U.S. property catastrophe reinsurance rates rose by as much as 50% at a key July 1 2023 renewal date, with states such as California and Florida increasingly hit by wildfires and hurricanes.

Climate change, which has led to increased frequency and severity of weather-related natural catastrophes, also poses a significant risk to insurers and reinsurers.

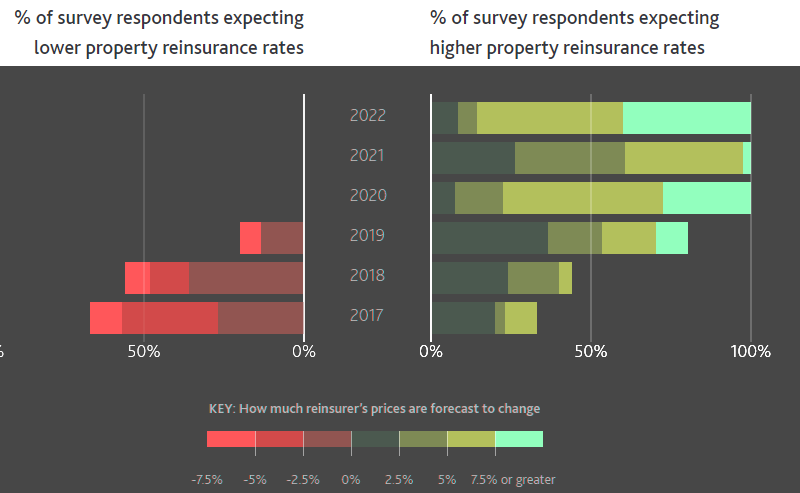

Reinsurance rates for natural catastrophes policies

Reinsurers in particular are feeling the heat as they accumulate losses from primary companies. To counter this, many are raising prices, limiting coverage and even exiting some markets to improve returns, according to Gallagher Re.

U.S. reinsurance rates for policies which previously faced claims for natural catastrophes rose 30-50%. Reinsurance rates for similar policies in Florida rose 30-40%.

Losses and the changing view of risk has been a particular driver for this renewal with reassessments of risk resulting in some drawbacks of capacity after derisking exercises or complete withdrawals of capacity.

Guy Carpenter explained that the property catastrophe reinsurance market saw some “significant” price adjustments for loss-impacted programs in peak zones, whereas loss-free accounts in other geographies actually trended flat to down.

Reinsurers have responded to the increase in natural catastrophes

Largest reinsurers in United States have responded to the increase in natural catastrophes with significant premium rate increases, reflecting a sector-wide reassessment of catastrophe risk following several consecutive years of bigger than expected claims.

Global insured natural catastrophe losses have averaged about $100 bn over the past five years.

In Moody’s survey of reinsurance buyers, 40% of respondents expected rate increases of at least 7.5% for property lines this year. In fact, average increases at the 2023 renewals were well above that level.

Some insurers have pulled out because of the risk of heavy losses. In Florida, all the major insurers left and so you ended up with this market which is populated by a large number of very small, very thinly capitalised insurers which is exactly what you don’t want.

While reinsurance supply was seen as in the main sufficient to meet increasing demand, apart from in some of the most constrained areas of the market, Guy Carpenter said that renewal outcomes have varied significantly by geography, line of business and cedent, with their performance one of the key differentiators.

Reinsurance market in Florida

According to Global Reinsurance Property Catastrophe Market Outlook, reinsurance has been available this year for Florida insurers during a critical period in June and July when many reinsurance contracts are renewed.

The 2023 mid-year renewal was orderly for Florida-domiciled insurers, which are heavily reliant on reinsurance to trade and meet solvency and ratings requirements, according to Aon report.

Reinsurance rate increases for U.S. and Florida property catastrophe policies averaged 25-35% at July renewals.

Reinsurance rates for some types of aviation war policies rose by up to 100% on the July 1 renewal date.

Reinsurers have experienced poor profitability in their Florida programs in recent years, because of a combination of high catastrophe losses and claims litigation costs significantly above the US average.

A number of reinsurers have reduced their exposure to the Florida market over the past few years, by writing less coverage, increasing the minimum dollar amount of damages that primary insurance must cover before reinsurance will apply, and increasing their own retro coverage.

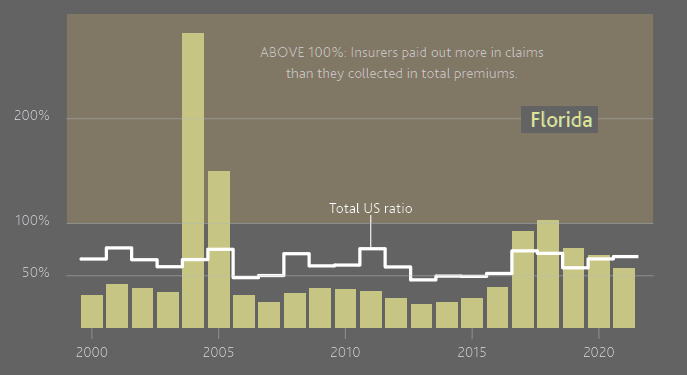

Florida & California loss and expense ratios for insurers

Although Florida did not experience hurricanes for about a decade, Hurricanes Hermine and Matthew in 2016, Irma (2017) and Michael (2018), have generated high loss ratios for several years, partly because of higher than originally expected claims costs associated with the Florida legal environment that significantly affected homeowners’ policies.

