AM Best has released the Market Segment Outlook: Global Reinsurance report on the outlook for global non-life reinsurance, maintaining a stable view on the market’s prospects.

Positive pricing momentum leads the list of reasons why rating agency AM Best has maintained a positive view on the non-life reinsurance sector globally.

Property Cat Market Experiences Significant Shifts

Prior to 2023, the property reinsurance market had benefitted from an abundance of capital and participants in recent years. Competitive forces and a lack of catastrophic events in prior periods led to lower cedent retentions and loosened up terms and conditions (see ILS, Cat Bond & Post Hurricane Ian Reinsurance Market Update).

Traditional catastrophic events have plagued the industry. Additionally, secondary perils continue to grow, which has brought into question the accuracy of modeled exposures.

Adverse trends in loss activity have pressured reinsurers’ results the last few years, as many have failed to generate returns that meet their cost of capital, testing investors’ risk tolerance (see April 2023 Reinsurance Renewal by Regions).

This has been more evident in the ILS markets, including retro, which, owing to severe losses and trapped capital issues, have been unable to expand or reload in recent years and continue to experience a significant flight to quality when allocating capital.

The January 2023 renewal period experienced initial delays, as reinsurers held firm on the rate increases they felt were necessary.

As cedents and reinsurers aligned their expectations, almost all renewals were completed on time. According to Global Reinsurance Industry Results FY2022, renewal rates on catastrophe-exposed property business was up anywhere from 50% to 100% across the board.

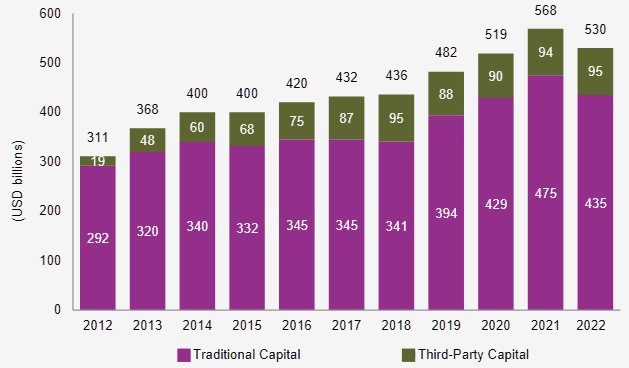

Estimated Total Dedicated Reinsurance Capital

Significant increases in attachment points and tightening conditions lowered the costs of cedents’ treaties.

Recent renewal cycles showed that reinsurers strongly prefer stable results over the potential for larger but volatile profit margins.

According to AM Best’s Market Segment Report, for the last two to three years, reinsurers have been shifting covers to higher layers of protection, raising deductibles, lowering limits, adding explicit exclusions, avoiding aggregate covers, restricting specific perils and geographies, and generally becoming more selective with their cedents, to mitigate adverse selection and credit risk—all this at a time when cedents themselves are craving more stable results and have made protecting their balance sheets their top priority.

