Insured losses from the 7.6 magnitude earthquake that struck the Ishikawa prefecture on the Noto Peninsula, Japan, on 1 January 2024 are likely to be small, with no major impact on Japanese non-life insurers’ earnings, according to Fitch Ratings.

On January 1, 2024, a magnitude 7.6 earthquake struck the Noto Peninsula in Ishikawa Prefecture, Japan.

The earthquake, with its shallow epicenter, caused large tremors across many areas, leading to a tsunami warning.

Following the main shock, there have been 1,487 aftershocks. This natural disaster resulted in significant damage, including approximately 160 hectares affected by the tsunami in Suzu City and Noto City, with disruptions in power and water supplies, communication issues, and hundreds of houses reportedly burnt down.

No issues were found with reactors at nuclear power plants in the affected area. The Japanese Red Cross Society has been actively involved in relief efforts, providing assistance to those affected by the earthquake.

Insurers’ underwriting risks from earthquakes are low

Underwriting risks from earthquakes are low for Japan’s three non-life groups, mainly because their exposure to earthquake risks has been low and within manageable levels.

The three main non-life groups are Tokio Marine Holdings (operating entity, Tokio Marine & Nichido Fire Insurance), MS&AD Insurance Group (operating entity, Mitsui Sumitomo Insurance Company) and Sompo Holdings.

Forcasts for economic loss from earthquake in Noto

Per the United States Geological Survey (USGS), the January 1, 2024, M7.5 earthquake on the west coast of Japan occurred due to shallow reverse faulting in the Earth’s crust. Japan is a seismically active region with most earthquakes occurring off the east coast, where the Pacific plate subducts beneath Japan.

This earthquake occurred on the west coast of Japan, where crustal deformation created by the broader plate motions is accommodated in shallow faults.

According to the Nomura Research Institute, the economic losses caused by the earthquake are estimated to exceed JPY800 bn ($5.6 bn).

This amount is less than 5% of the JPY16.9 trillion ($118 bn) of economic losses from the Great East Japan Earthquake on 11 March 2011, and is small relative to the three non-life groups’ aggregate net assets of around JPY8 trillion ($57 bn) on a consolidated basis at end-March 2023.

The Noto Peninsula earthquake caused damage across an extensive area around and south of the epicenter. While most of heavy damage occurred in Ishikawa prefecture and in particular Wajima city including a large fire, damage from ground shaking and liquefaction was observed in other prefectures such as Niigata and Toyama. Tsunami waves of over one meter inundated many buildings along the shore, especially in Wajima, Suzu, and Noto.

Building codes in Japan are among the most advanced in the world and have been adopted and practiced well since 1981. In the areas impacted by 2024 Noto Peninsula earthquake, seismic code requirements are higher than those in the southern part of Japan.

Forcasts for insured loss from earthquake in Noto

- Moody’s RMS estimated loss of between JPY 435 bn to 870 bn ($3 bn to $6 bn)

- Verisk estimated between loss of $1.8 bn and $3.3 bn

- Karen Clark & Company estimated $6.4 bn

- CoreLogic estimated up to $5 bn

Moody’s RMS has estimated the insured loss from the earthquake in Noto at between JPY 435 bn to 870 bn ($3 bn to $6 bn).

The industry loss estimate is based on an analysis of the earthquake using Moody’s RMS Japan Earthquake and Tsunami high-definition (HD) Model and reflects property damage, contents, and business interruption across residential, commercial, and industrial lines and includes both private and mutual (Kyosai) markets.

The estimate includes losses from strong ground shaking, earthquake-induced fires, tsunami inundation, land sliding, and liquefaction-induced ground deformation, and also considers sources of post-event loss amplification (PLA), and inflationary trends. It does not include losses to non-modeled exposures such as transport and utility infrastructure, government, or automobile lines.

Verisk esimated for an insurance industry loss of between $1.8 bn and $3.3 bn.

According to Verisk, shallow earthquakes cause more damage than intermediate- and deep-focus ones since the energy generated by shallow events is released closer to the surface and therefore produces stronger shaking relative to earthquakes located deeper within the Earth. This coastal earthquake produced strong shaking on land and generated a tsunami.

The USGS has also noted that while earthquakes are common in Japan, the region surrounding the Noto Peninsula earthquake sees lower rates of seismicity as compared to the major subduction zone along its east coast. Still, since 1900, 30 other M6 and larger earthquakes have occurred within 250 km of the January 1 event.

Karen Clark & Company put the insured losses from the Japan quake at an estimated $6.4 bn.

Losses from residential properties account for more than two thirds of the total, according to KCC, as most commercial and industrial buildings in the affected cities are more seismic-resistant because of their predominantly steel construction.

The government is considering designating the powerful earthquake as a disaster of extreme severity, officials said Friday. Once designated, the central government’s subsidy rate for restoration projects conducted by local governments will be raised.

The central government aims to make a decision on the designation as early as next week. The quake struck Ishikawa Prefecture’s Noto Peninsula on the afternoon of New Year’s Day, flattening homes, triggering a tsunami and cutting off remote communities.

CoreLogic estimated the insured loss from the earthquake in Noto below $5 bn.

CoreLogic estimates that insured losses in Japan due to damage from ground shaking, fires following, tsunamis, and liquefaction could be between $1 and $5 billion (144.6 billion and 722.8 billion yen).

This insured loss estimate includes damage to buildings and their contents, as well as business interruption or the costs associated with additional living expenses. Damage to residential, commercial, industrial, and Kyosai structures are included. Government property; infrastructure such as road and rail networks; water and electric power systems; and oil and gas pipelines are not included.