Florida loss and related expense ratios for homeowners insurers compared with the average US homeowners ratio

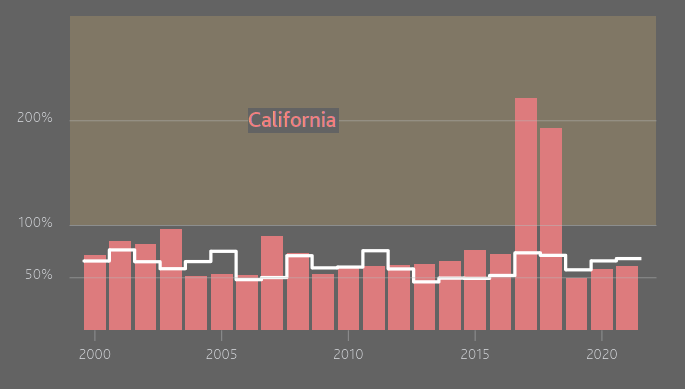

In California, property & casualty insurers, and their reinsurers, absorbed $36 billion of losses from major California wildfires in 2017 and 2018 combined.

California loss and related expense ratios for homeowners insurers compared with the average US homeowners ratio

Reinsurers are raising the amounts which insurers have to pay themselves before reinsurance kicks in. Last year’s near-normal hurricane season included Hurricane Ian, expected to be one of the costliest U.S. hurricanes on record.

Primary insurers, meanwhile, are increasingly seeking reinsurance in the wake of rising natural catastrophe losses, and the additional demand will push reinsurance rates even higher this year.

Reinsurers also buy their own insurance, called retrocessional or retro coverage, from other (re)insurers and alternative capital providers. Retro coverage includes products like catastrophe bonds, collateralized reinsurance, and industry loss warranties.

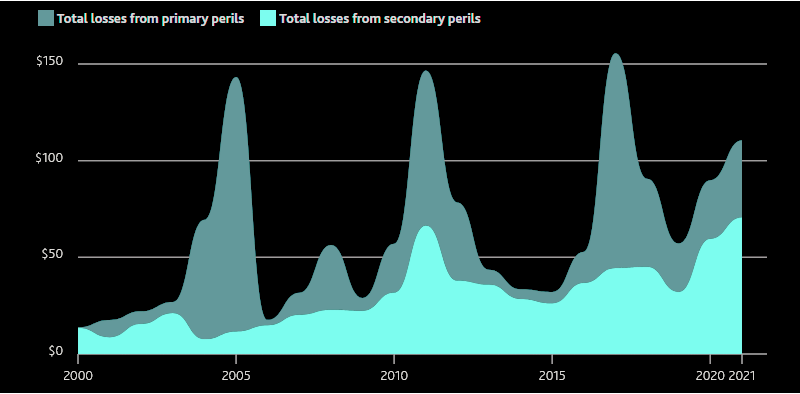

Re/Insurers’ losses from natural catastrophes

Both insurers and reinsurers have also invested significantly in catastrophe models. This will help them better understand and manage their exposures and tailor their prices more closely to their risks.

Cumulative natural catastrophes that caused $1 billion or greater in damages

Beyond the broader measures affecting the macro dynamics of most markets, Global Reinsurance Sector Outlook report covers several factors impacting both supply and demand including Standard & Poor’s upcoming model changes, real and social inflation, new risks emerging from PFAS and other chemicals, secondary peril considerations and climate change.

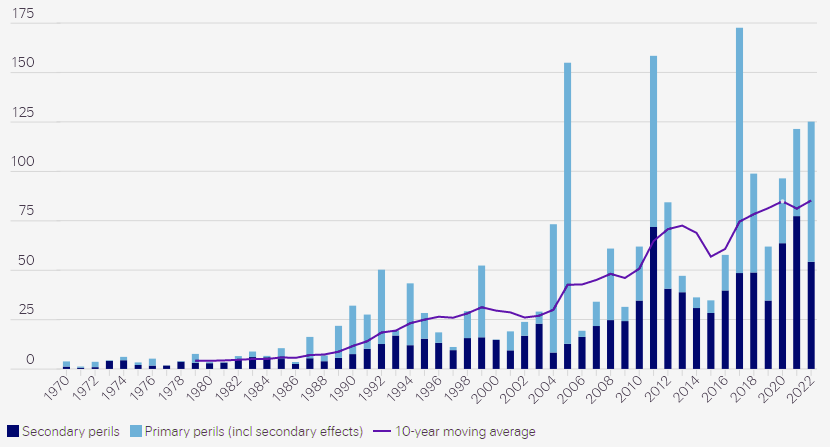

Insured Natural Catastrophe losses

USD bn

Supporting risk transfer, global reinsurance capital increased 3.8% through year end 2021 to $675 billion, with traditional capital increasing 4.1% to a new peak of $579 billion and alternative capital growing to $96 billion (slightly shy of the peak levels at $97 billion in 2018).

The industry has focused particularly on secondary perils – natural catastrophes such as convective storms, flooding and wildfires – that are more frequent but individually less costly than primary perils such as hurricanes.

Secondary perils are a significant share of overall catastrophe losses

in $ bn

This is because secondary perils’ share of total insured losses globally has risen sharply, reaching over 60% on average over the last three years.

Alternative capital allows pension funds and other investors to assume reinsurance risk. The cost of this coverage has been on the rise and will go up significantly in 2023.

Reinsurers review claims following a natural catastrophe and may adjust their underwriting and risk framework as a result. Modelers will also review claims to see if models need updating. However, despite model enhancements, insurers could find that they are not able to achieve profitability in certain locations. In such cases, they may decide to reduce business or even exit some markets.

Since the start of the pandemic, all property reinsurance exposures – the nominal value of buildings, motor vehicles, and other fixed assets that insurers cover – have grown faster than headline inflation and real GDP growth.

With more risk and more exposure to leveraged capital from outside of their own balance sheets, reinsurers retained earnings have been insufficient to bear their cost of capital, let alone build stronger balance sheets to cater for an increasing risk landscape.

………………….

Edited by