelerate during the lockdown.

This is reflected in a report from IBM, published in December 2020, which found that a Covid-related culture shift was allowing insurers to break free from pre-pandemic hesitancy.

The pandemic accelerates digitisation in insurance operations

Before the pandemic, many organisations seemingly distrusted their own technological capabilities and doubted the skills of their own workforces. Yet, in the blur of pandemic-induced reactions, those anxieties proved largely unfounded.

In an effort to bring some clarity to the complex world we find ourselves in, KPMG interviewed hundreds of CEOs from many of the world’s largest companies, first in January and then again in July and August, to get their perspectives and understand how their priorities have changed.

Overall, three key themes emerged from this year’s survey, which we characterize as Purpose, Prosperity and Priorities.

With profound consequences for people’s health and livelihoods — as well as the future of companies and industries — the pandemic has presented CEOs with the greatest possible test of their leadership abilities and personal resilience. Chief executives of the world’s largest organizations are using this unparalleled moment in history to lead with increased purpose and impact, both societal and economic.

79 percent have had to re-evaluate their purpose as a result of COVID-19 to better address the needs of their stakeholders

They are leading with empathy and humanity as they prioritize talent and corporate responsibility, finding opportunity amid a fall in global economic confidence, and rewiring their businesses for tomorrow’s new reality.

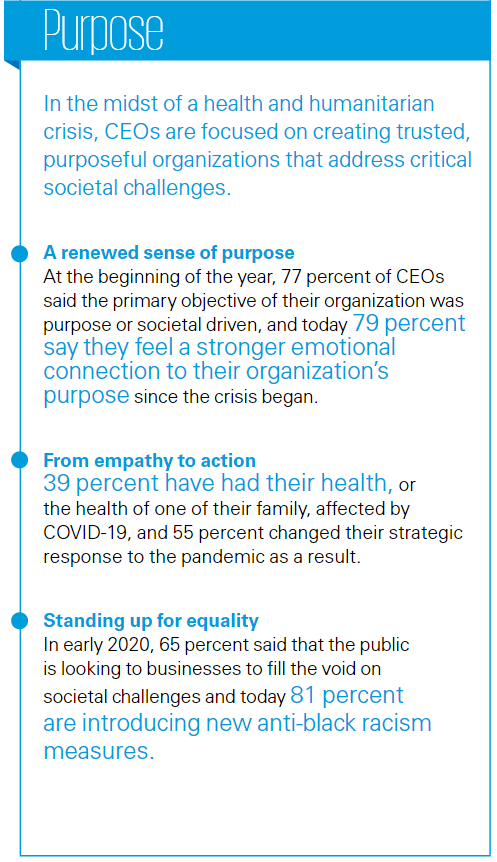

A renewed sense of purpose

At the beginning of the year, we found that most CEOs were seeing the primary objective of their organization shift from purely profit to also consider their purpose in society. Less than a quarter (23 percent) saw the organization’s overall objective in narrow ‘managing for shareholder value’ terms, with 54 percent taking a broader, purpose-driven approach focused on multiple stakeholders. Furthermore, one in five (22 percent) say that their primary objective is to improve society.

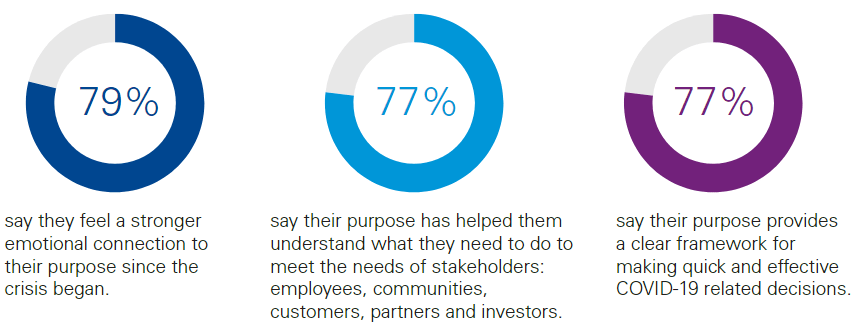

Purpose has become a central pillar for CEOs: 79 percent say they feel a stronger emotional connection to their corporate purpose since the crisis began. At the same time, however, the massive disruptive impact of the pandemic has caused many CEOs to question whether their current purpose really meets the needs of stakeholders. In fact, 79 percent say they have had to re-evaluate their purpose as a result of COVID-19. Carefully listening to different stakeholders and encouraging dialogue, will be an important element of this re-evaluation, particularly if it becomes clear that the current purpose needs to be adjusted to better meet the needs of a stakeholder group.

