According to GlobalDatas Insurance Market Outlook in Asia-Pacific, the global property insurance industry recorded a CAGR of 4.1%, backed by an increase in weather-related events, which fueled the demand for property insurance. The motor insurance industry in Asia-Pacific will grow at a CAGR of 5.4% over 2022–2027, supported by the recovery in new vehicle sales and product innovation in motor insurance. Among all the regions, Asia-Pacific recorded the highest increase in this industry. Its share in global premiums increased from 14.3% to 17.2%.

Escalating natural catastrophe losses, wildfire and Coronavirus (COVID-19) outbreak impacted property underwriting and claims exposure. Asia-Pacific property insurers were also impacted by contentious claims and lawsuits in business interruption and event cancellation insurance due to lack of clarity in policy wordings on epidemic and pandemic coverage.

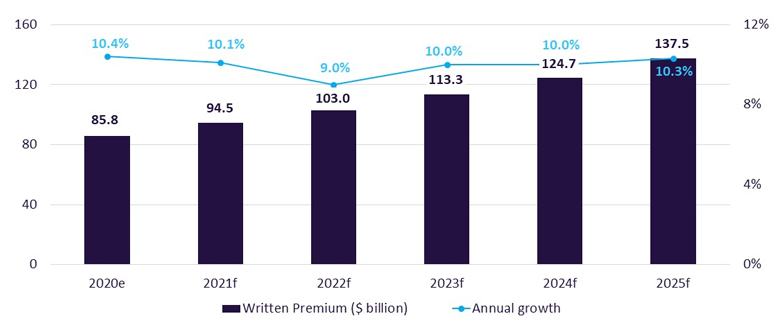

The property insurance industry in Asia-Pacific (APAC) is projected to grow from $85.8bn in 2023 to $137.5bn in 2027, in terms of written premiums.

Insight report reveals that the property insurance industry in Asia-Pacific will grow at a compound annual growth rate (CAGR) of 9.9%, supported by the increasing demand for insurance against natural hazards and commercial developments.

The Key Takeway

- The property insurance industry in the Asia-Pacific (APAC) region is expected to grow by 9% and reach $103bn in 2023

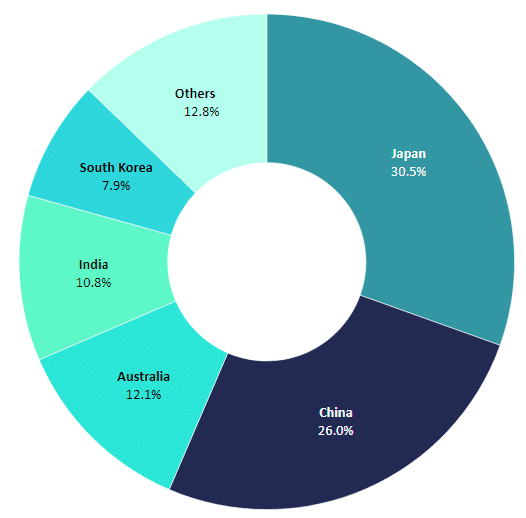

- Japan was the leading market in the region with 30.5% share. The other top markets are – China, Australia, India and South Korea with a collective share of 56.8%

- The top 10 insurers accounted for 80% of the APAC’s property insurance premiums. The top three insurers held 70% share, indicating a concentrated market. The remaining market is highly competitive and fragmented

Property Insurance Industry Outlook

The unprecedented situation caused by COVID-19 highlighted the importance of clear policy wording compelling insurers to make changes in the risks covered in those policies.

Despite the outbreak, Asia-Pacific exhibited strong growth of 10.4%, supported by growth from developing economies in the region. China and India registered double-digit growth of 14.2% and 21.4% respectively.

Demand in these markets was strongly backed by commercial and industrial developments.

Clean energy, climate change and environmental, social and governance (ESG) considerations are expected to remain key focus areas for property insurers. With increasing awareness towards climate change and new standards laid under the COP26, property insurers are expected to reduce carbon footprints at the operational level, as well as review investment strategy and underwriting.

Property insurance in Asia-Pacific, premiums and grow

Kotu Keerthi Naimisha, Insurance Analyst at GlobalData, comments: “Asia-Pacific’s exposure to high severity natural-catastrophes (Nat-cat) in the last few years has resulted in strong awareness and demand for property insurance. Premium growth is also driven by a consistent increase in insurance prices across the region since 2017, resulting from heavy Nat-cat losses, a trend that is expected to continue in 2023-2027.”

