The reinsurance segment has been generating return-on-equity ratios of approximately 4-5%, in a market where the cost of capital is at least twice that.

The ongoing gap between return-on-equity ratios and the overall cost of capital is one of the key drivers for higher reinsurance prices going forward

AM Best maintains a stable outlook on the global reinsurance segment

The ongoing gap between return-on-equity ratios and the overall cost of capital is one of the key drivers for higher reinsurance prices going forward, according to a new AM Best report capturing the views of panelists from a recent reinsurance industry briefing.

The Best’s Market Segment Report, “Hesitant Capital Had Looming Role at January 1 Reinsurance Renewals,” is based on a briefing earlier this week in which a panel of AM Best analysts and industry executives discussed pricing pressures around the Jan. 1, 2023, reinsurance renewal season.

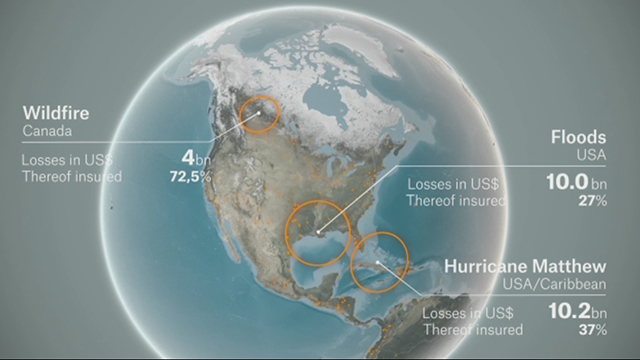

Persistently high levels of losses and volatility from small and medium-sized natural catastrophes, coupled with rising inflation and geopolitical concerns, has made property catastrophe exposures a less favourable play for reinsurers.

Global natural disasters in 2022 resulted in near-average economic losses totaling $313 billion. Half of those losses occurred in the United States and were driven by the devastating Hurricane Ian and multiple severe convective storm outbreaks.

According to AON Catastrophe Insight report, three global drought events were among the 10 costliest disasters, which underlines the growing significance of the peril on a global scale. These occurred in the United States, Europe and China.

Global natural disaster losses are better covered by insurers who face their fifth costliest year in history; climate change drives new extreme weather records.

The reinsurance sector covered $132 bn — marking 2022 as the fifth costliest year for insurers on record.

The industry the second costliest event on record, as Hurricane Ian resulted in approximately $50-55 bn of insured losses covered by public and private entities.

It is only surpassed by Hurricane Katrina with $99 billion on a price-inflated basis. With a protection gap of 58%, most disaster losses were uninsured. While this is one of the lowest protection gaps on record (only matched by a similar percentage from 2005), the remaining gap presents both a challenge for the global resilience, as well as an opportunity to facilitate further protection.

Additional topics of report included the future role of insurance-linked securities in underwriting property catastrophe exposures, the impact of economic instability on market conditions and whether reinsurance pricing and results have stabilised enough to persuade new investors and capital to enter the market.

The reinsurance segment has been generating return-on-equity ratios of approximately 4-5%, in a market where the cost of capital is at least twice that. That cost of capital is due to increase even further, according to one of the panelists

Carlos Wong-Fupuy, senior director, AM Best

While the market remains well capitalised, it’s important to note how capital is being deployed and that significant amounts remain on the sidelines.

Property reinsurers experienced the heaviest hit at the 1 January renewals, with catastrophe-exposed lines up 50-100% generally.

Some factors influencing the capital inflow are beyond the sector’s control, such as the rapid interest rate changes and the estimated 20% drop-off in equity markets, all within the past 12 months alone.

by Yana Keller