From empathy to action

This increasingly personal and emotional connection to purpose during the pandemic reflects the fact that CEOs face similar health and family challenges as their people and communities. In fact, well over a third of chief executives (39 percent) have had their health, or the health of one of their family, affected by COVID-19.

The pandemic will be remembered by many as a defining moment for this generation. CEOs are clearly determined to learn from the pandemic and their own personal experience to recalibrate and make not only the best-informed decisions, but also the most authentic ones. Out of those who were personally affected by the health implications of the crisis, only 4 percent made no change to their approach to the pandemic. In all, 55 percent changed their strategic response, either completely or to some degree. Another 40 percent, while not changing their strategy, did pay more attention to the human aspect of the pandemic.

Standing up for equality

At the beginning of the year, we found that CEOs were increasingly prepared to personally lead the way in tackling society’s major challenges. Around two-thirds (65 percent) said that the public is looking to businesses to fill the void on societal challenges. At the same time, 76 percent said they had a personal responsibility to be a ‘leader for change on societal issues’.

Being able to draw on a diverse spectrum of talent is critical to addressing the unique challenges of the pandemic, and CEOs are looking to strengthen their anti-discrimination approaches. In the wake of widespread protests following the death of George Floyd on 25 May, 81 percent have either publicly announced new anti-black racism measures in 2020 or plan to do so in the near term.

