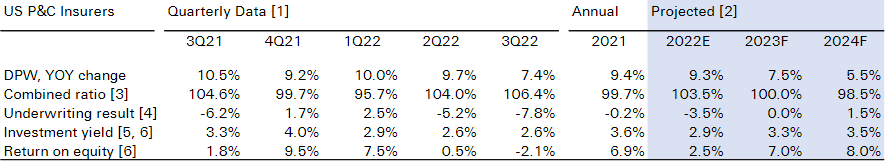

2022 was a difficult year for the US P&C insurance industry: claims severities surged with inflation, natural catastrophe losses were elevated for a sixth straight year, and the lowest realized capital gains since 2009 offset higher fixed income yields.

According to Sigma Research Swiss Re Institute, higher used car prices alone caused auto insurers an estimated USD 15 billion of extra claims costs; costlier repairs added to the bill. Elevated construction costs reduced profitability in property lines.

Swiss Re Institute forecast better results in 2023 and 2024 as inflation eases, and premium rates and portfolio yields increase.

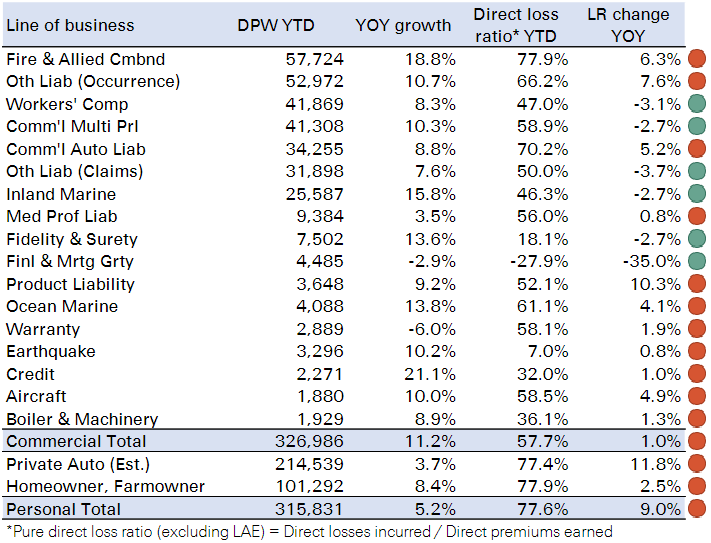

The 20 percentage point (ppt) gap between personal and commercial insurance lines loss ratios in the first nine months of 2022 is likely to decrease in 2023 as personal lines rate increases gain momentum and the drivers of motor inflation decelerate.

This Report summarizes statutory data as of 2022, and provides estimates and forecasts from 2022 to 2024.

- Inflation, catastrophes and volatile markets eroded the benefits of nominal premium growth and interest rate increases during 2022.

- Used car inflation caused an estimated USD 15 billion in extra claims costs in 2022.

- SROE to improve to 7% in 2023 and 8% in 2024 on higher premium rates and investment yields.

- Premiums to grow 7.5% in 2023 and 5.5% in 2024 after two years of growth above 9%.

- Slowing rate gains in commercial lines will likely be partly offset by acceleration in personal lines.

Insurance Profitability & Underwriting

Swiss Re forecast ROE to reach 7% in 2023 and 8%in 2024, from an estimated 2.5% in 2022, as strong premium increases and reinvestment rates above portfolio yields boost insurers’ profitability.

Profitability: P&C insurance industry return on equity (ROE) to rebound on higher underwriting and investment income

In 3Q22, Hurricane Ian and high inflation combined to create a USD 14.2 billion underwriting loss and an industry net loss of USD 3.7 billion. Investment results disappointed for a second consecutive quarter in 3Q22 as net realised capital losses again offset the benefit of higher interest rates.

However, downside risks remain, and a more severe-than-expected recession or inflation this year or in 2024 would pose risks for insurers’ exposure and premium growth, claims costs, investment yields and capital gains.

Underwriting: easing inflation to lower the industry combined ratio (CR) to 100% in 2023 and 98.5% in 2024, from 103.5% estimated for 2022 (see Impact of Inflation on Insurance Industry).

In 3Q22 the industry netcombined ratio deteriorated to 106.5% despite international cessions offsetting part of the impact of Hurricane Ian on the US net loss ratio (LR).

Reserve releases of USD 650 million also improved the 3Q accident period result by 0.4 ppt. Swiss Re expect loss severities to ease as headline inflation decelerates to 3.7% in 2023.

Swiss Re forecast wages and healthcare cost increases to rise above general CPI inflation this year, which could weaken reserve adequacy and slow the profitability improvement. These primarily affect longer-tail liability exposures, which account for roughly half of industry premiums but nearly 90% of reserves.