Commercial expansion and infrastructure development, along with regulatory support to develop sustainable property insurance products, have provided further impetus to the property insurance industry, which grew at a CAGR of 9%.

APAC Property Insurance Industry – Written Premium

APAC Property Insurance Industry – Annual Growth

Property Insurance Industry Outlook in Asia Pacific report provides a comprehensive overview of the Asia Pacific property insurance industry.

- This report provides the market size of the property insurance industry in the Asia Pacific region. Asia-Pacific was the fastest-growing region recording growth at a CAGR of 9%

- The report provides details on the market size of property insurance premiums for the 20 largest markets in the Asia Pacific region along with their profitability ratios

- Japan is the largest market accounting for 30.5% of the region’s property insurance premiums. Bangladesh followed by Sri Lanka recorded the highest loss ratio in the region

- A challenging property market, along with severe natural catastrophe events, contributed to the growth of the specialty insurance market. The report provides an insight into key trends, the impact of climate change, technology developments, and potential disruptors in the property insurance industry

- The report discusses the impact of the COVID-19 on the industry as well as other challenges that impacted the property insurance industry in the Asia Pacific region. In Australia, the regulators agreed to file a test case regarding the application of infectious disease cover under business interruption policies. This is likely to add to the profitability challenges of commercial insurance products

Insurers are focusing on prudential underwriting practices and technology to safeguard their losses

Given the region’s high vulnerability to natural hazard risk, insurers are wary about their exposure and are turning to insurtech to improve industry practices. Japan-based MS&AD Insurance Group and Sompo Japan are among the leading regional insurers that have partnered with tech companies to access AI-enabled geospatial data for hazard mapping and improved claim settlements.

Country-Wise Distribution of Property Insurance Premium

Japan is the largest market in the APAC region, accounting for 30% of the region’s written premiums in 2020. The country’s exposure to high severity earthquakes, floods, and storms has been a consistent driver for property insurance in the country.

With 26% of the region’s written premium, China is the second-largest property insurance market. Agriculture insurance is the major growth driver for property insurance in China and accounted for over 50% of the property insurance premiums. The uptake of agriculture insurance has increased due to its availability at a subsidized premium rate with support from the government.

