Climate change will have a larger impact on economic losses in the future, according to Swiss Re Institute. A new analysis of 36 countries ranks the Philippines and the US as the most economically exposed countries today, where hazard intensification is likely to occur due to climate change.

Even adjusting for inflation, the September storm, one of history’s most-destructive natural catastrophes, would have been half or even a third as expensive in the 1970s, Swiss Re data shows. At its one-year anniversary, a analysis pivots off the dynamic drivers behind Hurricane Ian’s costs and offers insights for the US Southeast, Gulf Coast and Northeast, regions with diverse characteristics but something critical in common: the importance of adapting our built environment to a future of volatile weather.

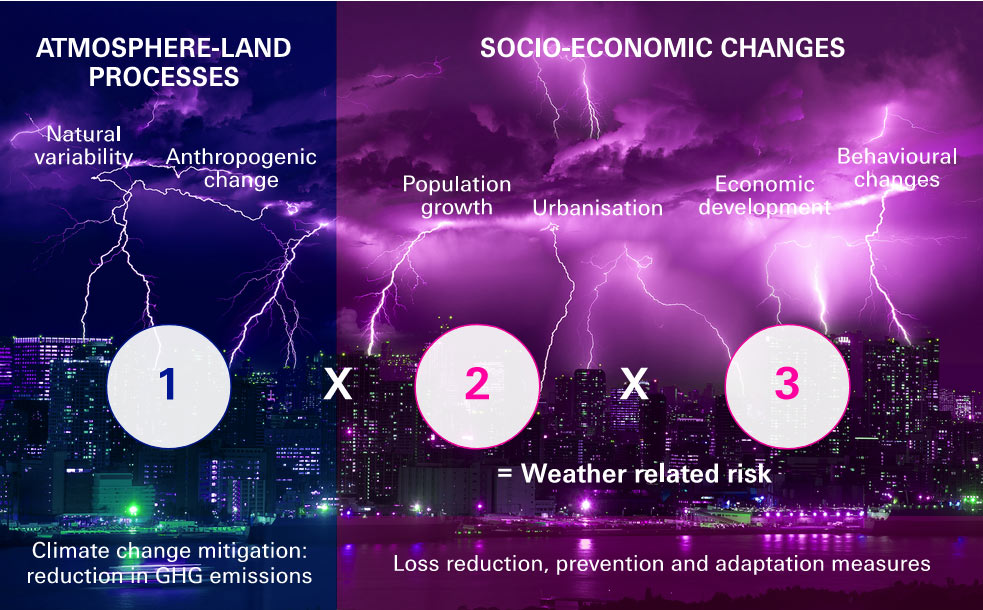

Rising temperatures bring physical repercussions including more intense hazards.

Understanding how natural perils shape the risk landscape is critical to advancing global preparedness for climate change.

Natural catastrophes will once again break several loss records in 2023. A high number of low-to-medium-severity events will aggregate to insured losses of more than $100 bn in 2023, according to Beinsure research Natural Catastrophes Will Break Several Insured Losses Records.