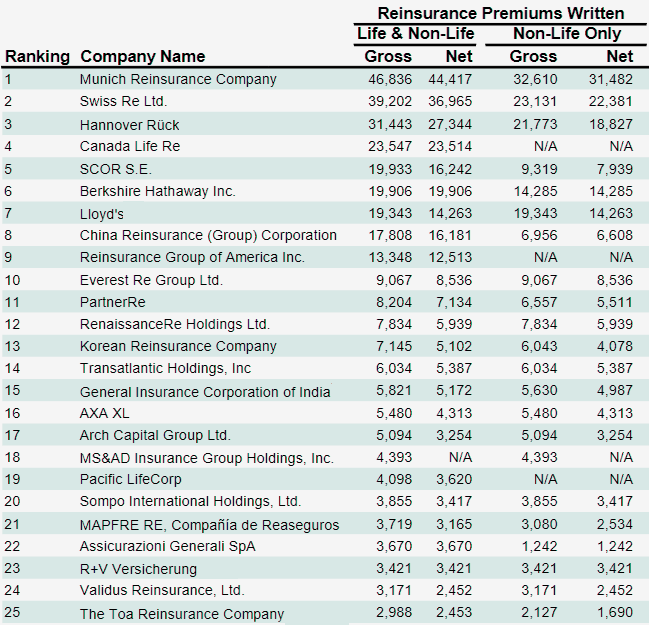

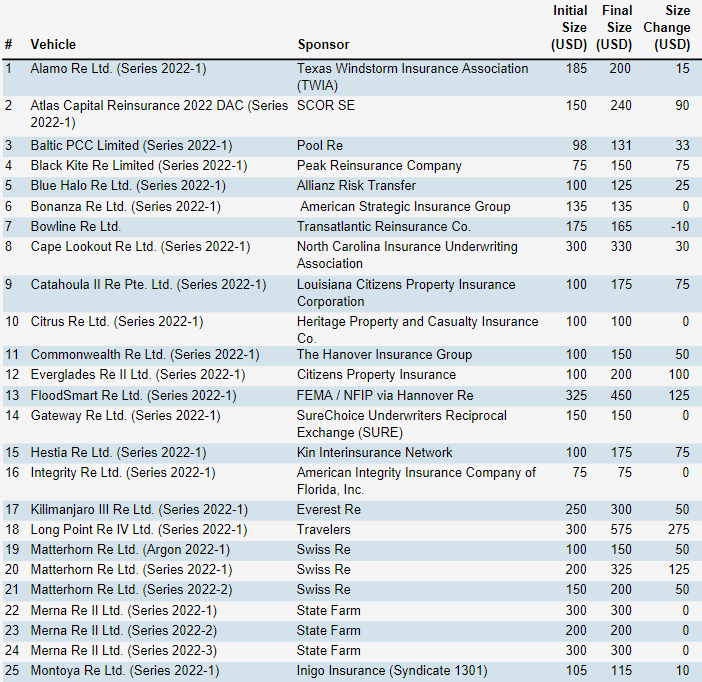

Top 25 Global Reinsurers

Top 15 Global Non-Life Reinsurance Groups

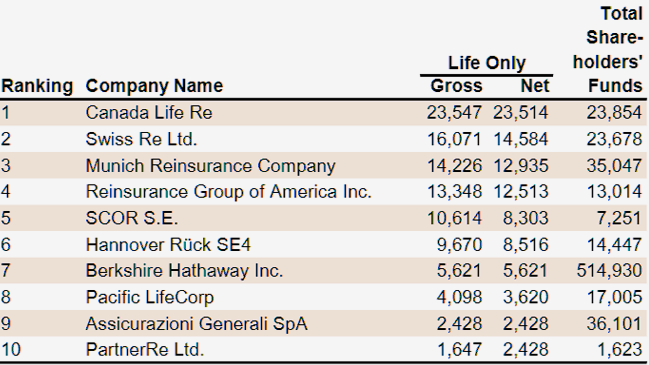

Top 10 Global Life Reinsurance Groups

With the January reinsurance renewal period wrapped up, the focus now shifts to mid-year renewals and the historically problematic Japan and Florida markets.

The shortage in supply of catastrophe reinsurers is likely to continue to drive rates higher at mid-year.

Some companies have been actively shrinking their property cat exposures or even modifying their organizational structures and exiting altogether, although a few players—including some of the largest European reinsurers—seem to see the current environment as an opportunity to improve profit margins and consolidate their market positions even further.

The largest reinsurance groups remain more cautious when it comes to risk selection, but their longer-term views on catastrophe risks tend to be influenced by much greater risk diversification, size, and financial flexibility, supported by less of a reliance on the currently constrained retro markets or by better access to ILS capital.

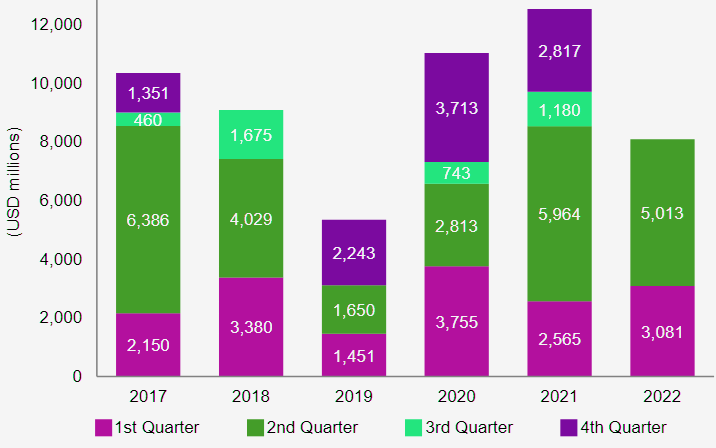

ILS – Cat Bond Issuance

Those of the Swiss Re Global Cat Bond Return and Eurekahedge ILS Advisers indices have been far less volatile than the returns of Barclay’s High Yield and S&P 500 indices.