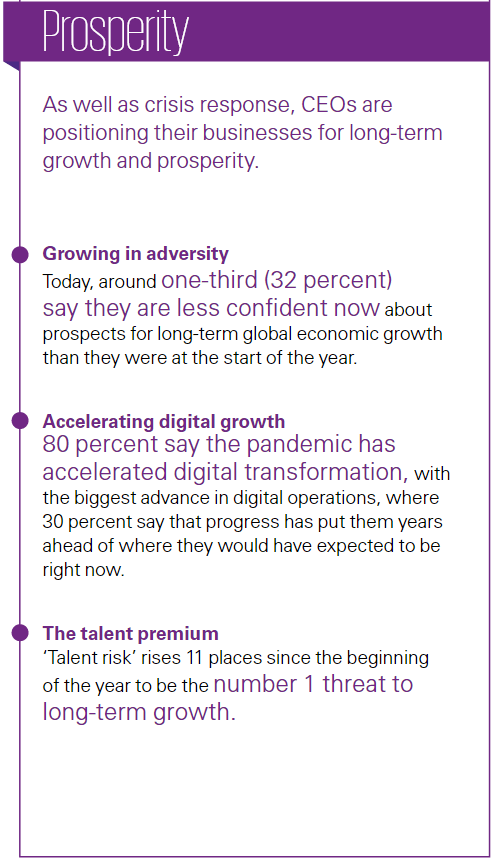

Growing in adversity

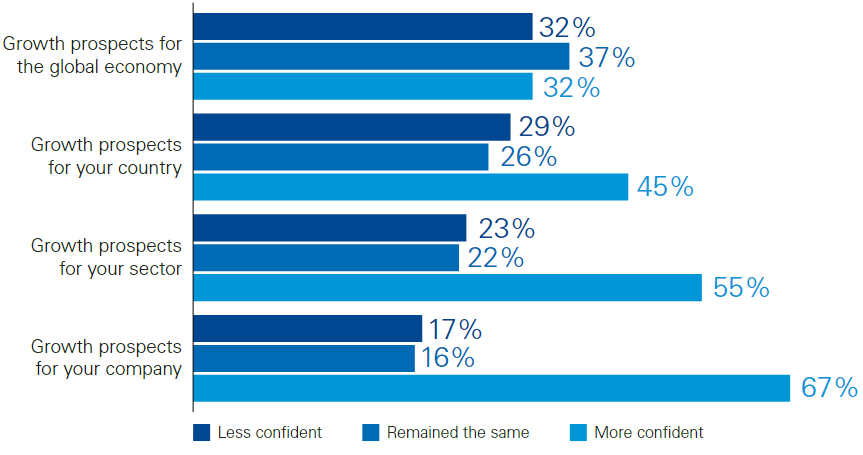

The survey finds that the COVID-19 crisis has shaken CEO confidence in global economic growth. Today, around one-third (32 percent) say they are less confident now about prospects for global growth over the next 3 years than they were at the start of the year. However, this loss of confidence is not as dramatic when CEOs consider what the future holds for their companies, with only 17 percent less confident today. They are clearly more confident in mastering their own company’s fortunes, where they have more control and levers of influence.

CEO‘s confidence in global, country, sector and company growth over the next 3-years, compared to the beginning of the year

Accelerating digital growth

As we saw earlier CEOs are more confident in their own businesses’ growth prospects over the coming 3 years. In part, this is because they have greater control over the levers that will determine this. One of the most critical levers they can control here, and a major growth driver, is digital acceleration.

With commerce increasingly taking place online because of factors such as physical distancing, companies are having to rethink what customers want and how to deliver.

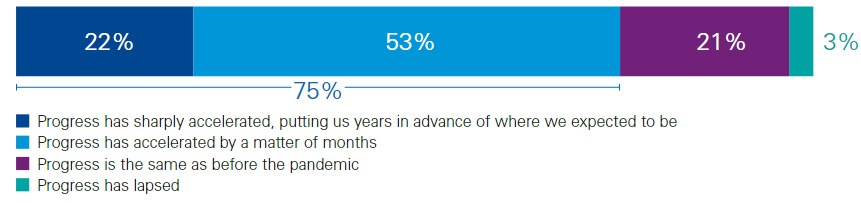

We found that 75 percent of CEOs say the pandemic has accelerated the creation of a seamless digital customer experience, with over 1 in 5 (22 percent) of those saying progress “has sharply accelerated, putting us years in advance of where we expected to be”.

Accelerated progress on digital customer experience

The challenge for organizations is to focus efforts and investment on the areas that are capable of generating the most long-term value, while avoiding those areas that might just prove to be a short-term reaction to the pandemic.

Shifting risks

As they plan their path to long-term growth, business leaders recognize that there have been new challenges to contend with during the lockdown. A potential second wave of COVID-19 in their key markets would likely deepen these concerns, with further adverse consequences in terms of retaining key employees, hiring talent and keeping their workforces productive.

CEOs ranked talent risk behind 11 other risks to growth. However, since the start of the pandemic, talent risk has risen to be named as the most significant threat to their businesses ahead of supply chain, the threat of a return to territorialism and environmental risk.

Supply chain risk has accelerated up the agenda from its ninth-placed position at the beginning of the year — it now occupies second place as a major strategic threat. Even before COVID-19, supply chain risk was in the spotlight as a result of increasing volatility, be it trade tensions or extreme climate-driven events.

However, the pandemic has brought this issue into even sharper relief, as organizations desperately sought to maintain supply chain continuity in the midst of worldwide lockdowns.

