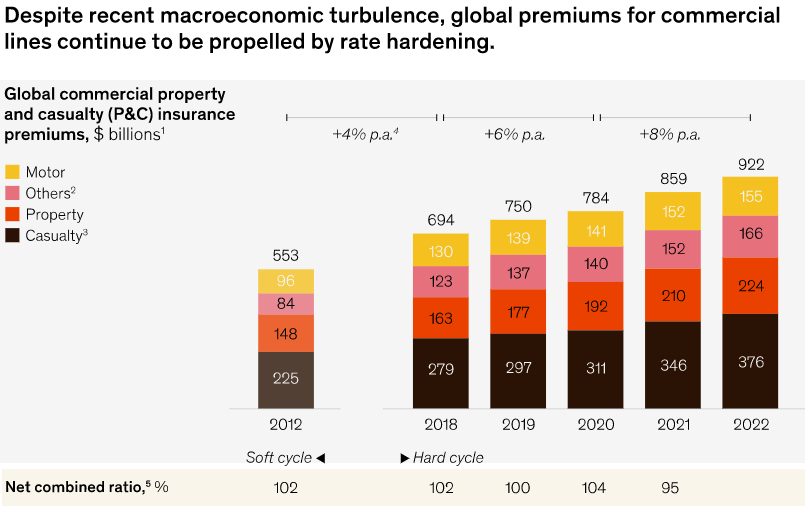

Global commercial property and casualty insurance lines have delivered strong financial performance in recent years following the soft market of 2013 to 2018, despite widespread disruption in the wake of the COVID-19 pandemic, the war in Ukraine, and the resulting supply chain disruptions.

According to McKinsey Report, insurance premiums have been propelled by extensive year-on-year risk-adjusted rate hardening: the annual premium growth rate for commercial P&C lines has hovered at 6 to 8% since 2018, and combined ratios have been improving (see Commercial Insurance and Reinsurance Market Outlook 2023).

Commercial insurers must step up to fulfill the societal desire for resilience in a volatile world by closing protection gaps—or risk losing relevance.

Commercial carriers find themselves at an inflection point as they face a continuing cycle of economic uncertainties, including inflation, geopolitical headwinds, environmental challenges, and capital constraints.

This gradual acceleration of macroeconomic trends across multiple events that are pressuring the insurance industry is different from previous shocks. In combination with the structural changes in the nature of risks, commercial carriers today need to address four critical challenges.

Commercial carriers find themselves at an inflection point as they face a continuing cycle of economic uncertainties.

- First, in the current environment, rates in some lines are starting to soften as capacity returns, while hardening continues in other lines—in some cases further supported by maintaining limits, despite inflation (see US P&C Insurance Outlook: Inflation, Catastrophes & Volatile Markets). Rising claims inflation and growing competition from distributors are squeezing profits. But opportunities exist as well. Some commercial carriers are expecting meaningful investment returns due to the increase in interest rates. The race to decarbonize underwriting portfolios—with nuances depending on geographies—is challenging and calls for new capabilities but also offers opportunities for growth.

- Second, the nature of risks is evolving faster than ever, especially when it comes to natural catastrophes (NatCats), the net-zero transition, and supply chain and cyber risks. Rather than stepping back and reducing their exposure, commercial carriers have a significant opportunity to step forward to address the growing protection gaps—or risk losing relevance in a changing world.

- Third, these challenges are exacerbated by tightening capacity in both traditional reinsurance capital and alternative capital markets, and the full extent and duration of the capacity squeeze are still uncertain given the strong hardening observed in January 2023 renewals.

- Fourth, to navigate the new nature of risks, commercial carriers must prepare to transform their capabilities and talent as underwriting and claims shift from an art to a science.

Commercial carriers will need to invest and take decisive action in response to each of these four challenges.

First, commercial carriers must define a clear source of distinctiveness to protect their margins by competing beyond rates.

Second, they can expand relevance by closing protection gaps through product innovation, more sophisticated pricing, and risk prevention and mitigation solutions.

Third, commercial insurance companies will need to secure capacity by innovating the use of alternative capital and addressing investor concerns about long-term profitability.

