Usage-based insurance with telematics is gaining popularity, many motor insurers are beginning to offer it as an option to customers. Over the past decade, insurers have transitioned from discussion and experimentation to market introduction of insurance telematics. Beinsure Media has collected the opinions of experts and introduce you telematics technology and give you some vocabulary to help you stay abreast of the growing trend.

The pandemic has driven this change even more, as more people did not use their vehicles to get to work and would wish for usage-based insurance.

Types of telematics insurance

Most used types of telematics insurance – Usage-Based Insurance (UBI), pay-as-you-drive (PAYD), and pay-how-you-drive (PHYD). Insurance telematics is revamping auto insurance by effectively merging technology with finance and human behavior. It makes the entire system more transparent and increases driver safety.

In the early days, the definitions of those acronyms were imprecise. But as they imply, the factors affecting premiums are generally how much (far), when, how well (behavior), and where (location) the vehicle is driven.

Telematics technology has the potential to overhaul the fleet industry and is becoming a mainstream option for customers.

According to Verisk, in the taxonomy of the Internet of Things, a phrase coined by Kevin Ashton in 1999 that has gained currency in the past few years, telematics is in the topic family of machine-to-machine (M2M) communication mechanisms.

The enabling technologies stem from telecommunication advances that have reduced the cost of connecting associated but remote endpoints: everything from smartphones to temperature sensors. The word telematics implies a bidirectional exchange between endpoints for sensing or measuring feedback or control (see How will Technology Impact Insurance? 16 New Technology Trend Evolution).

Furthermore, the new generation of young people is used to pay for usage, like data contracts for phones or car sharing. But what does this change mean, how do telematics and usage-based products reshape the traditional motor insurance industry and how can insurers use it for their benefits?

As technology evolves and the cost of implementation becomes more accessible, insurers and fleet operators are increasingly adopting UBI insurance.

Currently, telematics is the adopted terminology for all technologies associated with communication for a motor vehicle, from Google’s self-driving vehicles to aftermarket location-reporting gadgets.

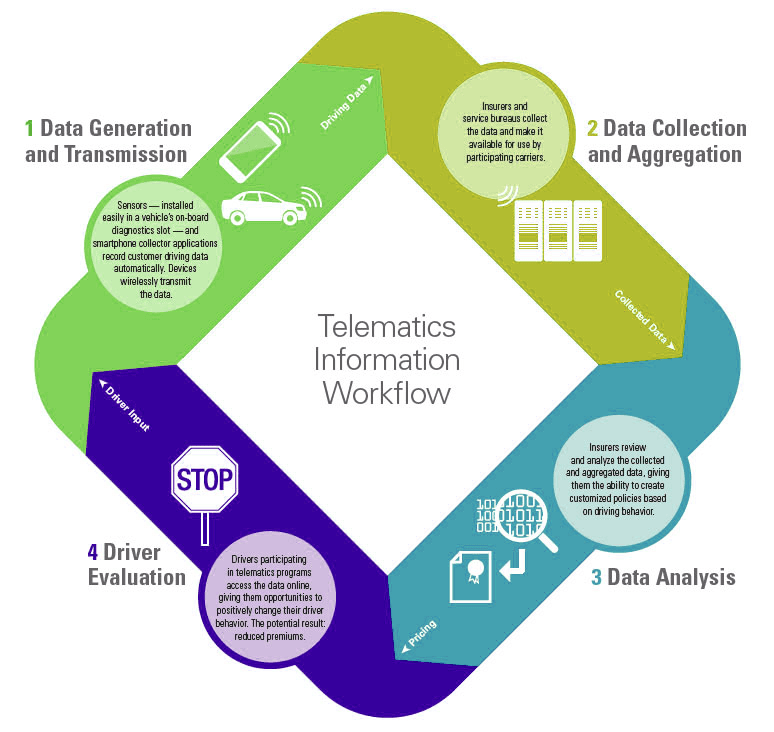

Since the advent of the General Motors OnStar program, there’s been an increasing penetration of telematics capabilities and services in automobiles. Estimates put expected penetration by 2017 at more than 70 percent for car manufacturers’ new vehicles. Today’s telematics in insurance usually refers to one-way collection of available information from a vehicle. Strictly defined, that’s telemetry, a subtle but important difference, because telemetry doesn’t impose control over a vehicle. The figure above is a simplified diagram of the process available today.

