Europe’s multiline insurance earning season will likely center on concerns about 2023 reinsurance coverage, even as the largest primary carriers are expected to report solid results for 2022.

Volatility has returned to financial markets and has been accompanied by rising interest rates as markets expect monetary tightening to head off inflation. Bond and equity prices fell in view of the ongoing crisis and the risk of a further correction is material.

Reinsurers remained resilient despite higher catastrophe losses, inflation expectations and uncertainties surrounding the pandemic.

Hardening market conditions have increased written premium and improved reinsurers’ solvency positions. Climate change, cyber and the COVID-19 pandemic continue to be a source of risk and uncertainty for the sector.

Rising prices for various assets and the latest major losses make considerably higher reinsurance rates in Europe likely.

Doris Höpke, Member of the Board of Management at Munich Re

The major losses produced by extreme flooding in Central Europe and the rise in weather events like droughts and wildfires affect regions that, in some cases, are not characterised by risk-adequate prices and conditions. In addition, the higher inflation is accompanied by continuing low interest rates for investments.

Insurers managed to large losses

According to S&P Global Market Intelligence, multiline insurers managed to navigate large losses, claims inflation and capital markets turmoil in 2022.

While the direct impact of Russia’s invasion of Ukraine on European insurers and IORPs is very limited. Second-round effects from the macro side and spillovers from other parts of the financial sector, especially banking, could become a potential source of risk.

The “key focus” will be on how high reinsurance costs will impact their operating margins and how much risk exposure they keep on their own balance sheets

Hadley Cohen, an analyst at Deutsche Bank Research

The pandemic has disrupted supply chains, caused pockets of bottle-up demand and seems to have shifted consumers’ spending habits. Russia’s War in Ukraine with all its consequences has only made pre-existing inflationary pressures worse (see How Russian War in Ukraine Impacts for Global Insurance Sector?). The impact of inflation on insurance and pension undertakings as well on policyholders and beneficiaries warrants our full attention.

Primary insurers will be paying more for less-comprehensive reinsurance coverage after reinsurers secured large price increases and more restrictive terms during the Jan. 1 renewal season, particularly for loss-affected property-catastrophe cover.

The crunch is a bigger potential issue for Zurich Insurance Group AG than it is for Allianz SE, given their relative exposures.

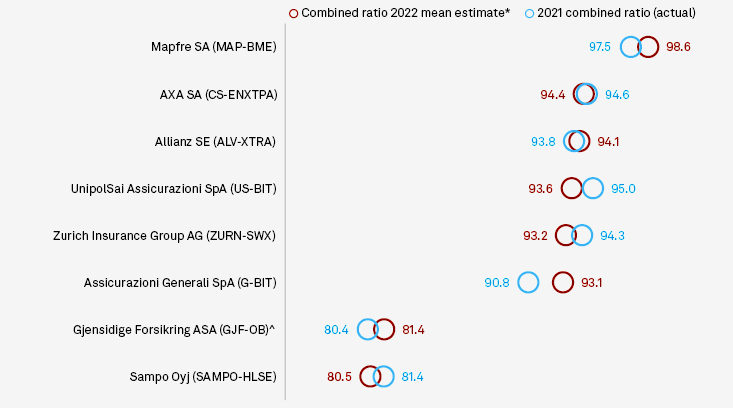

European insurers` combined ratio estamates

The “drastically” higher prices mean that Zurich has likely dropped its catastrophe aggregate reinsurance cover, following a similar move by AXA SA in 2022. Still, the insurer likely redeployed its reinsurance budget elsewhere to manage earnings volatility.

Analysts will also be watching 2022 results for evidence of whether pricing in commercial and personal lines is keeping pace with claims inflation.

