Insuramore’s recently published ranking for the global auto (motor) insurance market shows that its GDPW (gross direct premiums written) rose to around USD 823 billion in 2021 with Progressive overtaking State Farm to become the world’s largest underwriting group in this sector. The other groups in the top five by this measure were Berkshire Hathaway Insurance (4th position) plus China-based PICC and Ping An (3rd and 5th, respectively).

- Auto (motor) insurance remains a tough market but some challengers are growing profitably

- Automotive brands may be tempted to follow the lead of Tesla by increasing their involvement in this sector

- Progressive is the world’s leading insurer group for this class having overtaken State Farm in 2021

The ranking also shows that many groups struggled to achieve significant growth in their GDPW for this line of business in 2021; consequently, they have since suffered deteriorating profitability in the wake of higher-than-anticipated auto insurance claims inflation in 2022.

Nevertheless, a few groups did manage to report strong double-digit growth during 2021; for instance, these included Sampo, thanks mainly to its acquisition of Hastings Group, plus Root and Skyfire, two challengers lower down the ranking, through organic growth.

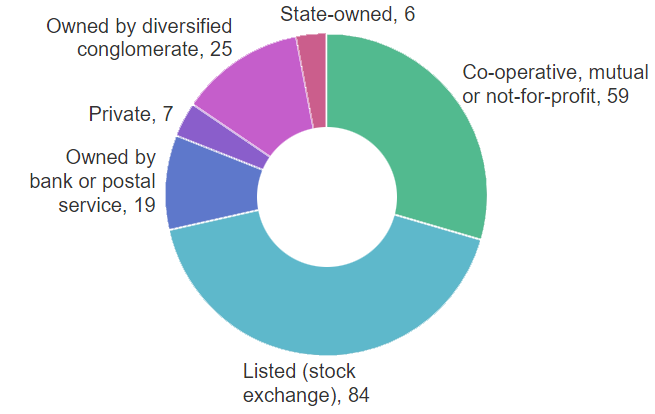

Segmentation by Type of the Top 200 Insurer Groups Worldwide Auto (Motor) Insurance, 2021

While US-based insurtech Root remains loss-making, Skyfire has been profitable in recent years and for the first time was ranked among the world’s top 200 groups by auto insurance GDPW in 2021 (in 173rd position).

Belonging to First Central Group, an insurance distribution and technology enterprise active in the UK and focused principally on selling through online marketplaces (a.k.a. comparison sites), the progress of Skyfire illustrates how there is scope for competitors with an apt and genuinely differentiated proposition to take on incumbent underwriting groups even in a relatively mature and tough sector such as auto insurance.

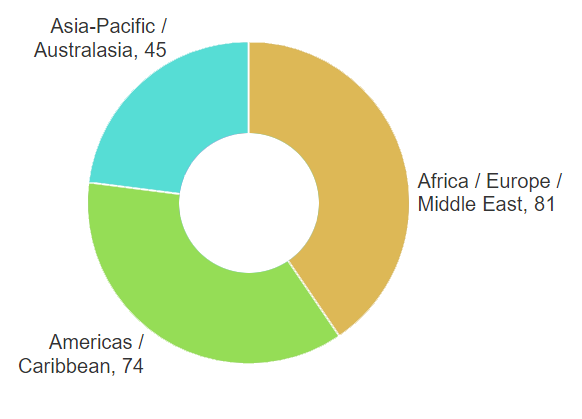

Segmentation by Region of the Top 200 Insurer Groups Worldwide Auto (Motor) Insurance, 2021

With this thought in mind, a key question for the global auto insurance market in future will be the extent to which automotive manufacturer brands may elect to participate more actively in the sector.

Hitherto, where getting involved, the preference of manufacturers in this field has generally been to develop branded policies underwritten by conventional insurers rather than to take on underwriting risk themselves.

In fact, manufacturer groups have typically preferred the risk profile of other financial services such as automotive credit and vehicle service contracts (a.k.a. extended warranties) which have long been crucial to augmenting their profit margins.

Gross direct premiums written for auto (motor) insurance, 2019-2021

| № | Insurer group | GDPW, 2019 ($bn) | GDPW, 2020 ($bn) | GDPW, 2021 ($bn) | Global market share, 2021 (%) |

| 1 | Progressive | 37,46 | 39,77 | 44,22 | 5,38% |

| 2 | State Farm | 41,74 | 41,08 | 42,50 | 5,17% |

| 3 | PICC | 39,44 | 39,85 | 39,56 | 4,81% |

| 4 | Berkshire Hathaway Insurance | 35,68 | 35,64 | 39,16 | 4,76% |

| 5 | Ping An | 29,15 | 29,45 | 29,29 | 3,56% |

| All other insurer groups / insurers | 601,53 | 606,71 | 627,77 | 76,32% | |

| Approximate global total | 785,00 | 792,50 | 822,50 | 100,00% |

One notable exception is VW group which in 2013 launched Volkswagen Autoversicherung in Germany as an underwriting joint venture with Allianz. However, even by 2021, its share of GDPW in the German auto insurance market was still less than 1% in spite of its having a vastly higher share of vehicle sales.

Notwithstanding that, there is considerable interest in the activity of Tesla which introduced its first branded auto insurance product in the US in 2019 and began underwriting cover in selected states via its own insurance business in 2022.

In this context, it is being encouraged both by its ability to harvest real-time driving data from its vehicles and by the degree to which it can embed auto insurance as part of a subscription service for its customers.

The former may help it to assess accident risk more accurately than conventional insurers, thereby providing the chance to generate superior underwriting results, while the latter should bring about a lower churn rate, which reduces the need for insurance-specific marketing expenditure.

As other automotive brands increase their sales of connected vehicles with similar capabilities, they may also be tempted to take a fresh look at the opportunities for them in auto insurance, which could include getting involved in underwriting as well as marketing and distribution.

Indeed, it is widely known that manufacturer-branded policies tend to enjoy greater customer loyalty than the average for auto insurance in general, irrespective of how they are underwritten.

Auto (motor) insurance is defined as insurance for motorized vehicles acquired by any type of buyer (i.e. private, commercial, public sector and not-for-profit) including cover for cars, motor cycles, RVs (recreational vehicles), LCVs (light commercial vehicles) and HGVs (heavy goods vehicles), and for both liability and vehicle damage but excluding niche cover types such as vehicle service contracts (extended warranties), GAP protection, scratch and dent protection, tyre insurance etc.

………………………..

by

by