Despite relatively resilient growth this year, Swiss Re Institute expect the world economy to grow by just 1.7% in real terms next year as inflationary recessions approach major economies. Having last year flagged inflation as the number one immediate macro concern, we continue to see upside risk in the next two years and expect it to prove sticky. With it, we see downside risks to growth from higher central bank interest rates.

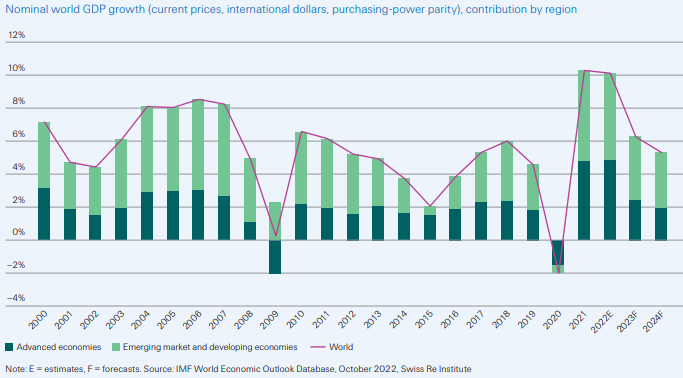

In advanced markets we forecast real GDP growth of just 0.4% in 2023, the lowest since the 1980s outside of the global financial and COVID-19 crises. In emerging markets, we anticipate substantially lower growth rates than pre-pandemic that will likely feel akin to recession.

The higher interest rate environment is repricing risk in financial markets and we see this continuing. We anticipate significant insurance market rate hardening in 2023 and potentially some years after. This should ease pressure on the global insurance industry from inflation, natural catastrophe losses and weaker investment results this year.

- Global real GDP growth of only 1.7% in 2023 as inflationary recessions approach major economies

- This year we add a new “D”, for debt and related risks, to our “3D” structural economic drivers

- The insurance industry faces pressure from high inflation this year, but higher interest rates will be a silver lining from 2023

- Alternative scenarios enable us to prepare for new risks as they emerge

This year we add a fourth dimension to the “3D” set of long-term economic drivers we identified last year: to the structural trends of divergence, digitalisation and decarbonisation we add debt, and its related risks.

The withdrawal of market liquidity as central banks unwind unconventional monetary policies is exposing financial vulnerabilities that have built up over the past decade. Debt is a key concern, specifically whether governments can sustain public spending commitments in the face of higher interest rates. We see a risk that market shocks accumulate and fuse into financial instability.

Inflationary recessions are materialising, led by advanced economies

Central banks face competing priorities of price stability, financial stability and enabling governments to pursue looser fiscal policy. This creates a risk of real interest rates being repressed in the longer term, either through higher inflation or eventually lower nominal interest rates, to manage debt sustainability or financial stability concerns. If so, we see inflation likely being higher and more volatile.

Emerging markets will no longer be such a strong engine of global GDP growth

Addressing demand-side drivers of inflation with supply-side or productivity-enhancing policies and investments would help ease this tension.

The global insurance industry faces multiple pressures this year but we expect rate hardening to regain momentum in response. Higher interest rates should be a silver lining as inflation pressure abates in 2023 and 2024, supporting investment results and profitability. Inflation remains the number one industry concern.

