2023 is a continuation of the recent run of years with high losses from natural disaster. While the overall losses of $110bn were lower than those in 2022 ($120bn), they were still well above the average for the last ten years ($98bn, inflation-adjusted), according to Munich Re’s Earthquakes, thunderstorms, floods Report.

The insured losses has decreased from $47bn to $43bn (10-year average for half-year losses: $34bn).

Less than 40% of overall losses in the first half of the year were insured – evidence of the large insurance gap that persists in many countries for multiple natural hazards. Insurers bore around 35% of worldwide losses in terms of the average losses in the period 2013–2023 (see Main Factors of the Increase in Insurance Losses from Natural Disasters).

Natural disasters in figures

- Overall losses of $110bn – above the 10-year average

- Insured losses according to provisional estimates amount to $43bn, also much higher than the 10-year average

- Devastating earthquake in Turkey and Syria responsible for highest overall losses

- Series of extreme thunderstorms, including tornadoes and hail, in the USA account for roughly one third of overall global losses

- Climate change and El Niño drive record temperatures

The earthquake disaster in Turkey and Syria illustrates the importance of robust and safe buildings. The primary aim must be to save lives. The next step is to reduce losses in such catastrophes. This is starkly illustrated by the loss figures.

Re/Insurers need to adapt to handle the consequences of global warming in the form of more frequent or more severe weather disasters much more effectively – by employing appropriate construction methods, selecting sites that can withstand future impacts and by having insurance to cover the immediate financial consequences.

Thomas Blunck, Member of the Board of Management Munich Re

JP Morgan have estimated that total natural catastrophe insured losses in Q1 2023 so far are in the region of $6-8 bn. Looking at the last 10 years, the average industry loss for Q1 is around $13.5bn which, adjusting for inflation, is probably close to $15bn for 2023.

Material changes in retentions by the primary insurers should mean that a higher proportion of losses end up with the primary insurers rather than the reinsurers.

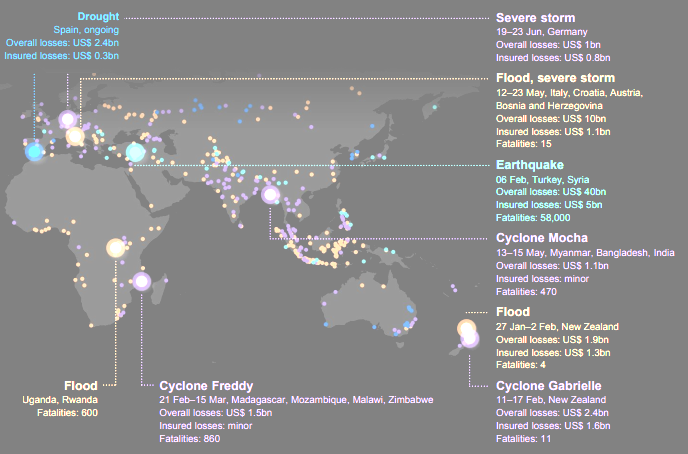

Global Nat cat loss events in 2023

Catastrophe risk modeller Moody’s RMS anticipates that economic losses from the two earthquakes will surpass $25 bn, with insurance and reinsurance industry losses expected to exceed $5 bn.

What were the costliest natural disasters in 2023?

The earthquake in Turkey and Syria was by far the most devastating natural disaster in the six months of the year. On 6 February, a series of tremors struck southeastern Turkey close to the border with Syria (see How Earthquakes in Turkey & Syria Impacts for Re/Insurance Industry?).

The two strongest tremors had magnitudes of 7.8 and 7.5 respectively and were the strongest earthquakes in Turkey in decades. A very large number of buildings, roads and bridges were destroyed.

Around 58,000 people lost their lives. As a result, the global number of victims of natural disasters in the first half of the year (some 62,000) was higher than it had been since 2010. Overall losses from the earthquake in both countries are estimated at around $40bn, with Syria accounting for roughly $5bn (see TOP 20 Costliest U.S. Hurricanes).

Despite the establishment of the Turkish Catastrophe Insurance Pool (TCIP), which provides compulsory insurance for residential buildings in Turkey and now has insurance penetration of more than 50%, the insured portion of overall losses totalling around $5bn remained small.