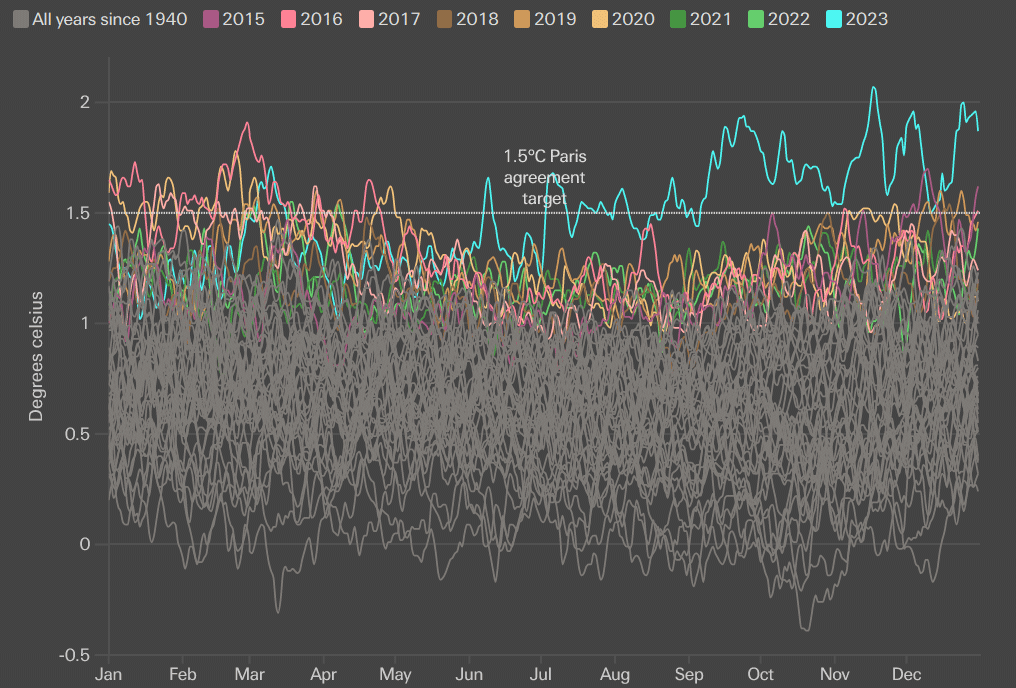

Daily average global temperature increase from 1940 to 2023 relative to pre-industrial levels

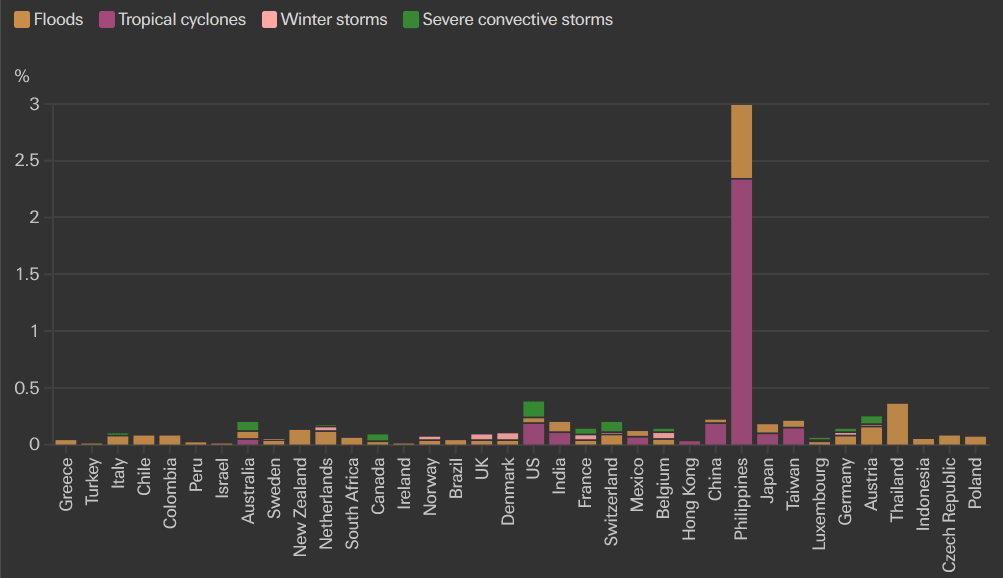

- Four weather perils – floods, tropical cyclones, winter storms in Europe and severe thunderstorms – today cause global estimated economic losses of USD 200 billion every year

- As of today, the US economy loses almost 0.4% of GDP (USD 97 billion) whereas the Philippines lose 3% of GDP (USD 12 billion) caused by the four weather perils, while at the same time being exposed to hazard intensification in the future (see Natural Catastrophes Drivers)

Insured losses from severe thunderstorms reach new all-time high of USD 60 billion in 2023, Swiss Re Institute estimates

Jérôme Jean Haegeli, Swiss Re’s Group Chief Economist, says: “Climate change is leading to more severe weather events, resulting in increasing impact on economies. Therefore, it becomes even more crucial to take adaptation measures. Risk reduction through adaptation fosters insurability. The insurance industry is ready to play an important role by catalysing investments in adaptation, directly as a long-term investor and indirectly through underwriting climate-supportive projects and sharing risk knowledge. The more accurately climate change risks are priced, the greater the chances that necessary investments will actually be made.”