Impressive 2022 re/insurance performance

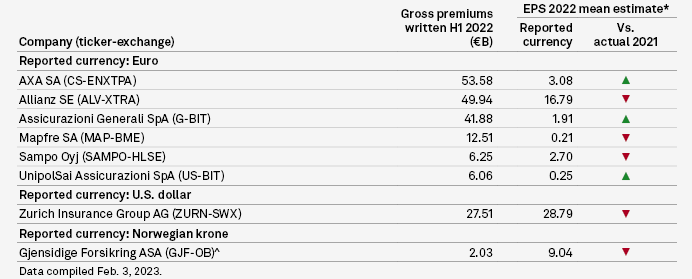

In terms of full-year 2022 results, analysts expect AXA, Assicurazioni Generali SpA and UnipolSai Assicurazioni SpA to report year-over-year EPS growth.

Allianz, Mapfre SA, Sampo Oyj and Zurich are projected to record declines. Nonlife combined ratio expectations are a mixed bag, with AXA, UnipolSai, Zurich and Sampo predicted to report year-over-year improvement in 2022 and the rest expected to see worsening ratios.

European insurers` earnings estamates

The four large-cap European composites — Allianz, AXA, Generali and Zurich — are expected to produce “an impressive set of updates” for full-year 2022 despite a tough macroeconomic environment, according to Bank of America.

They expect the four companies to average 7% operating profit growth in 2022, led by Zurich, with 15%.

Solvency ratios will be around or above 200%, to clients, suggesting overcapitalization and supporting returns of capital to investors

Several analysts have AXA and Allianz as their picks of the bunch. Bank of America said both of those companies will deliver strong operating results and have attractive capital return stories.

Analysts at UBS said multiline is its most-preferred subsector in all of European insurance, and they highlighted AXA as a top pick, saying that consistent share buybacks could lead to a stock re-rating.

A further positive for some is that claims from Hurricane Ian, the most costly natural catastrophe of 2022 for the insurance industry, are now expected to come in lower than originally thought

Michael Huttner, analyst at Berenberg

While the big European multiline carriers should not expect a much easier ride in 2023, with continuing pressures from claims inflation and an uncertain economic outlook, their capital bases should help cushion them. Capital levels are incredibly strong making them well positioned to weather capital market volatility.

In addition to improved preventive measures, the influence of climate change, which makes precisely this type of regional extreme rainfall more probable, has to be taken into greater account in risk assessments (see Climate & Global Natural Catastrophe Insight).

At the same time, the eurozone has seen a recent spike in inflation – well above 3% in September, and climbing to over 4% in Germany.

Higher inflation also leads to higher claims costs. In the long term, the inflation rates will likely normalise again, but remain above the pre-COVID level.

In contrast, interest-rate levels have remained virtually unchanged. Taken together, these two factors are producing an upward pressure when it comes to insurance prices.

Very large losses and the role of insurance

In response to the very large losses resulting from the flooding, the pandemic, and increasingly also cyber attacks, insurers’ strategy is to be a reliable point of contact for all aspects of clients’ risk management in the context of very large risks – from consulting on risk prevention and risk transfer, working hand in hand with the state or the capital market wherever necessary, to providing support with disaster recovery (see 5 Largest Natural Catastrophes).

The latest very large losses, including those in Europe, show that the role of insurance must extend far beyond assuming risks and compensating for losses.

Consulting based on sound risk expertise can promote more active prevention, helping to prevent or reduce losses. Risk assumption puts a price tag on risks, which supports risk-adequate action. And when it comes to managing losses, insurers can help by entering into partnerships with suitable companies and by working to ensure that claimants receive support that goes beyond simple loss compensation.

Where people’s risk awareness is too low, or the risk exceeds the risk-bearing capacities of private insurers, reinsurance providers actively work to help find new solutions.

Examples to be mentioned include the perennially discussed topic of compulsory flood insurance in Germany, or the potential expansion of state-supported risk pools, which would be necessary in order to cover pandemic-related business interruptions.

State-supported risk pools would also be needed to combat certain systemic cyber risks, e.g. those resulting from cyber warfare, since they can’t be borne by insurers alone.

…………………………………

AUTHORS: Ben Dyson and Jason Woleben – S&P Global Market Intelligence

Fact checked by Oleg Parashchak