According to Fitch Ratings, for the last several years, U.S. life insurers were under continued pressure to improve yields to support their products, while limiting investment risk in a low interest rate environment. As a result, they increased allocations to asset classes outside of bonds, including mortgages, to improve overall general investment portfolio yields.

U.S. life insurers’ commercial mortgage fundamentals have largely recovered since the pandemic, with stable property outlooks for hotel, office retail and multifamily sectors. However, the Fed’s monetary tightening and the current recession will pressure some sectors of commercial mortgages over the midterm, with consistently high inflation and rising interest rates negatively affecting some property valuations.

The pandemic has brought financial security into sharp focus the past two years. Life insurance is one way to bolster your financial plan and protect your family’s financial future.

U.S. life issuers allocated 13% of their total investment portfolios to mortgages in 2021, which is stable yoy but continues to be above historic levels of 8%–12%. Life insurers maintained credit quality yoy with 53% of mortgage loans at the CM1 level, or the strongest quality.

The best life insurance for you will depend on your financial goals, budget and how much cash value you want to build within a policy.

The life insurance market in the United States is both massive and highly competitive

Though bigger may not mean better, either for consumers or for investors, it does imply a degree of longevity and financial stability in the life insurance business.

Life insurance is a policy or contract that guarantees the customer or the insured’s beneficiaries a sum of money outlined in the insurance policy.

In exchange, the customer agrees to pay periodic premiums or payments to the life insurance company. Life insurance can be helpful since it can provide a measure of security for a policyholder’s loved ones by providing financial support to pay for funeral expenses and pay off debts (see Global Insurance Markets Trends).

Buying a life insurance policy can help provide financial protection for your loved ones, but choosing the right policy can be confusing.

There are several types of life insurance policies available. Some, like term life insurance, last for a set number of years. Others, like permanent life insurance policies, can provide coverage that lasts a lifetime while offering additional savings or investment components.

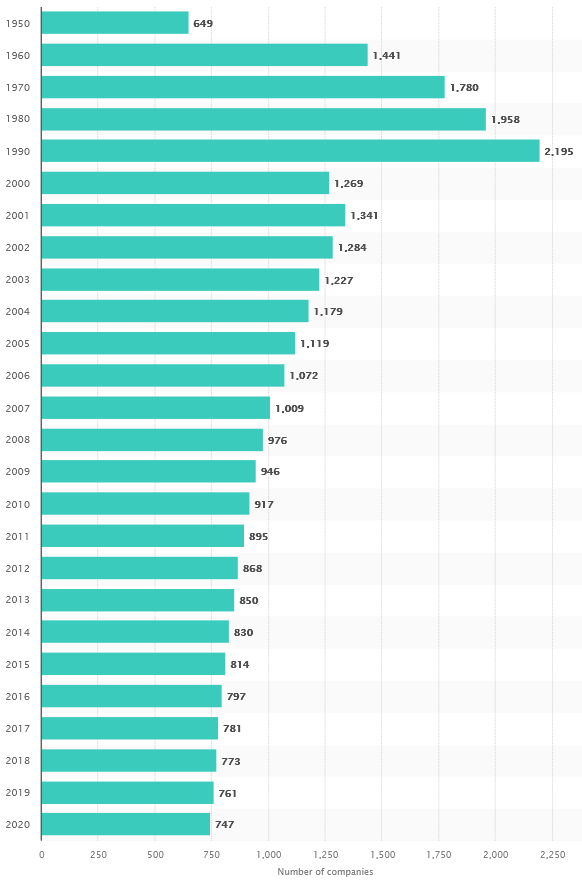

Development in the total number of life insurance companies in the United States

Biggest life insurance companies in the U.S.

Here are the 20 largest life insurance companies in the United States based on market share for individual policies in 2023, according to S&P Global Market Intelligence. The top nine companies are the same as 2020’s list, with some fluctuation in market share.

To help you get started, we’ve compiled a list of the top life insurance companies of 2023. We’ve also gathered information about different types of policies, how the life insurance quote process works, and how to purchase a policy once you find the right one.

TOP 20 Largest Life Insurance Companies

| Company | Life insurance options | Market share |

|---|---|---|

| 1. Northwestern Mutual | Term life Whole life Universal life | 11.5% |

| 2. New York Life | Term life Whole life Universal life Variable universal life | 7.3% |

| 3. MassMutual | Term life Whole life Universal life Variable universal life | 7.1% |

| 4. Prudential | Term life Universal life Variable universal life Indexed universal life | 5.1% |

| 5. Lincoln Financial | Term life Universal life Variable universal life Indexed universal life | 4.2% |

| 6. State Farm | Term life Whole life Universal life | 3.3% |

| 7. John Hancock | Term life Universal life Variable universal life Indexed universal life | 3.2% |

| 8. Guardian | Term life Whole life Universal life Variable universal life | 3% |

| 9. Transamerica | Term life Whole life Universal life Indexed universal life | 2.8% |

| 10. Pacific Life | Term life Universal life Variable universal life Indexed universal life | 2.8% |

| 11. Sammons | Term life Indexed universal life Guaranteed universal life | 2.6% |

| 12. MetLife | Life insurance offered through workplace plans only. | 2.5% |

| 13. Protective Life | Term life Whole life Universal life Variable universal life Indexed universal life | 2.2% |

| 14. AIG | Term life Whole life Variable universal life Indexed universal life Guaranteed universal life | 2.2% |

| 15. Nationwide | Term life Whole life Universal life Variable universal life | 1.8% |

| 16. Equitable (formerly AXA) | Term life Variable universal life Indexed universal life | 1.8% |

| 17. Primerica | Term life | 1.7% |

| 18. Penn Mutual | Term life Whole life Variable universal life Indexed universal life Guaranteed universal life | 1.6% |

| 19. National Life | Term life Whole life Universal life Variable universal life Indexed universal life | 1.6% |

| 20. Globe Life | Term life Whole life | 1.5% |

According to Life Insurance Value Chain Review, traditional problems that have plagued the Life Insurance industry for decades—such as earnings sensitivity to external factors and opaque risks that investors are challenged to underwrite—will remain.