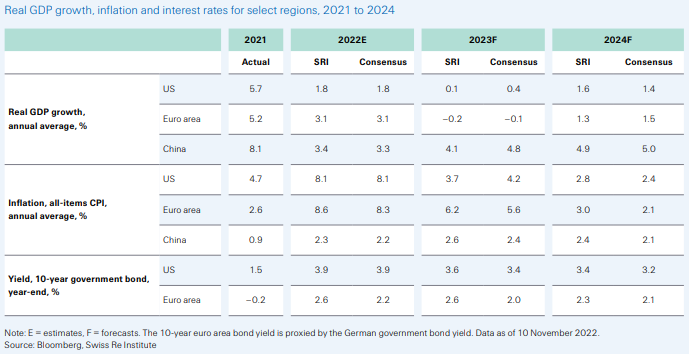

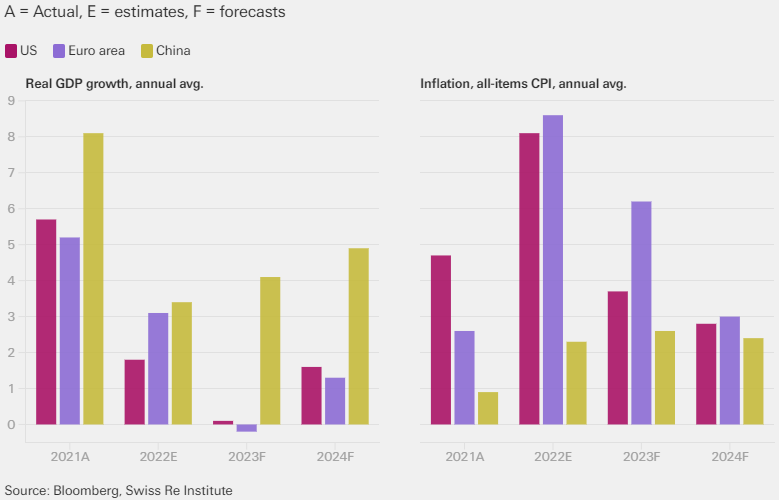

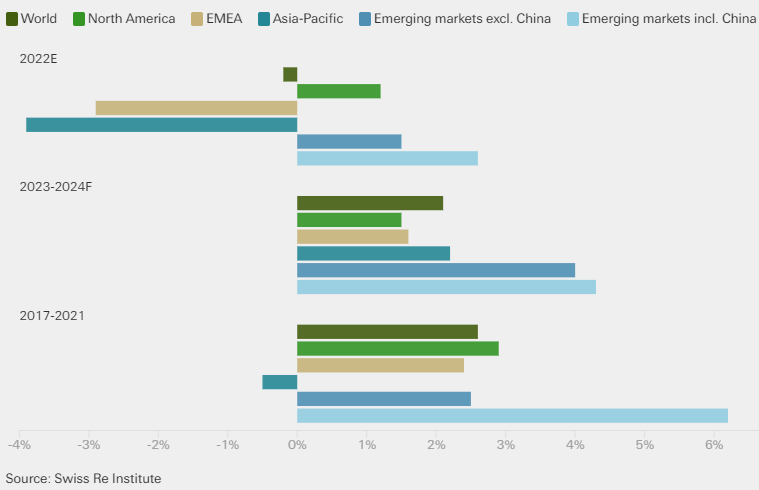

Real GDP growth and inflation in select regions, 2021-2024

We forecast high inflation in cost components relevant for insurers, such as construction and healthcare that suggests insurers’ claims and costs could rise markedly in 2022 and 2023, even without considering changes in claims frequency and natural catastrophe activity (see How Do Insurance Markets Respond to Inflation?).

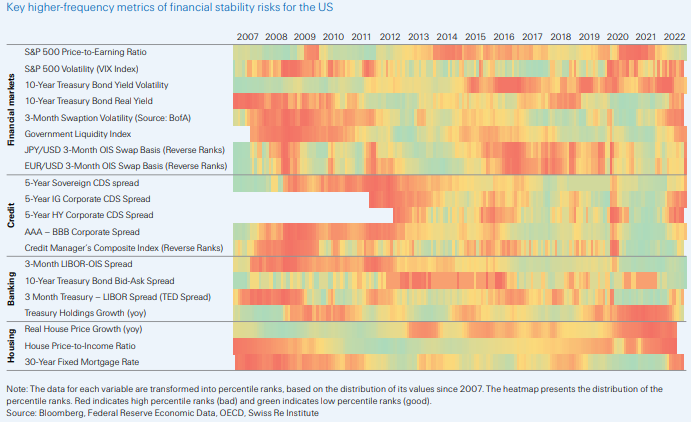

Financial stability risks are beginning to emerge in the US as well as elsewhere

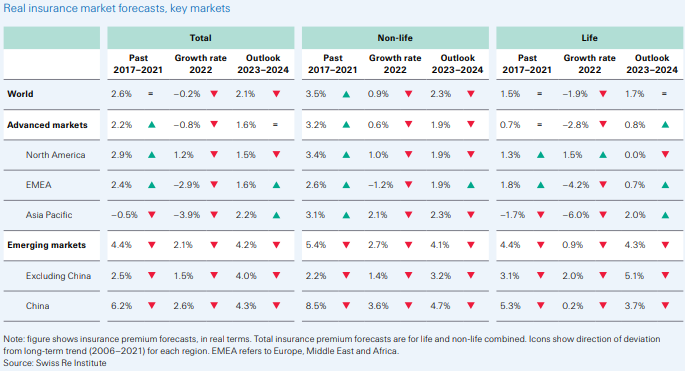

We expect total global insurance premiums to decline slightly in 2022, with a gradual recovery but still below-trend real premium growth for the next two years.

