Traditional problems that have plagued the Life Insurance industry for decades—such as earnings sensitivity to external factors and opaque risks that investors are challenged to underwrite—will remain.

More recently, fundamental changes in industry structure have created significant competitive pressure (see 16 Most Common Life Insurance Myths). Specifically, the emergence of private capital–backed platforms—which have evolved their primary focus to include new sales as well as the acquisition of legacy blocks of business—has changed the game in new-product development, where such platforms have become leaders in several retail and institutional categories.

Life insurance leaders who take a deliberate, unbundled approach to their business—and double down on their strengths—will outperform in the decade ahead. Making this transition will not be easy, but failing to act will only result in further challenges.

According to McKensey Report, US life insurers also face drastic changes in other parts of the value chain. In general account asset management, a significant spread between top- and bottom-quartile performers has emerged as poorer performers struggle with dynamic asset allocation as well as investment performance within each allocation.

Changing market dynamics in distribution—such as a shift toward independent channels, new technological capabilities, and evolving investor perceptions—also raise new important strategic questions for insurers to consider.

Life insurers continue their struggle to modernize operations and technology as further investments fail to reduce net expenses in the system.

These new market dynamics may be daunting, but leading life insurance leaders also see opportunities to pave new paths toward value creation. To compete, insurers should carefully consider each part of the industry value chain and determine where they can and cannot reasonably have competitive advantage.

And similar to other industries—such as auto manufacturers—life insurers now need to consider unbundling their value chains and doubling down on the right links.

The Global Life Insurance Report offered a comprehensive overview of the challenges and opportunities facing the global insurance industry. The 2023 report builds on that work with a new level of granularity and precision of recommendations for how insurers can accelerate growth and exceed performance targets (see Term Life Insurance vs. Whole Life Insurance).

In this Review, McKinsey share insights and implications across each major component of the life insurance value chain—new-product development, distribution, asset management, and operations and technology—and outline three main life insurer archetypes that will likely emerge: product origination specialists, balance sheet specialists, and integrated insurers (see Key Technology Strategies for Insurance Companies).

Before insurers can determine in which parts of the value chain they are best positioned to win, they must first gain an understanding of market dynamics and trends, then determine what it will take to be distinctive.

New Life Insurance product development and risk assessment

New-product development has historically been perceived as an area of distinctiveness for life insurance companies. Shifts within the marketplace, however, have already ignited unbundling of new-product development, with a clear bifurcation in natural ownership among public life insurers, mutual insurers, and private capital–backed insurers.

Analytics covers life and retirement, including the major forces at play in the current life insurance industry, several ways insurers have adapted, and opportunities that life insurers and stakeholders can consider going forward—as well as the fundamental implications for their business models as a result.

Life Insurance Market dynamics and trends

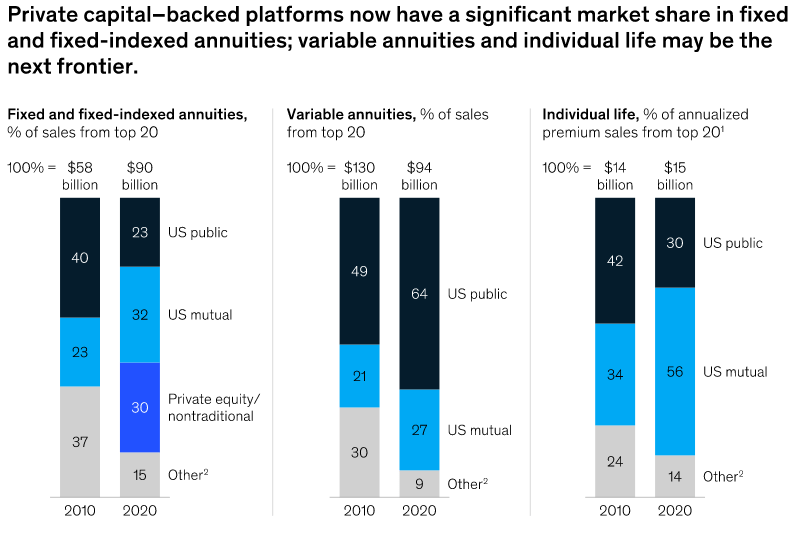

Over the past ten years, we have seen the entrance and expansive focus of private capital–backed platforms, from legacy back books to new-business generation.

These platforms now have significant market share in select retail annuity sales categories—specifically fixed and fixed-indexed annuities, where they have 20 and 40% shares of new business, respectively.

Even in variable annuities, where public insurance carriers have maintained their leadership position, those insurers are pulling back by focusing on investment-only variable annuity products and reinsuring or selling back books to private capital–backed platforms.

