Total global insurance market premiums grew by 3.4% in real terms. The non-life sector posted 2.6% growth, driven by rate hardening in commercial lines in advanced markets. According Swiss Re Institute Report, Life premiums in China contracted by 2.6% due to weakness in life savings business caused by a further decline in critical illness business.

However in China, the largest emerging market, non-life premium volumes contracted by 0.7% as the de-tariffication of motor insurance sparked fierce competition and rate reductions.

In life insurance, global premium growth bounced back strongly (+4.5%) in both the advanced (+5.4%) and emerging markets (+6.7%, excluding China).

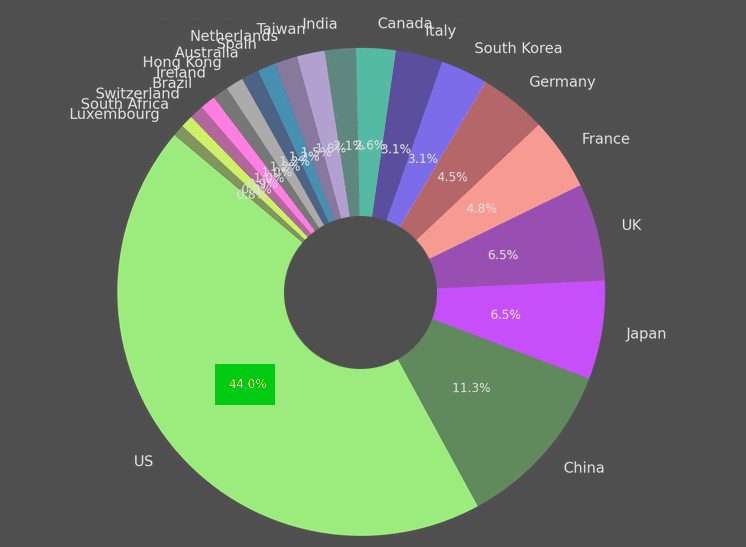

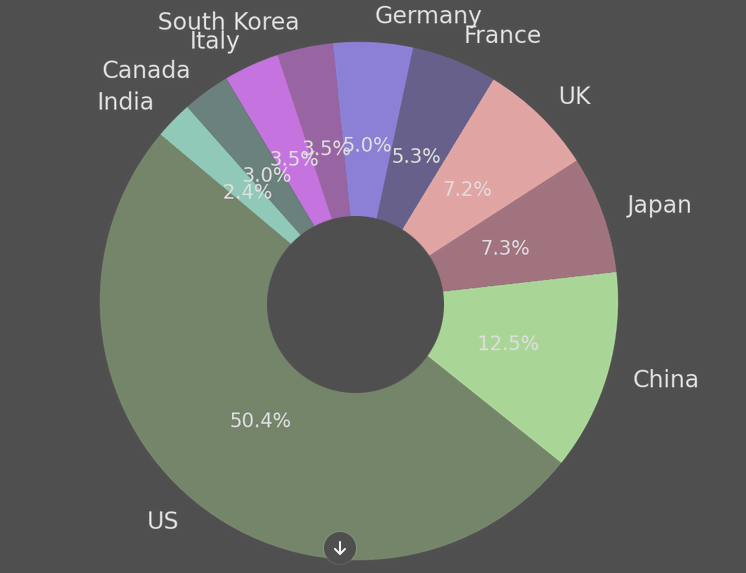

The US remains the largest insurance market in the world, with total premiums (non-life and life) of USD 2.8 trillion. Next are China and Japan. The three markets together accounted for almost 56% of the global premiums, slightly less than in 2023 (57%).

A complex macro environment shaped insurer confidence and strategies. Economic resilience, gradual improvements in global supply chains, and a global construction boom served to bolster insurer confidence, while geopolitical instability, persistent social and economic inflation, and climate-related concerns created uncertainty and conservatism.

Insurance market continued to moderate as insurers sought to balance growth with profitability, divergent conditions continued for favored versus challenged risks.

The US and Japan insurance market together lost around 1% market share, the ground lost taken up by the UK and France.

Adverse claims trends pressured pricing upward across Auto and Casualty, while Cyber and Directors and Officers experienced a softening market as incumbent insurers sought to retain and grow their portfolios.

Property pricing remained volatile due to concerns related to inflation, high reinsurance costs, climate change and Natural Catastrophe exposures. USA-exposed risk (on non-USA placements) remained challenged.

The insurance market share of the top 20 countries declined to 90%. Asian markets have six seats in top 20 rankings, with a 23% market share.

With the war in Ukraine weighing on economic growth in Europe in particular, we expect insurance industry growth in emerging markets will outpace that in the advanced markets this year, with emerging Asia in the lead.