Motor insurance in Asia-Pacific

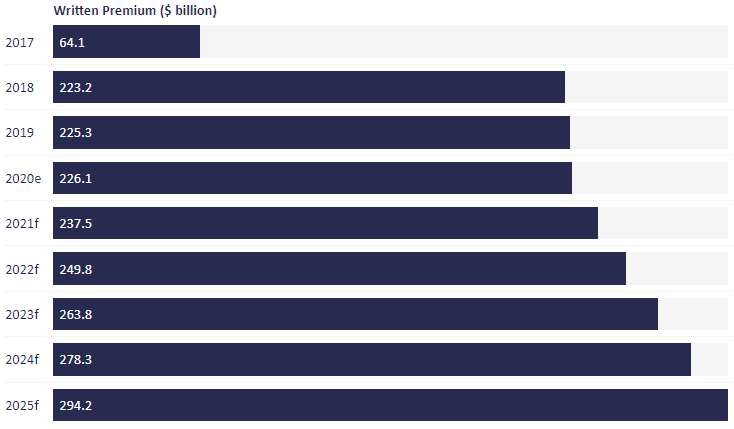

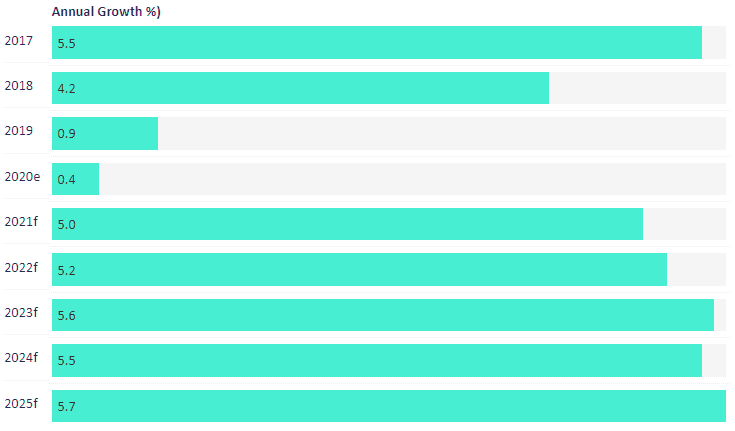

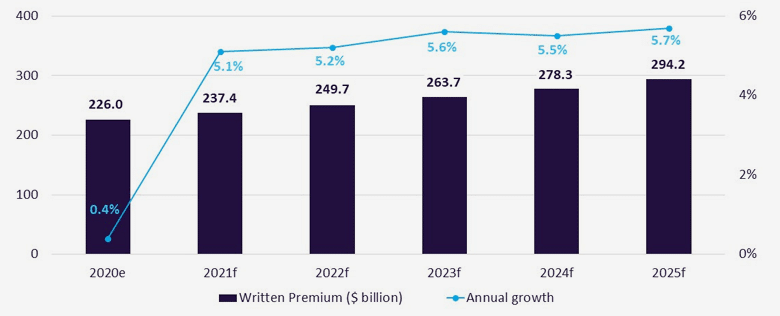

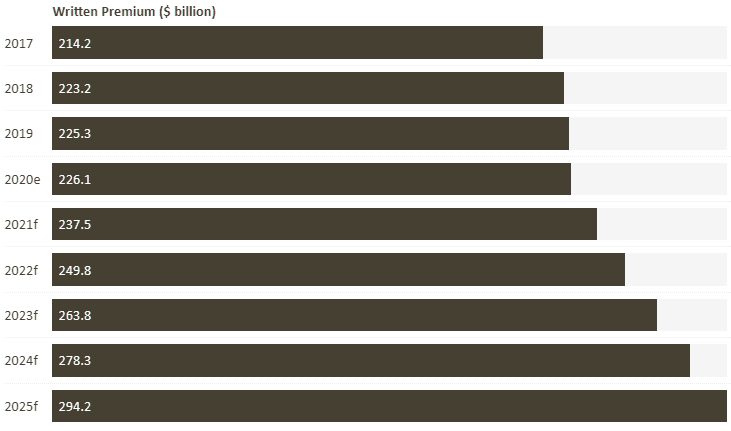

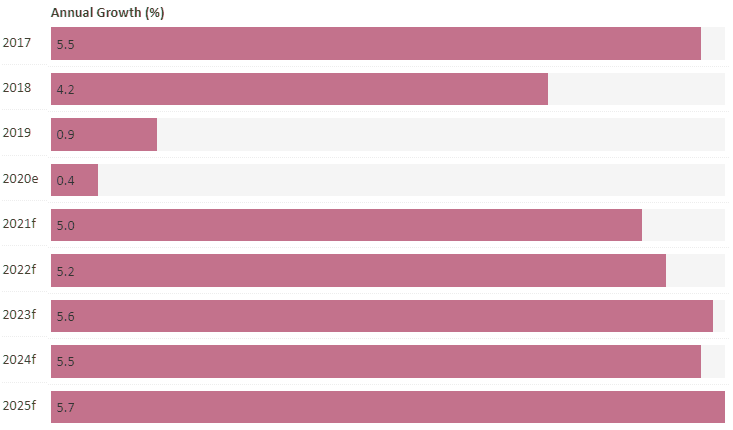

GlobalData’s insight report reveals that the motor insurance industry in Asia-Pacific will grow at a compound annual growth rate (CAGR) of 5.4% over 2020–2025, supported by the recovery in new vehicle sales and product innovation in motor insurance.

- The motor insurance industry in the Asia-Pacific (APAC) region is expected to grow by 5.2% and reach $249.8bn

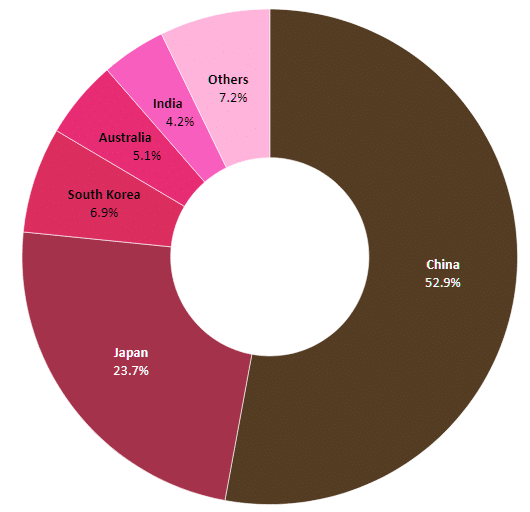

- China was the leading market in APAC with a 52.9% share in the region’s motor insurance premiums. Mature markets such as Japan, Australia, and South Korea collectively accounted for a 35.8% share

- The top 10 insurers accounted for 87.2% share of the Asia-Pacific’s motor insurance premiums

The motor insurance industry in Asia-Pacific (APAC) is projected to grow from $230bn in 2023 to $298bn in 2027, in terms of written premiums, according to GlobalData, a leading data, and analytics company.

