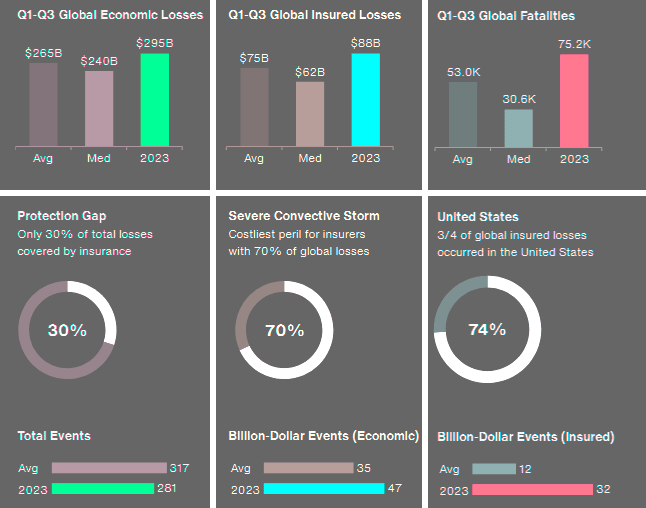

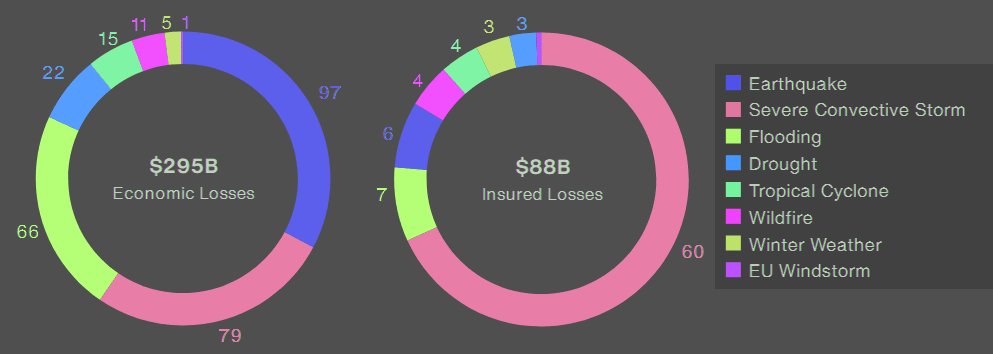

2023 saw multiple significant disaster events, which drove total year-to-date economic losses above $295 billion, approaching the 21st-century annual average of $310 billion. The costliest event of the quarter was the widespread flooding in Beijing and several Chinese provinces in early August, according to AON’s report Q3 Global Catastrophe Recap.