Beyond the retail annuity segment, these platforms are rapidly expanding their position in institutional categories, such as funding agreements and structured settlements, as well as in pension risk transfer, which has now surpassed $200 billion in assets alone (see Global Insurance Markets Trends and Forcasts for Life & Non-Life Insurance).

In the past decade, market positions on the life insurance side have drastically shifted, as well.

US public life insurers were the leading providers of individual life insurance, with 42% of the market. However, US mutual companies have replaced that leadership, now accounting for 56%.

While private capital–backed platforms have not yet targeted the individual life insurance market to the same extent as the annuities market, it may become their next frontier.

In the medium term, however, investors’ return expectations will increase as volatility pushes up nominal risk-free rates and risk premiums, requiring life insurers to deliver a higher ROE to meet shareholder expectations (see about Digital Life Insurance).

Furthermore, higher interest rates could also result in deteroriation of credit, resulting in higher delinquencies and ratings migration, which could directly affect investment portfolios.

Achieving distinction in new-product development will require leading capabilities across customer insight–led product design, risk assessment, pricing, and claims management. In most cases, insurers will likely focus on building these capabilities in a few core product categories consistent with their risk appetite, return expectations, capital efficiency, investor considerations, and ability to develop competitive differentiation.

In product categories where they don’t have competitive advantage, insurers will increasingly seek to exit.

This trend is well under way, as the US M&A market continues to build on the $620 billion of life and annuity assets that have already traded to private capital–backed platforms (see our report 11 Types of Merger & Acquisition). We anticipate there will, indeed, be a “middle ground” where insurance carriers can leverage their own capabilities in certain product lines and partner with others for complementary capabilities.

As a result, models such as white labeling, coinsurance, and flow reinsurance are likely to grow in use, and insurers may increasingly distinguish between product design, distribution, and balance sheet risk retention. Indeed, by 2023 the volume of flow reinsurance across US life insurance increased to $598 billion.

General account asset management

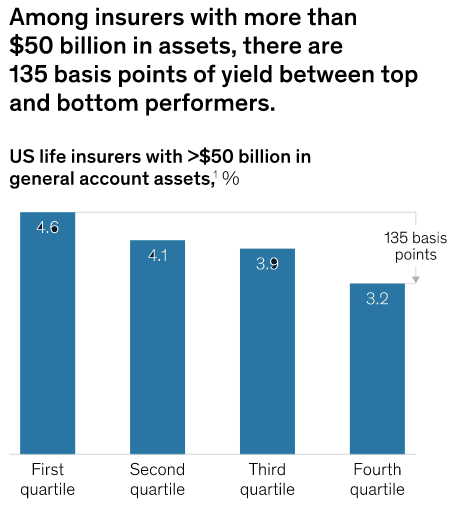

General account asset management has become a critical source of value creation among life insurers—and one with wide disparity between top and bottom performers. This gap will provide further impetus for asset management unbundling.

Investment portfolios are designed for a wide variety of liability profiles, inherently driving differences in asset allocations and yield. Nevertheless, performance variability across general accounts is significant. Among insurers with more than $50 billion in assets, top- and bottom-quartile performers are separated by 135 basis points (bps) of yield.

The prolonged impact of historically low interest rates has forced investment portfolios to reconfigure their strategic asset allocations.

Many insurers increased their allocations to high-yielding debt, structured products, private credit, and other alternative asset classes. North American insurance companies allocated $355 billion to alternatives.

As insurers consider shifting toward higher-yielding alternative asset classes, they will have to marry their investment decisions with rigorous risk management, making deliberate choices about their risk tolerance and ensuring their risk management capabilities are commensurate with their risk appetite.

When making such choices, insurers will have to consider capital availability, robust monitoring and stress testing of various types of risks (credit, liquidity, duration), and active reviews based on market conditions. Taken together, we believe more evolved and dynamic strategic asset allocation will continue in the years to come.

Insurers that continue to own asset management will have to meet a high bar. They must have strong asset origination capabilities, industry-leading talent and investment processes, and quantifiable proof points of investment alpha. Further, such insurers will have to optimize the role they play across their investments—acting as an allocator among certain asset classes and an operator in others, such as real estate. Finally, they will need to have leading risk management capabilities commensurate with their placement on the risk/return frontier.

33% of life insurers outsource more than 50% of their assets to unaffiliated managers. Life insurers with less than $10 billion of assets—which represent $267 billion of general account assets —may be prime early candidates on which to grow such businesses and to capture the capital-light, fee-based income they offer.

