ILS and collateralized markets have seen little signs of new capital entering, but lower estimates from certain clients on Hurricane Ian losses has eased some concerns over trapped capital and helped to provide much needed additional liquidity for retrocession buyers in the last few weeks of the renewal season.

According to Gallagher Re, in the stressed US natural catastrophe market, more positive signs of regulatory reform are tentatively emerging and whilst not impacting the 1/1/2023 capacity challenge they should provide some tangible relief further into 2023.

Times of significant market change are always challenging to navigate but we have seen a significant difference how individual reinsurers have reacted despite a widespread stated ambition to grow premium volumes in what is being viewed as the best treaty underwriting terms and conditions for a generation.

Clients have favoured growth with these core strategic reinsurers, leaving both in good stead especially once capital and competition rebuild in the global reinsurance market.

Some have reached the end of the renewal season with reputations enhanced, and frankly deservedly so (see How Global Reinsurance Market Endured a 2023 Renewals?).

This was done by exercising a firm and transparent approach based on client selection, allied to a commitment to their own view of pricing adequacy.

Frontier Advisors shows the dispersion of reported hurricane Ian losses, across catastrophe bond funds, mid-risk private ILS funds and high-risk private ILS fund strategies (see how Investors in Insurance-Linked Securities (ILS) Are Seeking Innovation).

The average loss reported across catastrophe bond funds is actually slightly higher than the average across mid-risk private ILS fund strategies.

This is due to the level of the initial mark-to-market hit to catastrophe bonds after hurricane Ian, which has reduced as loss estimates have come out lower than anticipated from cat bond sponsors in a number of cases.

ILS Update

- The combination of Hurricane Ian losses, less than expected returns results over the broader 2017 to 2022 period, the strong U.S. dollar and large number of issuances since 2020 leave USD ILS capital constrained in terms of liquidity implicating that risk spreads are widening considerably.

- The potential inaccuracy in modelling introduced by inflation remains an investor concern even more so than climate change.

- ILS capacity continues to gravitate away from collateralised reinsurance towards Cat bonds, as Cat bonds have performed better for investors over the past five years and are more liquid.

- Aggregate, cascading structures and unmodelled perils remain decidedly out of favour.

- The Cat bond pipeline is quite strong and potentially record breaking moving into H1 2023; however, the capacity constraints mentioned above may make it difficult for some of the deals to succeed.

- Moving further into 2023, conditions should improve as investors are raising new capital to deploy; however, the speed with which this new money comes in is highly uncertain.

Most reinsurers have responded by substantially increasing rates for cat coverage, with some going even further and reducing exposure to problematic lines.

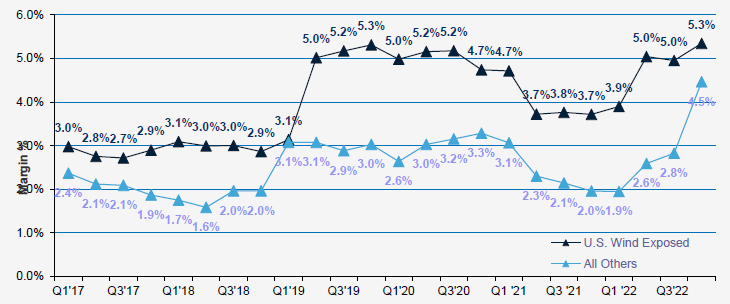

The charts below show the changes in quarterly weighted average margin (risk spread – expected loss) for different types of Cat bonds, along with the capacity development of the Cat bond market, and a comparison of the total return on Cat bonds as against two other comparable investment classes.

Quarterly weighted average margins for new issue Cat Bonds on an LTM basis

Aggregate data exclude private ILS deals. LTM = Last 12 months. Aggregate data are for primary issuance only and do not reflect secondary trading.

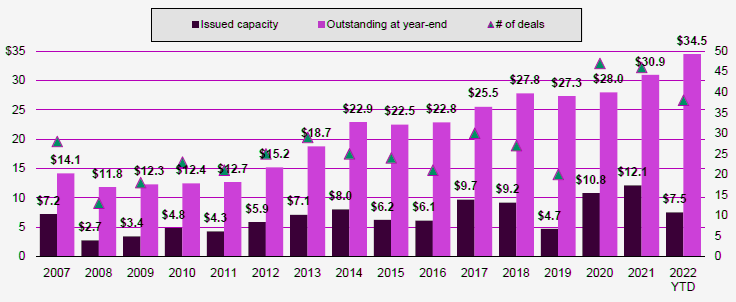

Catastrophe bond and related insurance-linked securities in Q4 2022 issuance fell when compared with the prior year quarter, but remained robust at $1.6 bn, helping the outstanding market hit a year-end high of $37.9 bn, according to Cat Bond & ILS Market Report.

For Q4 2022 specifically, the average multiple of cat bond issuance was 4.93, which is the highest multiple seen in a single quarter since Q1 2013.

Throughout 2022, the average multiple has increased for each quarter when compared with the prior, which shows the strong pricing achieved by investors, notably after Hurricane Ian.

Non-life Catastrophe Bond capacity issued and outstanding by year

Aggregate data exclude private ILS deals. 2-All issuance amounts reported in or converted to USD on date of issuance (see Reinsurance Rates for Property Catastrophe).

Cat bonds and other alternative risk transfer instruments may have a greater role to play going forward as reinsurers restrict coverage and additional sources of risk absorbing capital are needed.

Despite the uncertain issuance environment going into 2023 with rising interest rates, cat bonds are expected to continue to absorb a growing share of the cat risk over time as traditional reinsurers are unwilling or unable to provide the capacity needed by direct writers.

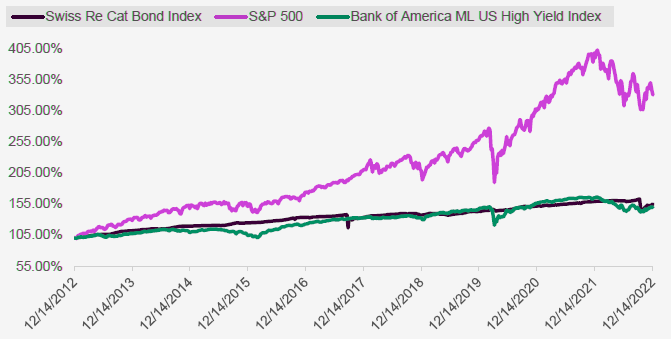

Historic Relative Returns

Cat bonds have become a popular medium of transferring catastrophe risk given their advantages in current environmental and economic conditions.

Following multiple years of large catastrophe losses, reinsurers are raising prices and pulling back cat reinsurance coverage.

This puts the cat bond market in a favourable position to provide the large amount of risk capital needed to cover the most damaging global catastrophes.

While P&C insurers have generally performed well in recent years, catastrophe experience has been challenging for the industry as 2022 marked the second consecutive year where global catastrophe insured losses exceeded $100 bn.

………………..

AUTHOR: James Kent – Global CEO, Gallagher Re

Fact checked by Oleg Parashchak