In non-life insurance, slowing global growth and inflation will likely cut real premium growth to below 1% this year, with a recovery as inflation eases and the hard market goes on.

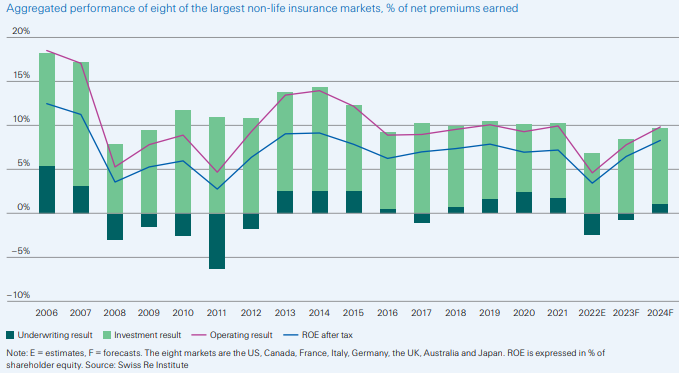

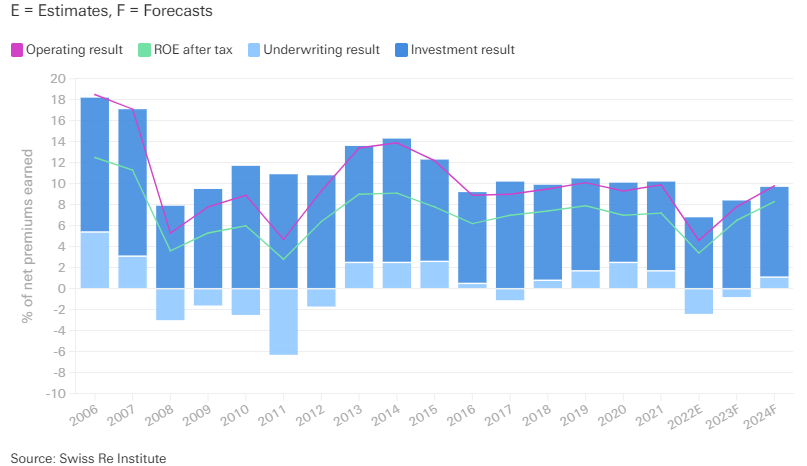

Global non-life insurance return on equity (ROE) is expected to halve to just 3.4% in 2022 as underwriting performance and investment results are weaker, but rebound to a 10-year high in 2024 as the interest rate tailwind and potential rate hardening take effect.

In life insurance, we forecast a 1.9% contraction in global premiums in real terms in 2022 as consumers face cost-of-living pressure, but a return to trend growth in 2023 and 2024, carried by emerging markets. Life profitability is improving due to rising interest rates and normalising COVID-19 mortality claims.

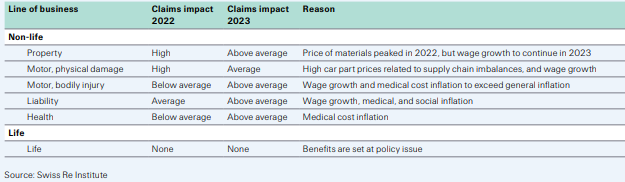

Inflation is a risk to insurance claims and profitability

Inflation is a double-edged sword for insurers. On the downside, it typically increases the cost of claims and expenses, and hurts demand for products as affordability declines. On the upside, it generally pushes up nominal premiums and interest rates, thereby generating higher nominal investment returns – albeit with a lag.

We expect inflation to affect non-life insurance the most, as we forecast higher costs for car parts and construction that would increase motor and property claims severity.

Higher fuel prices also have an effect, as more expensive transportation adds to the final cost of claims. We anticipate that long-tail business, such as liability claims and health insurers, will be more impacted by wage and healthcare inflation in the long term.

The inflationary shock has varying impacts on claims in different lines of business

To prepare as new risks emerge, we monitor three alternative scenarios to our baseline outlook. Two scenarios are pessimistic: “1970s-style structural stagflation” and “severe global recession”, with the former envisaged to be worse for insurers than the latter due to the impact of prolonged severe inflation on balance sheets (see Global Insurance Premium Volumes to Reach New High).