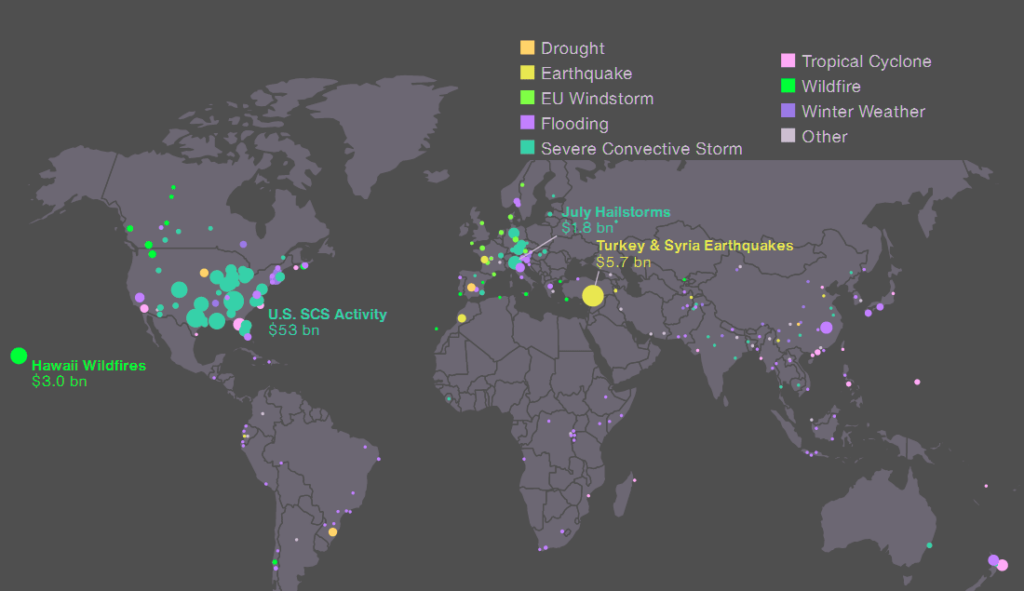

Insured losses from severe convective storms in the United States continued to increase due to relentless activity and surpassed the $50 billion mark for the first time on record, accounting for roughly 60% of all global insured losses, according to Climate & Global Natural Catastrophe Insight.

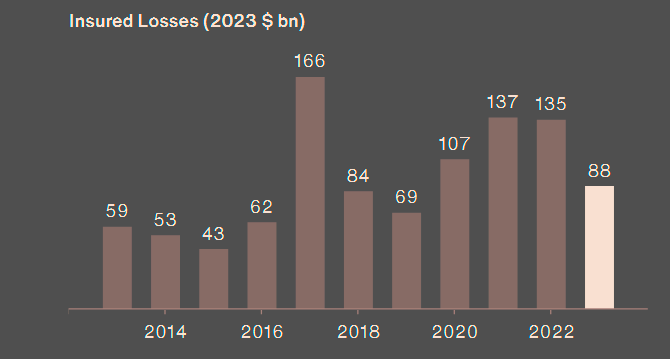

Total aggregated insured losses from natural disasters in the first three quarters were estimated to exceed $88 billion, and the number of billion-dollar events is already expected to set a record in 2023.

Another significant event for the industry was the wildfire that destroyed the town of Lahaina in Hawaii.

Aggregated death toll from 2023 events is already running above 75,000, making this year the deadliest since 2010.

Several significant events occurred in Q3, including the flooding associated with the Mediterranean storm Daniel, and the earthquake in Morocco. Disaster costs continued to be affected by macroeconomic factors and continuing inflationary pressure.

Global fatalityes, economic and insured loss from natural disasters

Averages and medians since 2000. All losses are in 2023 USD (adjusted for price inflation)

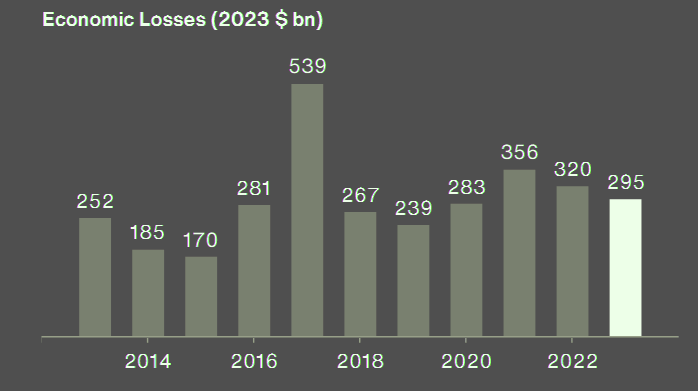

Global economic losses on annual average

Global economic losses from natural disasters in the first three quarters of 2023 were preliminarily estimated at $295 billion, above the 21st-century Q1-Q3 average of $265 billion.

The annual losses will approach or even surpass the long-term ($310 billion) and decadal ($339 billion) averages due to additional anticipated activity in Q4 and loss development for recent disaster events.