Swiss Re Institute expect India will be one of the fastest growing markets in the world over the coming decade.

Top 20 ranking by total premium volume

| Rank | Country | Total premium, $mn | % change |

| 1 | US | 2 718 699 | 8.1% |

| 2 | China | 696 128 | 6.1% |

| 3 | Japan | 403 592 | –2.6% |

| 4 | UK | 399 142 | 16.7% |

| 5 | France | 296 380 | 24.0% |

| 6 | Germany | 275 779 | 5.9% |

| 7 | South Korea | 193 008 | 1.5% |

| 8 | Italy | 192 481 | 11.5% |

| 9 | Canada | 161 289 | 15.8% |

| 10 | India | 126 974 | 13.5% |

| 11 | Taiwan | 113 423 | 0.1% |

| 12 | Netherlands | 92 986 | 5.7% |

| 13 | Spain | 73 571 | 9.4% |

| 14 | Australia | 72 576 | 15.5% |

| 15 | Hong Kong | 72 227 | –1.0% |

| 16 | Ireland | 64 696 | 31.3% |

| 17 | Brazil | 62 082 | 7.2% |

| 18 | Switzerland | 57 793 | 1.2% |

| 19 | South Africa | 51 215 | 24.6% |

| 20 | Luxembourg | 48 287 | 30.9% |

| Top 20 markets | 6 172 328 | ||

| World | 6 860 598 |

Total insurance premiums contributed by country

The chart to show the proportion of total insurance premiums contributed by each country. This visualization will give a clear picture of the market share each country holds in the data provided.

Top 20 ranking by global market share, %

| Rank | Country | Global market share | |

| 2023 | 2022 | ||

| 1 | US | 40.6% | 39.6% |

| 2 | China | 10.1% | 10.4% |

| 3 | Japan | 5.9% | 6.6% |

| 4 | UK | 5.8% | 5.4% |

| 5 | France | 4.3% | 3.8% |

| 6 | Germany | 4.0% | 4.1% |

| 7 | South Korea | 2.8% | 3.0% |

| 8 | Italy | 2.8% | 2.7% |

| 9 | Canada | 2.4% | 2.2% |

| 10 | India | 1.9% | 1.8% |

| 11 | Taiwan | 1.7% | 1.8% |

| 12 | Netherlands | 1.4% | 1.4% |

| 13 | Spain | 1.1% | 1.1% |

| 14 | Australia | 1.1% | 1.0% |

| 15 | Hong Kong | 1.1% | 1.2% |

| 16 | Ireland | 0.9% | 0.8% |

| 17 | Brazil | 0.9% | 0.9% |

| 18 | Switzerland | 0.8% | 0.9% |

| 19 | South Africa | 0.7% | 0.7% |

| 20 | Luxembourg | 0.7% | 0.6% |

| Top 20 markets | 90.0% | 90.4% |

Global insurance market shares (TOP 10 countries)

The pie charts displaying the global market shares. Each chart uses a different color scheme to clearly distinguish the data for each year.

Expiring deductibles were achieved on most placements, although increases and minimum deductibles were required on some poor-performing risks and higher-risk sectors.

Decreases were available on some well-performing classes and risks but were often declined by clients due to incommensurate additional premiums.

Coverage enhancements, supported by quality underwriting data, were available in areas targeted for growth as insurers continued to leverage coverage terms as a differentiator. Some exclusions remained non-negotiable.

India is one of the fastest growing insurance markets in the world (see Life & Non-life Insurance Market of India Outlook). In terms of total premium volumes, it was the 10th largest globally in 2023, with an estimated market share of 1.9%, and the second largest of all emerging markets.

Swiss Re forecast that premiums will grow by an average 9% per annum (in real terms) over the next decade, stronger than the 7.5% annual average of 2015–2023.

At this rate, India will be the 6th largest insurance market in the world by 2032, ahead of Germany, Canada, Italy and South Korea. Our projection is based on expectations of strong economic growth, rising levels of disposable income, India’s young population, increased risk awareness and also digital penetration, and regulatory developments.

At 1%, non-life insurance penetration (premiums as a percentage of GDP) in India last year was significantly below the global average of 3.9%.

Growth in the non-life sector will be driven by demand for health covers, with people more aware of health security post COVID-19, and also strong support from a government-sponsored mass health programme (Ayushman Bharat).

Compulsory motor insurance will also grow rapidly as India’s middle class continues to expand and buy more cars.

Life insurance profitability in 2023 and 2024 will continue last year’s trend of moderate improvement, based mainly on rising interest rates. We also expect that the severity of pandemic-related claims will likely subside and normalise.

We estimate that real premiums in China’s life market will contract by 0.9% in 2023. Strict COVID-19 lockdowns in major commercial hubs are dampening income growth and consequently demand for life insurance products.