Natural catastrophes will once again break several loss records

A high number of low-to-medium-severity events will aggregate to insured losses of more than USD 100 billion in 2023, estimates Swiss Re Institute, with severe thunderstorms (severe convective storms) being the main contributor. It is the first time ever that severe thunderstorms have caused this level of loss for the industry.

The cumulative effect of frequent, low-loss events, along with increasing property values and repair costs, has a big impact on an insurer’s profitability over a longer period. The high frequency of severe thunderstorms in 2023 has been an earnings’ test for the primary insurance industry.

Jérôme Jean Haegeli, Swiss Re’s Group Chief Economist

Global Insured Losses from severe thunderstorms have steadily increased by 7% annually in the last 30 years. 2023 marks an increase of almost 90% compared to the previous 5-year average (USD 32 billion), and more than doubles the previous 10-year average (USD 27 billion).

Increased losses from severe thunderstorms in the US and in Europe

The US is particularly prone to SCS due to its geographical location. In 2023, the amount of USD 50 billion insured losses for US SCS activity was exceeded for the first time — and it is set to keep rising. The US has experienced 18 events year to date which each caused insured losses of USD 1 billion and above.

Europe has seen an increase in insured losses from severe thunderstorms: Italy was the most affected in 2023 as was France the year before. Italy experienced losses of more than USD 3.3 billion, the costliest natural catastrophe-related insured losses ever in Italy.

Balz Grollimund, Head Catastrophe Perils, says: “For the insurance industry, recent events provide robust benchmarks for estimating the increasing loss trends. Nevertheless, to further progress the deeper understanding of this peril, it is important to get better insights from primary insurers on distributions of insured exposure and detailed claims data. It is equally important that insurance premiums adequately reflect the risk for the coverage provided especially also in light of increasing loss trends.”

Probability of hazard intensification and probabilistic annual economic losses by peril as % of GDP per country

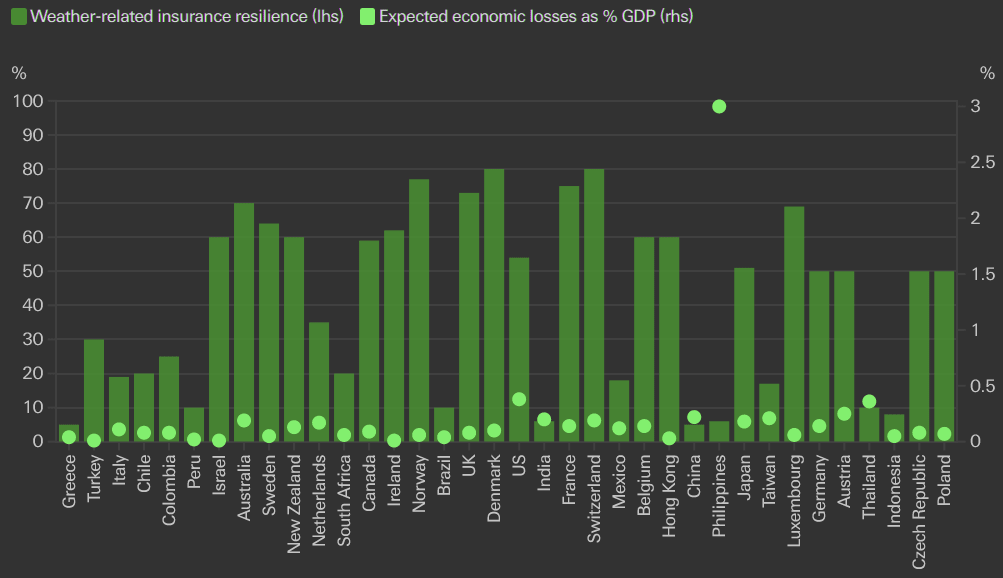

The losses inflicted by severe weather bring financial repercussions too. Drawing on our research on insurance resilience (the share of physical assets insured against weather perils), from this perspective we find that low insurance penetration renders important global growth engines like China and India as among the least ready to face the rising losses from peril intensification.

