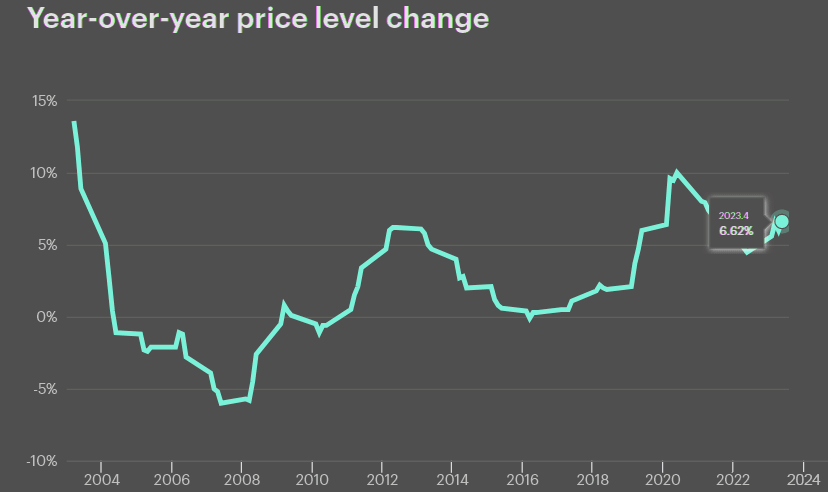

U.S. commercial insurance prices continued to rise in the fourth quarter of 2023. The WTW’s survey assessed the prices for policies written in the 2023 and compared them to the prices from the 2022.

According to the recent survey by WTW, after an increase where price changes reached and exceeded 10% from the second to the fourth quarters of 2020, there was a decline to just under 5% by the fourth quarter of 2022.

Commercial insurance prices began to rise again, exceeding 5% in the 2023 and further increasing to above 6% by the 2024

Data for nearly all lines continue to indicate the moderate to significant price increases in the fourth quarter with the exception of workers compensation, directors’ and officers’ liability, and cyber.

Line-of-business insurance price changes

The survey consistently shows a marginal decrease in workers’ compensation costs. Directors’ and Officers’ liability rates also declined for another quarter, albeit at a slower pace than before.

Commercial auto liability experienced the most substantial rate increase, maintaining near or above ten percent for the 25th consecutive quarter.

Commercial property rates followed, rising by double digits again, though slightly less than in the previous quarter. Excess/umbrella liability rates, which have been rising sharply for the past 18 quarters, saw a further increase this quarter, exceeding the previous quarter’s rise.

Cyber insurance rates, which had surged significantly until the third quarter of 2022, are now increasing at a decelerated pace, matching the reduction seen in the previous quarter.

Most of the lines continued to have moderate to significant rate increases in Q4

Account size price changes

When comparing account sizes, reported price increases for small, mid-market and large accounts were all higher than the prior quarter.

Specialty lines essentially had a flat rate change, where professional liability and employment practice liability generally showed rate increases offset by rate decreases experienced in directors’ and officers’ liability.