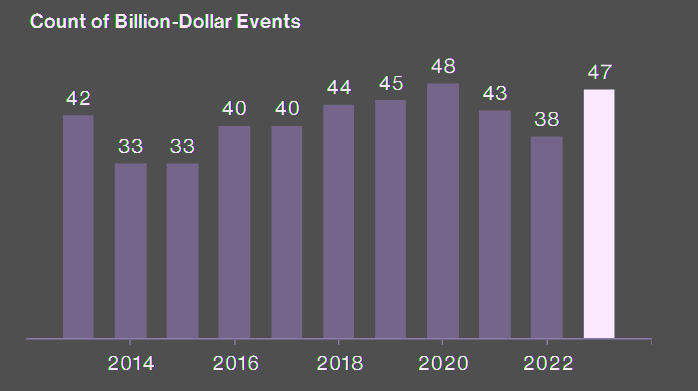

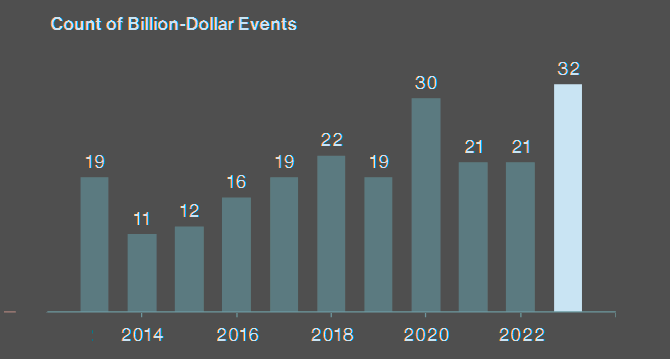

Insured Losses from Convective Storms in the U.S. exceedes $50 bn. It is currently estimated that by the end of September, the world saw at least 47 individual billion-dollar disasters, which was the fifth-highest number on a price-inflated basis.

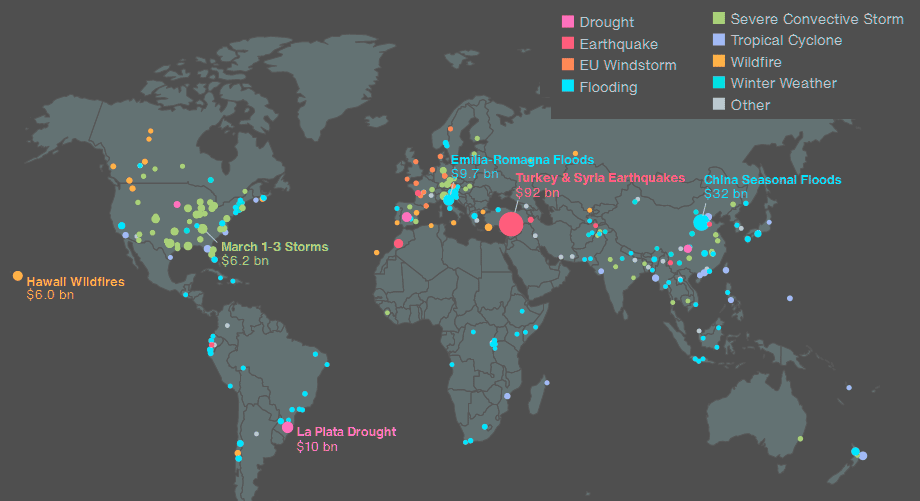

Q1-Q3 Global Natural Disaster Losses

- Widespread flooding in Beijing and several Chinese provinces in early August resulted in the costliest global economic loss event of Q3.

- On September 8, a magnitude-6.8 earthquake occurred in the Moroccan High Atlas Mountain range, claiming nearly 3,000 lives, injuring more than 5,600 people, and causing significant material damage across the affected area.

- The destructive flash flooding in northeastern Libya in early September damaged thousands of buildings in Derna city and ranked as the second deadliest event of the year, with more than 4,300 fatalities.

- Hurricane losses in the U.S. were lower than average in Q3, which is considered the peak of the Pacific and Atlantic hurricane seasons. Two notable tropical systems, Hilary and Idalia, still caused significant losses that, collectively, reached into billions of USD.

