The insurance industry of India has 57 insurance companies – 24 are in the life insurance business, while 34 are non-life insurers. Among the life insurers, Life Insurance Corporation (LIC) is the sole public sector company. There are six public sector insurers in the non-life insurance segment. In addition to these, there is a sole national re-insurer, namely General Insurance Corporation of India (GIC Re). Other stakeholders in the Indian Insurance market include agents (individual and corporate), brokers, surveyors and third-party administrators servicing health insurance claims.

Insurance industry of India CAGR

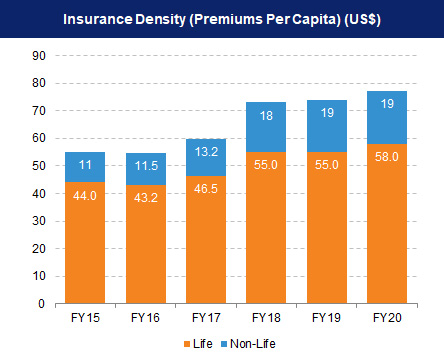

The life insurance industry is expected to increase at a CAGR of 5.3% between 2019 and 2023. India’s insurance penetration was pegged at 4.2% in FY21, with life insurance penetration at 3.2% and non-life insurance penetration at 1.0%. In terms of insurance density, India’s overall density stood at US$ 78 in FY21.

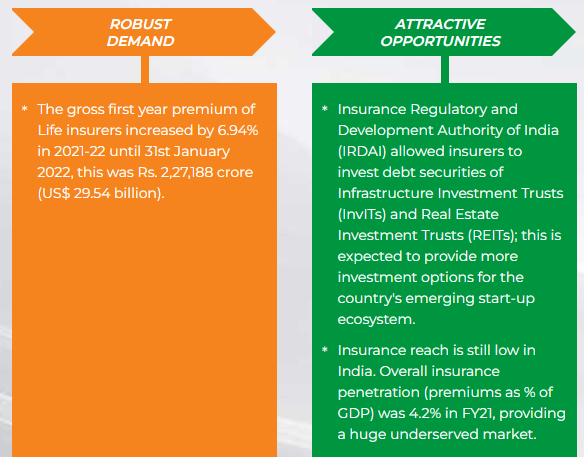

Premiums from India’s life insurance industry is expected to reach Rs. 24 lakh crore (US$ 317.98 billion) by FY2031. In the first half of FY22, the life insurance industry recorded growth rate of 5.8% compared with 0.8% in the same period last year.

The gross first-year premium of life insurers increased by 12.93% in 2022-23 to Rs. 314,262.42 crore (US$ 40.06 billion).

Gross premiums written off by non-life insurers reached Rs. 220,772.07 crore (US$ 28.14 billion), an increase of 11.1% over the same period.

The total premium earned by the non-life insurance segment stood at Rs. 36,680.73 crore (US$ 4.61 billion), a 24.15% increase as compared to the same period in the previous year.

The market share of private sector companies in the general and health insurance market increased from 48% to 49.31%. Six standalone private sector health insurance companies registered a jump of 66.6% in their gross premium at Rs 1,406.64 crore (US$ 191.84 million) in May 2021, as against Rs. 844.13 crore (US$ 115.12 million) earlier.

According to S&P Global Market Intelligence data, India is the second-largest insurance technology market in Asia-Pacific, accounting for 35% of the US$ 3.66 billion insurtech-focused venture investments made in the country.

Major investments and developments in Indian insurance sector

The following are some of the major investments and developments in the Indian insurance sector.

- ICICI Lombard and Airtel Payments bank have entered into a partnership for providing cyber insurance.

- Probus Insurance receives US$ 6.7 million in funding from a Swiss impact fund.

- Companies are trying to leverage strategic partnership to offer various services as follows:

- ICICI Lombard collaborated with Vega to provide a personal accident insurance cover with every online Vega helmet purchase to increase road safety awareness among customers.

- ICICI Prudential Life Insurance partnered with NPCI Bharat BillPay, a subsidiary of National Payments Corporation of India (NPCI), to offer ClickPay feature to its customers.

