In virtually all U.S. states, motorists are legally obligated to purchase bodily injury liability and property damage liability. A handful of states also require drivers to purchase extras, such as uninsured & underinsured motorist coverage and personal injury protection (PIP). Penalties for non-compliance range from small fines to suspension of license and/or registration, vehicle impoundment, and in some cases imprisonment.

Thirty-eight states are what is known as “fault” insurance states, whereby the driver who is at fault in an accident is legally responsible to cover damages through their bodily-injury and property-damage liability coverage. The remaining 12 states are “no-fault” states, whereby policyholders claim losses from their own insurance provider – regardless of which driver was at fault (see New Trends that Will Disrupt US Auto Insurance Market).

Car Insurance in United States

The best auto insurance companies in each state provide liability, comprehensive, collision, PIP, and uninsured & underinsured motorist coverage, plus a range of paid add-ons.

Car insurance is a neccessary expense that comes with being a driver in the United States, but it doesn’t have to be complicated or overpriced. It’s essential that you choose a reliable insurer that you know will pay your claim if you ever need it, and comparing multiple insurers means that you will get the best rate possible for your driving needs.

How much is car insurance in the U.S.?

The average cost of car insurance is $1,771 per year for full coverage, or about $148 per month. Minimum coverage costs an average of $545 per year.

But because auto insurance premiums are based on more than a dozen individual rating factors, the actual cost will differ for every driver, according to Bankrate (see U.S. Auto Insurance Performance & Underwriting Results).

- Full coverage car insurance costs an average of $1,771 per year, while minimum coverage is $545 per year.

- USAA, Geico and Erie offer some of the cheapest full coverage car insurance, but are not all available to all drivers.

- Having a severe infraction like a DUI on your motor vehicle record could increase your car insurance premium by 93% on average.

- Teen male drivers may pay $807 more for car insurance on average compared to teen female drivers.

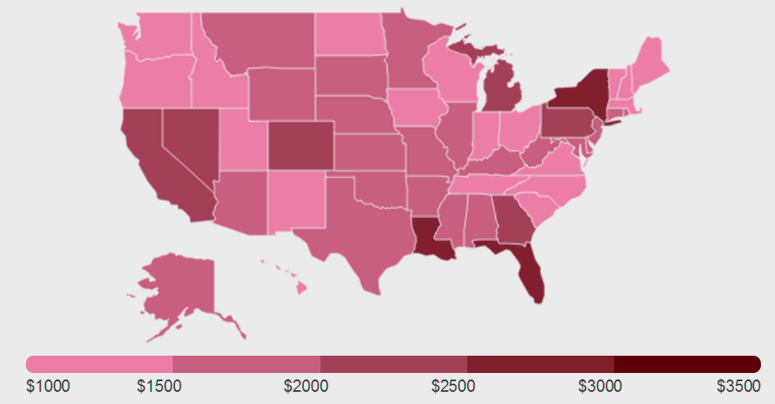

How much does car insurance cost by state?

However, when determining “how much does car insurance cost” in a specific area, the answer can vary depending on a variety of factors. The state where you live, individual rating factors, accident and claim reporting frequency, and even cost of labor and parts can cause one city or state to be more expensive than others.

Average car insurance cost by state in 2022

| State | Average annual premium for full coverage insurance | Average annual premium for minimum coverage insurance |