Initial Japanese reports indicate material damage in the smaller towns and cities nearby the Noto Peninsula, such as Wajima and Suzu. The Mayor of Suzu said that over 90% of the 5,000 homes in the city may have been damaged or destroyed. However, the earthquake spared major economic centers like Tokyo, reducing the loss potential from this event.

CoreLogic Hazard HQ Command Central will continue to analyze the damage left in the aftermath of the Mw 7.5 earthquake in Japan. Additional information may be provided if new data is found.

Then, Verisk’s Extreme Event Solutions business unit put the insurance industry loss at between JPY 260 bn ($1.8 bn) and JPY 480 bn ($3.3 bn).

The lowest-end of RMS’ estimate is almost at the top-end of Verisk’s, once again demonstrating the delta between catastrophe risk model outputs, but also importantly the delta in what gets included in one estimate of insurance market losses and another.

Moody’s RMS said that its industry loss estimate includes insured losses from property damage, contents, and business interruption across residential, commercial, and industrial lines and includes both private and mutual (Kyosai) markets.

Verisk’s estimate did not include business interruption losses, which is likely a reasonably significant component of Moody’s RMS’.

History of Earthquakes in Western Japan

The west coast of Japan experiences far fewer earthquake events than the major subduction zone in the east of the country.

Since the beginning of the 20th century, there have been 30 Mw 6.0 or greater earthquakes within 155 miles (250 km) of the Jan. 1 Mw 7.5 event , according to the USGS.

Only three of these events were on or near the Noto Peninsula. The most serious earthquake was a Mw 7.6, which occurred on June 16, 1964. This event destroyed 3,500 homes when it struck 127 miles (205 km) east-northeast of the Jan. 1 Mw 7.5 event.

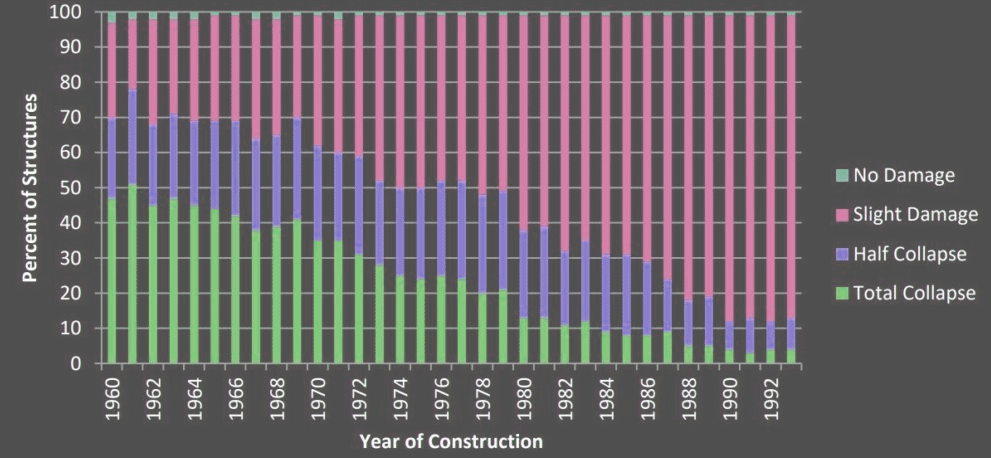

More recently, a Mw 6.7 earthquake struck just west of the Noto Peninsula at a depth of just 3.1 miles (5 km) on March 25, 2007. According to the Earthquake Engineering Research Institute (EERI), the earthquake destroyed 476 homes, half-destroyed another 620 homes, and partially damaged nearly 7,000 homes. The EERI noted that engineered structures, those built to withstand significant ground shaking from earthquakes, performed well during the 2007 event. Older wood-framed structures were damaged or destroyed with much more frequency.

Common building materials and building codes

In Japan, the most common building structure types are wood-frame, reinforced concrete, steel, and composite steel–concrete (SRC).

Single-family, residential houses in Japan are predominately timber-frame structures and comprise the largest market share of Japanese building types. Reinforced concrete construction is the most common for residential apartments.

For example, a post-event analysis of the damage state of wooden structures in Nishinomiya after the 1995 Great Hanshin Earthquake (Kobe Earthquake) showed that the percentage of buildings that experienced only slight or no damage was much higher for post-1981 construction. Nearly 97% of the buildings that did collapse were built before 1981.

Given the high level of seismic activity in Japan, building codes have been continuously updated since the late 19th century, and building performance with respect to earthquake risk has steadily improved. As a result, the seismic vulnerability of old buildings is high compared to newer buildings, with post-1981 buildings performing much better than pre-1981 construction.

The main area the quake struck in Ishikawa

The main area the quake struck in Ishikawa prefecture was a rural and residential area rather than an industrial site and, therefore, the losses from residential would account for at least more than half of the total economic losses.

Japan’s Fire and Disaster Management Agency (FDMA) said that over 4,000 properties are reported as damaged.

This number is expected to rise significantly as damage assessments continue, particularly in the worst affected areas on the Noto Peninsula.

Japanese non-lifers have limited net retention on residential earthquake risk as it is run by the government.

In addition, their net exposure to corporate earthquake risk is also small, as the Japanese insurers tend to avoid retaining large earthquake risks and transfer the exposure to major European and US reinsurers to limit their retention. Therefore, Fitch estimates that the net insured losses of the non-life groups from the earthquake would be small.

The Noto Peninsula earthquake caused damage across an extensive area around and south of the epicenter. While most of heavy damage occurred in Ishikawa prefecture and in particular Wajima city including a large fire, damage from ground shaking and liquefaction was observed in other prefectures such as Niigata and Toyama.

………….

Author: Yana Keller, Fact checked by Oleg Parashchak