Q1-Q3 2023 Economic Loss Events

Several significant events in Q3 changed the ranking of the top 10 loss events of the year to date. In particular, seasonal flooding in China, which includes the catastrophic episode in Beijing in August and floods in major river basins, resulted in aggregated economic losses exceeding $30 billion.

The wildfire, which destroyed Lahaina in Hawaii, impacted an incomparably smaller area, yet also resulted in multi-billion-dollar losses.

Top 10 Costliest Economic Loss Events in Q1-Q3 2023

| Event | Location | Deaths | Economic Loss, $bn | ||||||

| Turkey & Syria Earthquakes | Turkey & Syria | 59,259 | 91.7 | ||||||

| China Seasonal Floods | China | 370 | 31.9 | ||||||

| La Plata Basin Drought | Brazil, Argentina, Uruguay | N/A | 10.1 | ||||||

| Emilia-Romagna Floods | Italy | 15 | 9.7 | ||||||

| Severe Convective Storm | United States | 13 | 6.2 | ||||||

| Hawaii Wildfires | United States | 97 | 6.0 | ||||||

| Drought | Spain | N/A | 5.6 | ||||||

| Severe Convective Storm | United States | 37 | 5.5 | ||||||

| Severe Convective Storm | United States | 7 | 5.0 | ||||||

| Severe Convective Storm | Italy, Europe | 14 | 4.3 | ||||||

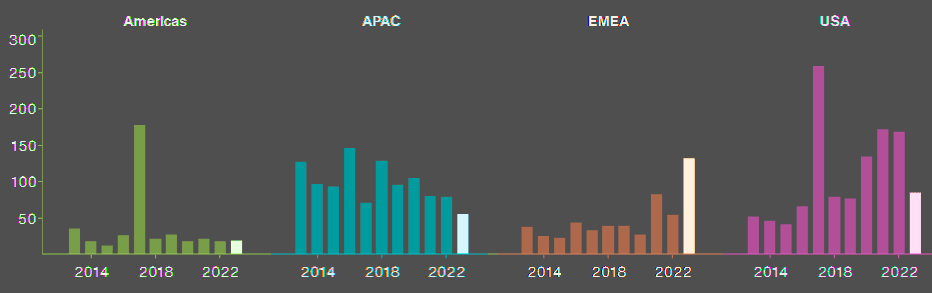

From a regional perspective, the EMEA region accounted for the largest portion of global economic losses with the current estimate of $134 billion.

This was primarily driven by significant earthquakes, with the Morocco event in September being a notable addition.

Economic losses in APAC were running lower than average, while total damage from the events in the Americas was close to the median (with an outlier in 2017).

United States recorded losses were slightly below the 21st-century Q1-Q3 average, yet already 25% higher than the median.

Q1-Q3 Economic Losses by Region

Costliest Insured Loss Events

Global insured losses from natural disaster events in the first three quarters of 2023 were estimated to reach at least $88 billion, which was higher than the average ($75 billion) and median ($62 billion) for the period.

From an annual perspective, it is now likely that the eventual 2023 losses will also surpass the yearly average of $89 billion.

Remarkably, 32 individual billion-dollar disasters likely occurred, which is already the highest annual total on record. This was largely due to relentless severe convective storm activity in the United States, which contributed with 21 individual events.

Q1-Q3 Global Insured Losses

Severe convective storms are among the most common, most damaging natural catastrophes in the United States. The result of warm, moist air rising from the earth, they manifest in various ways, depending on atmospheric conditions – from drenching thunderstorms with lightning, to tornadoes, hail, or destructive straight-line winds.

Q1-Q3 2023 Insured Loss Events

Severe convective storm events in the United States dominated the table of top 10 costliest events in terms of insured loss, even though none of them were expected to surpass the February earthquake sequence in Turkey and Syria.

The Hawaii wildfires, including the catastrophic event that destroyed the town of Lahaina, were expected to rank among the eight costliest wildfires ever recorded.