Insurers unable to meet this bar have several options, ranging from complete outsourcing to outsourcing select capabilities to specialists while building certain capabilities in-house (see Top Ranking the World’s Largest Insurance Markets). Those that have distinctive asset management capabilities, however, may create the next frontier of third-party asset management.

Such insurers may launch new outsourced chief investment officer (OCIO) or subadvisory businesses targeted toward subscale insurers.

Life Insurance Distribution

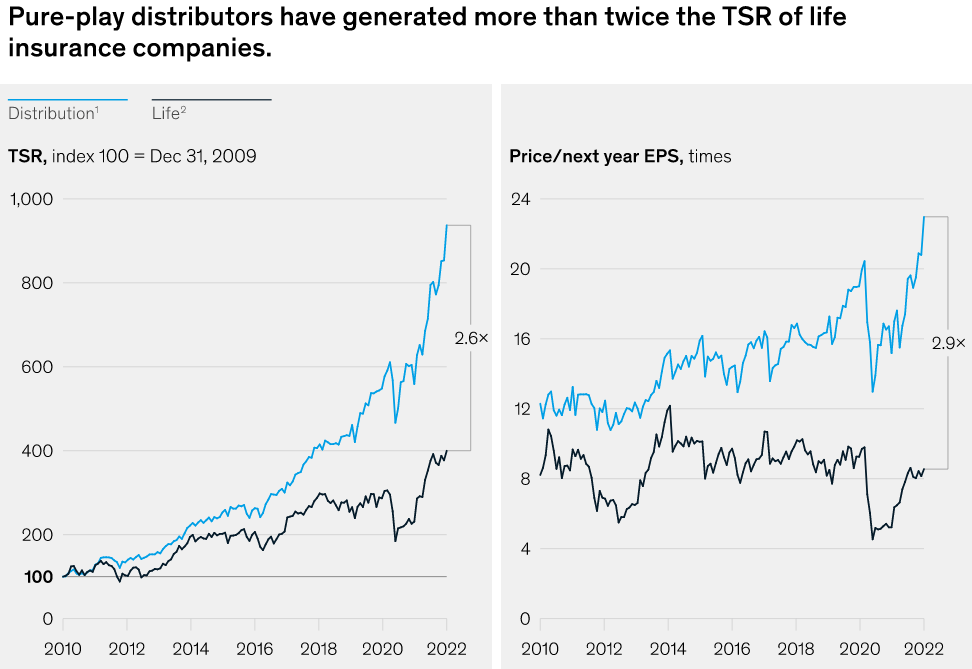

For many insurance carriers, the distribution function holds a place of pride and significance beyond all other functions. And many insurers are now thinking about earnings streams from distribution in different ways.

Indeed, insurers have witnessed how investors reward the capital-light earnings generation of pure-play distributors—such as brokerages, independent marketing organizations, and field marketing organizations—which have generated 2.6 times the TSR of life insurance companies and currently trade at nearly 2.9 times the P/E multiple of their life insurance counterparts.

Historically, life insurers have invested heavily in their captive distribution, including recruiting and training their own sales forces to ensure that their new products were marketed and sold properly.

Captive distribution, however, is no longer economically viable for most insurers. The increased commoditization of many insurance and annuity products, coupled with the increasing open architecture of insurance distributors, has resulted in the slow and steady shift away from affiliated agents.

In 2000, affiliated agents sold nearly half of all individual life policies in the United States. In 2020, that share had fallen to one-third.

The difference in share has been captured almost entirely by independent agents, banks, and broker–dealers.

For insurers that no longer have captive distribution or that can no longer afford to maintain it, the focus will shift to more effectively managing third-party intermediaries. They will also focus on building unique value propositions beyond product features and pricing. Such propositions will have to include more digital and analytics capabilities and technological connectivity—leading to a seamless end-to-end experience from manufacturer to distributor to customer.

Developing such capabilities and creating this seamless experience will be table stakes for insurance carriers that maintain captive distribution as a primary source of competitive differentiation.

The more interesting questions will focus on how to create additional value from distribution. Indeed, some insurers are already looking at their captive distribution as value-creating hubs and sources of fee-based earnings through the sale of wealth management and third-party protection products.

Going forward, we anticipate that public insurers will also report their earnings from distribution as a stand-alone segment, as they seek the higher multiples investors offer on this part of their earnings.