According to Losses of Earthquakes in Turkey Report, the sum insured under the TCIP is limited to TL 640,000 per residential unit (equivalent to approximately $34,000 at the time of the earthquake). Commercial enterprises are not included in the pool. Similarly, infrastructure is generally not insured.

Particularly in a country as exposed to earthquakes as Turkey, it would be both desirable and practicable to have a wider spread of insurance cover, to ensure that those affected – governments included – can recover more rapidly from the financial losses.

Global insurers and reinsurers are expected to bear the bulk of the claims burden. The Turkish Catastrophe Insurance Pool, or TCIP, had a total claims paying ability of 46 billion Turkish lira in 2021, according to its annual report for that year, most of which came from its excess-of-loss reinsurance program, which covers losses from 5 billion lira to 36.9 billion lira.

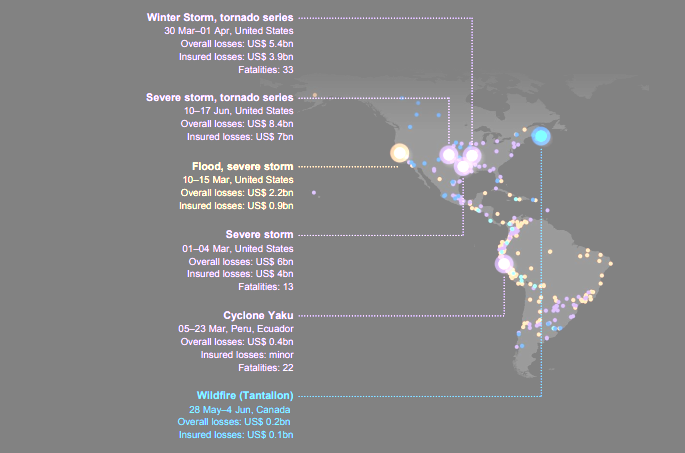

Extremely high losses from severe thunderstorms in the USA

In the USA in the first half of the year, multiple rounds of severe thunderstorms, accompanied by destructive tornadoes and hail, caused losses to spike (see Worldwide Severe Convective Storms).

Overall losses from these storms came to more than $35bn, of which more than $25bn was insured. Losses of this magnitude from severe thunderstorms in the USA now seem to be normal occurrences, rather than outliers.

After adjustment for inflation, higher first-half thunderstorm losses have only occurred once before in the USA (in 2011, with $46bn in overall losses and $29bn in insured losses).

Karen Clark & Company estimates that the insured loss from this Severe Convective Storm outbreak will be close to $5.5 billion.

The costliest single event of the year so far was a series of thunderstorms in mid-June, which affected large parts of Texas. Severe squalls and hailstones measuring up to twelve centimetres in diameter – almost twice the size of a tennis ball – caused the most serious damage.

More than 50 tornadoes were recorded, some of which were rated F3 on the Enhanced Fujita Scale, with wind speeds in excess of 218 km/h.

The overall loss for this outbreak is estimated at around $8.4bn, of which approximately $7bn was insured.

When considering weather-related catastrophes, few perils have generated as many column inches in recent months as severe convective storms (SCS).

Even more notable is that annual losses have averaged more than USD25 billion in the past decade alone. The 2023 is on track to be one of the most expensive on record for US SCS activity, both in terms of economic loss (at least USD35bn) and insured loss (at least USD 29billion), according to Gallagher Re’s Natural Catastrophe Report 2023 and event estimates as of mid-June.

Storms “trained” nearly every day throughout this event, meaning that they formed along the east-west-oriented frontal boundary and tracked eastward along it, steered by the eastward-flowing upper-level jet stream overhead.

Most researchers assume that climate change is facilitating the formation of severe thunderstorms with tornadoes and hail, since the continuing warming is resulting in greater evaporation and, particularly at ground level, in increased humidity.

This increases the potential for thunderstorms to form. Loss statistics for thunderstorms in North America and Europe are also trending upwards, even after adjustment for the increase in values from economic development.

Climate change and El Niño

The global average temperature for June was the warmest ever recorded, up by more than 1.2°C compared to pre-industrial times.