A severe global recession would reduce premiums, investment performance and underwriting results in most lines of business in the near term. With inflation anticipated to be persistent and volatile, and macroeconomic risks overall skewed towards our downside scenarios, we see strong capital and risk management as essential to mitigate risks, alongside underwriting rigour, portfolio steering, reinsurance, asset allocation and hedging.

A challenging 2022 for insurers will be followed by a gradual recovery in 2023 and 2024

Non-life insurance profitability is set to rebound in 2023 and 2024 after a downturn in 2022

Weakness in both underwriting performance and investment results will challenge global non-life profitability in 2022, we forecast. Using a sample of the largest non-life insurance markets – the US, Canada, Japan, Australia, the UK, Germany, France and Italy – as a proxy for global profitability, we estimate global non-life after-tax return-on-equity (ROE) at 3.4% in 2022, down from an average of 7.3% between 2017-2021. From 2023, however, we expect a rebound in global non-life ROE to 6.5% in 2023 and to likely above 8% in 2024, about the highest in a decade.

Aggregate performance of eight of the largest non-life insurance markets, % of net premiums earned

As we close out a volatile 2022, we see major economies like the US and Europe heading towards “inflationary recessions” in the next 12 to 18 months. In latest sigma, we forecast global real GDP growth to fall from 2.8% this year to 1.7% in 2023. Generally, global real GDP growth of about 1-2% or less is considered a global recession.

In advanced markets, we expect real GPD growth to decline from 2.4% this year to 0.4% in 2023. This is the largest annual slowdown since the 1980s outside of the global financial crisis, which logged 0.3% in 2008 and -3.4% in 2009, and the COVID-19 crisis, which recorded -4.5% in 2020.

We expect emerging markets will also weaken. Excluding China, we forecast emerging market real GDP growth of 2.9% in 2023. Slowing global demand, rising debt levels, higher interest rates and a strong US dollar are raising emerging market debt burdens, shrinking their exports and limiting room for fiscal policy to support the economy. While we don’t forecast real GDP contraction in 2023, we expect growth rates to be substantially lower than their pre-COVID trend, which will feel like a recession in terms of impact on businesses and consumers.