Operations and technology

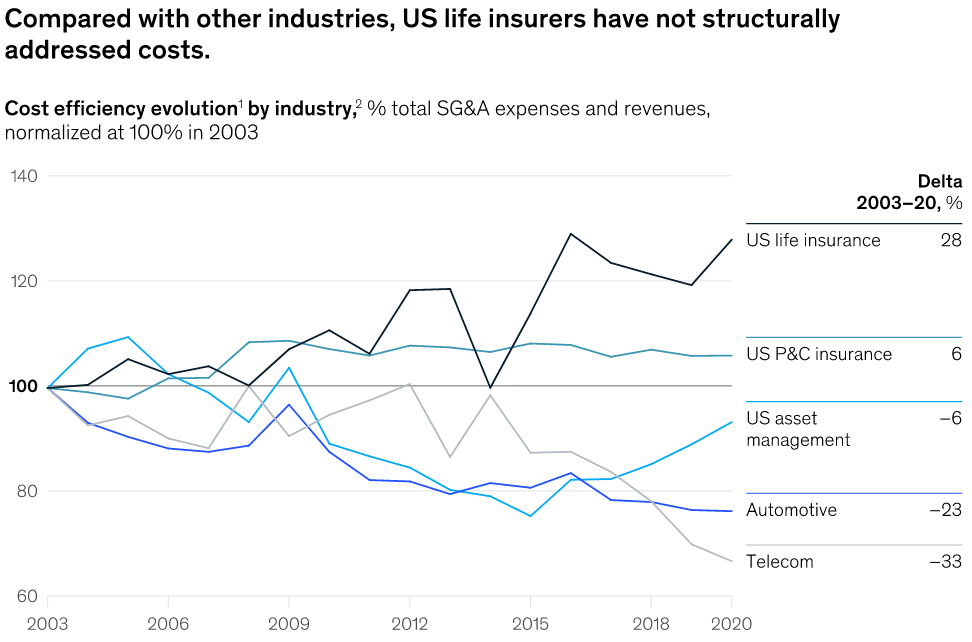

Life insurance is one of the very few industries—within and outside financial services—that have seen cost ratios increase over the past 20 years (Exhibit 4). Yet this headline does not tell the full story.

There is a wide disparity in efficiency across life insurers. According to McKinsey’s Insurance 360° performance benchmark, top-performing North American life and annuity insurers have half the expense ratio of their bottom-quartile peers. Technology and operations-related costs, which have grown faster than other categories, represent a big part of the difference in performance.

Complex legacy-technology systems and platforms are the biggest bugbear for almost all life insurers (see report Scaling & Digital Adaptations Hasten Insurance Technology Transformation). They create complexity, increase costs, and hinder insurers’ ability to launch new products and manage existing portfolios.

Many insurers have tried to address their legacy-technology problems by outsourcing to technology providers.

In most instances, however, performance falls far short of promise: insurers are beset by issues of delayed transitions, significant cost overruns, and service levels that fail to meet expectations. This often creates a vicious cycle.

One of the greatest challenges insurers face in modernizing their technology pertains to older blocks, where many investments are fundamentally uneconomical. Technology investments on back-book policies (particularly closed blocks) will amortize over a shrinking number of policies— and such investments will not fuel future growth.

While technology investments are uneconomical, current technology platforms are becoming obsolete, with fewer and fewer programmers available to maintain these legacy platforms. The status quo is clearly not viable.

The choice for insurance carriers in addressing operations and technology is not straightforward. Operations is core to the touchpoints along the insurance customer journey, and insurers want to continue to own their client relationships. Companies that want to maintain such ownership and make it a source of competitive differentiation will need to ensure that their technology investments are accretive and tackle the challenges they face head-on.

These insurers will need to develop a new set of robust and distinctive capabilities, including the following:

- modern cloud-first approaches to managing applications and data

- AI and advanced analytics to tackle complex issues across data extraction, premium calculations, reserving, and operational tasks

- the ability to attract and retain a different type of technology talent, including engineers, developers, and data scientists

- a culture of software engineering and more agile ways of working through tighter collaboration between business and technology

For most insurers, building these capabilities on their own will be difficult and require significant bandwidth—taking focus away from their core business. This will create an impetus for the next generation of technology service providers to offer a more modern, customer-centric, integrated, end-to-end solution to serve both open and closed blocks.

Life insurance unbundling is already under way. Insurers are making deliberate choices across the value chain, building new capabilities, and shifting their business models. And while the pace of unbundling may be up for debate, it will continue nevertheless.

Unbundling will also lead to the blurring of boundaries between traditional competitors and more fluid competitive dynamics. Insurers will have to think beyond the “zero sum” approach and welcome new collaborative partnerships with different stakeholders in the spirit of creating greater “shared value.” In fact, insurers competing head to head in one area of business could end up being partners in another area where they have complementary capabilities.

……………………..

AUTHORS: Ramnath Balasubramanian – senior partner in McKinsey’s New York office, Asheet Mehta – senior partner, Andrew Reich – associate partner, Rajiv Dattani – associate partner in McKinsey’s London office.