The April 1 reinsurance renewal season has seen a continuation of the discipline shown by reinsurers at January 1 but with a greater determination that pricing and contract improvements are applied across all territories and to all business lines.

The January renewals did see some smaller territories being treated more favorably than major mature markets, but this differentiation has largely vanished by April, according to Gallagher Re Report.

The reinsurance market remains stressed as reinsurers seek to achieve reasonable returns on their capital whilst nursing large mark to market investment losses.

Headline capital in the global insurance industry has reduced as a result of investment losses but provided reinsurers do not have to realise these losses through the early sale of underlying assets the underlying economics remain sound providing ceding companies with secure capacity (see How Global Reinsurance Market Endured a 2023 Renewals?).

The hopes of some buyers that new capacity might enter the market at this renewal – and some signs of amelioration in hardening terms and conditions would emerge – remain unfulfilled.

James Kent – Global CEO, Gallagher Re

This is pushing primary companies back to reexamine their original underwriting strategies, which in the current strained economic environment is extremely demanding to address with original policyholders.

Key Findings for the Reinsurance Market

- The market has faced similar discipline to that seen at January 1, although with a more intense focus on pricing and contract improvements across all territories and to all business lines

- Capital remains constrained with limited signs of new capacity entering the market and existing reinsurers facing mark-to-market investment losses

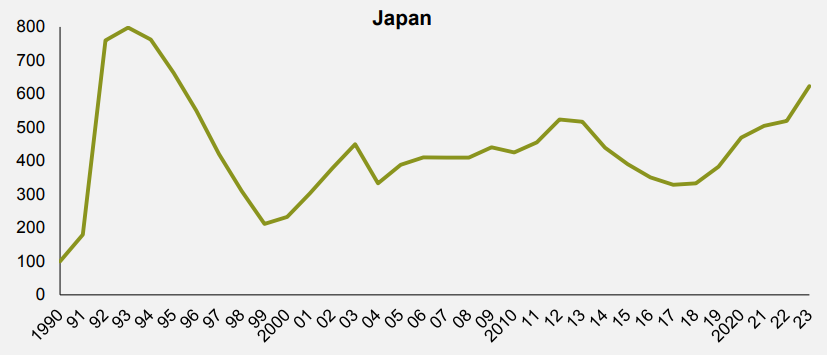

- In Japan, long term reinsurer relationships, aided by improvements in primary underwriting, led to a better alignment of client and reinsurer expectation

- The supply/demand dynamic was finely balanced but overall buyers managed to secure sufficient capacity

- Similar to January 1, the Casualty treaty market remained calm and logical, though continued concern regarding US ‘nuclear’ award verdicts are increasingly coming to light on US casualty placements, including some treaties with incidental US exposures

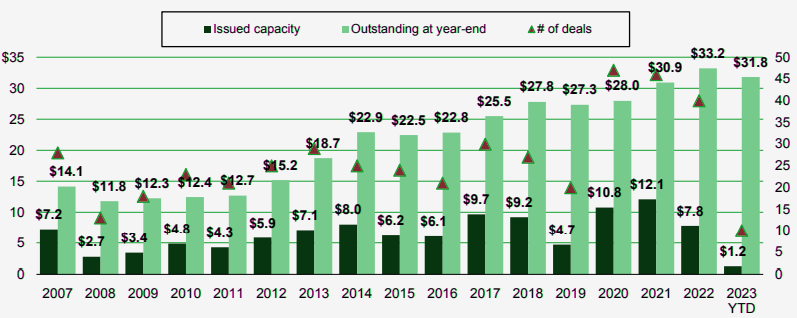

- ILS issuance is picking up due to capital constraints in the traditional market, although at higher pricing than traditional indemnity pricing

Despite this more uniform and global approach, a client-led underwriting process remained evident (see 2023 Global Reinsurance Market – a Hardest Market). Clients and markets who had seen significant price increases and tightening of reinsurance conditions in recent years consequently experienced more measured increases.

However in some smaller markets, where terms and conditions have remained largely unchanged for many years, the pressure from reinsurers seeking to correct soft market conditions in a single renewal has been intense.

For Japanese buyers, both client and reinsurers expectations were better aligned than at January 1, which led to a more orderly renewal process.

This was aided by both the long-term nature of reinsurer relationships in the Japan market as well as the considerable improvements in primary underwriting that Japanese insurers have achieved in recent years.

Unfortunately, in other smaller markets there were examples of major structural changes being enforced at the last minute and quotes being delayed to minimize negotiating time (see Global Economy & New Drivers of Re/Insurance Sector Growth).

The impact of these structural changes has been both unexpected and profound on the financials of some insurance companies and is leading to an immediate impact on their original underwriting with all the challenges that this entails, causing significant strain in some of the client and reinsurer relationships.