The type of data that devices can collect from or about a vehicle varies by implementation, typically drives cost, and is constrained by regulation and customers’ willingness to share. Programs in place use sensors to determine factors as simple as distance (vehicle-miles traveled) and as sophisticated as camera-based recording. Devices transmit and store the resultant collection for immediate or deferred analysis, meaningful interpretation, and/or visualization.

These types of integrations – which can either incorporate onboard telematics systems or plug-and-play options instead – allow insurers to provide more bespoke cover to their customers while capturing a clearer picture of driving behaviour. Despite the availability of telematics solutions, their uptake among commercial operators is still relatively low.

The internet of things (IoT) and artificial intelligence (AI) are accelerating innovation in the automotive industry, giving new opportunities to improve customer experiences.

A focus area within this digitalization movement is telematics-powered Usage-Based Auto Insurance Programs. But the adoption has been slower than expected for several reasons.

Ptolemus expects growth in the UBI space, projecting that there will be over 20 million fleet UBI vehicles by 2030. Commercial insurance telematics premiums are expected to reach €20bn by the same year.

Higher interest in fleet telematics, a desire to reduce losses and more sophisticated, affordable technology solutions entering the market are just three key drivers.

Telematic Challenges

Telematic devices gather data in real-time so that insurers can use these to collect data about a customer’s driving behavior. This leads to data privacy concerns, as telematics devices have to be added or retrofitted to cars, data must be collected, stored.

Telematics technology has traditionally been used for real-time tracking of the fleet and accessing reports on their usage, including fuel consumption, utilisation, idle time and crashes

Data often has to be shared with multiple parties before it gets analyzed on massive scales to generate useful insights. If an insurance business wishes to partner or collaborate, this new data stream adds a layer of complexity.

A strong insurance platform can help here to organize data streams and collaboration.

On the other hand, the acceptance of information sharing is growing as more technology devices such as smartphones, GPS devices or social media networks are normal in our daily life. The overall usage of data has to be streamlined within the industry, transparency and regulations make a first step in the right direction.

Insights through Telematic Data

With the introduction of both mobile and devices-based telematics technologies, insurance providers can acquire a pretty accurate picture of their customers’ on-road driving behavior.

Insurers can use this information in an individual or collective way to understand how drivers behave at a certain time a day or even while driving a specific vehicle. (see Global Insurance Markets Trends and Forcasts).

Most fleet management software has technical debt challenges and is often difficult to change or integrate with other platforms that are being used by the fleet operator. Due to those limitations, most fleet management software does not utilise telematics data as part of its core processes, often requiring fleet operators to purchase and manage two different solutions, then manually reconcile the data between them.

At the same time, insurers can obtain ample information about their customers’ behavior, which allows them to identify low-risk groups. This provides a powerful tool to access if the customer is worth retaining.

Keen insights through data create a deeper overview of individual risk profiles, as well as reducing the claim loss ratios through faster and intelligent claim handling.

Telematics helps insurers to estimate damages more accurately and reduce fraudulent claims through analyzing driving data such as hard braking, cornering, or speeding during an accident.

The ability to integrate with operational platforms – such as accounting, payments and service networks – will help to provide advanced fleet insights like fleet planning and cost management.

With consumers increasingly aware of environmental issues – and the negative PR that comes from lagging behind – there is also the possibility for operational data to be utilised to measure an operator’s carbon footprint, helping reduce energy and fuel usage.

Manufacturer installs are still viewed with some suspicion in terms of GDPR and who is watching. Customer-installed units have more trust, but they have to be easier to manage.

How telematics influences the Motor Insurance Industry?

The world of mobility is changing rapidly. Telematics is a word everyone has heard of by now! Starting as a niche feature, telematics is merging into the insurance and automotive mainstream. Usage-based insurance with telematics is gaining popularity, many motor insurers are beginning to offer it as an option to customers.

The pandemic has driven this change even more, as more people did not use their vehicles to get to work and would wish for usage-based insurance.

