US property and casualty P&C industry underwriting results are likely to improve in 2023 as premium rates rise significantly in underperforming automobile and property segments, according to Fitch Ratings.

Claims volatility amid higher inflation and macro uncertainty may impede a return to underwriting profitability.

The neutral sector outlook on US P&C insurance is premised on stable to improving operating performance in 2023.

According to 2023 US P&C Insurance Outlook, declining underwriting performance in personal lines drove a 31% drop in statutory earnings in 2022 for the P&C industry. The personal lines sector should improve in 2023, as recent pricing and underwriting adjustments take hold amid normalizing insured catastrophe losses.

However, underwriting profits may not return in 2023, and Fitch forecasts a 100.4% industry combined ratio for the full year.

2022 was a difficult year for the US P&C insurance industry: claims severities surged with inflation, natural catastrophe losses were elevated for a sixth straight year, and the lowest realized capital gains since 2009 offset higher fixed income yields.

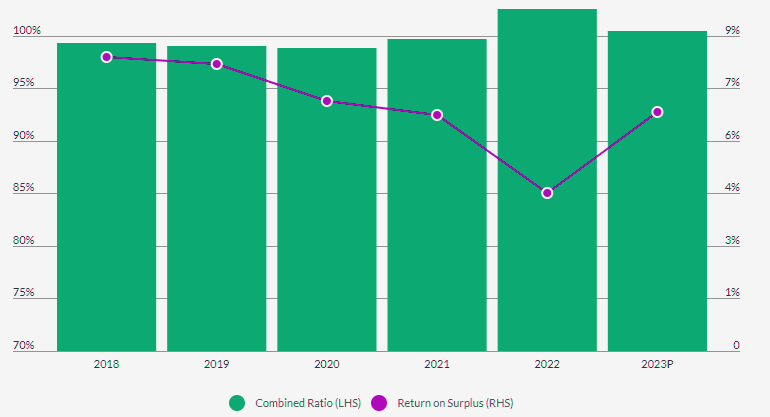

Above-average catastrophe-related losses and sharp deterioration in auto segment results drove the industry combined ratio (CR) 3 percentage points higher in 2022 to 102.5%, significantly above the 99%–100% range for the previous four years.

Commercial lines combined ratios in aggregate are anticipated to slightly deteriorate from current favorable underwriting profit levels (see Most expensive US P&C and Life Insurance Companies).

Property & Casualty Industry Aggregate Statutory Profitability

Return on surplus dropped for the fourth consecutive year in 2022 to 4.3%, but is expected to rebound in 2023.

Following a 39% increase from 2018-21, industry policyholders’ surplus (PHS) declined by 7% to $980 billion in 2022, largely from large unrealized investment losses, projected to fall below the 10-year average level of 7%.

Growth in direct written premiums will moderate slightly in 2023, but remain above historical norms as momentum in personal lines premiums accelerate.

According to Sigma Research Swiss Re Institute, higher used car prices alone caused auto insurers an estimated USD 15 billion of extra claims costs; costlier repairs added to the bill. Elevated construction costs reduced profitability in property lines.

The 20 percentage point (ppt) gap between personal and commercial insurance lines loss ratios in the first nine months of 2022 is likely to decrease in 2023 as personal lines rate increases gain momentum and the drivers of motor inflation decelerate.

Direct written premiums expanded by over 9% for the second straight year in 2022, tied to commercial and personal lines rate increases.

Higher potential claims cost volatility may result in future adverse reserve development. Variability in natural catastrophe losses remain concerning, compounded by sharp increases in reinsurance costs and less reliable available capacity (see Impact of Natural Catastrophe for the US P&C Insurance).

Property Casualty Industry Year-End Statutory Results

| ($ bn) | 2021 | 2022 |

| Net Premium Written | 716.0 | 773.9 |

| % Change | 9.2 | 8.1 |

| Net Premium Earned | 690.3 | 745.7 |

| % Change | 7.4 | 8.0 |

| Combined Ratio (%) | 99.7 | 102.5 |

| Operating Ratio (%) | 91.6 | 92.9 |

| Return on Surplus (%) | 6.4 | 4.3 |

| Net Income | 63.4 | 43.6 |

| Policyholders’ Surplus | 1,052.7 | 979.6 |

| % Change | 13.3 | -6.9 |

The U.S. property insurance reported a 31% decline in statutory earnings in 2022, largely tied to deterioration in underwriting performance in personal lines.

The US P&C industry recorded a net underwriting loss of $26.5 billion in 2022, worsening by $21.5 billion from the previous year, according to S&P Global Market Intelligence. The US insurers showed a substantial weakening of underwriting profitability over the year, with personal lines losses and the impact of Hurricane Ian causing its collective combined ratio to deteriorate to 102.7%.

8.4% growth in net earned premiums and a 21.4% decline in policyholder dividend were countered by a 13.9% increase in incurred losses and loss adjustment expenses and a 6.2% rise in other underwriting expenses.

The 20 percentage point (ppt) gap between personal and commercial insurance lines loss ratios in the first nine months of 2022 is likely to decrease in 2023 as personal lines rate increases gain momentum and the drivers of motor inflation decelerate.

The 102.5% combined ratio represents a significant decline, compared with a consistent range of 99%–100% for the previous four years. Each of the five largest insurers in the U.S. has more than 5% of the total market across the full range of P&C insurance products.

Return on surplus dropped for the fourth consecutive year in 2022, to 4.3% versus 6.4% in 2021.

Following a 39% increase in policyholders’ surplus (PHS) from 2018 to 2021, substantial unrealized investment losses from equity market declines contributed to a 7% annual decrease to $980 billion in 2022. Industry statutory leverage rose to 0.8x, similar to a level last reported in 2018, which remains relatively conservative.

Premium increases requested in personal lines rate filings have been accelerating in response to higher prices of used cars and bodywork for auto and construction materials, contents and labor costs for homeowners. Effective rate increases in 2022 amounted to 8.7% for personal auto and 4.6% for homeowners, the largest taking effect in 4Q22.

P&C insurance includes auto, homeowners and commercial insurance. Net premiums written for the sector totaled $652.8 bn last year. Meanwhile, the life/annuity insurance sector includes annuities, accident and health, and life insurance with net premiums for the sector totaling $240 bn (see Global Commercial Property & Casualty Insurance Market Review).

………………………

AUTHORS: James Auden – Managing Director, Insurance at Fitch Ratings, Christopher Grimes – Director at Fitch Ratings, Laura Kaster – Senior Director of North and South American Financial Institutions at Fitch Ratings