Inflation continues to be the key concern for insurers according to Swiss Re Institute’s latest sigma. The effect of inflation on the global economy has led to total global insurance premium falling slightly by an estimated 0.2% in real terms in 2023.

- The insurance industry is forecast to return to growth in 2023–2024 after total global premiums are estimated to have contracted by 0.2% in real terms in 2022

- Inflation remains the key concern for insurers, with average annual global consumer price index (CPI) inflation forecast at 5.4% in 2023 and 3.5% in 2024

- Real non-life premiums forecast to grow by 1.8% in 2023 and 2.8% in 2024; life premiums to grow by 1.7% across 2023 and 2024

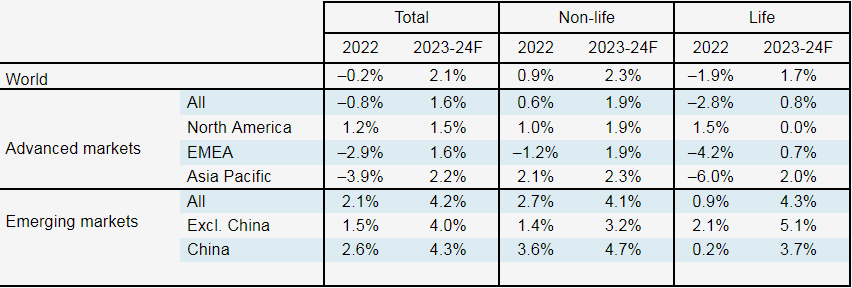

Swiss Re Institute expects the insurance industry to return to premium growth of 2.1% annually on average in real terms in 2023 and 2024, supported by a combination of easing inflation, market hardening in property and casualty lines, as well as stronger life insurance demand.

A silver lining for the insurance industry comes from central bank interest rate increases that are expected to improve investment results over the medium term.

The global economy will cool down noticeably under the weight of inflation and interest rate shocks. The repricing of risk in the real economy and financial markets is actually healthy and a long-term positive. Higher risk-free rates should mean higher returns for investing into the real economy.

During today’s challenging times – and for the economic recovery period ahead – the insurance industry can show its value as it provides financial resilience at all levels of the community.

Major economies, notably in Europe, are likely facing inflationary recessions in the next 12–18 months amid higher interest rates. Global GDP growth is forecast to slow to 1.7% in 2023, from 2.8% in 2022.

Swiss Re Institute forecasts 5.4% average annual global CPI inflation in 2023 and 3.5% in 2024, down from 8.1% in 2022. Despite expected easing in momentum, inflation is anticipated to stay volatile and persistently above historic averages. For insurers, inflation is a challenge because it erodes nominal premium growth, impacts global demand, and creates higher claims costs in non-life lines.

Insurance market improvements in 2023 and 2024 as economies recover and pricing improvements take effect

Swiss Re Institute forecasts that non-life real premium growth will recover to 1.8% in 2023 and 2.8% in 2024 after weak 0.9% growth in real terms in 2022.

In Europe, the expected rebound reflects improving economic conditions as the region recovers from the forthcoming downturn.

Potential insurance rate increases and easing inflation in the US, as well as more favourable real growth in Asia are expected to support stronger premium growth in those regions.

China, which represents 60% of emerging market non-life premiums, can anticipate 4.0% real non-life premium growth in 2023 and 5.8% in 2024.

Insurance premium forecast in real terms

Real GDP growth and CPI inflation forecasts in select regions, 2022 to 2024

| 2022 | 2023 | 2024 | ||

| Real GDP growth, annual avg. % | Global | 2.8% | 1.7% | 2.8% |

| US | 1.8% | 0.1% | 1.6% | |

| UK | 4.3% | –1.0% | 0.9% | |

| Euro area | 3.1% | –0.2% | 1.3% | |

| Japan | 1.3% | 1.3% | 1.0% | |

| China | 3.4% | 4.1% | 4.9% | |

| Switzerland | 2.2% | 0.9% | 1.5% | |

| Inflation, all-items CPI, annual avg., % | Global | 8.1% | 5.4% | 3.5% |

| US | 8.1% | 3.7% | 2.8% | |

| UK | 9.1% | 7.0% | 3.7% | |

| Euro area | 8.6% | 6.2% | 3.0% | |

| Japan | 2.3% | 1.5% | 0.9% | |

| China | 2.3% | 2.6% | 2.4% | |

| Switzerland | 2.9% | 2.0% | 1.5% |

Commercial lines are expected to benefit most from rate hardening and expand more than personal lines (excluding health) in the coming years.

Swiss Re Institute estimates 3.3% growth in commercial premiums in 2022 and a 3.7% increase in 2023.

By contrast, global personal lines insurance premiums are expected to shrink by 0.7% in 2023, primarily due to underperformance in motor insurance in advanced markets, and then recover to 1.8% growth in 2024.

The cost-of-living crisis in advanced markets is estimated to have led to a contraction in global life insurance premiums of 1.9% in real terms in 2022. This is forecast to be followed by real premium growth across 2023 and 2024 of 1.7%, primarily driven by 4.3% growth in emerging markets, including China.

Life premium growth drivers are diverging in advanced and emerging markets. Inflation in advanced markets, particularly Europe, is squeezing household budgets and therefore reducing consumer demand for individual savings products.

In emerging markets, the growing middle class and government targets for life insurance penetration are supporting growth in savings business. Demand is also being supported by younger, digitally savvier emerging markets consumers who are more aware of the benefits of holding long term life policies.

………………….

AUTHOR: Jérôme Haegeli – Swiss Re Group Chief Economist