The U.S. commercial lines insurance segments are being challenged by slower revenue growth, inflation-based claim uncertainty and less favorable loss reserve experience. The sector will see a combined ratio of 97%–98% for 2023 vs. 96% in 2022, according to Fitch Ratings.

While commercial lines reported statutory underwriting profits in four of the last five years, net written premium (NWP) growth is likely to slow in 2023 to 6%–7% YoY, vs. 10% in 2022 and 15% in 2021.

Global commercial insurance market outlook

According to Commercial Insurance and Reinsurance Market Outlook, pricing cycles in the commercial insurance and reinsurance sectors are now converging, marked by price increase moderation overall for the former, albeit with strengthening in challenged areas, and rapid acceleration (dislocation even) for the latter.

The global commercial insurance market is projected to reach $1,613.34 billion by 2030, growing at a CAGR of 9.7% from 2022 to 2030.

The convergence of geopolitical and macroeconomic shocks – war in Europe, fractured energy markets, 40-year high inflation, interest rate hikes, depleted capital – as well as the second most expensive natural disaster ever (Hurricane Ian), has introduced significant volatility into the market.

Capital erosion of 15.7% to USD 355 billion at YE22, the first full-year decline since 2008, together with significantly higher premiums, sent the sector’s solvency margin ratio (capital divided by premiums) to below 100, a level last recorded during the global financial crisis.

Increase in competition among small and medium sized business and availability of large number of commercial insurance providers are some of the major factors that propel the commercial insurance market forecast (see Commercial Insurance Pricing by Region).

Increase in need for insurance policies among the enterprises to protect business from pandemic scams is considered as an important factor boosting the global commercial insurance market.

However, high insurance premium of commercial insurance and lack of information among small-sized businesses about commercial insurance are some of the factors that limit the market growth.

Furthermore, surge in usage of telematics device in insurance, retail, construction, and healthcare industries and adoption of advanced technology in commercial insurance are some of the major factors expected to create an immense opportunity for the market in the upcoming years.

Global commercial insurance pricing rose 4% in the fourth quarter of 2022, compared to 6% in the prior quarter, according to the Marsh Global Insurance Market Index.

The overall pace of pricing increases slowed for the eighth consecutive quarter; increases peaked at 22%

Insurance pricing in the fourth quarter of 2022 in the US increased by 3%, compared to 5% in the prior quarter.

Property insurance pricing increased by 11% in the fourth quarter, up from 8% in the third quarter and the twenty-first consecutive quarter in which pricing rose (see Global Natural Catastrophe & Hazard Review).

Total insured values increased by 10%, on average, in the fourth quarter. The pricing increases experienced by clients were largely driven by challenges in the reinsurance market leading up to the January 1 treaty renewals.

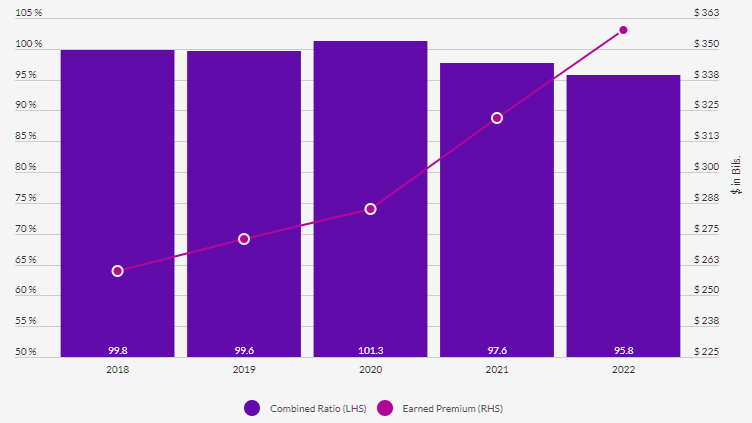

Commercial Lines Industry Aggregate Earned Premiums

The Estimated Combined Ratio for 2023 Should Moderate to 97% – 98%

An unprecedented four-year hardening phase of the commercial lines underwriting cycle will continue through 2023. The Council of Insurance Agents & Brokers’ (CIAB) commercial lines market survey indicates overall rates rose 8.8% in 1Q23, compared with 6.6% in 1Q22.

Rate momentum since 2020 was boosted by pandemic-related socio-economic uncertainty, followed by subsequent persistently high inflation.

Although pricing trends showed signs of moderating in early 2022, weaker loss experience and higher reinsurance costs are leading to a 2023 rebound in pricing momentum in property lines and, to a lesser degree, in the auto segment.

Workers’ compensation continues to post the best product segment insurance underwriting profits, with an average combined ratio of 89% from 1998–2022. Strong premium growth in 2022 from exposure changes, falling claims frequency and highly favorable reserve experience bolstered recent performance.

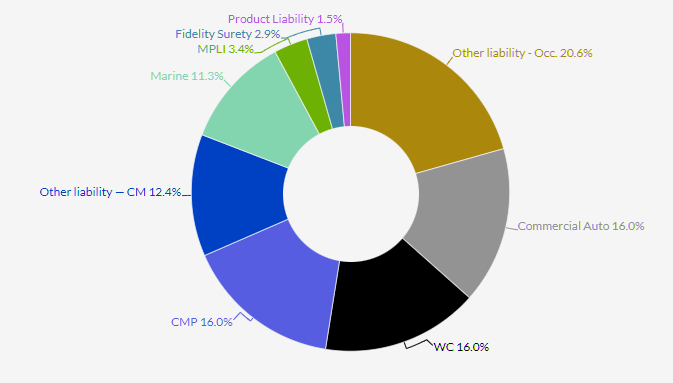

Commercial Lines Direct Written Premium

Direct Written Premium Growth of 11% in 2022 to $426 billion Should Moderate in 2023. The commercial auto line combined ratio worsened to 105%

Despite ongoing commercial auto premium rate increases, claims severity issues tied to higher auto parts and repair costs and litigation exposures will continue to challenge performance in 2023.

U.S. Commercial Lines Insurance Market Share

Commercial insurance performs a critical role in the world economy. Without it, the economy could not function. Insurers protect the economic system from failure by assuming the risks inherent in producing goods and services.

Top 10 insurers have 36% Market Share

| № | Company | Premiums, $ bn | Market Share |

| 1 | Chubb | 25.1 | 5.6% |

| 2 | Travelers | 21.8 | 4.9% |

| 3 | Liberty Mutual | 21.4 | 4.8% |

| 4 | National Imdemnity | 17.2 | 3.9% |

| 5 | Zurich American | 17.2 | 3.9% |

| 6 | AIG | 14.2 | 3.2% |

| 7 | CNA | 12.3 | 2.8% |

| 8 | Progressive | 10.9 | 2.5% |

| 9 | Nationwide Mutual | 10.4 | 2.3% |

| 10 | Hartford Financial | 10.0 | 2.2% |

| Rest of industry | 285.0 | 64% | |

| P&C Industry | 445.7 | 100% |

Property/casualty insurance can be broken down into two major categories: commercial lines or types of insurance and personal lines. Personal lines, as the term suggests, include coverages for individuals—auto and homeowners insurance. Commercial lines, which account for about half of U.S. property/casualty insurance industry premium, include the many kinds of insurance products designed for businesses.

There are over eight million small businesses in the U.S., ranging from construction firms to grocery stores to home-based businesses. Without the right insurance coverage, each could be wiped out by a disaster or a lawsuit. In addition, almost all businesses are accountable for the safety of their workers and bear responsibility for injuries suffered on the job.

Edited by