Probability of hazard intensification and weather-related insurance resilience index per country

The first step to cutting economic losses is to reduce the loss potential in the first place, through adaptation measures. Insurance can compensate for residual losses. Examples of adaptation actions include enforcing building codes, increasing flood protection and discouraging settlement in areas prone to natural perils.

The economic dividends of adaptation steps can outweigh their costs by multiples ranging from 2:1 to 11:1. Even so, adaptation and insurance can only go so far. Climate change mitigation (ie, reducing emissions) is fundamental to counter the overall economic effects of global warming.

Hurricanes, floods, wildfires and earthquakes

While losses from the North Atlantic hurricane season remain below average in 2023 to date, hurricane Otis will likely become the costliest insured event in Mexico according to Swiss Re Institute. In New Zealand, floods and cyclones caused the costliest weather-related insured losses ever for the country (USD 2.4 billion), while the wildfires on Maui are estimated to become the costliest insured loss event ever for the state of Hawaii (USD 3.5 billion).

Urban development, wealth accumulation in disaster-prone areas and inflation are key factors at play, turning extreme weather into ever rising natural catastrophe losses.

Rising temperatures are further increasing the risk of severe droughts and wildfires. With 2023 expected to be the warmest year on record, the effects of climate change are becoming apparent.

The earthquake in Turkey and Syria is the costliest natural catastrophe in 2023, with insured losses of USD 6 billion, while the Morocco earthquake was the strongest earthquake to hit the country since 1900.

The disaster in Morocco also shows that rural areas are not immune to large-scale losses and need to be included in preventative efforts to improve resilience.

The three components of weather-related risk, and their associated drivers

Mind the insurance protection gap

Based on findings from the Intergovernmental Panel on Climate Change (IPCC), Swiss Re Institute’s report “Changing climates: the heat is (still) on” analyses where hazards are likely to intensify and overlays it with its own estimates of economic losses resulting from the four major weather perils as of today. This provides a view of the possible direct economic implications if weather-related natural catastrophes intensify due to climate change.

With annual economic losses of 3% of GDP as of today, the Philippines is most impacted by the four weather perils of all 36 countries, while also being exposed to high probability of hazard intensification.

The US is second-most exposed. At USD 97 billion (0.38% of GDP) as of today, it experiences the highest economic losses in absolute terms from weather events worldwide and at the same time, a medium probability that hazards will intensify.

In general, countries with sizeable insurance protection gaps and where the establishment of loss mitigation and adaptation measures lags the rate of economic growth, are most financially at risk from hazard intensification. Fast-growing Asian economies like Thailand, China, India, and the Philippines are most vulnerable according to the report.

Floods expected to intensify, tropical cyclones main loss driver

While flood risk is projected to intensify globally, the main driver of major weather-related economic losses in the US, as well as in east and southeast Asia, are tropical cyclones.

Today, in absolute terms, economic losses from weather events in the US are the highest in the world, mostly driven by tropical cyclones (hurricanes). Severe thunderstorms also account for a large share of the economic losses.

The first step towards cutting losses is to reduce the loss potential through adaptation measures. Examples of adaptation actions include enforcing building codes, increasing flood protection, while keeping an eye on settlement in areas prone to natural perils. Ultimately, losses as a share of GDP of each country will depend on future adaptation, loss reduction and prevention.

Top 10 countries most exposed to four weather perils as of today

| Rank | Country | Annual economic loss (% of GDP) |

| 1 | Philippines | 3.00% |

| 2 | US | 0.38% |

| 3 | Thailand | 0.36% |

| 4 | Austria | 0.25% |

| 5 | China | 0.22% |

| 6 | Taiwan | 0.21% |

| 7 | India | 0.20% |

| 8 | Australia | 0.19% |

| 9 | Switzerland | 0.19% |

| 10 | Japan | 0.18% |

As-of-today probabilistic economic losses as a percentage of GDP from the four major weather-peril events, by country, in 2022. Note: These are just the lower bound of potential economic losses, as the study does not cover all weather perils (eg heatwaves) and account for property losses only. And, as changing climates fuel weather-event intensity, loss potential will likely rise.

……………….

AUTHORS: Jérôme Jean Haegeli – Swiss Re’s Group Chief Economist,