Furthermore, the new generation of young people is used to pay for usage, like data contracts for phones or car sharing. But what does this change mean, how do telematics and usage-based products reshape the traditional motor insurance industry and how can insurers use it for their benefits?

The internet of things (IoT) and artificial intelligence (AI) are accelerating innovation in the automotive industry, giving new opportunities to improve customer experiences. A focus area within this digitalization movement is telematics-powered usage-based insurance (UBI). But the adoption has been slower than expected for several reasons.

Usage-Based Insurance offers many advantages

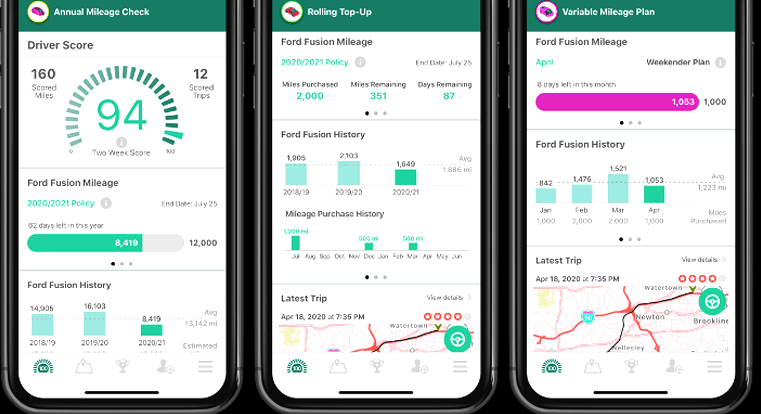

Usage-Based Insurance offers many advantages to insurers, customers, and society. For example, a telematics device collects data about the customer’s driving behavior and usage. If it detects safe driving behavior, it can reward the customers by offering lower premiums.

More recently, telematics data is providing access to real-time vehicle data that is being used for monitoring driving behaviour such as harsh braking and speeding by fleet operators and insurance companies. More advanced fleet software is also able to use data such as diagnostic engine alerts to schedule early maintenance of vehicles.

Linking insurance premiums more closely to actual individual usage allows insurers to price premiums accurately and transparently which often leads to customer satisfaction.

This offers especially young drivers, which usually pay higher premiums to get fair premiums based on their driving behavior. It also gives customers the ability to control their insurance premium by reducing miles driven and adopting safer driving habits. Usage-based Insurance plans like pay-as-you-go (based on mileage) or pay-how-you-drive (based on driving behavior), allow customers to stay flexible.

Safer driving and fewer miles aid in reducing accidents and vehicle emissions, which is a benefit for society. The driving insights could even give young drivers immediate feedback on their driving behavior to help them learn safer driving habits. These insights would also allow elders to see how their driving behavior is changing.

With the introduction of both mobile and devices-based telematics technologies, insurance providers can acquire a pretty accurate picture of their customers’ on-road driving behavior.

Insurers can use this information in an individual or collective way to understand how drivers behave at a certain time a day or even while driving a specific vehicle.

At the same time, insurers can obtain ample information about their customers’ behavior, which allows them to identify low-risk groups. This provides a powerful tool to access if the customer is worth retaining.

Keen insights through data create a deeper overview of individual risk profiles, as well as reducing the claim loss ratios through faster and intelligent claim handling. Telematics helps insurers to estimate damages more accurately and reduce fraudulent claims through analyzing driving data such as hard braking, cornering, or speeding during an accident.