Finally, commercial carriers must reinvent their employee value proposition and develop the capabilities to shift from art to science to address the risks of the future.

The most successful commercial carriers have defined a clear source of distinctiveness that allows them to compete beyond prices.

Define a clear source of distinctiveness to compete beyond rates

Commercial carriers are facing four competing pressures: rate volatility; rising inflation and price adequacy uncertainty; the expansion of distributors up the value chain; and pressure to decarbonize underwriting portfolios.

Deceleration in rate growth.

Global rate growth has slowed for the past seven consecutive quarters—from 20% in the third quarter of 2020 to 6% in the third quarter of 2022. In real terms (adjusting for inflation), rates declined (softened) in the third quarter of 2022 for the first time since 2019.

However, this trend varies across lines. For example, financial and professional liability lines experienced the most significant rate deceleration, from 40% in the third quarter of 2020 to –1% in the third quarter of 2022.

Rate increases in NatCat and reinsurance lines are accelerating across both loss- and non-loss-affected policies.

Global property catastrophe reinsurance rates increased by 37% in January 2023 renewals—representing the largest increase since 1992, with implications for primary rates to follow. Inflation (measured by the consumer price index, or CPI) may have peaked in 2022, but for certain lines, the market is continuing to harden in 2023 with both rate increases and flat limits even as asset values increase.

Rising inflation and price adequacy uncertainty

Most major economies are experiencing decades-high inflation. In the fourth quarter of 2022, year-on-year inflation was 12% in Europe, 7% in the United States, and 4% in Asia.

Inflation adds pressure to the top line as clients review their coverages and retain more risks to reduce costs.

At the same time, loss costs and reserve requirements grow, negatively affecting the bottom line, which resulted in $8 billion in estimated incremental inflation across US commercial lines loss costs in 2021.

On the positive side, as interest rates rise for the first time in years, commercial carriers may see an increase in investment returns—with effects varying across commercial carriers depending on investment portfolio exposure.

Thus, long-tail lines in particular experience price adequacy uncertainty in the current cycle, given that their pricing economics are especially sensitive to inflation and interest rates, as well as to the challenges of modeling the evolving frequency and severity of catastrophe events and cyber risks.

Pressure from distributors.

Distribution partners are faring well in the race for talent and capital, with stronger returns, greater proximity to customers, and more capital-light business models than commercial carriers. Thus, brokers delivered an average annual TSR of 20% in 2019–22 versus 9% delivered by commercial carriers.

Emerging managing general agents (MGAs) have successfully recruited respected underwriting veterans to join them.

Based on this position, they are even moving up the value chain; the rise of MGAs reflects this trend. In the United States, MGAs grew at 10% per annum between 2012 and 2021—more than twice the rate of industry premiums.

However, these channels can bring significant benefits for commercial carriers if they are leveraged effectively.

Scrutiny of underwriting portfolio emissions.

Commercial carriers play a major role in decarbonizing the “real economy” by 2050 because economic activities are driven, in part by, the availability of insurance coverages.

With the goal of increasing accountability, the Net Zero Insurance Alliance (NZIA) has committed to disclosing underwriting portfolio–enabled CO2 emissions and defining near-term reduction targets for 2030 by July 2023, in addition to annual progress reporting.

Initial estimates show that to achieve net-zero emissions by 2050, underwriting portfolio–enabled emissions need to be reduced by 43% by 2030.

Over time, commercial carriers will likely move capacity toward industries with a lower emissions intensity, faster decarbonization pathways, and net-zero supporting technologies. This trend will affect rates in these evolving industries and in those with a higher emissions intensity.

To successfully compete, commercial carriers will need to develop new capabilities in underlying portfolio management and underwriting functions.

Progress in decarbonizing underwritten emissions still varies across geographies, with European commercial carriers and NZIA members leading the way.

Compete on distinctive proposition rather than price

The most successful commercial carriers have defined a clear source of distinctiveness that allows them to compete beyond prices—and have doubled down their investment in these areas.

