The war in Ukraine, high food and energy prices, the fight against inflation, the looming recession, the transition to renewable energy, and China’s uncertain post-pandemic path present just some of the entangling challenges that will preoccupy the global economy in the following years, according to Allianz Research’s recently published Economic Outlook 2023-2024 report.

Since Allianz Research last quarterly economic update in September, the deteriorating energy crisis and a challenging policy mix have confirmed our forecast of slowing growth, sticky inflation and rising interest rates.

For 2024 year, Allianz have identified 8 trends & themes to keep your ear to the ground during the great energy quarantine:

#1. Slow Down

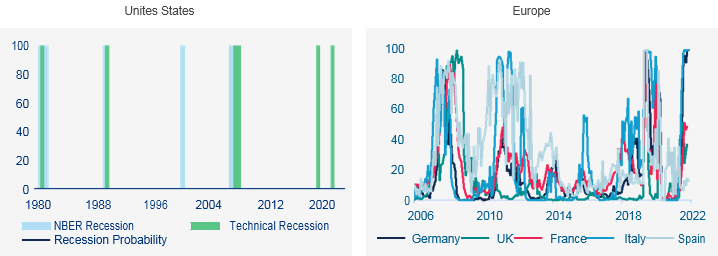

In 2023, we continue to forecast a mild recession in Europe onthe back of the energy crisis, and in the US due to the abrupt normalization of monetary and financial conditions. This triaging recession will test resilience (see Insurance and Macroeconomic Outlook). Stronger balance sheets, demand backlog, and fiscal support will help limit the damage. In the emerging world, growth is expected to remain stable in 2023. In 2024, we anticipate a recovery in the US while the eurozone could be stuck in a muddle-through scenario because of the energy stop-and-go.

#2. Cold Heart

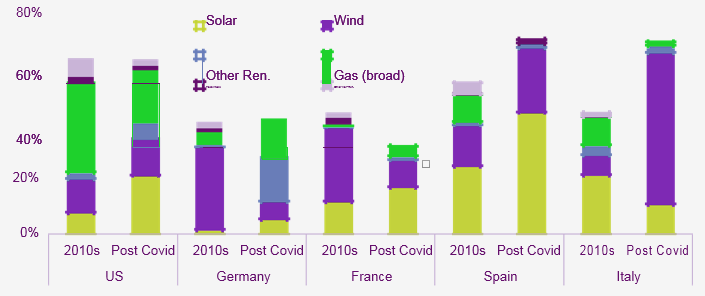

According to Allianz Global Economic Outlook and Market Forecast, the energy gap will continue to pose concerns in Europe. Afterrecord gas storage and energy efficiency gains helped avoid a blackout scenario in 2022, prospects for next winter (2023-2024) are limited as substitution to Russian gas imports will not suffice. Uncertain gas supply will create negative confidence effects and put the region’s fiscal capabilities to the test to cushion the impact of high electricity prices on firms and households. It will also compel policymakers to find ways to enhance energy efficiency and stabilize gas consumption beyond near term savings, together. The alternative is a repeat of 2012 and a risk of fragmentation in Europe.

#3. Bad Blood

(Geo)politics made a bursting comeback at the forefrontof concerns. From a split Congress and a noticeable return to good ‘ole protectionism through the Inflation Reduction Act (IRA) in the US, to Europe’s red herring policies to the negative competitiveness shock stemming from the energy crisis (sovereignty, re-industrialization), to China’s balancing act to exit zero-Covid, and the many important elections upcoming , investors and corporates will have to play coping strategies and buffers.

#4. Dragon Attack

The shift in China’s containment measures will alleviatepressures on a slowing global trade, and accelerate the decline of producer prices. The domestic post-Covid rebound could start to be felt in the second half of 2023, and into 2024 as we expect sanitary restrictions to be eased in spring 2023. A faster easing would benefit the global economy while any setback could weigh on global trade and delay the easing of inflationary pressures.

#5. Never Give Up

Emerging markets will face very different challengesand headwinds in the coming months. Political risk has been rising in Latin America, Eastern European countries are being hit harder than most by the energy crisis, and commodity importers throughout the world will have to cope with a strong dollar, high energy and food prices. Credible policy moves will make the difference. Debt sustainability concerns are increasing for some countries in a context of increasing rates and capital flight to safety (see Global Economic and Insurance Market Outlook 2023-2024).