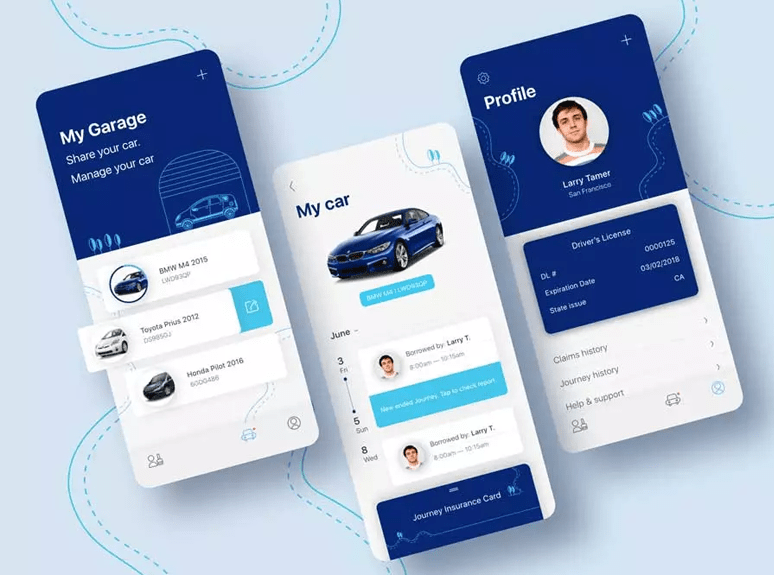

Customer engagement & personalized motor insurance products

Understanding your customer helps you to sort them more effectively and allows you to offer personalized motor insurance products that fit the customer’s needs perfectly. To provide outstanding customer experiences and engagement, the products you offer have to be individualized. Personalized products require a holistic overview of the customer, which can be created through the use of data analysis.

In addition to that, telematics solutions often lead to constant customer engagement with the carrier through an app or other devices, to check their usage. Gamification features such as rewards or point-scoring grab attention and paves the way to discourage dangerous driving. Customers with high engagement are more likely to be satisfied with the service and willing to pay more.

Telematics technology reduces insurance costs

As the world of telematics technology continues to evolve, more insurance companies are leveraging their customers’ smartphones. As most people carry their smartphones at all times, it has become a lucrative tool for insurers as it already provides sensors that allow measuring factors like speed, travel distance, or data about the driver like if the owner of the car is driving or the age of the driver. Using an app on a smartphone is therefore the cheapest possibility to implement usage-based insurance.

Next to this, usage-based insurance, which rewards safe drivers is likely to attract less risky customers. Save drivers reduce costs associated with claims, that is why they are more profitable for insurers.

A usage-based insurance program is not likely to attract drivers with a lot of accidents or speeding tickets.

Positive selection and improved behavior can reduce claims. Moreover, the data enrichment enables insurance businesses to detect accidents earlier and alert service. The service can then make more accurate liability decisions based on location or time data. Besides that, the First Notification Of Loss (FNOL) allows the insurer to shorten the time of claim management from several days to minutes.

Telematics adapts to the EV Era

As the world becomes increasingly electric, insurers and fleet operators will have no choice but to keep up. The most obvious challenges arise from recharging needs, which, along with the prospect of battery degradation, will need to be factored into platforms.

With telematics built into pretty much every new electric vehicle (EV), there is also scope for customers to share this data with insurance providers and allow a more seamless data transfer without the need for additional devices or apps – this will, however, need to be handled sensitively.

In addition, the need for connecting to wider services and the vehicle has also grown as EV drivers need information around charging stations and availability of chargers in real time.

Increased numbers of EVs on the road will increase the demand on charging grids as well, which may lead to other cyclical impacts on fleet management.

EV vehicles last longer and have longer gaps between their maintenance schedules, which will be different to petrol and diesel vehicles due to them requiring more frequent maintenance.

Insurers can foster a closer relationship with customers – not just one that is better at predicting risk, but one that can also benefit the operator. Telematics have the potential to flag bad driving practice, identify areas of fuel inefficiency and save the operator money, both on insurance and on day-to-day operations.

The rise of EVs presents some challenges to the industry. Telematics platforms will have to factor into their app the reality of operating an EV fleet, while insurers will have to constantly ensure that their policies reflect the evolving business challenges that their customers face. But more EVs on the road won’t slow the rapid acceleration of UBI or halt the growth in telematics within the commercial insurance space.

Telematics grabs the opportunity

Insurance companies have to modernize to keep up with the changing motor insurance industry. Telematics and usage-based insurance can help insurers to do that smartly, by using data as an opportunity. Offer customers new experiences that meet their expectations and deliver outstanding service to reach high-intent customers and retain them with telematics solutions.

Most customers navigate a variety of services digitally from filling prescriptions to buying groceries to banking. Customers expect a seamless interaction with carriers and the insurance industry is no exception. As a result insurance providers should adapt to meet customers’ expectations.

