Insurers the world surveyed by the Deloitte Center for Financial Services remain fairly bullish when it comes to their growth prospects for 2023, despite lingering concerns about the potential impact of COVID-19 on overall business recovery and return-to-workplace strategies.

Most respondents cited plans to increase investments in enabling technologies and evolving talent models to build on the digital and virtual platforms that sustained their operations and maintained their engagement with customers throughout the worst of the pandemic.

Among the 424 insurance respondents surveyed from North American, European, and Asia-Pacific (APAC) countries, about one-third expect revenues to be “significantly better” next year.

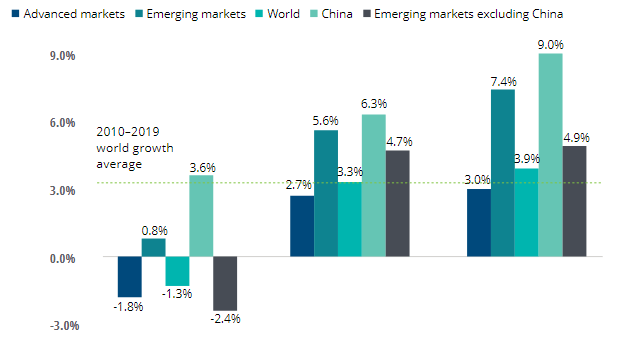

This positive outlook lines up well with industrywide forecasts for both sides of the industry. The Swiss Re Institute expects rising demand for insurance worldwide, with consolidated premiums for all lines rebounding by 3.9% in 2022.

China is predicted to lead the way with 9% growth in 2022, followed by emerging markets (excluding China) at 4.9%, while advanced markets are likely to see more moderate gains averaging 3%.

Breaking down the industry’s two main components, global life insurers, benefitting from heightened consumer risk awareness due to COVID-19, are expected to post above average premium growth rates of 4% in 2022.

Global nonlife premium growth is forecast at a more 3.7% in 2022 as more people are likely to return to their workplaces and business recovery is expected to pick up speed. Commercial insurance sales are expected to bounce back more robustly than in personal nonlife segments, driven by accelerating business activity.

Meanwhile, global property-casualty (P&C) reinsurance net premiums written were up 18.5% in the 2022.

Profitability also improved, as P&C reinsurers monitored by Fitch Ratings had an aggregated combined ratio of 94.5%, an 11.4 point improvement over 2020’s first half—which included US$6.1 billion in pandemic-related losses. Fitch expects renewal rates to keep rising after two years of growth but at a slower pace amid more abundant capacity.

Another growth factor is how increased demand on the nonlife side is driving significant price increases across the board. Premium rates at Lloyd’s were up 9.9% in 2022’s second quarter.

Global insurance market outlook foresees above-trend premium growth

Growth in premiums written (life and nonlife)

US P&C price hikes in the same period averaged 5.54% in commercial property, 4.51% in commercial auto, and 4.59% in business owner policies.

Cyber insurance rates soared 25.5% in the second quarter, due in large part to ransomware attacks as well as increased exposure to breaches after allowing remote access for millions more home-based workers.

Only workers’ compensation showed a rate decrease, down an average of 1.74%,12 likely due to the fact that US unemployment remained higher (5.4%) over the summer compared to before the pandemic (3.5%), with about 3 million people still not back in the workforce to insure.

On the life insurance side, US application activity was up 7.3% as of the end of June, according to the MIB Life Index.

AM Best reported first-half net income for US life insurers soaring to US$18 billion compared to just US$1 billion in the first six months of 2020, when the pandemic put tens of millions out of work—many of whom lost group life insurance coverage.

LIMRA updated its sales forecast in August as a result of better-than-expected gains, predicting a US market expansion of 7–11% for full-year 2022, with growth anticipated for nearly all life product lines.

The industry, therefore, appears poised for significant growth and a much stronger financial performance in 2022.

Yet our global survey shows that multiple challenges remain for leaders in finance, talent, technology, and marketing as carriers continue to adapt to the pandemic’s aftermath, while simultaneously seeking bigger picture transformation to generate faster growth and secure their long-term future.

Besides the potential for new COVID-19 strains to hinder or even derail economic recovery and insurer growth prospects in any number of countries, insurers are likely to grapple with several fundamental bottom-line threats in the year ahead.

To start with, rising inflation combined with flat interest rates could turn out to be major obstacles to improving insurer results. Rapid increases in demand for goods, materials, and labor, as well as ongoing supply chain disruptions have been raising claims costs for personal and commercial property losses.

Corresponding price hikes for construction materials, rental vehicles, and auto parts (including semiconductor and computer chips for smart cars) are among the expenses threatening to drive up insurer loss costs into 2022-2023.

This factor alone is likely to keep pushing P&C prices higher for buyers.

Yet, interest rates have remained relatively low around the world despite rising price and labor cost trends, as governments look to avoid undermining the recovery’s momentum and perhaps risk their economies slipping into recession. Still, this could undermine investment returns for the industry as a whole, while hindering growth and profitability of interest-rate–sensitive L&A products.