#6. Castle on the Hill

Central bankers are determined to fight inflation andmake sure that it does not become entrenched. While the current hiking path is about to moderate, central banks’ independence will be tested either way: if erring on the side of keeping their monetary stance more restrictive for longer despite a looming recession, or if throwing in the towel to early and risking stagflation for good. Against the background of moderate quantitative tightening and decreasing system-wide liquidity, there is a risk of squeeze from a policy mistake.

#7. Bad Habits

Since 2020, the war against the virus, and now against Russiahave one super weapon: fiscal spending. It will remain at the center stage over the next couple of years, from relief measures to the cost of living crisis, to green industrial policies to help with silent wars (climate change, ageing), to fighting the urge to a massive tax policy U-turn. More targeting for aid, and fewer distortions are welcome to avoid that financial markets become very selective.

#8. Easy on Me

According to BlackRock`s Global Macroeconomic & Invest Outlook, capital markets experienced an unmitigated disasterwith an unprecedented price correction in both equities and fixed income. Going forward, earnings forecasts still seem too benign, and even a milder recession is not fully priced in. Fixed income is back but mind the risk. Also, as central banks drain excess system-wide liquidity and trading volumes even in historically liquid markets decline, financial accidents needs to be watched out for.

Global Economic Outlook

Global growth: Still headed towards a recession

After a tumultuous year, we anticipate lackluster growth in 2023, followed by differing recovery paths across countries in 2024. Global growth is likely to slow to +1.4% in 2023 (-0.1pp downside revision) and to recover modestly to +2.8% in 2024, with significant divergence across countries. Advanced economies will register a shallow recession of -0.1% in 2023 (after growth of +2.5% in 2022), followed by a rebound to below-potential growth of +1.5% in 2024.

GDP growth (%)

| Growth (yearly %) | 2020 | 2021 | 2022f | 2023f | 2024f |

| Global (PPP exchange rates) | -3.0 | 6.1 | 3.1 | 1.9 | 3.1 |

| Global (market exchange rates) | -3.3 | 6.0 | 2.9 | 1.4 | 2.8 |

| USA | -2.8 | 6.0 | 1.9 | -0.3 | 1.6 |

| Latin America | -7.1 | 6.7 | 3.3 | 1.2 | 2.2 |

| Brazil | -4.2 | 5.0 | 2.8 | 1.1 | 2.1 |

| UK | -11.0 | 7.5 | 4.4 | -0.9 | 0.7 |

| Eurozone | -6.3 | 5.3 | 3.3 | -0.4 | 1.0 |

| Germany | -4.1 | 2.6 | 1.8 | -0.7 | 0.6 |

| France | -7.9 | 6.8 | 2.5 | -0.4 | 0.9 |

| Italy | -9.1 | 6.7 | 3.8 | -0.3 | 0.8 |

| Spain | -11.3 | 5.5 | 4.6 | 0.2 | 1.2 |

| Russia | -2.7 | 4.7 | -2.8 | -2.9 | 1.6 |

| Turkey | 1.9 | 11.4 | 5.1 | 1.9 | 3.8 |

| Central and Eastern Europe | -3.3 | 5.3 | 0.3 | 0.2 | 2.5 |

| Poland | -2.0 | 6.8 | 5.5 | 0.7 | 2.3 |

| Asia-Pacific | -1.0 | 6.1 | 3.2 | 3.6 | 4.5 |

| China | 2.2 | 8.1 | 2.8 | 4.0 | 5.2 |

| Japan | -4.7 | 1.7 | 1.4 | 0.8 | 1.1 |

| India | -6.6 | 8.3 | 6.7 | 6.0 | 6.2 |

| Middle East | -4.2 | 3.9 | 5.6 | 3.4 | 2.6 |

| Saudi Arabia | -4.1 | 3.2 | 10.2 | 4.9 | 3.1 |

| Africa | -1.7 | 5.8 | 3.2 | 3.1 | 3.5 |

| South Africa | -6.3 | 4.9 | 1.8 | 1.5 | 1.4 |

Europe will muddle through the ongoing energy crisis, while the US recovery is constrained by a cautious policy mix. Among emerging markets, growth is expected to remain stable in 2023 at +3.3% – mainly supported by the cautious reopening of China, while most other emerging countries are likely to slow down due to both external and domestic headwinds. A rebound to +4.3% is expected in 2024, supported by the policy pivot as well as the recovery of Chinese demand.

United States:

Despite rapid monetary tightening and elevated inflation, the economy has proven resilient so far. This is mainly thanks to strong exports amid a still large backlog of previously unfilled orders in the manufacturing sector while consumption is holding up. Households have reduced their savings and the labor market has remained strong, bolstering consumer spending (Figure 2).

