Private credit investments are increasingly important to the business models and investment strategies of US life insurers.

Fitch Ratings expect weaker asset quality to emerge in private credit assets, but do not expect US life insurers to face widespread pressure on ratings, as most exposures remain small relative to other asset classes, mitigating downside risk.

Most life insurers continue to return capital in normal course, and we don’t foresee meaningful credit impacts yet.

Most of the leading US life insurers experienced a year-over-year drop in total revenues.

US life insurers are expected to report improving mortality results for the second quarter and field questions related to credit risk as concerns mount over the industry’s exposure to commercial real estate, according to S&P Global Market Intelligence data.

Invested assets of US life insurers

Invested assets of broader universe of rated US life insurers declined 0.6% during the same period. Credit risk was a hot-button issue for life insurers in the first quarter.

Many life companies released commercial real estate disclosures in an attempt to quell investor anxiety, but scrutiny over exposure to the sector is likely to continue, particularly as worries around office space grow.

The aggregate GAAP basis invested assets of the 10 alternative asset manager (Alt IM) owned insurers grew at a CAGR of roughly 8% for YE 2019 to June 30, 2023.

Private credit borrowers are facing higher debt service burdens from rising policy interest rates and slower EBITDA growth amid macroeconomic headwinds.

Global Financial Crisis and Insurance Market

Elevated private credit borrower leverage and a relative deterioration in private credit terms and conditions during more competitive lending environments are adding to pressures in the credit quality of private credit assets.

Most private credit lenders have yet to experience an observable stress event to test their acumen, as much of their growth occurred in benign economic periods.

The U.S. has not experienced a prolonged recession since the Global Financial Crisis of 2007–2009.

The financial effects of the Great Recession were similarly outsized: Home prices fell approximately 30 percent, on average, from their mid-2006 peak to mid-2009, while the S&P 500 index fell 57 percent from its October 2007 peak to its trough in March 2009. The net worth of US households and nonprofit organizations fell from a peak of approximately $69 trillion in 2007 to a trough of $55 trillion in 2009.

As the financial crisis and recession deepened, measures intended to revive economic growth were implemented on a global basis. The United States, like many other nations, enacted fiscal stimulus programs that used different combinations of government spending and tax cuts.

These programs included the Economic Stimulus Act of 2008 and the American Recovery and Reinvestment Act of 2009.

The Federal Reserve’s response to the crisis evolved over time and took a number of nontraditional avenues. Initially, the Fed employed “traditional” policy actions by reducing the federal funds rate from 5.25% in September 2007 to a range of 0-0.25% in December 2008, with much of the reduction occurring in January to March 2008 and in September to December 2008.

The sharp reduction in those periods reflected a marked downgrade in the economic outlook and the increased downside risks to both output and inflation (including the risk of deflation).

The pandemic-led recession and recovery was accompanied by meaningful government support. Life insurers’ private credit investment growth has been driven by the increase in the overall size of the private credit market.

Growth is also supported by higher allocations given alternative investment managers’ (Alt IMs) acquisitions of partnerships with life insurers, particularly those focused on the annuity market.

US life insurers’ allocations to private credit assets

For US life insurers with larger allocations to private credit assets, Level III assets could face incremental liquidity risks during times of market stress, as assets with more pricing visibility gain favor with market participants.

Mitigating these concerns is Alt IMs’ strong/asset liability management, with assets and liabilities of a similar duration and a liquidity profile reducing the potential for forced selling.

Alt IMs have significant experience evaluating liquidity, structure and credit quality characteristics of privately placed credit risk, which bolsters risk management capabilities.

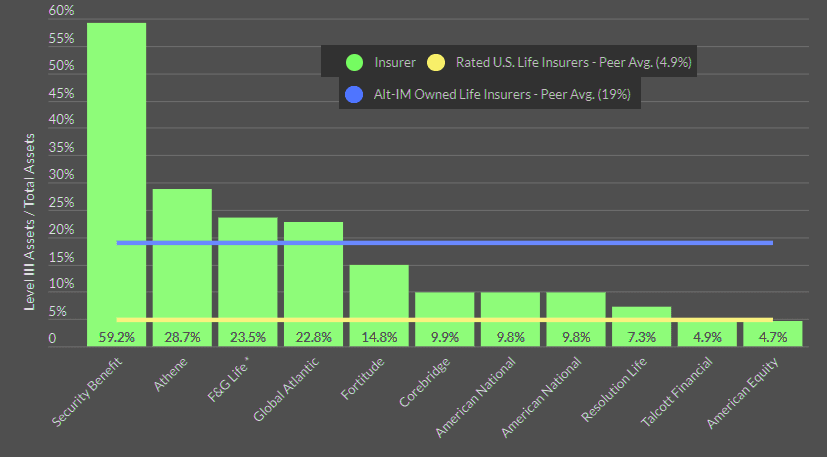

Alt IM-owned insurer illiquid asset allocation

Alt IM-owned insurer illiquid asset allocation is 4x larger than rated life insurers.

Level III FMV Assets / Total FMV Financial Assets (%) as of YE22

FMV – Fair Market Value. Level 3 assets are highly illiquid with limited pricing visibility. Rated U.S insurer peer group. avg. excludes alt IM insurers. F&G Life & Annuities is a subsidiary of holding company Fideliity National Federal (FNF). Blackstone does not own a stake in F&G Life, but manages a significant portion of its investment portfolio.

Private credit investment growth has been driven by the increase in the overall size of the private credit market, and also by higher allocations, given Alt IMs acquisitions of, and partnerships with, life insurers, particularly those focused on the annuity market.

Future Alt IM insurer partnerships over the near-to-intermediate term are likely to be more heavily weighted toward taking minority stakes in life insurers or investing in sidecars or offshore reinsurance platforms.

Traditional problems that have plagued the Life Insurance industry for decades—such as earnings sensitivity to external factors and opaque risks that investors are challenged to underwrite—will remain.

According to Life Insurance Value Chain Report, the emergence of private capital–backed platforms—which have evolved their primary focus to include new sales as well as the acquisition of legacy blocks of business—has changed the game in new-product development, where such platforms have become leaders in several retail and institutional categories.

………………

AUTHORS: Jamie Tucker, CPA, CFA – Senior Director, Life Insurance Fitch Ratings, Mark Rouck, CPA, CFA – Group Credit Officer, Laura Kaster, CFA – Senior Director, Fitch Wire (North and South American Financial Institutions)