US P&C insurance sector outlook

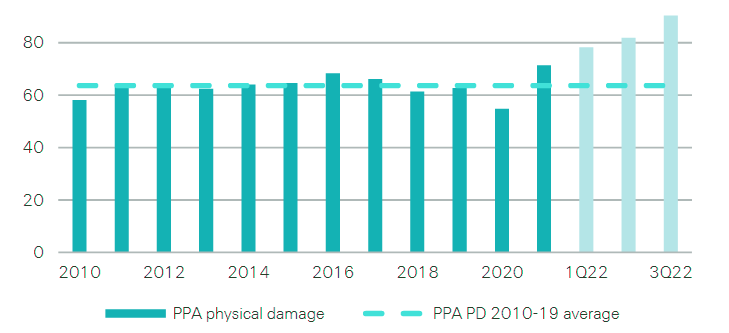

Personal auto physical damage was a key driver of underwriting losses in 2022

Thedirect loss ratio for this line of business stood at 84.5% in 9M22, more than 20 ppt above the average for the decade pre-pandemic. On estimated full-year earned premiums of USD 110 billion, we calculate that this implies USD 22 billion of extra claims costs in 2022.

Personal auto direct loss ratios, 2010-2021 (annual) and 1Q22-3Q22 (quarterly)

We attribute up to USD 15 billion of the underwriting deterioration to used car price inflation: insurers declare roughly 1.3 million vehicles as total losses each year, and used car prices were 47% higher on average relative to pre-pandemic levels.

We assume that below-average total loss frequency in 2022 is offset by an estimated 358 000 Hurricane Ian-related flood insurance claims.

Volatile used car prices cost the industry an estimated USD 15 bn in extra claims

The rising cost of motor vehicle body work – up 10% yoy as of December 2022 – has added to claims costs, with an impact on underwriting results since approvals for premium increases in some states were delayed until recently. But looking forward, we forecast rapid improvement in 2023.

In addition to accelerating rate increases, by December 2022 used car prices were down 14.9% from a year earlier according to Manheim, and Ally Financial expects an additional 15% drop in 2023.

Property lines results have also deteriorated

Inflation – and Hurricane Ian – have also affected property lines; through 3Q22, fire & allied and homeowners loss ratios deteriorated by 6.3% and 2.5% respectively from the prior year. We forecast that construction cost increases will decelerate from 17.6% in 2022 but grow at a still-high 12.5% in 2023 and 4% in 2024.

Price trends: ongoing rate increases are likely necessary and look set to continue through 2023

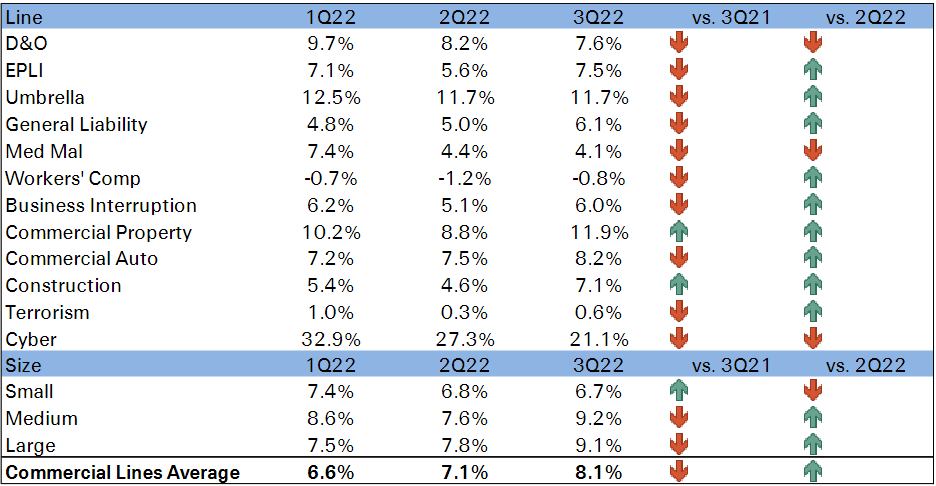

The latest CIAB survey reported that average rates for commercial linesincreased by 8.1% yoy in 3Q22, up from a 7.1% gain in 2Q22. MarketScout reports average increases of 5.1% for 4Q22 after 5.3% in the third quarter.

We expect continued rate increases through 2023 with inflation, natural catastrophes and geopolitical uncertainties including cyber among the top risks raising claims and operating costs, although commercial lines momentum is likely to slow.