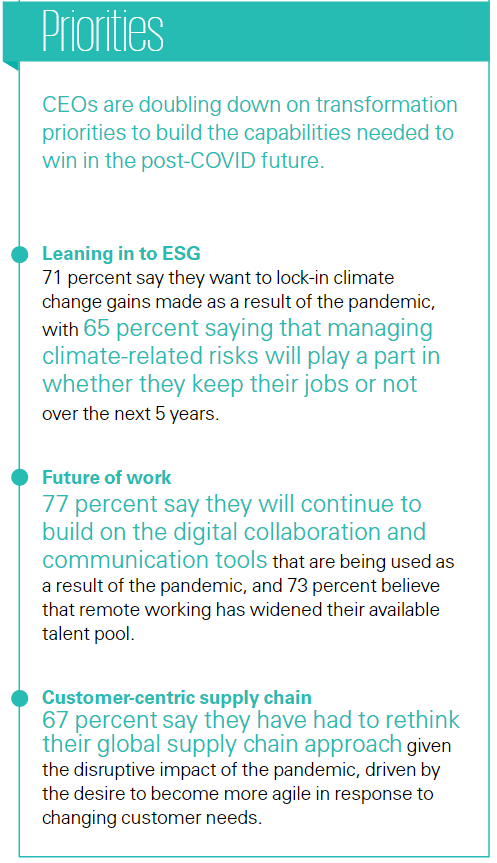

Leaning in to ESG

The pandemic has created what will be a career-defining economic challenge for most CEOs. Given the scale of that challenge, many were worried that chief executives would be forced to relegate the importance of environment, social and governance (ESG) themes.

However, our research shows that CEOs are still very much engaged with this issue, and in particular the ‘S’ of ESG. Close to two-thirds (63 percent) said that their response to the pandemic has caused their focus to shift to the social component of their ESG program.

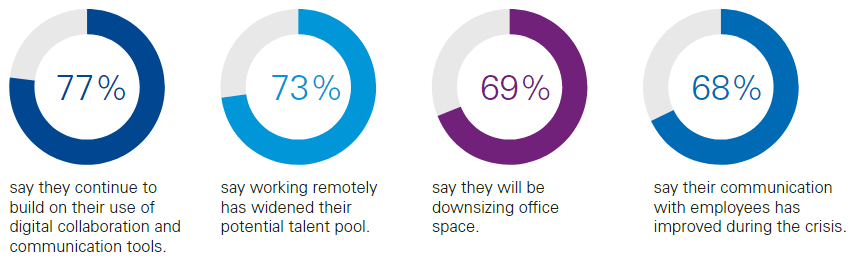

Future of work

COVID-19 has effectively forced many organizations to experiment radically with how work is done. For many organizations, virtual working kicked in literally overnight. With the pandemic transforming the world of work, 77 percent of CEOs say they will continue to build on their current use of digital collaboration and communication tools, and 73 percent believe that remote working has actually widened their available talent pool.

Customer-centric supply chain

In terms of the future operating model, supply chains have also been hard hit: 67 percent say they have had to rethink their global supply chain. However, CEOs are using this opportunity to ask how their supply chain can become a competitive advantage in the new reality that emerges. When we asked CEOs to say what was driving this supply chain re-evaluation, the top-ranked reason was to ‘become more agile in response to changing customer needs’ and ‘pressure from governments to bring production closer to home’ was second from bottom.

Consumer expectations have changed

COVID-19 completely changed the landscape for insurers. First, workers confined to their homes needed access to data and systems almost overnight, as well as the ability to conference and collaborate with colleagues. Then consumers became more demanding, driven by better digital experiences that they encountered in more agile industries, such as food delivery and online streaming.

Customer patience and loyalty has worn thin. With lots of digital competition now in the market, customers have become increasingly willing to reconsider their insurance options.

Prior to the pandemic, reluctance to embark on digital transformation programmes was not just affecting customer experiences – it was also hampering larger insurers in pursuing growth through M&As.

In light of the pandemic, CEOs believe that purpose is more powerful and relevant than ever

Legacy systems have long been a major issue in the M&A landscape, as integrating different systems has previously proved nigh-on impossible, with some major brokers still operating on multiple, siloed legacy systems today following years of acquisitions, with the huge inefficiencies and issues that this brings.

Improvements in cloud-based technologies and digitalisation have largely removed this issue in the M&A space, enabling the swift integration of the acquired parties’ data to accelerate and enhance management information, whilst unlocking the efficiency gains shareholders expect to see.