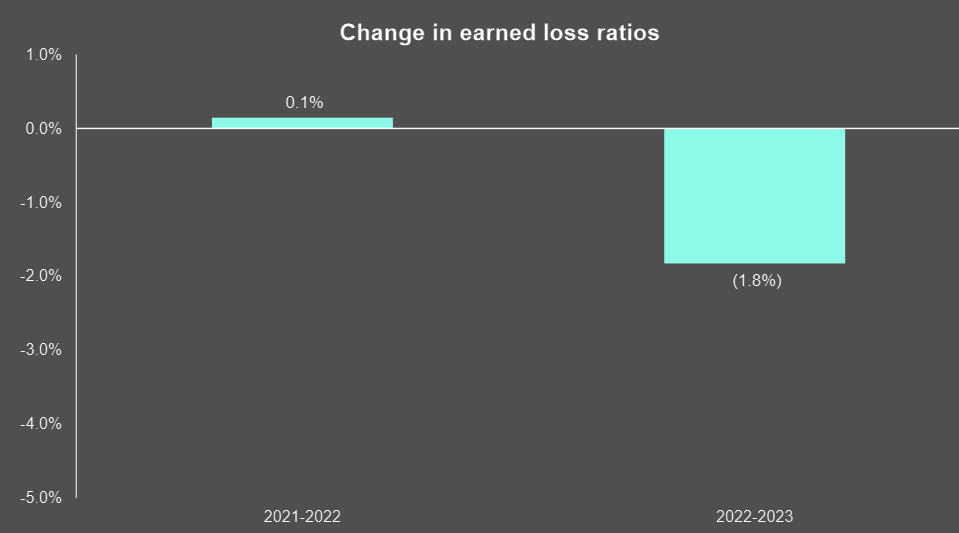

Insurers indicate 2% claim cost inflation for 2023, which is below the earned price increase of just above 6% realized during the year.

CLIPS data point to flat loss ratio movement for 2022 and a modest improvement of 2% for 2023.

Loss ratios decreased

Pricing increases across most regions moderated due to an overall decrease in certain financial and professional lines, most notably directors and officers insurance.

The US, with a composite pricing increase of 5%, experienced the largest moderation in average price increases, falling from a growth rate of 10% in Q2.

Meanwhile, rate increases slowed from 11% to 7% in the UK, from 7% to 5% in the Pacific region, and from 3% to 2% in Asia, staying the same in Latin America and the Caribbean at 5%, and at 6% in Continental Europe.

The survey noted that global property insurance pricing was up 6% on average in the 2023, the same level as the previous quarter, while casualty pricing was up 4% on average, compared to 6% in the previous quarter.

Cyber insurance pricing continued to outshine other lines with increases of 53% recorded through Q3, although even here increases were see to moderate, with prices rising by 48% in the US and 66% in the UK, compared to 79% and 68%, respectively, in the prior quarter.

The exclusion of cyber meant that, for the first time since 2017, overall pricing in financial and professional lines fell by 1% in Q3, compared to a 16% increase in Q2, driven by decreases in the US, UK and Australia and moderating rates of increase elsewhere.

Commercial Insurance Market

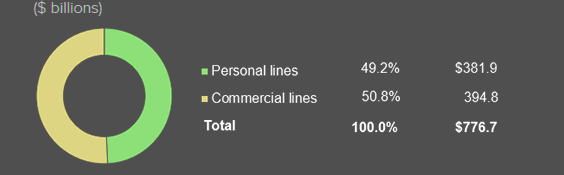

Property/casualty insurance can be broken down into two major categories: commercial lines or types of insurance and personal lines. Personal lines, as the term suggests, include coverages for individuals—auto and homeowners insurance, according to Triple-I report.

Commercial lines, which account for about half of U.S. property/casualty insurance industry premium, include the many kinds of insurance products designed for businesses.

Commercial insurance performs a critical role in the world economy. Without it, the economy could not function. Insurers protect the economic system from failure by assuming the risks inherent in producing goods and services.

Net Premiums Written, Personal And Commercial Lines

Carrier competition continues to put downward pressure on rates in the directors and officers (D&O) and cyber markets, although increased cyber claims may soon change the direction of pricing. The casualty market remains stable, with workers’ compensation remaining profitable. Property rates are moderating, but war in the Middle East may lead to limited capacity for insureds with exposures in the region.

Property premiums have finally started to moderate—a trend we noticed earlier last year—and everyone was relieved by the mild Atlantic hurricane season

Insurers have found profitability in this line, and we’ve heard that no insurer had trouble finding capacity in their January property reinsurance treaty renewals. We expect these factors to lead to the continued trend of moderating property premiums.

Severe convective storms (SCS) represented about 60% of insured natural catastrophes in 2023. Property carriers will intently focus on limits and deductibles for insureds exposed to SCS. Flood risk will also be a focus throughout 2024 as more precipitation occurs, particularly in coastal cities.

………………

AUTHORS: Alejandra Nolibos, FCAS, MAAA – Managing Director WTW Miami, Yi Jing, FCAS, MAAA – Director WTW Hartford