The Gulf Cooperation Council region is one of the world’s fastest-growing markets, registering growth of nearly 7% each year in gross written premiums over the last six years—several times higher than the global average. But that growth has slowed in the last three years, ramping up the pressure on insurers to out-innovate the competition.

Digitisation, as we understand it, means the streamlining and automation of processes, the consideration of trends and the desire for greater flexibility in product development and – not least – remaining close to the customer and making insurance information available to them while on the go and at any time. With the advent of digital platforms, mobile apps, and big data, customers now expect quicker and more effective service than ever before.

And they expect that enhanced level of service from the moment they buy a policy right through to the settlement of a claim. Social distancing measures introduced during the ongoing COVID-19 pandemic have also forced many laggards to become early adopters of digital and seek out online solutions. Meanwhile, global firms are also seeking to harness the power of digital solutions to help them understand their customers better—and increase effectiveness and minimize losses as a result.

Gulf Cooperation Council insurance market growth

According to Kearney Research, the insurance penetration rate in the Gulf Cooperation Council region is generally very low. The United Arab Emirates has the highest insurance penetration rate at 3.2%. Qatar has the lowest insurance penetration rate at about 1%.

The markets of Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar represent the biggest insurance markets in the Gulf Cooperation Council region. Non-life insurances are the more significant segment of the insurance industry in this region.

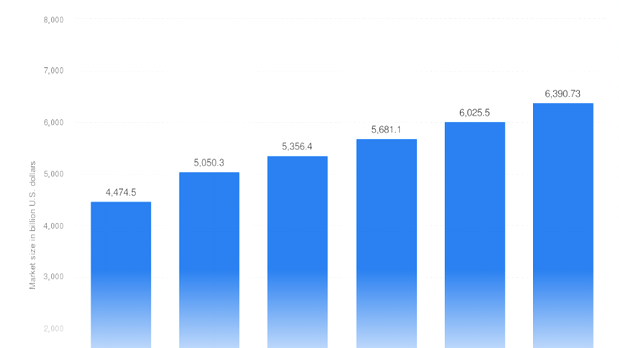

It is forecast that the global insurance market will grow by almost 13% from 2020 to 2021, reaching just over 5.5 trillion as the insurance industry recovers from the global coronavirus (COVID-19) pandemic. Following this, it is predicted that the industry will grow at a compound rate of around 6% per year, reaching almost 6.4 trillion U.S. dollars in 2025.

Forecast of the global GCC insurance market in 2020–2025

In this year, the value of net premiums written of Bupa Arabia for Cooperative Insurance Company totaled around 2.77 billion U.S. dollars. The value of gross written premiums of Qatar Insurance Co. totaled approximately 3.35 billion U.S. dollars, the net profits of Bupa Arabia for Cooperative Insurance Company totaled around 185.6 million U.S. dollars.

The research shows that these global players are innovating across the value chain. And they’re doing it by deploying new-age technologies such as AI, Internet of Things (IoT), drones, and blockchain to generate more value in marketing and distribution, product development and underwriting, and in claims prevention and customer support.

But maximizing the impact of these initiatives starts with digitalizing the firm’s core operations in order to gear it up—in terms of processes, people, data, and infrastructure—for seamless integration and alignment with the new technologies.

At the same time, insurtech has also captured the interest of private equity and venture capital firms, as is evident from the consistent increase in insurtech investment activity.

As the insurance sector expands in the GCC—one of the world’s fastest-growing markets—regional players now have the perfect opportunity to reap the rewards of being early movers in the global digital transformation story.

IoT spending in the Middle East and Africa is expected to grow at a compound annual growth rate of 15.9 percent and reach $17.63 billion by 2023.

The GCC countries are also leading the race to introduce 5G, with operators in Saudi Arabia, the UAE, Kuwait, and Qatar already having launched 5G services to a varying extent. So, what does a more connected and automated GCC mean for insurers? Crucially, it gives them the perfect opportunity to out-innovate the competition, and to create value by enhancing customer experience, improving the accuracy of risk assessment, and reducing operational costs and claims-related losses.

Digitalisation is no longer just propelling the growth of the insurance industry; it’s also transforming the entire value chain. Against the backdrop of this seismic change, companies that fail to commit to achieving a digital impact at scale—right here and now—risk being left behind.

On the other hand, firms with the foresight to position themselves as pioneers of digital innovation stand to capture a higher enterprise value—the innovation premium.

Some firms in the GCC have already started implementing the technology to make this happen.

For instance, I-Insured has launched an AI-based SafeDriver Pay-How-You-Drive (PHYD) app that offers policyholders lower premiums and incentives based on their driving behavior (see Potential and Opportunity of Telematics in Car Insurance).

