While insurers may have winced at the spike in property-catastrophe prices at the Jan. 1 renewals, the resulting rate hikes and new policy terms should spur investor interest in the reinsurance space.

Predictions that the new prices and terms secured at Jan. 1 should boost reinsurers‘ returns will catch investors’ attention, according to S&P Global Market Intelligence.

Global property-catastrophe prices growing

Global property-catastrophe prices increased by 37% at Jan. 1, compared with 9% the previous year, according to figures from Howden Broking Group, as heavy catastrophe losses — not least Hurricane Ian — inflation and continuing geopolitical uncertainty steeled reinsurers’ resolve to hike rates. Just as importantly, reinsurers secured changes to terms, conditions and contract structures that shifted more risk back to insurers.

There were also sharp price rises in certain specialty lines. For aerospace catastrophe programs where there had been claims, prices went up by between 150% and 200%, according to the renewal report from Arthur J. Gallagher & Co.’s reinsurance arm.

Fitch Ratings expects underwriting margins at the reinsurers it rates to improve by four percentage points in 2023 (see Reinsurance Market Dynamics).

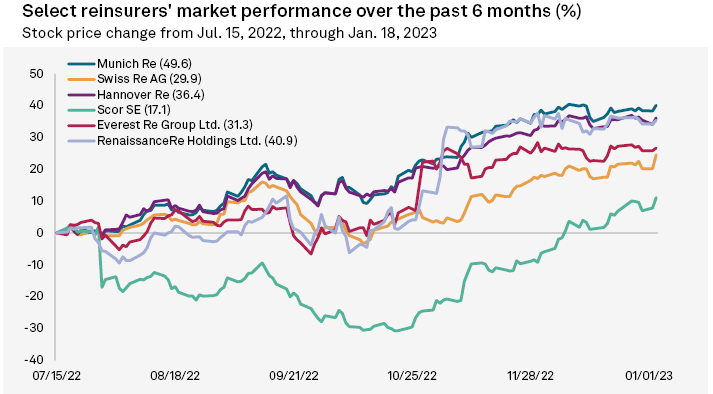

Investors have already been giving their support to reinsurers by buying their shares in the run-up to the renewals, the last two months of 2022 were “very strong” for most listed reinsurers‘ share prices. You don’t see a sharp increase in share prices unless you’ve got new money moving in to support these companies.

The share prices of six select listed reinsurers have all shown double-digit percentage increases over the past six months.

Germany-based Munich Re, the world’s largest reinsurer, led the pack with an increase of almost 50%.

If you’re interested in participating in insurance risk as an asset class, this is the time to come in, Guy Carpenter said. The current market conditions will be sustainable for a decent period.

Interest rate effects

While the current hard market in property-catastrophe, unlike in some previous cases, is not down to a lack of capital, reinsurers would welcome fresh money. Rising interest rates in 2022 cut the value of reinsurers’ bond-heavy investment portfolios, leading to unrealized losses and depleting shareholders’ equity.

Although reinsurers may never realize these losses, as they typically hold bonds until maturity, they could if they are forced to sell the bonds before maturity to pay for a series of large claims.

Howden’s report said the industry’s ratio of capital to premium was below 100% in 2022, a level last seen during the global financial crisis.

Rising interest rates also mean investors now have a wider array of attractive investment opportunities, which could leave less space for reinsurance.

That’s the other reason why I think that there’s every reason for capital to flow in. The sector needs the capital on the credit side and the sector can reward the capital on the equity side

David Flandro, head of analytics at Howden Broking Group

Because rates have risen so sharply, however, there is the potential for reinsurers’ forward returns on equity to rise, making reinsurance more competitive with other capital market instruments like high-yield bonds or even equities.

Wait and see

Despite these favorable tailwinds, some investors will want harder evidence to commit funds to reinsurance. Noting that talk of better returns will lure some investors in the early part of 2023.

There are a lot more investors out there who will probably wait for the improvement to actually be reflected in reported results.

Insurance risk adds diversity to investors’ portfolios; this is because it is largely not correlated to other asset classes, so keeping it there continues to make sense even in the face of a greater array of attractive investments (see How High Inflation & Hiked Base Rates Can Impact the (Re)Insurers). But markets remain volatile and uncertain, and rising interest rates have caused large unrealized losses on bond portfolios.

There’s not a lot of free money floating around out there for people to redeploy into insurance risk.

………………….

AUTHORS: Ben Dyson – S&P Global Market Intelligence

Fact checked by Oleg Parashchak