New Capital Remains Sidelined Despite Pricing Momentum

Non-life reinsurance rates have experienced more positive rate momentum in the last five years than in the recent past. Capital levels have deteriorated somewhat due to unrealized investment losses, but the consensus is that these capital levels are transitory in nature.

Many players in the market have stagnated or shrunk their capital allocations to reinsurance business, particularly property cat.

There has yet to be any new capital to enter the reinsurance market in a meaningful way, which has driven persistent price hardening.

What’s more, the pace at which pricing continues to harden for property catastrophe exposures seems to be accelerating.

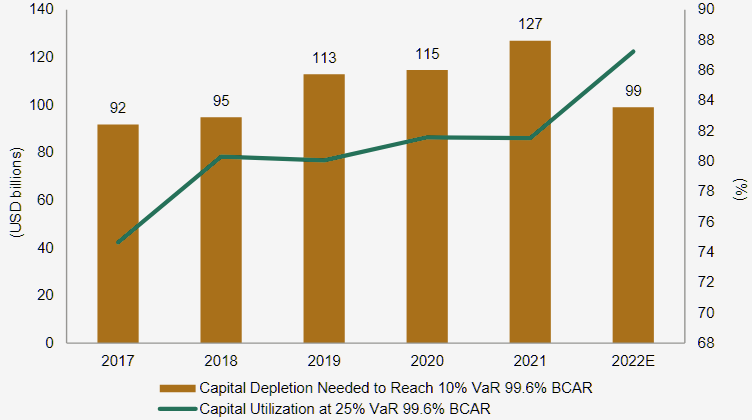

Global Reinsurance Capital Utilization

Guy Carpenter has calculated a rise of 30% for its US Property Catastrophe Rate-On-Line (ROL) at January 1, 2023. This brings the index to an all-time high, and cumulatively 97% higher than 2017, which is perceived as the bottom of the most recent soft market. Additionally, the increases are consistent globally, with the European index also up by 30%.

Price conditions outside property cat have improved as well. Concerns about prior year development, inflation, and social inflation have driven increases in casualty lines.

Specialty business was impacted by lines such as aerospace/aviation, which were affected by ongoing political uncertainty. In prior cycles, some of the momentum of hardening markets had been mitigated by new market entrants competing for business.

ILS – Cat Bonds Issued

As global markets continue to struggle with inflation and unrealized losses, new formations have found obtaining funding a challenge.

The expectation is that eventually pricing will reach a point where new capital will enter the market. As risk-free rates have increased and credit spreads have widened, so has the optimal entry point for new capital.

Global Reinsurance Capital Is Impacted by Unrealized Losses

AM Best’s estimate for available traditional capital for the global reinsurance segment had been rising for an extended period, but expectations were that capital levels would decline in 2022.

The original year-end estimate was an 8.4% decline in capital levels globally, but, as companies finalize their results, this estimate has been revised downward.

AM Best now estimates a 14% decline in available traditional capital levels globally for year-end 2022, to USD409 billion.

Given that a significant proportion of this decline is explained by unrealized investment losses on fixed-income instruments, careful consideration of a company’s liquidity needs and its ability to hold assets to maturity is crucial as part of the balance sheet strength assessment.

The year-end 2022 projection incorporates a fair amount of “fixed-income equity,” which reflects the value of fixed-income instruments that will be pulled to par as they mature.

This adjustment takes into account each company’s liquidity position and ability to hold devalued bonds to maturity—in some of the larger reinsurance groups, we have seen this account for 4% to 9% of available capital. This adjustment also aligns various accounting standards, as US statutory filers do not record the full impact of their fixed-income unrealized losses.

The drop in available traditional capital brings it to its lowest nominal point since 2018, although the impact is much more severe than that.

When we examine capital utilization, which is AM Best’s measure of the capital required to maintain a BCAR (Best’s Capital Adequacy Ratio) at the current rating level, it increases to a new high of 90%.

This projection assumes that net required capital will decline at half the rate of available capital. A number of companies have attempted to de-risk property portfolios, but many are also growing in other areas.

What the overall impact to net required capital will be for year-end 2022 remains somewhat unclear. However, we expect that market to be operating with a far smaller capital buffer than in prior years.

Source: A.M. Best Company