Regulatory costs also will likely keep mounting. For example, global carriers are entering the home stretch in concluding preparations to comply with International Financial Reporting Standards 17 (IFRS 17), determining how insurance contract assets and liabilities are presented on company balance sheets.

Implementation of IFRS 17, due to go into effect in January 2023, could cost global insurers between US$15 billion and US$20 billion when all is said and done, according to a survey of 312 carriers from 50 countries by Willis Towers Watson.

Rising inflation combined with flat interest rates could turn out to be major obstacles to improving insurer results.

Preparations for IFRS 17 are already complete at 37% of companies participating in Deloitte’s global outlook survey. About one-third, however, said their companies are only somewhat far along or are just getting started in preparing to make the transition.

Climate risk and sustainability efforts still a work in progress

Financial losses from climate risks are likely to continue cutting into P&C insurer profitability and drawing heightened attention from sustainability advocates. The Swiss Re Institute estimated global insured natural disaster property losses of US$40 billion through June—the second highest first-half figure in a decade, and well above the prior 10-year average of US$33 billion.

Hurricane Ida in the United States alone should add between US$31 billion and US$44 billion in onshore and offshore insured losses in the second half of 2021.

Many insurers have been ramping up efforts to quantify and address climate risk in both their underwriting and investment portfolios, spurred on in part by increasing demands for data and evidence of concrete mitigation action from a wide variety of stakeholders.

The International Association of Insurance Supervisors’ executive committee adopted a paper to help regulators “promote a globally consistent approach to addressing climate-related risks,” and a number of regulators have already launched their own initiatives.

For example, the European Insurance and Occupational Pensions Authority (EIOPA) laid out expectations for insurers to employ more robust and longer-term scenario analyses in their Own Risk and Solvency Assessments to account for climate-related physical risks such as fires and floods, as well as transition risks in moving coverage and investments to less carbon-intensive industries.

And the Bank of England has launched climate risk stress tests for insurers based on three scenarios over 30 years, in which governments take early action to limit carbon emissions, take later actions, or take no action at all.

In the United States, the New York Department of Financial Services, following a public comment period earlier this year, is expected to promulgate new guidance on how insurers should be disclosing and managing financial risks from climate change.

Quantification of ESG elements for financial disclosure statements should be a top priority for insurer CSOs and senior leadership, to establish both sustainability goals and benchmarks to measure progress

Elements on the table for review include climate considerations in risk management frameworks and processes, business strategies, and financial metrics.

Quantification of ESG elements for financial disclosure statements should be a top priority for insurer CSOs and senior leadership to establish both sustainability goals and benchmarks to measure progress.

While the vast majority of outlook survey respondents in finance roles said their carrier had made at least some headway in this area, only one in four indicated they had finished quantifying metrics on climate risk in their books of business or in assessing their own carbon footprint, while fewer than one in five had accomplished this in their investment portfolios. Only 28% of respondents had fully quantified the impact of diversity and inclusion (D&I) initiatives, while just 20% have done so for social equity programs to bolster their presence in underserved markets.

More active M&A activity expected as insurers seek scale and growth

Global insurance merger and acquisition (M&A) activity leveled off in 2021’s first half, with 197 completed deals nearly even with the prior year’s total. Yet activity was stronger in the Americas (up 7.3%) and Europe (2.0%) than in APAC, where deals were down 51.4%.

Thirty-five of 2021’s deals (17.7%) have been cross-border, mirroring the second half of 2020, while more than half of those deals were interregion, as more insurers seek growth by expanding outside of their home markets.

However, the appetite appears to be stronger on the life side, with 44% of respondents citing increased deal-making as very likely, versus nonlife at 32%. Expanding geographic reach outside their home country was the top motivating factor for M&As across the respondent pool, followed by increasing scale and adding new technology capabilities.

Tax departments face upheaval from legislative reforms, operating model changes

A little more than one-third of insurance finance executives surveyed for this outlook say they are very prepared to respond to potential changes in corporate tax rates, cross-border taxation, and taxation of foreign operations, with about the same number feeling at least somewhat prepared. But that left about one in four of those surveyed indicating they are only somewhat or even very unprepared for such tax rule changes.

55% of respondents say they have a plan in place to respond to any tax issues arising from shifts in workplace staffing as employees return to the office and continue working from home in significant numbers, while 36% are working on such a plan, with virtually no differences among regions.

Nearly all those surveyed said they are committed to changing their tax department’s operating model in some significant way over the next year—for example, by outsourcing more. One in five said such efforts are already complete, while over one-third have such transformations in progress, and about one-third are very likely to begin making such changes in 2022.

Insurers are likely to be increasingly called upon to take steps to rebuild trust, contribute to a more just and sustainable world, and build a more equitable financial services industry where profit and societal impact coexist amicably.