More recently, fundamental changes in industry structure have created significant competitive pressure. Specifically, the emergence of private capital–backed platforms—which have evolved their primary focus to include new sales as well as the acquisition of legacy blocks of business—has changed the game in new-product development, where such platforms have become leaders in several retail and institutional categories.

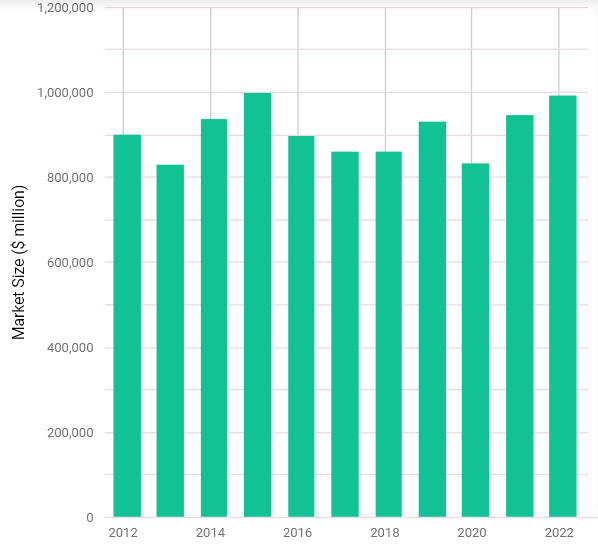

Life Insurance & Annuities in the US – Market Size

The market size of the Life Insurance & Annuities industry in the US is measured by revenue is $995.4bn in 2023 and expected to increase 5.1%.

- According to NAIC report, Northwestern Mutual, New York Life, Metropolitan, and Prudential are the four largest life insurance companies in the United States, all together holding 31.09% of the market.

- The next biggest life insurance companies are Mass Mutual, Lincoln National, State Farm, and John Hancock, which together hold about 17.93% of the market.

- Some insurance companies offer riders, which are benefits added to policies, allowing for customization.

- Some of the insurers offer unique coverage options, including coverage for those who are HIV positive and who have been diagnosed with diabetes.

According to McKensey Report, US life insurers also face drastic changes in other parts of the value chain. In general account asset management, a significant spread between top- and bottom-quartile performers has emerged as poorer performers struggle with dynamic asset allocation as well as investment performance within each allocation.

Changing market dynamics in distribution—such as a shift toward independent channels, new technological capabilities, and evolving investor perceptions—also raise new important strategic questions for insurers to consider.

This above-average concentration could leave investment portfolios potentially more vulnerable in a declining real estate scenario.

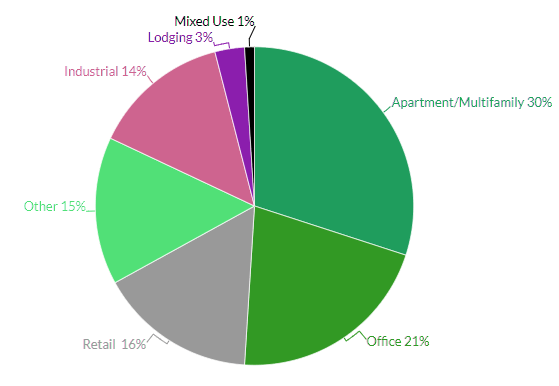

However, life insurers have moderate exposure to retail and office properties and limited exposure to hotel, the sectors expected to be the most affected from an economic slowdown and elevated inflation pressures.

U.S. Life Insurer Commercial Mortgages by Type

Largest Exposures Include Multifamily, Office and Retail

Given rising rates, insurer mortgage growth is expected to moderate and focus on high quality investments to manage risk. The level of higher quality loans stabilized after slight declines prior to the pandemic, with 53% of mortgage loans at the CM1 level, or the strongest quality.

Life insurers maintained favorable loan-to-value ratios

Life insurers also maintained favorable loan-to-value ratios (LTVs) of 53.5% in 2023, down from 55.1% in 2022, 55.3% in 2021 and 58% in 2020. Conservative LTVs are expected to remain at current levels over the near term, which should help life insurers manage investment risks in a weaker economy with slowing demand.

U.S. commercial mortgage-backed securities (CMBS) loan delinquencies were 2.1% as of June 2023, down from a peak of 5% in July 2020.

U.S. CMBS delinquencies to decline to 1.25% based on healthy new issuance volume, improved resolution volume outpacing defaults, and an increased number of maturing loans able to refinance versus the prior two years.

However, uncertainty is growing around the effects of inflation and rising rates on resolution velocity, new issuance volume and property valuations.

Edited & Fact checked by