CEOs see the pandemic as an opportunity to rethink the way we work and communicate

However, with advances in analytics, artificial intelligence, process automation, and the Internet of Things accelerating, the organization of the future will look very different: flatter, digitized and with a very different talent profile, potentially made up of fewer people with distinct new skills. CEOs will need to make some difficult people decisions and prioritize investment; focusing on bold and ambitious digital transformation moves. Two-thirds (67 percent) say they are likely to put their capital investment into technology versus developing their workforce’s skills and capabilities (33 percent). Interestingly, this balance hasn’t changed at all since the initial survey at the beginning of this year.

Are incumbents moving fast enough?

Richmond adds: “Looking at the London Market speciality space, the speed at which incumbents have switched has often related to their legacy issues, as well as the need to align with Lloyd’s Blueprint Two, despite its setbacks. The understanding of the need for change is there, but much remains to do.

In segmenting the market and its third parties, Lloyd’s said it had broken it down into six carrier, three broker and one vendor community made up of about 15-20 companies in each group.

Lloyd’s released the second edition of their Blueprint Two Interactive Guide. The release of the second interactive guide is the fifth major publication related to the marketplace’s Future at Lloyd’s transformation programme initiated by CEO John Neal.

It follows the original Prospectus, Blueprint One, Blueprint Two and the first edition of the Interactive Guide. It is the first release following the JV between Lloyd’s, the International Underwriting Association (IUA), DXC and is supported by the LMA.

This month we have met with eight of the communities and have introduced them to their market readiness partners. But this is just the start, and there is a lot of work to do; from setting one-to-one meetings with each of the firms, focused planning sessions to assess their business case and benefits, working on bespoke readiness plans, and involving them in market acceptance testing

wrote Lloyd’s

The processes and risks in the retail/SME space are usually less complex, and customers are also more expectant of change. Because of this, new entrants and forward-thinking firms are pushing the boundaries of what’s possible such as integrated self-service portals and other online solutions.

Despite the progress already made towards digitisation, there is still much work left to do before the insurance industry can claim to be fully and truly digital-first.

In the speciality market, where risks are more complex, the need for human interaction and relationships will remain for many years to come. Digital here is about providing better connectivity to trading partners and using real-time data to enable better risk and operational management.

Greatest risk to growth today

Greatest risk to growth today

Greatest risk to growth at the beginning of the year

In the retail and corporate markets, companies should be striving to move as much high-volume, lower-complexity business to a digital self-service model so they can focus on the high-net-worth and more complex risks, which the market manages so well through personal interactions. That element will never change, I hope.

Giving customers multi-channel choices will be important, whereby they can engage with insurers and brokers in different ways at different times. For instance, a customer may be happy to use a self-service portal to change a policy address, but when a major flood hits the house they will want to speak to a real person to resolve the claim.

The future of digital transformation in insurance

Research from PwC published last year identifies three key areas of improvement when it comes to digital transformation in the insurance industry.

First, insurers agree on the high strategic relevance of digital transformation for their company’s success, but they’ve been struggling to unlock its full potential. As COVID-19 continues acting as an accelerator, however, their momentum toward adopting more digital capabilities at scale is expected to increase.

Second, past investments into digital self-service platforms and robotics process automation (RPA) have proven to be successful.

Therefore, budgets have shifted to account for new use cases in the field of artificial intelligence (AI) and to unlock additional potential from data analytics – especially as it relates to automating and accelerating claims processes and customer service.

5 out of 6 insurers expect AI to be a core part of the way they provide services over the next 3–5 years.

Third, insurers acknowledge that they need new ways to enable change within their workforce in order to foster a truly digital mindset within the organisation. While insurers are deploying new technologies with some impact, they are reporting lower emphasis on keeping the organisational setup aligned with technological change.

The greatest hurdle for an insurer on its way to become a digital organisation is change management. Companies must make structural changes to secure the sustainable impact of their new technologies and upskill their workforce, often by closing digital skill gaps through collaborations with tech firms.

Edited & Fact checked by