|---|---|---|

| Alabama | $1,760 | $443 |

| Alaska | $1,770 | $417 |

| Arizona | $1,743 | $579 |

| Arkansas | $1,806 | $437 |

| California | $2,190 | $619 |

| Colorado | $2,019 | $495 |

| Connecticut | $1,533 | $646 |

| Delaware | $1,963 | $747 |

| Florida | $2,762 | $997 |

| Georgia | $2,009 | $642 |

| Hawaii | $1,206 | $338 |

| Idaho | $1,065 | $271 |

| Illinois | $1,533 | $475 |

| Indiana | $1,242 | $329 |

| Iowa | $1,254 | $227 |

| Kansas | $1,802 | $419 |

| Kentucky | $1,954 | $658 |

| Louisiana | $2,864 | $807 |

| Maine | $876 | $227 |

| Myland | $1,931 | $836 |

| Massachusetts | $1,296 | $446 |

| Michigan | $2,345 | $946 |

| Minnesota | $1,692 | $600 |

| Mississippi | $1,701 | $450 |

| Missouri | $1,893 | $515 |

| Montana | $1,795 | $310 |

| Nebraska | $1,538 | $367 |

| Nevada | $2,426 | $846 |

| New Hampshire | $1,182 | $324 |

| New Jersey | $1,891 | $855 |

| New Mexico | $1,489 | $347 |

| New York | $2,996 | $1,339 |

| North Carolina | $1,392 | $431 |

| North Dakota | $1,225 | $268 |

| Ohio | $1,200 | $336 |

| Oklahoma | $1,902 | $408 |

| Oregon | $1,371 | $625 |

| Pennsylvania | $2,002 | $441 |

| Rhode Island | $1,847 | $569 |

| South Carolina | $1,464 | $518 |

| South Dakota | $1,542 | $274 |

| Tennessee | $1,383 | $372 |

| Texas | $1,868 | $551 |

| Utah | $1,449 | $544 |

| Vermont | $1,000 | $242 |

| Virginia | $1,347 | $483 |

| Washington | $1,313 | $482 |

| Washington D.C. | $1,948 | $613 |

| West Virginia | $1,527 | $427 |

| Wisconsin | $1,246 | $363 |

| Wyoming | $1,510 | $262 |

Top 5 cheapest states for car insurance

Drivers in Maine, Vermont, Idaho, New Hampshire and Ohio pay the cheapest annual full coverage car insurance rates in the nation, on average. Factors like cheaper cost of living, lower probability of accidents and claims, and less traffic congestion could be contributing to these states’ lower average premiums (see Global Auto Insurance Market Outlook)..

- Maine: $876 per year — 51 percent below national average

- Vermont: $1,000 per year — 44 percent below national average

- Idaho: $1,065 per year — 40 percent below national average

- New Hampshire: $1,182 per year — 33 percent below national average

- Ohio: $1,200 per year — 32 percent below national average

Top 5 most expensive states for car insurance

Based on our research, drivers in New York, Louisiana, Florida, Nevada and Michigan have the highest average annual cost of full coverage car insurance. This could be due in part to frequent claims for common losses in these states, making drivers riskier to insure overall.

- New York: $2,996 per year — 69 percent above national average

- Louisiana: $2,864 per year — 62 percent above national average

- Florida: $2,762 per year — 56 percent above national average

- Nevada: $2,426 per year — 37 percent above national average

- Michigan: $2,345 per year — 32 percent above national average

How much does car insurance cost by age and gender?

Insurers typically consider age as a significant factor in setting auto insurance rates, with young drivers paying the highest premiums on average based on 2022 rates.

Auto insurers use actuarial data to determine that teens and young adult drivers — as well as the elderly — are more likely to get in an accident, so the car insurance costs that these drivers pay are typically higher to compensate for the greater risk.

Note that your age will not affect your premium if you live in Hawaii or Massachusetts, as state regulations prohibit auto insurers from using age as a rating factor (see Who Should Be Listed on Car Insurance Policy?).

Additionally, gender impacts your premium in most states. Men typically cost more to insure than women. This is because men generally engage in riskier driving behaviors than women and have a higher rate of accident severity, according to the Insurance Information Institute (Triple-I).

However, not all states allow gender to be a factor in rates. If you live in California, Hawaii, Massachusetts, Michigan, North Carolina or Pennsylvania, your gender does not affect how much you pay for car insurance because of state regulations prohibiting this rating factor.

Insurance cost by age and gender

| Age | Male | Female | Difference | Percent difference between rates |

|---|---|---|---|---|

| 16 year old | $4,004 | $3,669 | $335 | 8.7% |

| 17 year old | $3,740 | $3,420 | $320 | 8.9% |

| 18 year old | $5,694 | $4,946 | $748 | 14.1% |

| 19 year old | $4,440 | $3,819 | $621 | 15.0% |

| 20 year old | $4,060 | $3,504 | $556 | 14.7% |

| 21 year old | $3,188 | $2,822 | $366 | 12.2% |

| 22 year old | $2,931 | $2,627 | $304 | 10.9% |

| 23 year old | $2,759 | $2,491 | $268 | 10.2% |

| 24 year old | $2,614 | $2,374 | $240 | 9.6% |

| 25 year old | $2,196 | $2,059 | $137 | 6.4% |

| 30 year old | $1,888 | $1,854 | $34 | 1.8% |

| 40 year old | $1,778 | $1,764 | $14 | 0.8% |

| 50 year old | $1,661 | $1,652 | $9 | 0.5% |

| 60 year old | $1,612 | $1,597 | $15 | 0.9% |

| 70 year old | $1,755 | $1,729 | $26 | 1.5% |

……………………….

AUTHORS: Mark Friedlander – Director of corporate communications at Insurance Information Institute, June Sham – Insurance Writer and Mariah Posey – Insurance Editor at Bankrate