Natural catastrophe-related losses will continue to be the largest risk to Japanese nonlife insurers’ earnings in fiscal year 2023, though the effects of inflation are catching up, according to S&P Global Ratings Intelligence.

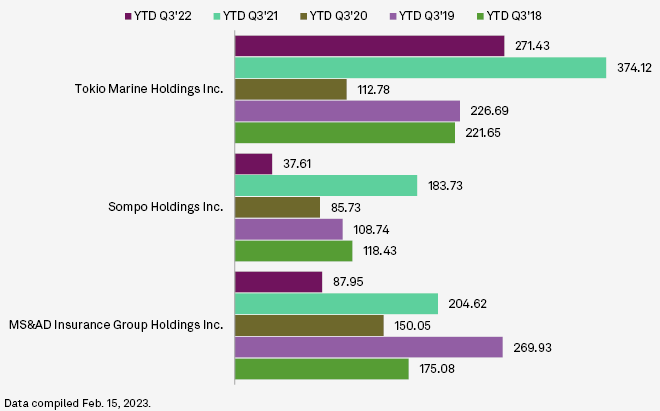

The three major domestic nonlife insurance groups in Japan — Tokio Marine Holdings, MS&AD Insurance Group Holdings and Sompo Holdings — are forecast to record lower year-over-year earnings for fiscal 2022 following a weak performance through the fiscal year’s first nine months.

Inflation in Japan has been very low compared to overseas. However, the prices are going up, so we are watching whether the nonlife insurers can adjust premiums to absorb the impact

S&P Global Ratings director Toshiko Sekine

While the pandemic’s effect is expected to wane in fiscal 2023, the virus will drag on nonlife insurers’ fiscal 2022 results, Sekine added.

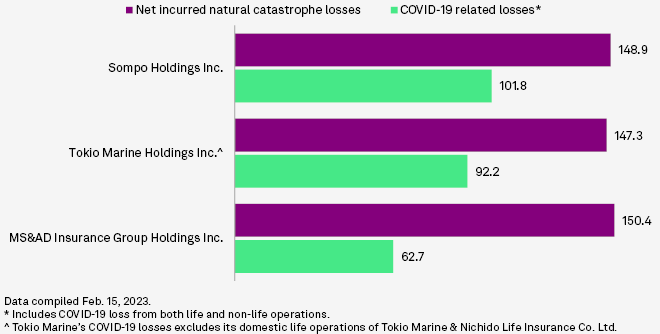

Catastrophes, COVID-19 weigh on insurance performance

Tokio Marine, MS&AD and Sompo posted lower earnings for the nine months ended Dec. 31, 2022, as their local and overseas businesses struggled to deal with the twin effects of COVID-19 and natural disasters.

Tokio Marine’s adjusted net income shrank by ¥145.1 billion year over year, while net incurred losses, before taxes, related to natural catastrophes climbed to ¥147.3 billion in the nine months ended Dec. 31, 2022, from ¥73.8 billion in the prior-year period.

Natural catastrophe and COVID-19 related losses

Major catastrophes that affected Tokio Marine’s domestic operations included typhoons Nanmadol and Talas, both of which brought torrential rain that led to flooding and mudslides in Japan.

Gross incurred losses from those storm systems were about ¥53.4 billion. The insurer’s international operations also felt the impact of Hurricane Ian in the U.S., bearing net incurred losses of ¥32.8 billion.

Tokio Marine’s domestic non-life, domestic life and international segments all recorded COVID-19 losses so far in fiscal 2022.

MS&AD’s adjusted profit fell by ¥194.8 billion to ¥81.2 billion year over year in the first three quarters of fiscal 2022. The insurer attributed the significant decline to natural catastrophes in Japan and abroad, as well as to pandemic-related losses at its domestic nonlife insurance companies.

Incurred losses from domestic natural catastrophes such as a June 2022 hailstorm and Nanmadol were ¥92.3 billion. Overseas natural catastrophes, including Ian, generated incurred losses of ¥58.1 billion for MS&AD.

Sompo also recorded a massive year-over-year decline in adjusted consolidated profit to ¥83.4 billion from ¥205.1 billion, partly due to the effect of natural catastrophes in Japan and COVID-19.

Net income of the Japanese Insurers

Projections unchanged

Tokio Marine did not change its latest projection of ¥400 billion adjusted net income for fiscal 2022. The insurer expects an upturn in profits from its overseas businesses and greater-than-expected gains on the sale of business-related equities to counter adverse development of COVID-19 losses in Taiwan and an increase in losses related to overseas natural catastrophes.

Global Flooding & Landslides Review includes a select listing of global events that resulted in >USD 100mn in economic loss and/or >10 fatalities. It does not include a listing of aggregated loss totals from agencies which are not easily attributed to an individual event.

Sompo’s recent adjusted consolidated profit forecast for fiscal 2022 also remained at ¥160 billion on projected increases in profits from its overseas units, as well as group investment income.

MS&AD made no changes to its projection of ¥170 billion for fiscal 2022. The insurer disclosed in an earnings presentation that it expects an increase in natural catastrophe losses and COVID-19-related claims to affect the fiscal-year results of its domestic nonlife insurance business. For the overseas insurance subsidiaries, investment losses could also weigh on results.

With inflation and its consequences roiling global financial markets, preparations for tougher times by Japan’s insurers are looking to have paid off.

According to S&P Global Ratings, the creditworthiness of Japan’s insurers will likely remain stable in 2023.

S&P anticipate natural catastrophe-related losses will remain the most significant risk factor for domestic non-life insurers.

Non-life insurers will maintain their capital at a certain level by stabilizing underwriting income and conducting adequate risk management. Still, inflation, stock market volatility, and increased overseas credit risk are on our radar.

Sharp increases in interest rates have reduced unrealized gains from available-for-sale securities. S&P noted how this has pressured shareholders equity under JGAPP.

With financial markets likely to continue to fluctuate due to central banks tightening measures globally, insurers accumulated retained earnings and capital bases, which are enhanced by reduced exposure to market risk, will support their creditworthiness.

From fiscal 2025, insurers operating in Japan will likely be required to calculate their capital strengths based on new economic-value based solvency regulation.

Given that SMR and ESR trend differently, insurers are likely to face difficulty in financial management.

Japanes largest insurers continues providing marine war insurance coverage

Some of Japan’s largest non-life insurers continues providing marine war insurance coverage in a major policy U-turn, following negotiations with reinsurers, and after pressure from the Japanese Government not to drop the business.

Insurers including Tokio Marine & Nichido Fire Insurance, Sompo Japan Insurance and Mitsui Sumitomo Insurance had previously announced that they planned to stop offering coverage for ship damage and requisition caused by war in Russian waters.

Japan’s Financial Services Agency (FSA) and Agency for Natural Resources and Energy therefore issued an appeal to national insurers, asking them to continue financing coverage specifically for voyages to the Sakhalin-2 project.

The insurers have since entered negotiations with reinsurers and seem to have emerged with enough reinsurance coverage replaced to be able to continue offering war insurance for natural gas carriers.

Total of 30 billion yen ($224 mn) could be secured from UK reinsurers, with domestic insurers covering some 8 billion yen and overseas reinsurers taking on about 22 billion yen.

………………….

AUTHORS: Katherine Dela Cruz, Jason Woleben – S&P Global market intelligence contributors

Fact checked by Oleg Parashchak