James Kent – Global CEO, Gallagher Re

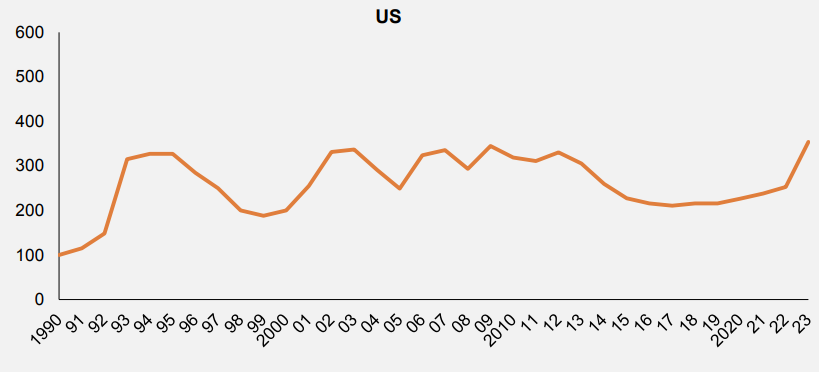

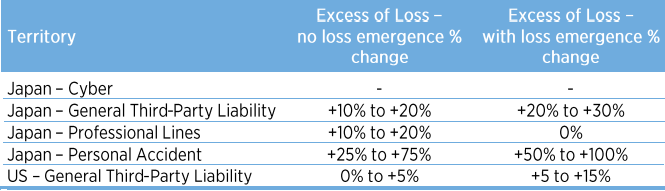

In line with what was witnessed at January 1, the April renewals of long tail classes have been less contentious, remaining calm and logical – though US casualty nuclear awards are increasingly making their presence felt on many US casualty placements, and in some instances on treaties with incidental US exposures.

The notable exception has been US Public D&O where pressure on ceding commissions remains following decreases of up to 2 points at January 1 (see Top 5 Risk Trends D&O Insurance Market).

Reinsurers cited continued prior year adverse development and negative rate in the underlying market as the drivers of these shifts while cedants countered that portfolio dynamics are less volatile and renewal rate change is misleading given impact of IPO/SPAC and de-SPAC business in recent years.

Capital supply remained constrained with few signs of fresh capital entering the market and existing reinsurers being impacted by mark to market investment losses.

ILS issuance is picking up and remains expensive compared to previous years with pricing and capacity in line with traditional indemnity pricing.

The overall market supply demand dynamic remains delicately poised with sufficient capacity available at April 1 to meet clients’ needs; however, since the largest capacity requirement at April 1 remains Japan, which represents a significantly lower than peak US cat exposure demand, the renewal cannot be regarded as a true test of market supply demand dynamics.

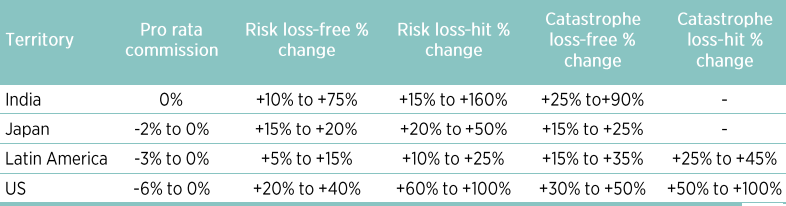

Property Rate Movements

Property Catastrophe Pricing Trends

Casualty Rate Movements

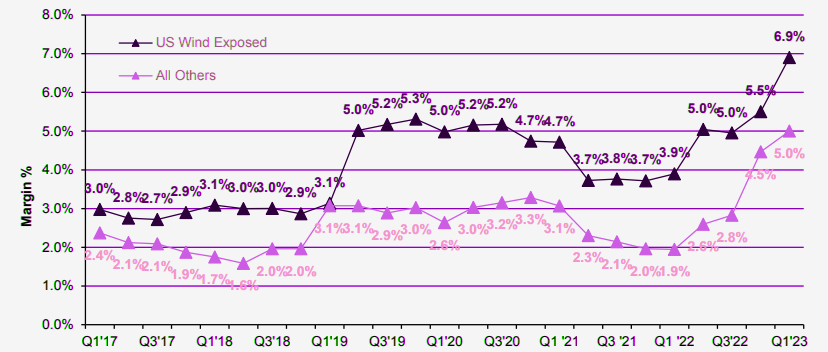

Quarterly Weighted Average Margins for New Issue Cat Bonds

Non-Life Catastrophe Bond Capacity Issued and Outstanding

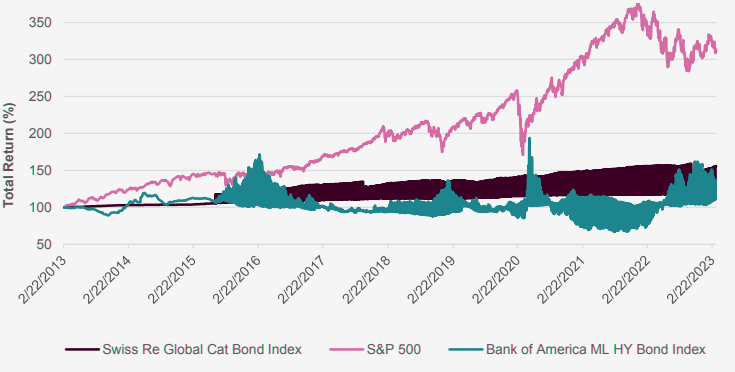

Historic Relative Returns

Issued three times a year, this report delivers the very first view on current market conditions within the reinsurance industry at the key renewal seasons: 1 January, 1 April and 1 July.

………………

AUTHOR: James Kent – Global CEO, Gallagher Re