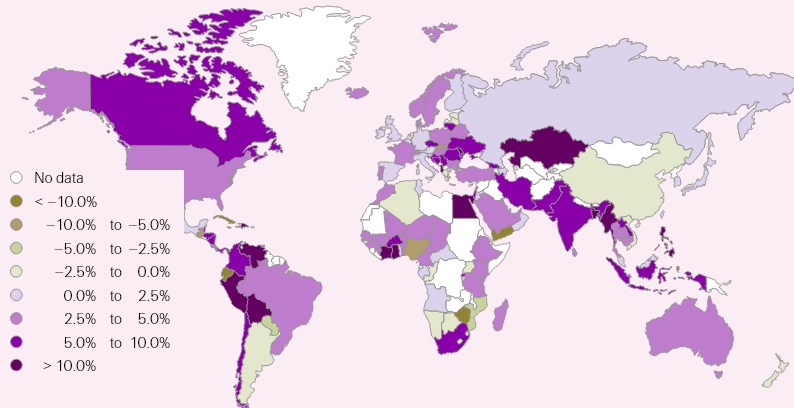

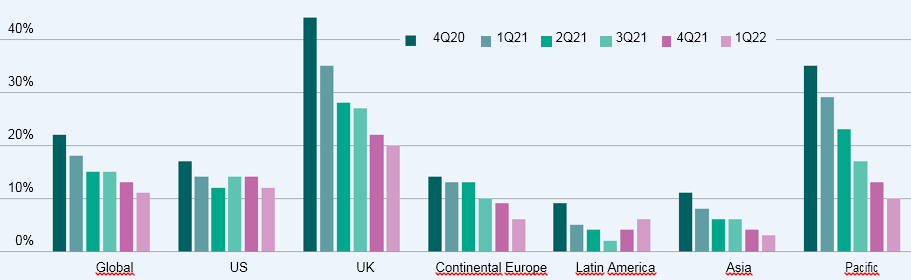

Non-life real premium growth

A declining agent workforce and difficulties to sell critical illness products constitute additional drags on the industry. The Insurance Association of China revised the definition of Critical Illness (CI), and pricing directives of CI products in April last year. The revisions introduce more stringent claims criteria and reduce lump sum payments for certain common CI (such as thyroid), making new CI products less attractive.

By region, we estimate that premium growth in advanced markets will stagnate this year (+0.4%) and grow by a below-average 1.8% in 2023 in real terms.

Strength in commercial insurance will be offset by weakness in personal lines (particularly motor), while health will only resume trend growth in 2024.

In 2023 premiums in North America will increase marginally by 0.9% but Europe will see a negative growth of 1.4%. In advanced Asia-Pacific, premiums will grow by an estimated 0.9%, with the region’s economies also impacted by inflation and low growth.

We expect non-life premium growth in emerging markets to outstrip that in advanced markets this year and next, with real growth of 3% in 2022, 4.2% in 2023 and 4.5% in 2024.

We see a strong rebound in China, with non-life premiums up an estimated 3.7% this year and by 4.7% in 2023. Even so, that is still well below pre-pandemic double-digit growth rates. The increase this year and next will be driven by demand for short-term health insurance, fuelled by consumers’ rising risk awareness of health security post COVID-19, and strong policy support as the government seeks to expand access to healthcare.

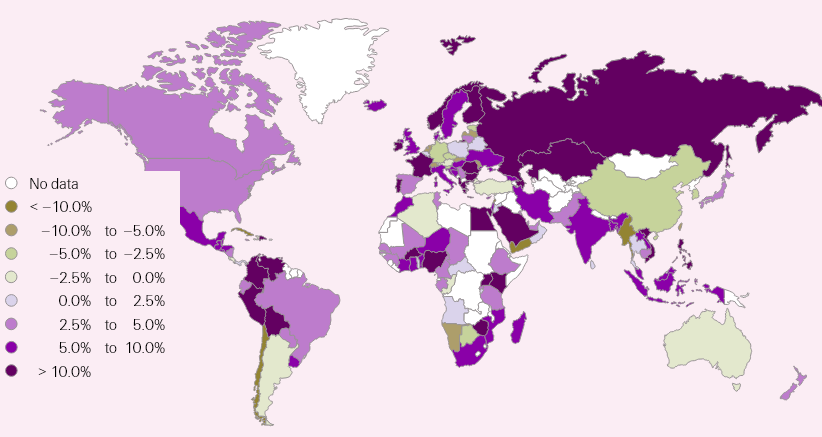

Life real premium growth

We expect these headwinds will dissipate over the medium term and subsequently forecast that life premiums will grow by 3.4% next year. The growing middle class, rising awareness of insurance, and potential reforms to promote pension insurance should underpin rising demand for traditional life products.

