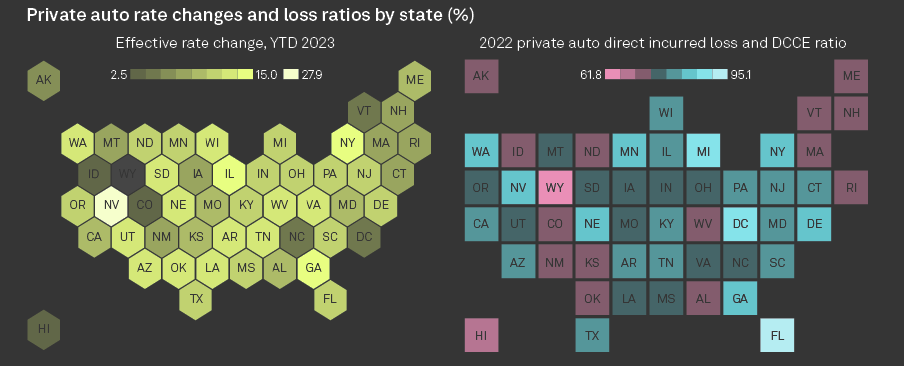

US auto insurers are racing to increase premium rates as they seek to offset historically poor underwriting results. The year-to-date nationwide average increase for private auto insurance is 12% in February 2024. There is a wide variance in the effective rate change between individual states, according to S&P Global Market Intelligence.

U.S. auto insurers continue to report underwriting losses despite sharper improvement in premium rates, with the 2024 marked by continued unfavorable claims severity and higher catastrophe related losses. Future profit improvement will continue to be hindered by unusually high loss severity (see TOP 10 Largest U.S. Auto Insurance Companies).

US private auto insurance premiums rose in the 2023 to $223 bn. Overall direct loss ratio for the business line also deteriorated, rising to 76%.

The rise in premiums can be attributed in part to carriers continuing to produce strong top-line growth as they attempt to catch up to fast-rising private auto loss costs via rate increases.

The average cost of auto insurance in the U.S.

Car insurance is like a fingerprint. Although your circumstances may seem similar, your personalized rating factors will cause your premium to vary from that of friends, family and the national average.

The average cost of auto insurance in the U.S. is $2,014 per year. Minimum coverage, on the other hand, has an average annual cost of $622. On a monthly basis, full coverage averages $168, with minimum coverage averaging $52 per month.

Although men tend to pay more for car insurance than women, this is not the case for 50-year-old drivers. 50-year-old women pay, on average, $2 more a year for full coverage car insurance than 50-year-old men.

Some vehicles experience higher average insurance premiums than others because of MSRPs, safety features, repair costs, parts availability and other variable characteristics. For example, the average cost of full coverage insurance for a Tesla Model 3 is 60% higher than for a Subaru Outback.

Nevada has had the highest overall calculated effective rate increase so far in 2024 at 27.9%, compared to a low of 2.5% in Idaho.

In total, 32 states reflect a double-digit increase based on about 11 months of approved rate filings.

Auto insurance rate changes and loss ratios by State

US auto insurance rate increases

The countrywide average will have increased by double digits in back-to-back years if this trend continues for the remainder of 2024. For several years prior to the current spike in private auto premiums, the average yearly change was a low single-digit increase.

The exception was in 2020, when COVID-19 spurred a rash of premiums credits to compensate consumers for their decreased driving habits.

Texas has the highest cumulative rate increase of 37.6% over the past 20 months when factoring in the surge in private auto rates since the start of 2022.

Seven other states have a cumulative effective rate increase of 30% or more: Illinois, Ohio, Tennessee, Nevada, Arizona, Illinois and Utah.

TOP 10 States by highest effective Auto insurance rate

| № | State | US Insurance Rate change |

| 1 | Nevada | 27,9% |

| 2 | Louisiana | 15,0% |

| 3 | Illinois | 14,4% |

| 4 | New York | 14,2% |

| 5 | Georgia | 13,6% |

| 6 | Wisconsin | 13,0% |

| 7 | Nebraska | 12,9% |

| 8 | Utah | 12,8% |

| 9 | Tennessee | 12,7% |

| 10 | Washington | 12,5% |

The states with the lowest cumulative increase are Hawaii (4.4%), Vermont (6.3%), North Carolina (8.2%) and California (11.1%). The relatively minimal cumulative rate increase in The Golden State is due to the almost two-year hiatus by the state regulator to approve any private auto rate increase.