However, the housing market has continued to weaken rapidly since the summer: home sales and mortgage demand have dipped amid tighter financing conditions while residential investment is falling. We expect GDP growth to fall by -0.3% in 2023, with the recession starting in Q1 2023. Growth is likely to pick up by a modest +1.6% in 2024, held back by fiscal consolidation and still elevated real interest rates.

Europe and US: recession probabilities (%)

Eurozone:

While gas rationing is likely to be avoided on the assumption that demand for natural gas can be reduced by at least -10% relative to last year, persistently high energy prices will push the Eurozone into a recession at the turn of the year.

We still expect a bottom-out in H1 2023, followed by a shallow recovery below potential growth.

Scaled-up public sector support over the past months only partially compensates for households’ declining purchasing power and lower corporate profitability.

We anticipate only a modest pick-up in 2024-25 for countries with a higher dependence on gas and larger manufacturing sectors (Germany). Spain (and to a lesser extent France) should be more resilient compared with Eurozone peers.

The energy crisis will depress growth for another few years, with material downside risks for winter 2023-24 amid a still negative output gap in 2024. We expect GDP growth to fall -0.4% in 2023 before picking up by +1.0% in 2024, which would make the recovery as weak as after the Eurozone debt crisis in 2012. All in all, we see a risk that the energy crisis will put Europe on a lower growth trajectory going forward.

China:

The coming months are still likely to be difficult. There is a high probability of negative q/q growth in Q4 2022, with overall growth for 2022 likely at +2.8% (down from our forecast of +2.9% previously). We also expect soft growth in Q1 2023. As a result, we have cut our 2023 GDP growth forecast to +4.0% from +4.5% but revised up our 2024 growth forecast from +4.7% to +5.2%. Against the latest socio-economic backdrop, Chinese authorities have made concessions and accelerated efforts to move towards an exit from zero-Covid policies, including:

- doubling down on efforts and incentives to inoculate the vulnerable population;

- easing quarantine conditions for some Covid-19 cases and contact cases (e.g. at home instead of at quarantine facilities)

- reducing the frequency and scope of testing requirements.

Emerging markets & developing economies

Emerging markets and developing economies will continue to be impacted by strong global headwinds and many are facing additional domestic challenges, all of which vary across regions or if a country is a commodity importer or exporter.

Global headwinds include still tightening global liquidity, a strong USD, elevated food and energy prices and the ongoing slowdown of Chinese demand.

Net importers of energy and food will remain particularly vulnerable to the adverse effects of the high prices for these goods on inflation, public and external finances. Central and Eastern European countries will be the most affected as they face an energy-supply crisis on top of the energy-price crisis over the winter as Russia and Ukraine were their main pre-war suppliers.

Inflation: reaching the peak

Inflation will remain uncomfortably high over the near term, averaging 6.4% at the global level in 2023 before receding to 3.9% in 2024. It should continue to remain strong over the coming quarters (despite strong disinflationary base effects in 2023), with core inflation remaining rather sticky next year.

Inflation (%)