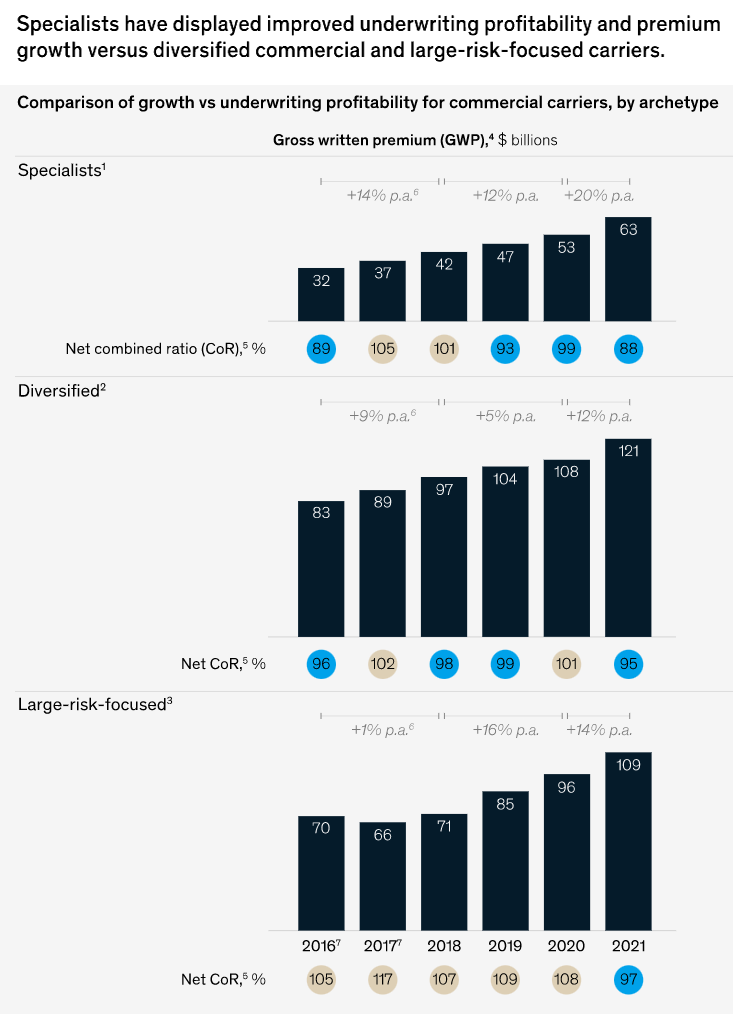

By focusing on certain lines of business, specialist commercial carriers have almost consistently outperformed their more diversified peers (as measured by premium growth and profitability) in both hard and soft markets between 2016 and 2021.

During the same period, the more specialized US excess and surplus E&S market grew at 16% annually—more than three times the rate of the US admitted market. Their historical resilience suggests that specialist commercial carriers are better equipped to thrive amid ongoing economic uncertainty.

Nonetheless, all commercial carriers—including diversified and large-risk-focused commercial carriers—can act on four imperatives to compete on proposition rather than price.

Be clear on where to compete

Offering distinctive expertise, products, and services that are connected not only to risk transfer but also risk prevention and mitigation deepens carriers’ value proposition to clients. This allows commercial carriers to avoid competing on price alone and becoming commoditized capacity providers.

More-specialized commercial carriers have been able to focus their investment to create these propositions, but even diversified and large-risk commercial carriers can prioritize their resources with a clear view of where they want to be distinctive (across specific lines and value chain steps).

Focus on technical excellence to address inflation

Commercial carriers will need to double down on technical excellence to manage rates effectively by keeping them ahead of loss cost trends in response to inflation.

Pricing models and renewal underwriting will need to reflect a forward-looking view of inflation across various components, combined with strong underwriting risk discipline for softening lines.

The most sophisticated commercial carriers leverage inflation scenario models to frequently rebalance their portfolio mix exposures across lines with larger and smaller gaps between the market price and technical price once accounting for inflation.

Implement targeted distribution strategy

Commercial carriers should develop a targeted distribution strategy across lines of business, regions, industry verticals, and client segments, depending on their own source of distinctiveness and the areas in which they develop underwriting excellence.

