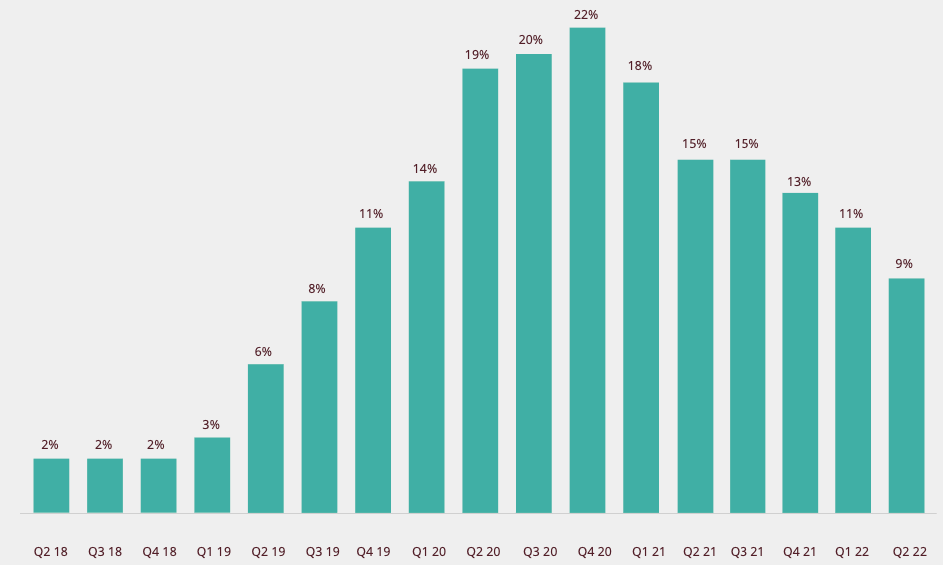

Global commercial insurance prices increased 9% in the second quarter of 2023, down from an 11% increase in Q1, according to the latest Global Insurance Market Index by Marsh.

While this does represent the 19th consecutive quarter of increases, analysts note that the rate of increase continued to moderate across most lines of business and in almost all geographies (see Global Insurance Markets Trends for Life & Non-Life Insurance).

Marsh explains that pricing increases across most regions moderated due to slower rates of increase, and some decreases, in certain financial and professional lines.

The UK, with a composite pricing increase of 11%, experienced the largest decline in average price increases, dropping from 20% in Q1.

Global commercial insurance prices

In the US, price increases moved from 12% to 10%, in Pacific from 10% to 7%, in Latin America and the Caribbean from 6% to 5%, while in Asia Q2 increases remained stable at 3%, and at 6% in Continental Europe.

Among other findings, the survey noted that global property insurance pricing was up 6% on average in the second quarter of 2022, down from a 7% increase in the previous quarter, while casualty pricing was up 6% on average, compared to 4% in the previous quarter.

Overall pricing in financial and professional lines, driven by cyber, again had the highest rate of increase across the major insurance product categories, at 16%. However, this was down from 26% in the previous quarter.

At a time of global business uncertainty, driven by the ongoing war in Ukraine, supply chain disruption, and rising inflation, trading conditions remain tough for many clients. We are also seeing the impact of rising inflation on insured values and exposure growth, which has the potential to impact pricing and insurer appetite.

Lucy Clarke, President, Marsh Specialty and Global Placement, Marsh

Marsh also found that cyber insurance pricing continued to rise significantly, although the pace of increase slowed in the quarter, to 79% in the US and 68% in the UK, compared to 110% and 102%, respectively, in the prior quarter.