| Inflation (yearly %) | 2020 | 2021 | 2022f | 2023f | 2024f |

| Global | 2.6 | 4.3 | 8.6 | 6.4 | 3.9 |

| USA | 1.3 | 4.7 | 8.1 | 4.1 | 2.3 |

| Latin America | 11.8 | 13.9 | 16.2 | 14.2 | 10.3 |

| Brazil | 3.2 | 8.3 | 9.6 | 4.8 | 3.6 |

| UK | 0.9 | 2.6 | 9.0 | 7.5 | 3.5 |

| Eurozone | 0.3 | 2.6 | 8.5 | 6.1 | 2.6 |

| Germany | 0.5 | 3.1 | 8.8 | 6.8 | 2.4 |

| France | 0.5 | 1.6 | 5.8 | 5.4 | 2.3 |

| Italy | -0.1 | 1.9 | 8.0 | 5.8 | 2.2 |

| Spain | -0.3 | 3.1 | 8.6 | 4.8 | 3.5 |

| Russia | 3.4 | 6.7 | 14.0 | 12.0 | 7.9 |

| Turkey | 12.3 | 19.6 | 72.6 | 36.1 | 20.6 |

| Central and Eastern Europe | 4.5 | 8.1 | 14.8 | 11.8 | 5.6 |

| Poland | 3.4 | 5.1 | 14.5 | 11.8 | 5.5 |

| Asia-Pacific | 2.2 | 1.7 | 3.7 | 3.2 | 2.7 |

| China | 2.5 | 0.9 | 2.0 | 2.2 | 2.4 |

| Japan | -0.0 | -0.2 | 2.3 | 1.9 | 1.5 |

| India | 6.6 | 5.1 | 7.0 | 5.8 | 4.7 |

| Middle East | 9.9 | 15.8 | 25.0 | 21.6 | 12.9 |

| Saudi Arabia | 3.5 | 3.1 | 2.5 | 2.6 | 2.1 |

| Africa | 10.0 | 12.4 | 17.5 | 14.1 | 8.8 |

| South Africa | 3.3 | 4.6 | 7.0 | 5.1 | 4.7 |

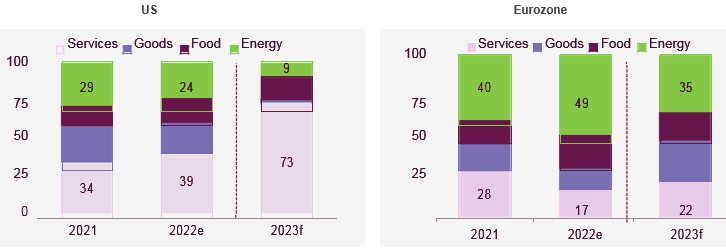

For instance, in the Eurozone, energy prices should still explain about a third of total inflation compared to almost 50% in 2022. Besides the lower contribution from supply chains and a negative contribution from demand and monetary policy, a stronger euro should reduce inflation by around -1pp in 2023-24.

In advanced economies, we expect inflation to reach 4.7% in 2023 (down from 7.4% in 2022).

Continued wage pressures coupled with persistently high energy and food prices will keep inflation at 2.4% until late 2024, especially in Europe. Inflation in emerging markets will decline to only 8.5% (from 10.4% in 2022) and remain elevated at 5.9% in 2024. Structural factors (including demographics) will keep labor markets tight despite the anticipated recession, and policy support will prevent larger adjustments in domestic demand and hence stronger disinflation, notably for services.

Eurozone and US: decomposition of headline CPI inflation

On the goods side, imported deflation from China starting to be more visible in the coming months. This should shave off at least -0.5pp of inflation in the US, Eurozone and the UK, and support a downward adjustment in inflation expectations.

In the US, according to the NFIB survey, the share of small corporates that want to increase prices in the coming months fell to 34% from a peak of 52% in March. In the Eurozone, the same share decreased from close to 60% in April to 44% recently.

Global economy: slow growth ahead

With significant difference across countries, global growth is likely to slow down to +1.4% in 2023 and recover modestly to +2.8% in 2024.

Advanced economies are heading toward a mild recession of -0.1% in 2023, followed by a rebound to below-potential growth of +1.5% in 2024.

Although the Eurozone will most likely be able to avoid gas rationing, persistently high energy prices will bring recession with the new year.

Allianz economists expect a bottom-out in the first half of 2023, followed by a shallow recovery and anticipate only a modest pick-up in 2024-25 for countries with a higher dependence on gas and larger manufacturing sectors (like Germany).

Both Europe and the U.S. are heading for a mild recession in 2023. But while 2024 could bring about a recovery in the U.S., the Eurozone could still be stuck in a muddle-through scenario because of the energy stop-and-go

Ludovic Subran, Allianz Chief Economist

Thanks to mainly strong exports and a large backlog of previously unfulfilled orders in the manufacturing sector, coupled with steady consumption, the U.S.’s economy has proven to be resilient although it is facing rapid monetary tightening and elevated inflation.

Infrastructure investment by type

China’s growth will most likely be negative in the last quarter of 2022, but is likely to slowly grow in the first quarter of 2023.

Strong global headwinds and additional domestic challenges as well as political uncertainties will hit emerging markets (EMs) and developing economies (DEs) in various country-specific ways.

Central and Eastern European (CEE) countries will be most affected as they face an energy-supply crisis on top of the energy-price crisis. Many DEs in Africa and Asia as well as non-commodity exporters in the Middle East will also continue to suffer from the food- and energy-price surge and are especially vulnerable to increased social risk as a result. Major emerging markets in Latin America will benefit from the commodity price boom and a strong job market.

Global trade continues to slow down as industrial activity recedes despite easing supply-side constraints. Global trade in goods and services is expected to grow by only +0.7% in volume terms in 2023 and to contract by -1.3% in value terms.

The cost-of-living crisis: are we living in a permacrisis?