Private auto insurance effective rate change by US State

| State | Insurance change 2023 | Insurance rate change 2022 | Change, % |

|---|---|---|---|

| Countrywide | 11,0 | 11,1 | 23,3 |

| Alabama | 9,7 | 6,1 | 16,3 |

| Alaska | 6,2 | 5,2 | 11,8 |

| Arizona | 12,3 | 16,7 | 31,0 |

| Arkansas | 12,4 | 8,4 | 21,9 |

| California | 9,7 | 1,3 | 11,1 |

| Colorado | 2,9 | 10,8 | 14,0 |

| Connecticut | 8,3 | 8,9 | 17,9 |

| Delaware | 11,0 | 14,0 | 26,5 |

| District of Columbia | 4,5 | 12,6 | 17,6 |

| Florida | 11,0 | 12,5 | 24,9 |

| Georgia | 13,6 | 14,3 | 29,8 |

| Hawaii | 3,8 | 0,6 | 4,4 |

| Idaho | 2,5 | 9,0 | 11,7 |

| Illinois | 14,4 | 17,8 | 34,7 |

| Indiana | 10,0 | 12,1 | 24,3 |

| Iowa | 9,0 | 10,3 | 18,2 |

| Kansas | 10,2 | 13,2 | 24,8 |

| Kentucky | 11,4 | 8,5 | 20,8 |

| Louisiana | 15,0 | 9,0 | 25,3 |

| Maine | 10,1 | 14,2 | 25,7 |

| Maryland | 9,4 | 17,4 | 28,4 |

| Massachusetts | 7,9 | 4,8 | 13,1 |

| Michigan | 10,5 | 6,8 | 17,9 |

| Minnesota | 10,6 | 13,4 | 25,4 |

| Mississippi | 10,9 | 8,6 | 20,4 |

| Missouri | 9,9 | 15,7 | 27,1 |

| Montana | 8,4 | 5,4 | 14,3 |

| Nebraska | 12,9 | 9,2 | 23,3 |

| Nevada | 27,9 | 4,9 | 34,2 |

| New Hampshire | 7,3 | 15,6 | 24,0 |

| New Jersey | 10,5 | 6,0 | 17,2 |

| New Mexico | 8,7 | 13,7 | 23,6 |

| New York | 14,2 | 6,3 | 21,4 |

| North Carolina | 4,3 | 3,7 | 8,2 |

| North Dakota | 10,7 | 10,0 | 21,8 |

| Ohio | 11,5 | 18,9 | 32,6 |

| Oklahoma | 12,3 | 13,9 | 27,8 |

| Oregon | 11,2 | 15,5 | 28,5 |

| Pennsyt ania | 10,5 | 15,3 | 27,5 |

| Rhode Island | 8,7 | 7,1 | 16,4 |

| South Carolina | 10,7 | 13,3 | 25,4 |

| South Dakota | 12,2 | 7,5 | 20,6 |

| Tennessee | 12,7 | 17,3 | 32,2 |

| Texas | 11,5 | 23,4 | 37,6 |

| Utah | 12,8 | 15,2 | 30,0 |

| Vermont | 4,1 | 2,1 | 6,3 |

| Virginia | 11,9 | 14,4 | 28,0 |

| Washington | 12,5 | 2,9 | 15,8 |

| WestVirginia | 12,1 | 8,3 | 21,5 |

| Wisconsin | 13,0 | 12,6 | 27,2 |

The rate information is sourced from disposed private passenger auto rate filings collected by S&P Global Market Intelligence that are submitted to the Department of Insurance in various states.

The analysis is limited to rate filings of each state’s 10 largest private auto underwriter based on 2022 direct premiums written plus any of the country’s 10 largest private auto underwriters outside the state’s top 10.

The effective rate change is the average of the cumulative changes by renewal business effective date for each insurer weighted against respective calendar year direct premiums written reported within the NAIC property and casualty regulatory statements.

Top 10 U.S. private auto insurers’ effective rate change

| Insurer | Changes, % | 2024 Rate change | 2023 Rate change |

| 1. Farmers Insurance | 30,7 | 14,2 | 14,5 |

| 2. Allstate | 27,3 | 11,1 | 14,5 |

| 3. GEICO | 25,9 | 7,6 | 17,1 |

| 4. USAA | 24,4 | 14,9 | 8,2 |

| 5. State Farm | 24,4 | 13,9 | 9,2 |

| 6. Liberty Mutual | 22,7 | 8,8 | 12,8 |

| 7. Travelers | 21,8 | 11,9 | 8,8 |

| 8. American Family Insurance | 19,9 | 11,5 | 7,5 |

| 9. Progressive | 19,4 | 8,5 | 10 |

| 10. Nationwide | 18,9 | 8,8 | 9,3 |

TOP 10 U.S. Car Insurance Companies

| № | Insurer | Premiums written in billions |

|---|---|---|

| 1 | State Farm | $40.4 |

| 2 | Geico | $33.9 |

| 3 | Progressive | $33.2 |

| 4 | Allstate | $25.9 |

| 5 | USAA | $15.8 |

| 6 | Farmers | $12.2 |

| 7 | Liberty Mutual | $11.8 |

| 8 | Nationwide | $5.8 |

| 9 | American Family | $5.2 |

| 10 | Travelers | $4.9 |

Geico has boosted its rates by a calculated effective rate of 53.8% in Nevada, the highest percentage increase among the largest US private auto insurers. The large effective rate calculation for the insurer is due to multiple approved rate filings with a renewal business effective date occurring in 2024.

The state’s largest auto insurer first boosted its rates in February by an overall average of 26.3%. GEICO subsequently requested and received approval to again raise its rates by more than 20% in July. The additional rate increase is expected to take effect Sept. 18.

Geico has received approval to increase its rates in 36 states, with 18 of them greater than 10%. Overall, GEICO’s calculated countrywide effective rate change is 7.6% against its total direct premiums written.

State Farm Mutual Automobile Insurance Co.’s multiple rate filings in The Silver State will boost its rate by 34.7%. A 9.4% overall rate increase went into effect in March, followed by a 23.1% increase in July.

State Farm has boosted its rates by double digits in 32 states out of the 46 states with approved increases. The Illinois-based insurer’s countrywide calculated rate increase is 13.9% so far in 2024.

Car insurance policies that major insurance companies underwrite tend to be less expensive. Because large insurers write millions of policies each year, they can afford to price their policies more competitively.

Additionally, the biggest insurance companies in the U.S. often have more coverage options. If you want to customize your policy with endorsements or need specialty coverage like rideshare insurance, a large provider is more likely to have those policies.

……………………

AUTHOR: Jason Woleben – Research Analyst at S&P Global Market Intelligence

Fact checked by Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media