In the other emerging markets together (excluding China), we estimate that life premiums will grow by 3.5% in real terms this year, below 3.9% growth between 2011 and 2023.

The outlook for emerging Europe and central Asia is negative. Given its proximity, this region is the most exposed to the economic turbulence caused by the conflict in Ukraine, and we estimate an 9.3% contraction in real life premiums in 2023.

We forecast growth of 6.6% in India in real terms, the second largest life insurance market in emerging world, as group business continues to perform well.

Term products have also performed well, post-COVID-19. For Latin America, we see life premiums up 2.5% this year, with real growth eroded by high inflation. We also estimate 2.4% real premium growth in the Middle East and Africa this year. As an underlying reality, we expect low insurance penetration rates to continue to support growth in emerging markets over the medium-term.

Life insurance penetration was 3.2% in 2023, almost twice more than the emerging market and slightly above the global average.

However, most life insurance products sold in India are savings-linked, with just a small protection component. Hence households remain exposed to a large financing gap in the event of premature death of a main breadwinner.

The mortality protection gap in India stood at USD 17 trillion, (or 83% of total protection needed), one of the largest in the world.

In 2023, the government raised the level of foreign direct investment (FDI) in domestic insurers to 74% from 49%, and there are expectations that the level will increase to 100%

The increase to 74% already allows foreign insurers to further strengthen their foothold in one of the fastest growing insurance markets in the world, with controlling stakes. The move will also facilitate greater access to capital, underwriting know-how and product innovation for the country’s insurers.

By region, we estimate that premium growth in advanced markets will stagnate this year (+0.4%) and grow by a below-average 1.8% in 2023 in real terms.

Strength in commercial insurance will be offset by weakness in personal lines (particularly motor), while health will only resume trend growth in 2023. In 2022, we estimate that premiums in North America will increase marginally by 0.9% but Europe will see a negative growth of 1.4%.

In advanced Asia-Pacific, premiums will grow by an estimated 0.9%, with the region’s economies also impacted by inflation and low growth.

We expect non-life premium growth in emerging markets to outstrip that in advanced markets this year and next, with real growth of 3% in 2022 and 4.2% in 2023. We see a strong rebound in China, with non-life premiums up an estimated 3.7% this year and by 4.7% in 2023.

Even so, that is still well below pre-pandemic double-digit growth rates.

The increase this year and next will be driven by demand for short-term health insurance, fuelled by consumers’ rising risk awareness of health security post COVID-19, and strong policy support as the government seeks to expand access to healthcare.

In motor, we forecast premiums in China will grow by 4% and 3% in 2022 and 2023, respectively. In line with global economic trends, we expect other emerging regions to register slowing non-life premium growth rates of 2% in 2022, with an improvement to 3.5% in 2023.

Pricing Insurance trends

Pricing in commercial lines continues to improve in 2022, albeit at a more moderate pace than last year. In 2021, the strongest rate gains were in financial and professional liability lines (+34% on average) in the UK, the US and Australia. Property rates were up in all regions (up 11% on average), while casualty continued to lag in (+6%).

Commercial insurance composite rate outlook

Non-life insurance sector ROE will likely decline slightly

In moto, profitability has been squeezed by price competition and rising claims in 2022 after a very positive 2020.

In the first year of the pandemic, the restrictions on mobility imposed on populations resulted in far fewer motor insurance claims than normal. This brought large windfall gains to insurers’ profitability in 2020.

With mobility returning to normal levels in 2021 and 2023, we expect motor claims to jump back to pre-COVID-19 levels. The windfall profit gains also had the effect of intensifying competitive pressures in personal auto, in which rates are now softening as insurers seek to consolidate their market share.

Economic slowdown and inflation pressures will weigh

Global non-life insurance sector profitability will come under pressure this year and next. We forecast an industry return on equity (ROE) of around 5–6% in 2023, compared with 6% in 2022.

For 2024, analytics expect a significant improvement to 6.6% based on a recovery in underwriting results and increased investment returns.

Economic slowdown and multi-year high inflation rates will reduce premium income growth in real terms, while also increasing claims costs.

For global non-life insurance, we estimate a sector combined ratio of 101% in 2023, slightly worse than the 100% of 2022. The inflation impact on claims will offset the improvement in profitability we had previously anticipated from ongoing rate hardening in commercial and also in some personal lines insurance.

Forward-leading indicators such as the P&C insurance sector stock price index ratios, suggest an improvement in the sector profitability outlook for US and APAC markets. For insurers in Europe, the outlook has become more challenging with Russia’s invasion of Ukraine.

……………………………

Edited and factchecked by Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media