For example, some commercial carriers can go directly to clients with a digital proposition in an area where they are clearly distinct; this is especially true for small and medium-size enterprises (SMEs) with more-standard risks.

In other areas, commercial carriers may instead choose to underwrite more opportunistically or operate as a pure capacity provider alongside a lead insurer or through MGAs. Being targeted and transparent about their distribution strategy allows commercial carriers to avoid channel conflict, understand what it takes to be brokers’ preferred commercial carrier, and build strategic distribution relationships.

Capture the underwriting portfolio decarbonization opportunity

As commercial carriers think about their source of distinctiveness, they should reflect on how this relates to decarbonization targets.

To build a proposition related to the decarbonization of the “real economy,” carriers could follow four steps:

- First, create transparency for underwriting portfolio–enabled emissions, which may require identifying and closing existing data gaps.

- Second, develop a forward-looking view on sector-level emission intensity and revenue implications to define individual underwriting portfolio decarbonization pathways, targeting a portfolio mix that reflects the growth opportunities in sectors that support the net-zero transition.

- Third, integrate the emissions perspective across business processes—especially underwriting, pricing, and portfolio management.

Upgrade and innovate on product and policy design for risk transfer solutions

To provide coverage for net-zero transition risks—which are not sufficiently covered by existing insurance today—commercial carriers must build the capabilities to underwrite prototype-like risks, such as for decarbonization technologies, including carbon capture and energy storage.

While initial insurance products exist, they are not widely available due to the lack of historical data when underwriting these risks for the first time.

Commercial carriers can also support the adoption of carbon markets by offering alternative risk-transfer solutions, including coverages for buyers (for example, to insure a carbon offset becoming invalid) and sellers (for example, to cover nature-based loss from a pest infestation).

Parametric (or index-based) solutions—in which payouts are linked to defined and objective indexes or trigger points, such as flood levels or the strength of an earthquake—can improve the efficiency of NatCat coverages for both clients and commercial carriers.

Risks become more transparent, while payouts are instantaneous and are less exposed to long litigations, reducing the tail of the risk.

Products can also be tailored to certain segments. For example, SMEs within a specific industry often face similar types of risks and share the desire to be protected against them but would prefer to take a more hands-off approach to their insurance coverages. Here, commercial carriers can innovate by structuring product bundles across lines of business for traditional SME industries (for example bakeries and carpentries) as “tailor made” coverages to address their respective risk exposures while applying simplified wordings.

Adjust pricing to reflect the true cost of risk

Commercial carriers need to evolve their pricing models to be more nuanced in relation to changing risks and leverage more advanced modeling techniques and internal and external data.

For example, the industry tends to react to individual weather events, which can make coverage unaffordable the following year.

Pricing models should take a longer-term view of changing weather patterns with a through-cycle approach to risks.

This shift requires that commercial carriers apply advanced modeling to catastrophic events to determine whether a one-off weather event is a true anomaly or indicative of an emerging pattern.

Data and advanced analytics will be critical for commercial carriers to overcome the challenge of limited loss data history, especially for emerging risks.

Commercial carriers may need to partner with asset owners or other third parties, for example, to gain access to data and knowledge of new trends. In the short term, commercial carriers can leverage the underwriting expertise of the most advanced MGAs while they build out their own talent and capabilities over the long term.

Build the capabilities and talent to manage the shift from art to science

Many commercial carriers are investing heavily in advanced analytics, workbenches, and external data sources to help put data at the fingertips of underwriters and claims handlers to address the changing nature of risks.

To keep up with the speed of change, commercial carriers must attract and retain the necessary talent, as well as develop the capabilities of experienced employees.

This will necessitate a cultural shift because many underwriters and claims handlers still prefer to rely solely on their extensive experience rather than data-driven approaches and advanced technologies.

………………..

AUTHORS: Susanne Ebert – partner in McKinsey’s Frankfurt office, Robin Huettemann – consultant in the Munich office, Kia Javanmardian – senior partner in the Chicago office, James Polyblank and Leda Zaharieva – partners in the London office, Sirus Ramezani – senior partner in the Zurich office, Shannon Varney – partner in McKinsey’s Boston office

Fact checked by Oleg Parashchak