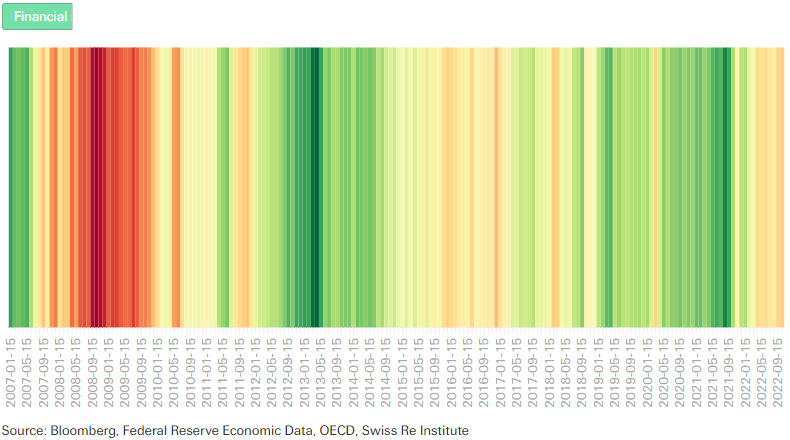

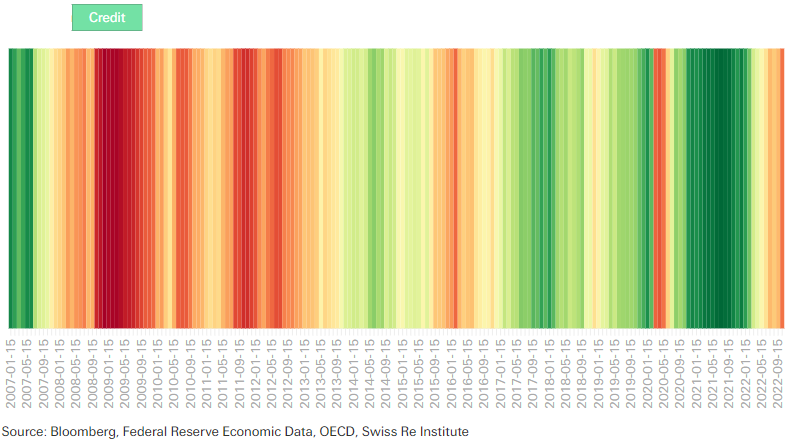

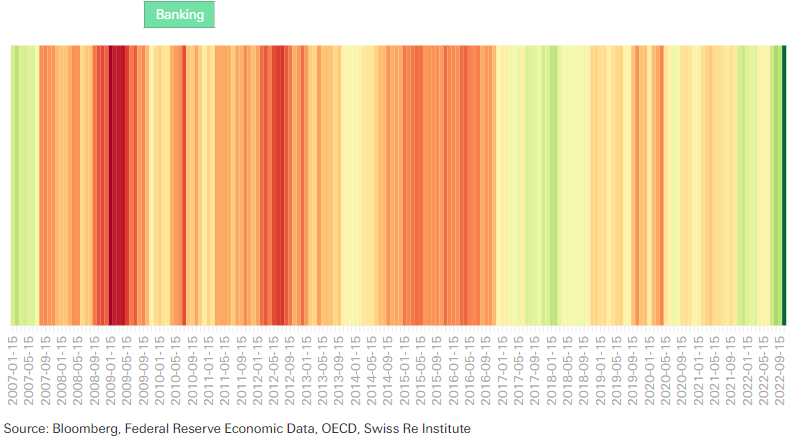

Stresses in the financial system are rising

There are signs that stress in financial markets is rising as monetary policy tightens. In the US, liquidity in the US Treasury bond market – possibly the most systemically important asset market worldwide – has deteriorated to spring 2020 levels.

We believe demand is thinning from a range of investors, from global pension funds to domestic commercial banks and even the Federal Reserve, which is selling as part of quantitative tightening.

Non-bank corporations are experiencing widening credit spreads. We see relatively higher risk among non-bank financial institutions, and lower risks in the banking sector, which has been more regulated since the global financial crisis.

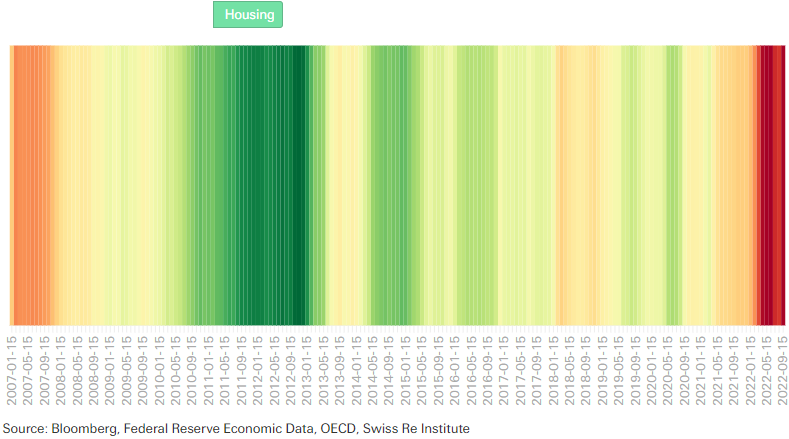

Overview of key higher-frequency metrics of financial stability risks for the US

Real estate has also taken a hit. The interest-sensitive housing market has rapidly entered a recession this year as demand fell dramatically amid a historic rise in mortgage rates. But we don’t see a repeat of the US housing market crisis like in 2008.

Insurance market outlook: we expect below-trend growth from 2023

We see below-trend growth in global insurance premiums for the next two years as a negative macroeconomic environment, inflation pressures and volatile financial markets weigh on premium growth and profitability. We forecast a 0.2% decline in total premiums in 2022 and below-trend growth of 2.1% annually on average over 2023 and 2024 in real terms, specifically 1.5% for 2023 and 2.8% for 2024.

Insurance premium forecasts

But ongoing rate hardening in non-life insurance should support premium growth in nominal terms and profitability for both life and non-life insurers. Fuelling this trend is higher inflation, large losses from Hurricane Ian and the war in Ukraine, fiscal support to relieve consumer cost-of-living pressures, and rising interest rates.

……………………..

AUTHORS: Fernando Casanova Aizpun – Senior Economist Swiss Re Institute, Li Xing – Head Insurance Market Analysis Swiss Re Institute, Roman Lechner – P&C Economic Research Lead Swiss Re Institute, Rajeev Sharan – Senior Economist Swiss Re Institute, James Finucane – Senior Economist of the Swiss Re Institute for the Americas