The opportunity now exists for direct measurement of driver behavior in place and time

Undoubtedly the most impressive utilisation of AI I’ve come across in the insurance industry is the Chinese automobile insurer Ping An and the way it uses cloud-based technology to transform the way motor insurance claims are handled.

The smart city of Shenzhen has established a level of connectivity that has improved transport flows, eliminated traffic jams and enabled the identification of potential accident hotspots. It also means that response teams can be positioned near these areas to access the scene of an accident within minutes, achieving response times that are the envy of the emergency services.

Once there, the insurance response teams can take pictures that can be uploaded immediately so that liability can be established and the cost of damage can be assessed – all by automated systems.

How Does Telematics Car Insurance Work?

There is a certain stereotype that all young drivers are reckless drivers and are a big insurance risk. In fact its only a minority of drivers who have serious (and thus extremely expensive) accidents – but all drivers have to pay for them. This can make it very difficult for young male drivers to get an insurance policy at an affordable rate.

Telematics insurance can change this – offering an insurance premium calculated on the individual drivers actual driving behaviour – the mileage covered, the road used and the time used, the observance of speed limits, the smoothness of acceleration and slowing down.

Black Box insurance allows drivers flexibility to choose, when, where and how to drive in order to reduce premiums and also to maximize their security (from accidents). The data collected also records the exact position of the vehicle device at any time – useful, for example, to deter theft, though creating a privacy issue which all insurers are addressing.

How Is The Collected Data Used?

The collected data is analysed by the insurance company and helps them in charging the insurance premiums and a multiplicity of other uses which include:

The insurance company recognises that some drivers rarely use their cars and if they do, they use them for local or short journeys, or maybe it is because they are trying to save on fuel. Such drivers drive their cars only a few thousand miles a year.

The mileage policy is generally suitable for any type of a car where premiums are charged according to the number of miles you drive. If you can save your cost of fuel by reduced car use, why not reap benefits as well of reduced insurance premiums.

Thus, those who drive fewer miles, and those who do not use their cars during the rush hours and at night benefit from lower premiums rates.

Some insurance companies use the black box technology to assess the drivers’ acceleration, cornering and braking and use the information collected from assessment to offer discounts or premium loads depending on the scheme.

The drivers need to select and appropriate scheme suitable for your driving pattern so at to reduce the premium costs.

In case you are involved in an accident in your car, the black box immediately alerts your insurance company of a sudden alteration in g-forces. The device can also be used as a telephone, thus they call you to check on your status and to establish whether you require any emergency assistance.

Moreover, the insurance company can immediately take down the details of the accident, which will hasten the claims process and deter probability of any fraudulent claims by the other party involved in the accident.

Why insurance telematics matters?

Today, insurers begin calculating premiums primarily with self-reported information. Starting from that premise, a portion of Verisk’s underwriting business is helping carriers verify and validate the data provided — everything from accurate vehicle identification number reporting to traffic violations. Information is valuable. Something as basic as annual usage (by distance) verification could help a carrier underwrite low- or seasonal-usage vehicles confidently.

The opportunity now exists for direct measurement of driver behavior in place and time. Vehicle electronics capture hundreds of sensor inputs for processing by on-board controllers and reporting to diagnostic ports.

Aftermarket device vendors have integrated technologies to allow the collection of such data (revolutions per minute, manifold air flow sensor output, malfunction indicator lights, engine trouble codes, and so forth) and combine it with time, precise GPS position, gravitational forces, and even ambient cabin noise on a second-by-second or higher frequency.

Experts distill and analyze those measurements to identify patterns that indicate poor or dangerous driving habits, such as rapid acceleration or cornering, harsh braking, or excessive speeding (>80 mph).

Furthermore, systems can now link the collected telemetry with other sources of data, such as weather, traffic, and road type, to provide context to improve understanding and insights about the driver.

The race is on to interpret the data and prove what the industry has termed “demonstrated predictive potential” of the collected data elements as a direct measurement of behavior and risk. As mentioned earlier, we’re in the early days of the technology. And except for the current carrier leader, which has more than a million UBI policyholders, there isn’t yet a single repository with enough data to validate risk rating models based on behavior measurements.

………………………..

Fact checked by Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media