YTD premium growth and loss ratios by line of business

Premium increases requested in personal lines rate filings have been accelerating in response to higher prices of used cars and bodywork for auto and construction materials, contents and labor costs for homeowners. Effective rate increases in 2022 amounted to 8.7% for personal auto and 4.6% for homeowners, the largest taking effect in 4Q22.

Growth: we expect nominal DPW growth to slow to a still-strong 7.5% in 2023 and 5.5% in 2024 from 9.3% in 2022.

DPW grew by 9.3% through 3Q22 compared to 9.8% at 1H22 after correcting for a new rule that leaves New Jersey-domiciled insurers out of the quarterly data. Commercial lines grew at roughly twice the pace of personal lines through three quarters. We expect growth to be driven by rate with slight exposure increases. We forecast US real GDP growth to slow to 0.1% in 2023 and 1.3% in 2024.

Investment income

Swiss Re expect the average investment yield to climb to 3.3% in 2023 as reinvestment yields in insurer portfolios rise.

Realized capital losses weighed on investment results in 2022, but the benefit from higher interest rates is accumulating

We revised down our estimated investment yield again for 2022 to 2.9% from 3.1% in 2Q, after a second consecutive quarter of realized capital losses. Realized capital gains averaged USD 10.6 billion annually in the decade to 2021; through 3Q22 they were less than USD 1 billion.

However, net investment income excluding realized capital gains is rising: the industry earned USD 12.3 billion (2.8%) in 3Q22, up from USD 11.4 billion (2.5%) in 3Q21.

In 2022 the S&P 500 moved down 19.4% and the 10-year Treasury yield ended at 3.88%, a 2.36 ppt increase from the start of the year. In 2023 we expect the Fed Funds Rate to pass 5% while the 10-year yield averages 3.5%.

As the benefits from reinvesting the industry portfolio at higher yields gradually accumulate – partly offset by headwinds from low realized capital gains through at least the first half of the year – we forecast an industry investment yield of 3.3% in 2023, expanding to 3.5% in 2024.

US P&C pricing trends

According to the latest CIAB survey, commercial lines prices increased 8.1% in 3Q22, the second consecutive quarter of acceleration.

Cyber rate increases are decelerating but it remains the fastest-increasing line, with rates up 21% in 3Q22.

US P&C pricing trends – CIAB

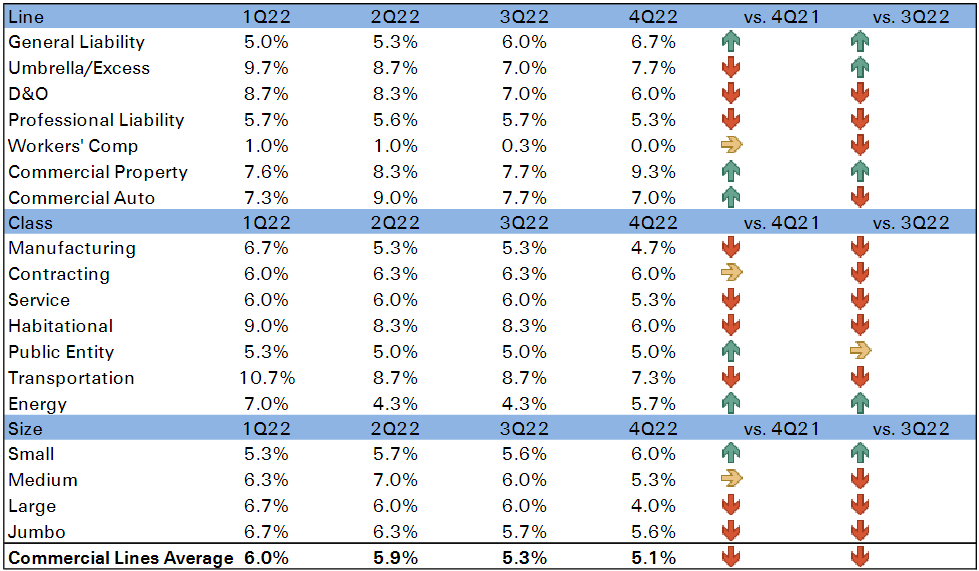

According to MarketScout, average commercial lines rates rose by 5.1% in 4Q22 for an annualized 5.7% increase.

US P&C pricing trends – MarketScout

D&O rate increases continue to decelerate as the slowdown of IPO and SPAC business lowers demand faster than capacity adjusts.

Commercial property accelerated strongly, returning to double digits, and auto accelerated slightly. Workers’ compensation rates dropped by 1%.

Rates improved across all account sizes, with large and medium accounts still seeing the strongest gains.

…………………….

AUTHORS: James Finucane – Senior Economist, Swiss Re Institute, Thomas Holzheu – Chief Economist Americas, Swiss Re Institute

Fact checked by Oleg Parashchak