Uncertain gas supply and rising energy and food prices continue to be a heavy burden for consumers. A crisis in one area seems to be sparking a crisis in another, engulfing us all in what seems to be one continuous crisis or permacrisis.

Permacrisis, the Collins Dictionary’s word of the year 2022, is described as an extended period of instability and insecurity.

This concept has its roots in contemporary systems theory, which claims that a crisis can become so complex that its outcome can be hard or even impossible to predict. It is something that the famous French philosopher Edgar Morin describes as a network of interlocking systems in which a crisis in one of those systems gives rise to a crisis in all the other systems.

How well Europe—the center of the energy crisis—holds up, will depend on how the set of all the interlocking problems develops going forward: how severe the winter turns out to be, how well-established EU’s solidarity is, and how efficiently the corporates detach themselves from Russian gas.

Going forward, Europe will have to find solutions for the redesign of national energy markets and the compatibility of different energy infrastructures.

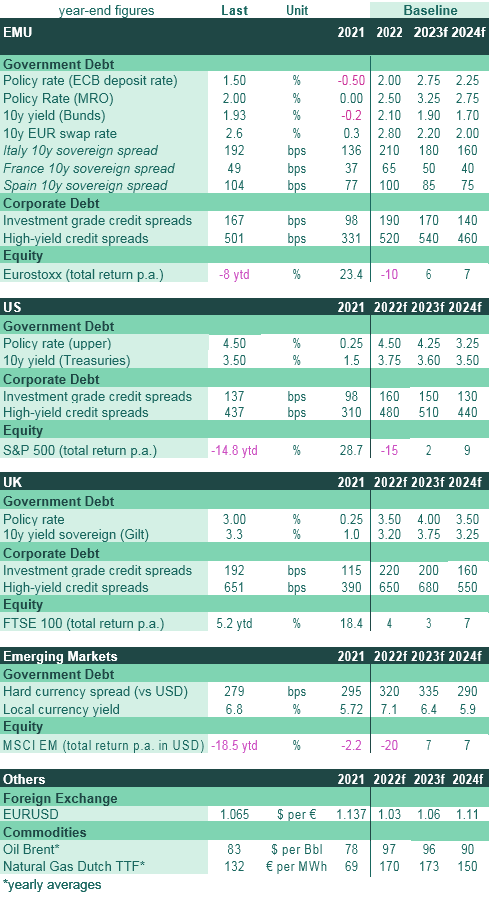

Capital markets 2023-2024 Forecasts

Scaling up investment in renewable energy infrastructure and viable alternatives to pipeline gas will also be essential, but it will require time. In the meantime, mitigating the impact of the energy crisis will require a coordinated fiscal policy response.

The majority of the current fiscal measures in Europe have been extended into 2023 for a total of more than 3% of GDP on average (close to 5% of GDP or more than EUR 600 billion since September 2021).

In most countries, the total measures (e.g. price caps, energy tax cuts, liquidity and equity injections, state-guaranteed loans and furlough schemes) amount to around half of the COVID-19 packages. With the energy crisis, EU governments are expected to increase spending further.

With rising uncertainty, business confidence is also decreasing. In addition, the layoff cycle has kicked off, given the rise in labor costs, especially in sectors that experienced a strong boom during the pandemic, such as technology.

Although central banks remain determined to fight inflation, it will continue to remain high over the near term, averaging 6.4% at the global level in 2023 before receding to 3.9% in 2024.

In advanced economies, inflation is expected to reach 4.7% in 2023 (down from 7.4% in 2022). Continued wage pressures coupled with persistently high energy and food prices will keep inflation at 2.4% until late 2024, especially in Europe. Inflation in emerging markets will decline to only 8.5% (from 10.4% in 2022) and remain elevated at 5.9% in 2024.

How to build bridges in a fragmented world?

The war in Ukraine signaled the return of the geopolitical risk. In Europe, the war triggered political and economic implications that will continue to dominate the policy debate.

The energy crisis threatens to become a political crisis if the EU fails to respond in a unified manner in the next two years, with EU elections scheduled for May 2024.

In addition, U.S. and China economic warfare via sanctions is likely to continue.

The world is navigating through systemic risks that have the potential to make this decade a decade of uncertainty and fragility.

…………………

AUTHORS: Ludovic Subran – Chief Economist Allianz SE, Ana Boata – Head of Economic Research Allianz Trade, Andreas Jobst – Head of Macro & Capital Markets Research Allianz SE, Arne Holzhausen – Head of Insurance, Wealth & Trend Research Allianz SE