Union Insurance Company also uses AI, which uses natural language processing to extract data from documents, to issue motor policies in less than one minute for the first time ever in the UAE. Five regional insurance players—Aman Insurance, Al Wathba Insurance, National Takaful Co. (Watania), Noor Takaful, and Oriental Insurance— collaborated with insurtech firm Addenda to adopt its blockchain platform as a part of their digitalization strategy and to streamline their processes.

Changing customer expectations are fueling the need for new, customer-centric products

When it comes to improving customer experience, data is everything. IoT devices have opened up new channels for insurers to gather data that can give them valuable insights into customer demands, and risks related to both customer behavior and external factors. And AI-based analytics is boosting insurers’ ability to make sense of this data and apply it to actuarial sciences.

Crucially, this enhanced level of data gives insurers the power to track consumer behavior and reward it through incentives such as lower premiums. One insurer doing exactly that is Beam Digital.

The company gives a smart toothbrush to customers, monitors their oral health, and uses the data to develop a bespoke dental insurance plan for them. In the past, premiums were calculated based on location, with data only available at the level of zip codes. Now, thanks to AI, firms can take a more granular approach and more accurately calculate premiums that are specifically customized for each individual customer.

In the US, Metromile has rolled out a “pay-per-mile” usage-based insurance model, which tailors premiums based on how frequently drivers use their cars and how far they drive. And Metromile is not alone in spearheading this kind of initiative; other firms, such as Allstate and Progressive, have also implemented similar programs.

The impact of initiatives such as these is clear to see from the loss ratio of the pioneers compared with those of similar firms that are bringing up the rear in the drive toward digitalization.

Some insurers are also combining this type of AI-based risk assessment with other emerging technologies such as drones and aerial imagery for even greater impact. In the US, home insurer Hippo turns big data to its advantage by using aerial images to assess the condition of the backyard of customers’ homes.

Blockchain technologies are also playing an important role in the insurance industry by enabling the creation of new types of products. Blockchain-based distributed ledger simplifies record-keeping and makes on-demand insurance more accessible by taking away the hassle of managing records and multiple interactions with policy documents.

Blockchain-based insurance products

French insurance giant AXA is offering a parametric insurance product to cover customers against flight delays, based on Ethereum blockchain.

Customers now expect the information they need to be transparent, easy to understand, and quick to access. Insurers are stepping up to meet these demands by deploying AI-powered platforms, which replace human input through features such as automated product recommendations and query resolutions by chatbots. Esurance, for instance, employs a direct insurance digital approach to customers, cutting out “middlemen” agents to offer lower, more competitive rates.

Digitalization is enhancing customers’ buying experience and cutting customer acquisition costs

Other firms are using chatbots and AI to provide round-the-clock access to customers. US-based Lemonade offers insurance to homeowners and renters with zero paperwork, lower fees, and instant responses by replacing brokers with bots and ML algorithms. As a result, Lemonade claims to insure policyholders in just 90 seconds and pay claims in as few as three minutes. Other insurers are going the extra mile to make it easier for customers to understand their policies by employing augmented reality (AR) technology.

Desjardins Insurance, a Canada-based firm that offers retirement plans, has turned the tedious and time-consuming process of choosing a retirement benefit plan into a more engaging experience through an AR app that uses video to explain people’s retirement goals.

IoT, AI, and AR are all equipping insurance firms with the tools they need to generate more value for each marketing dollar spent.

In the UK, AXA Insurance has used an AR-enabled game called Ingress to expand its brand awareness. Liverpool Victoria, a UK-based insurer, partnered with Blippar to use AR to make newspaper flyers. Other insurers are capitalizing on blockchain technologies to reduce sales and distribution costs and consequently offering low-margin microinsurance products, which were not feasible due to high sales and distribution costs. Surety.ai uses blockchain to offer microinsurance to customers in Asia, especially those who have no access to the services of banks or other financial organizations.

Telematics increases customer interaction directly with the insurance firm and boosts brand recall and awareness. AR- and VR-based gaming apps and advertising focus on improving customer interaction and increasing brand awareness.

Digitalization is accelerating the claims process and reducing claims losses

Innovations that speed up the claims process are not only focused on providing convenience to customers. They’re also designed to reduce the cost of processing those claims for insurers. Results from our survey of claims managers at leading insurers shows that inefficient processes and lack of digitalization are typical drawbacks of the claims management process, as shown in figure 6. But automated digital platforms are now being used by some insurers to file and record insurance claims, including Suncorp in Australia and Tata-AIG in India.

Using AI to understand first-notice-of-loss images, insurers have successfully processed claims within minutes. In addition, Japanese insurance firm Fukuoka Mutual is scanning medical records and data on surgeries and hospital stays through a cognitive machine-learning (ML) tool to calculate pay-outs. Meanwhile, ICICI Lombard has created an AI-based cashless claims settlement process, which can be completed in just one minute. Results depicted in figure 7 from the Claims Study show an upswing of interest in digitalizing the claims process.