- the Competition Commission of India (CCI) approved HDFC Life Insurance’s acquisition of 100% shareholding in Exide Life Insurance. The move is expected to strengthen HDFC Life’s position in South India.

- Willis Towers Watson acquired the remaining 51% shares in WTW India, taking the company’s holding in WTW India to 100%.

- Acko, a digital insurance start-up, raised US$ 255 million in funds, taking the company’s valuation to ~US$ 1.1 billion.

- ZestMoney raised US$ 50 million to enter new business opportunities in the insurance sector.

- PhonePe announced that it has received preliminary approval from IRDAI to act as a broker for life and general insurance products. As a result, the company can now offer insurance advice to its 300+ million users.

- LIC achieved a record first-year premium income of Rs. 56,406 crore (US$ 7.75 billion) under individual assurance business with a 10.11% growth over last year.

- In India, gross premiums written of non-life insurers reached US$ 26.52 billion, from US$ 26.49 billion, driven by strong growth from general insurance companies.

- ICICI Prudential Life Insurance tied up with the National Payments Corporation of India (NPCI) to provide a unified payments interface autopay.

- ICICI Lombard General Insurance introduced extensive coverage for remote piloted aircraft, particularly drone operators. This product protects the drone, as well as the payload (camera/equipment) attached to it, against theft, loss, or damage, and third-party liabilities.

- MedPay, a Bengaluru-based B2B tech start-up, built an API infrastructure that connects healthcare service providers, standalone clinics, pharmacies, labs and insurance companies through its MedPay Connected Care Network (CCN).

- Bharti AXA Life Insurance reported a 10% renewal premium increase of Rs. 1,498 crore (US$ 200.64 million) in FY21.

- LIC Housing Finance announced plans to raise ~Rs. 2,334.69 crore (US$ 312.43 million) through preferential issue of equity shares to the Life Insurance Corporation of India (LIC).

The study, which was carried out by Benori Knowledge, shows the sector has a compound annual growth rate of 11% in terms of total premiums, and 17% in terms of new business premiums.

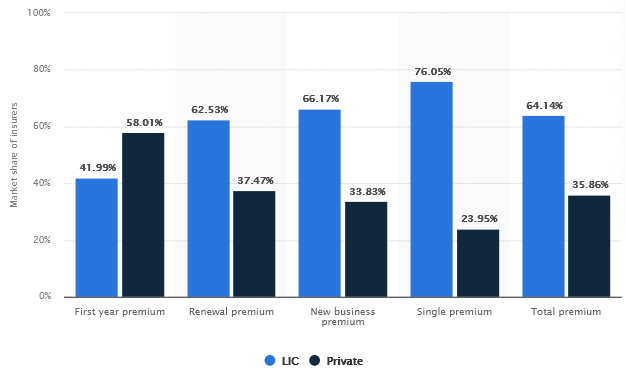

The Life Insurance Corporation (LIC) of India held approximately 64% of the market share of the sector’s total insurance premiums in financial year. LIC is the only public sector insurance company in India.

The Life Insurance Corporation (LIC) of India held approximately 64 percent of the market share of the sector’s total insurance premiums in financial year 2021. LIC is the only public sector insurance company in India. Private players entered the sector only in the year 2000. The share of premiums held by LIC is far higher compared to the more than twenty other private life insurers.

Market share of life insurers in India, by type of premium

24 lakh crore (US$ 317.98 billion) by 2031. In the 2023, the life insurance industry recorded growth rate of 5.8% compared with 0.8% in the same period last year.

Life Insurance Corporation (LIC) of India issued around 21 million new individual policies. In comparison, private insurers issued around seven million policies. Overall, there were about 28 million new individual policies issued across the country that year.

Number of new life insurance policies in India from financial year 2017 to 2023, based on sector

Life Insurance Corporation, India’s leading insurance company, had a brand value worth 8.65 billion U.S. dollars, putting the company on the second spot of the top 100 most valuable Indian brands.

The life insurance industry will continue to grow at a CAGR of 9% until 2027

The think tank also found that life insurance penetration rate in India increased to 3.2% from 2.8%, almost on a level with the global average of 3.3%.