Top 10 Costliest Insured Loss Events in Q1-Q3 2023

Top 10 Costliest Insured Loss Events in Q1-Q3 2023

| Event | Location | Deaths | Insured Loss, $bn | ||||||

| Turkey & Syria Earthquakes | Turkey & Syria | 59,259 | 5.7 | ||||||

| Severe Convective Storm | United States | 13 | 5.0 | ||||||

| Severe Convective Storm | United States | 37 | 4.4 | ||||||

| Severe Convective Storm | United States | 7 | 4.0 | ||||||

| Severe Convective Storm | United States | 3 | 3.1 | ||||||

| Severe Convective Storm | United States | 5 | 3.0 | ||||||

| Hawaii Wildfires | United States | 97 | 3.0 | ||||||

| Severe Convective Storm | United States | 1 | 2.9 | ||||||

| Severe Convective Storm | United States | 3 | 2.3 | ||||||

| Severe Convective Storm | United States | 5 | 2.3 | ||||||

Disaster events in the United States accounted for roughly three-quarters of global insured losses in Q1-Q3 of 2023, reaching approximately $65 billion. This is already higher than the long-term annual average and median (see Severe Thunderstorms the Main Driver for Insured NatCat losses).

While EMEA recorded the highest economic losses, the portion of that total that was covered by insurance was significantly lower than in the United States, owing to a large protection gap for major events, including earthquakes, floods, and droughts. Insured losses in both APAC and the Americas remained below their means.

Q1-Q3 2023 Economic & Insured Losses by Peril

While the overall proportion of economic losses covered by insurance was close to the long-term average, the structure of the individual contributions from regional and peril perspectives was completely different.

Tropical Cyclone and flooding events typically account for the largest part of total economic losses through Q3.

Earthquakes and severe convective storms were responsible for more than 60% of total economic losses in 2023. Severe Convective Storms caused approximately 70% of global insured losses in 2023, compared to an average of 34%.

The combined year-to-date death toll of more than 75,000 already makes 2023 the deadliest year in terms of natural disasters since 2010.

In the third quarter, several significant and deadly events occurred – most notably the catastrophic flash flooding in northeastern Libya, which was a result of rainfall released by Storm Daniel and following infrastructural failures.

The September earthquake in Morocco currently ranks as the third deadliest event of the year with nearly 3,000 fatalities.

Storm activity continued to drive record-breaking SCS losses

For the first time in history, total insured losses related to severe convective storms in the United States are expected to exceed $50 billion. In Q3 alone, at least 4, potentially 7 additional billion-dollar disasters (in terms of insured loss) occurred.

The month of July had the most local storm reports of any month in 2023, with over 1,200 more reports than the next month.

Severe wind was the largest storm report category, with reports concentrated over the Great Plains and eastern U.S.

The severe convective storm peril also resonated in Europe. In particular, relentless hailstorm activity in northern Italy throughout the month of July resulted in record-breaking insurance payouts for the country, potentially reaching € illion. On July 24, a hailstone of 19 cm (7.5 inches) in diameter was documented in Azzano Decimo, setting a new European record.

Relatively low hurricane losses

Hurricane losses in the U.S. were lower than average in Q3, which is considered the peak of the Pacific and Atlantic hurricane seasons. Two notable tropical systems, Hilary and Idalia, still caused significant losses that, collectively, reached into the billions USD.

Idalia struck Florida as a high-end category 3 hurricane, becoming the 4th major hurricane to make landfall in Florida in the last 6 years.

However, ’ region, near where the storm made landfall, potentially mitigated much higher losses from materializing. Meanwhile, the western Pacific saw 7 tropical systems primarily impacting the Philippines, Taiwan, China, and Japan in Q3.

…………………..

AUTHORS: Michal Lörinc – Head of Catastrophe Insight at AON, Ondřej Hotový – Catastrophe Analyst at AON, Antonio Elizondo – Senior Scientist, Catastrophe Insight at AON

Edited by Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media