AI-powered claims processing, coupled with other emerging technologies, is advancing the fraud detection capabilities of insurance firms. US-based Erie Insurance has been deploying drones to inspect property in the event of damage claims and expects to deliver a faster claim process by looking at damage without endangering employees, and to identify potentially fraudulent cases.

Catching fraudulent insurance claims

By leveraging machine learning, Chinese insurer Ping An saved itself $302 million from fraudulent claims in one year. It also achieved a 57% increase in accuracy in fraud detection from the previous year. In addition, blockchain technology is delivering a number of compelling benefits for insurers.

In addition to enabling them to process smart contracts to speed up the claims process on parametric insurance products, blockchain also allows them to collaborate by sharing data securely and anonymously, and to uncover current blind spots to improve fraud detection.

Insurance firms are also using IoT devices to alert customers in real time, correct customer behavior, and use the data to gauge risk levels and implement measures to prevent claims in the first place. Liberty Mutual has partnered with Google’s Nest to implement connected smoke alarms and reduce home insurance premiums. Nest alerts customers to smoke, increasing the chances of avoiding damage being done in the first place.

FitBit, the popular mobile fitness app, monitors customers’ behavior and feeds them objective data that helps them adopt a healthier lifestyle. And British insurance provider Vitality now runs a rewards program that uses similar fitness trackers and smart wearables to help its health insurance customers earn points as they manage their health risk.

Four-step approach to embracing digitalization

The scale and pace of the drive toward digitalization present an overwhelming number of opportunities. Companies seeking to establish themselves as digitalization winners must adopt a structured approach that enables them to:

- Step 1: Identify the right use cases

- Step 2: Digitalize the core operations

- Step 3: Create a portfolio of digitalization initiatives

- Step 4: Build a strategic blueprint

Step 1: Identify the right use cases

Firms must weigh the following three aspects when it comes to identifying and prioritizing the right use cases:

Financial impact—assesses the impact on the bottom line of increased efficiency, Net Promoter Score, diversification revenues, and so on and the investment required to achieve this

Strategic alignment—measures how each use case contributes to the firm’s short-, medium-, and long-term goals, and to its overall vision

Ease of implementation—covers both internal and external aspects of implementation. External aspects include the availability and maturity of technology, and the technology adoption rate by customers. Internal aspects include existing capabilities and the availability of human capital.

Step 2: Digitalize the core operations

Digitalizing a firm’s core operations is a significant undertaking and serves two key purposes:

- It enables people to focus on value-add activities by automating repetitive tasks

- It prepares the organization to absorb new initiatives in a seamless and efficient manner

We’ve identified five components that can help guide firms through the process of digitalizing their operations.

Step 3: Create a portfolio of digitalization initiatives

Each use case must be assigned to an initiative, and a portfolio of initiatives can be created based primarily on the time it will take to realize the potential of each initiative. Based on the time to benefit, which is primarily driven by the maturity of the technology, firms can decide to take one of the following actions for each initiative:

- Develop products that can be powered by mature technology that’s available now

- Incubate for technology that is expected to mature in one to two years

- Ideate and monitor for technology that is still more than two years out

Step 4: Build a strategic blueprint

Even with strategic goals set, effective implementations involve extensive preparation. In the most successful use cases that we reviewed in this study, companies were very clear about how, when, where, and why they wanted to deploy different technologies before moving forward.

For example, the AI use cases we studied provide extensive evidence that successful implementations went hand in hand with firms understanding the importance of their data. The process of cleaning and preparing data for use in training an AI engine is an important step in ensuring outputs are aligned with company strategy.

As a result, the pre-deployment data collection and preparation phase requires the support and responsibility of leadership, operators, and ecosystem partners alike.

In our experience, it’s crucial that companies develop and follow an executable road map that can help them realize their digitalization strategy.

This approach is underpinned by three key steps:

Strategic blueprinting—Identification of providers for priority use cases, and design of future interaction model and go-forward capability model, including a cross-functional digitalization center of excellence

Testing the strategy—Actual or simulated transactions flowing through use cases in order to test, learn, pivot, and deploy

Implementation of solutions—Broader rollout and full-scale implementation of digital solutions across the business, spanning countries, business units/functions, and products

In common with most other sectors, digitalization in the insurance space is here to stay. As the GCC’s nascent insurance sector continues to expand, the region’s firms now have an unmissable opportunity to stay ahead of the curve by adopting digital technology in the immediate term.

……………………………

AUTHORS: Piyush Dubey – Partner Kearney, Mukund Bhatnagar – Partner Middle East and Africa Lead, Financial Services Kearney, Aashbir Bhatia – Consultant Kearney.