The effects of climate change are having a stronger and stronger impact on our lives. The 2023 was characterised by record temperatures in many regions of the world, very high water temperatures in various ocean basins, droughts in parts of Europe, and severe wildfires in northeastern Canada

Ernst Rauch, Chief Climate and Geo Scientist at Munich Re

As in 2016, the natural climate phenomenon El Niño is playing a role in 2023. It is characterised by a temperature swing in the Pacific that influences extreme weather in many regions of the world and causes temperatures to temporarily rise further.

All the same, research on global temperature trends is unequivocal: rising water and air temperatures worldwide are mainly driven by climate change, in turn causing more weather-related natural disasters and financial losses.

Hurricane activity in the North Atlantic generally decreases during an El Niño phase

However, the exceptionally high water temperature in the main areas of hurricane formation, with values that are 1–2°C above the average, make it more likely that a greater number of storms will form in the season’s main phase starting in August. This makes it difficult to predict what the current hurricane season will be like.

North America severe thunderstorms losses

As usual, extreme severe thunderstorms in the USA in the first half of the year, in conjunction with other disasters, accounted for North America’s high share in worldwide losses.

Overall losses were $42bn, of which approximately $32bn was insured – a reflection of the region’s high insurance penetration for thunderstorm losses, motor own damage in particular.

Extreme wildfires in Nova Scotia in northeastern Canada attracted global attention. Massive fires blazed for several weeks in regions that were relatively sparsely populated. This helped keep direct losses within reasonable limits.

However, ash and clouds of smoke spread across large parts of the eastern USA and darkened the sky over cities such as New York. There were no major relevant losses for insurers.

Europe high proportion of insured losses

As a result of the earthquake disaster in Turkey, the proportion of losses in Europe in the 2023 was exceptionally high.

Of roughly $59bn (€48bn) in overall losses, only some $7bn (€6.7bn) was insured.

As well as the earthquake in Turkey, severe floods in northeastern Italy and neighbouring countries resulted in extremely high losses. Particularly affected was the Emilia-Romagna region in northern Italy, where after two years of drought, the area experienced several episodes of extreme rainfall in May.

As many as 23 rivers burst their banks. An analysis of the event concluded that there was a 1-in-200-year probability of such prolonged heavy rainfall in the affected region.

Due to the high level of urbanisation, the floods had a serious impact: overall losses came to roughly $10bn (€9bn).

However, only $1.1bn (€1bn) of these losses were insured due to the fact that, as in many other countries, flood risk is not covered under standard building insurance.

As in other European countries, a higher insurance penetration could ensure that those affected are not left to shoulder the losses themselves, or be left dependent on outside assistance. In addition, an appropriately designed policy could increase the incentive to take loss reduction measures.

Asia-Pacific several disasters

In the Asia-Pacific region, natural disasters resulted in overall losses of approximately $7bn, of which roughly $3bn was insured. In New Zealand, high losses were caused by flooding following heavy rainfall, as well as Cyclone Gabrielle making landfall. Assets worth some $4.3bn were destroyed, of which around $2.9bn was insured.

Large areas of China and Southeast Asia suffered recurrent heat waves between March and June, breaking many local and seasonal records.

Tianjin, a city with over 10 million inhabitants, measured a record high of 41.4ºC. For Asia as a whole, the months of February to June were the fourth warmest on record, as was June alone.

Cyclone Freddy claimed a large number of lives in Mozambique and other countries in southeastern Africa. Freddy was probably the longest active tropical cyclone since records began. It formed at the start of February to the north of Australia and then traversed the entire Indian Ocean.

After making landfall in Madagascar, it meandered back and forth between Madagascar and Mozambique. The southeastern African country was then impacted a second time by the cyclone. Some 860 people lost their lives. Overall losses in Mozambique and neighbouring countries came to approximately $1.5bn. Due to the very low insurance penetration in low-income countries, however, only a negligible portion of the losses was insured.

………………….

Disclaimer

Munich Re’s NatCatSERVICE collects information from governmental agencies, scientific institutes, associations, the insurance industry, the media and other publicly available sources in order to analyse nat cat losses.

QUOTES: Thomas Blunck – Member of the Board of Management Munich Re, Ernst Rauch – Chief Climate and Geo Scientist at Munich Re

Edited by