After registering 0.4% growth, APAC region’s motor insurance industry is expected to report strong recovery with 5.1% growth. Recovery in vehicle sales, new product development coupled with the easing of lockdown restrictions will support demand for motor insurance.

Recovery in vehicle sales is mainly driven by growing sales of electric vehicles (EV) as many economies aim to phase out internal combustion engine vehicles as part of their climate goals.

For instance, Singapore aims to phase out diesel-powered vehicles by 2025, as a result, EV sales rose by over 80%.

Motor insurance in Asia-Pacific, premiums and grow

As governments across the region rushed to impose partial or full lockdown in 2020 following the COVID-19 outbreak, the shock on the automotive sector was considerable, as it grappled with production halts by component manufacturers, supply chain disruptions, declining domestic sales and export volumes, and subsequently registering temporary layoffs as an aftermath of production halts.

APAC Motor Insurance Industry – Written Premium

APAC Motor Insurance Industry – Annual Growth

Even after economic recovery, a global shortage of semiconductors adversely impacted the sale of passenger vehicles in 2021 and its impact is expected to persist over the short term. With the gradual recovery in market conditions, demand for electric vehicles and product innovations such as usage-based insurance is expected to support the industry’s growth over the next five years.

During the lockdown, the demand for customized motor insurance surged particularly from ride-share services providers such as Uber, Tada (South Korea), and Ola (India).

Insurers are also focusing on product innovation to drive sales. Pay-as-you-go and short-term car insurance are examples of products that gained traction during the lockdown as demand for customized motor insurance surged particularly from ride-share services providers such as Uber, Tada (South Korea), and Ola (India).

Country-Wise Distribution of Motor Insurance Premium

Conducive regulatory policy on FDI will cater to business expansion for multinational insurers

Relaxation in FDI in insurance in many markets including China and India is expected to create a new market opportunity for multinational insurers. For example, after the FDI limit was enhanced in India, Japanese insurer Tokio Marine increased stake in its joint venture IFFCO-Tokio.

Similarly, after Myanmar liberalized its insurance industry, another Japanese insurer Sompo Japan formed a joint venture with AYA Myanmar General Insurance.

Overall, four out of the top 10 regional insurers were based out of Japan and collectively accounted for 64.8% of the market share. They included MS&AD Insurance Group, Tokio Marine, Sompo Holdings, and Sony Assurance Inc.

China is the largest motor insurance market in the region with a 52.9% share of premiums. The country’s growing middle-income population and rising disposable income are the key drivers of motor insurance growth. The motor insurance premium in China is expected to grow by 5.7%.

China’s motor insurance industry will also be supported by the undergoing reforms through which the regulator aims to control premium prices and develop commercial motor insurance. The penetration of commercial motor insurance is very low in the country due to a lack of insurance availability and high premiums. With this reform, motor liability premium prices were lowered by up to 50%.

Japan, South Korea, Australia, and India are among the region’s top five markets, with a collective share of 39.9%. Motor insurance premiums in these markets are expected to grow by 2.5%, 3.7%, 13.8%, and 3.2%, respectively.

APAC motor insurance industry is expected to maintain its growth trend over the next five years. However, the industry is exposed to the resurgence of COVID-19 pandemic and the ongoing supply chain disruption, which can impact the premium growth.

Competitive Asia-Pacific insurance landscape

MS&AD Insurance Group, Tokio Marine, Sompo Holdings, Fubon Insurance and Axa were the top five insurers, with a collective share of 73.8%.

Overall, five out of the top 10 insurers were based out of Japan. Apart from the top three, The Kyoei Fire & Marine Insurance and Secom General Insurance were the other two Japanese insurers that were ranked seventh and eighth, respectively.

Along with the demand from agriculture, insurance to cover large-scale ongoing projects such as one-belt-one-road and renewal energy projects aided in the growth of property insurance in China.

Australia, India, and South Korea with a collective share of 30.8% were among the top five markets in the APAC region.

In India, agriculture and fire insurance are key lines of property insurance with agriculture accounting for over 60% of the property insurance premiums in 2020. Premium collection from this business line is expected to be impacted by the 2020 regulation, in which the government withdrew the provision of mandatory insurance to secure agriculture loans.

Economic growth and growing demand from agriculture industry will support demand for property insurance in APAC region over the next five years. Product development for affordable Nat-cat insurance will be another focus area for insurers over the coming years.

………………………….

AUTHOR: Kotu Keerthi Naimisha – Insurance Analyst Global Data

Edited & Fact checked by