The data shows that India is a huge leader in terms of life insurance uptake. A 3.2% penetration means India ranks 10th in the global life insurance market and ahead of China (at 2.4%) and the UK (at 3%).

Adoption of life insurance in India is expected to increase because there is great awareness of the need for financial security, regulations regarding approval, product customisation and distribution have been updated, and mobile-ready insurtech products are far more palatable to the consumer.

This is bourne out in the 91% of respondents who said their perception of life insurance has changed, from being viewed as an investment to being for protection. Furthermore, 55% revealed they’d purchased their cover through an insurance agent, while 23% bought it online, from bank portals, web aggregators, and website direct purchase

The instability of the covid-19 pandemic highlighted the necessity for consumers to invest in products that would increase financial security, one of them being life insurance.

Government Initiatives to insurance industry

The Government of India has taken number of initiatives to boost the insurance industry.

Some of them are as follows:

- In 2022, the Indian government plans to sell a 7% stake in LIC for Rs. 50,000 crore (US$ 6.62 billion). This is the largest initial public offering (IPO) in India.

- In November 2021, the Indian government signed an agreement with the World Bank for a US$ 40 million project to advance the qualities of health services in Meghalaya, including the state’s health insurance programme.

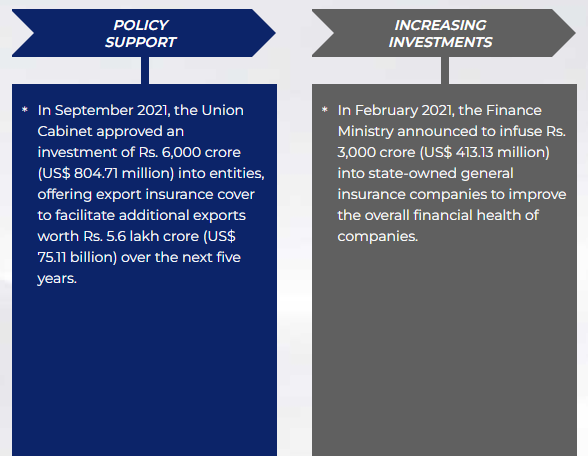

- In September 2021, the Union Cabinet approved an investment of Rs. 6,000 crore (US$ 804.71 million) into entities, offering export insurance cover to facilitate additional exports worth Rs. 5.6 lakh crore (US$ 75.11 billion) over the next five years.

- In August 2021, the Parliament passed the General Insurance Business (Nationalisation) Amendment Bill. The bill aims to allow privatisation of state-run general insurance companies.

- Union Budget 2021 increased FDI limit in insurance from 49% to 74%. India’s Insurance Regulatory and Development Authority (IRDAI) has announced the issuance, through Digilocker, of digital insurance policies by insurance firms.

- Under the Union Budget 2021, Finance Minister Ms. Nirmala Sitharaman announced that the initial public offering (IPO) of LIC will be implemented in FY22, as part of the consolidation in the banking and insurance sector. Though no formal market valuation has been undertaken, LIC’s IPO has the potential to raise Rs. 1 lakh crore (US$ 13.62 billion).

- In June 2021, the government extended a Rs. 50 lakh (US$ 66.85 thousand) insurance coverage scheme for healthcare workers across India until the next one year.

- In February 2021, the Finance Ministry announced to infuse Rs. 3,000 crore (US$ 413.13 million) into state-owned general insurance companies to improve the overall financial health of companies.

- Under Union Budget 2021, fund of Rs. 16,000 crore (US$ 2.20 billion) has been allocated for crop insurance scheme.

The future of Indian`s insurance market

The future looks promising for the life insurance industry with several changes in regulatory framework which will lead to further change in the way the industry conducts its business and engages with its customers.

Life insurance industry in the country is expected to increase by 14-15% annually for the next three to five years. The scope of IoT in Indian insurance market continues to go beyond telematics and customer risk assessment.

Currently, there are 110+ InsurTech start-ups operating in India.

Demographic factors such as growing middle class, young insurable population and growing awareness of the need for protection and retirement planning will support the growth of Indian life insurance.

…………………………

SOURCE: Staticta, Information Bureau, Union Budget, Insurance Regulatory and Development Authority of India (IRDA), Crisil