Over the past decade, the global life insurance and retirement industry has experienced increasing instability. A confluence of factors has deeply affected the industry’s performance in recent years.

The McKinsey Global Insurance Report offered a comprehensive overview of the challenges and opportunities facing the global insurance industry. The 2023 report builds on that work with a new level of granularity and precision of recommendations for how insurers can accelerate growth and exceed performance targets (see Term Life Insurance vs. Whole Life Insurance).

Beyond continued innovation and the shift in value toward distribution, the industry is also experiencing a structural shift toward more independent distribution.

Analytics covers life and retirement, including the major forces at play in the current life insurance industry, several ways insurers have adapted, and opportunities that life insurers and stakeholders can consider going forward—as well as the fundamental implications for their business models as a result.

Four paramount forces creating opportunities and obstacles for the industry

Four paramount forces will continue to shape the industry globally over the coming decade.

1. Growing awareness of personal risk and uncertain availability of socially funded benefits

The number of people over the age of 65 globally is expected to increase from 9.8% to 17%—from 0.78 billion to 1.67 billion—over the next 30 years. Asia is expected to drive about 67% of this increase, with China accounting for nearly 25% of that total and India making up 20%.

More citizens are realizing that they are personally responsible for their future health and retirement costs: advanced economies’ governments have become more indebted, and government health and retirement programs— such as the United States’ Social Security program and Japan’s National Pension System—are experiencing funding gaps, resulting in a nearly $41 trillion global pension gap (see 16 Most Common Life Insurance Myths).

This realization, however, is creating opportunity for insurers in the industry.

2. Near-term tailwinds from rising nominal rates, but real rates may remain low for long

Nominal interest rates will remain elevated in the foreseeable future as central banks look to get inflation under control. This is in sharp contrast to what we have seen over the past two decades, which have largely consisted of quantitative easing and ultralow nominal rates.

In the near term, life insurers may use these tailwinds to passively capture growth opportunities, especially as asset rotations on the investment side happen quicker than adjustments on the liability side, which results in higher spread.

In the medium term, however, investors’ return expectations will increase as volatility pushes up nominal risk-free rates and risk premiums, requiring life insurers to deliver a higher ROE to meet shareholder expectations (see about Digital Life Insurance).

Furthermore, higher interest rates could also result in deteroriation of credit, resulting in higher delinquencies and ratings migration, which could directly affect investment portfolios.

The near-term tailwind of increasing nominal rates is further mitigated by broader macroeconomic uncertainties and increased equity volatility, which influences valuations for public carriers, diminishes consumer confidence, and increases the hedging costs associated with many product lines, such as variable annuities.

Despite high nominal rates, real rates are low and are likely to remain so. The metric that has long been most closely correlated with real long-term rates is the five-year change in the share of the working population in the world’s major economies.

Over the past 30 years, that growth rate has decreased and is expected to continue trending downward.

3. The growing role of technology

Customer expectations are increasing when it comes to level of service, including the desire to integrate digital technology with conventional products (see Life Insurance Industry Results).

As such, many companies have shifted their business models to increase their adoption of disruptive technologies such as cloud computing and applied AI and have used more agile ways of working, as well as new talent attraction strategies.

Considering this (and that insurers are cleaning up complex legacy systems and platforms to invest in the future), even efficient life insurers—those in the top quartile of total costs to gross premiums written—have increased their IT spend from 2% of gross premiums to 3% (a 50% jump) within the past four years.

4. Rise of Asian economies and the return of geopolitics

A new middle class has begun to emerge in Asia and other developing economies. In China, India, and Southeast Asia, the middle-class population is projected to grow to 1.2 billion people by 2030 and make up nearly 14% of the total global population.

The trend implies that a greater share of the world’s population may need access to accumulation products, which brings opportunity for accelerated growth in these markets.

However, seizing the full potential of these opportunities won’t be easy given renewed geopolitical risks and concerns. High growth potential in Asia, combined with a growing risk of investing across geopolitical fault lines, suggests that insurers must take a nuanced approach to geographic expansion.

An industry at the crossroads

These forces have been affecting industry performance, shifting the sources of value creation and accelerating structural changes. A look at the current dynamics in the industry offers a compelling case for action.

Disappointing performance and declining industry relevance

A confluence of factors, some in direct control of life insurers and others exogenous, has deeply affected the industry’s performance in recent years (see Why You Should Get Life Insurance?).

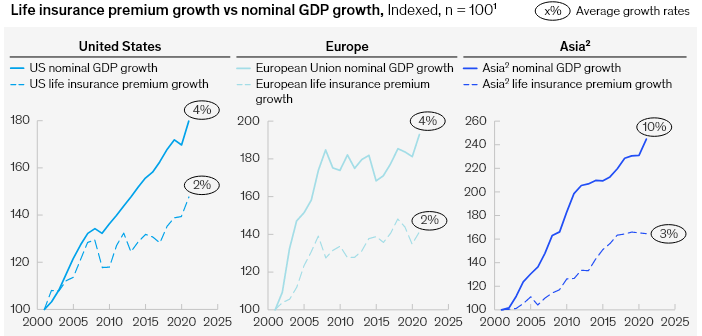

Nominal GDP growth has far outpaced premium growth. Life insurers have faced several challenges delivering growth and returns. In the past two decades, economies grew faster than insurance premiums, indicating insurers haven’t been growing at the same rate as the economies in which they operate.

Life insurance premium growth is lagging nominal GDP growth across the globe

In the United States and Europe, nominal GDP grew at a CAGR of 4% over the past 20 years, but premium growth grew at a CAGR of 2%. In Asia (excluding Japan), economies grew at a CAGR of 10%, while premiums grew just 3%.

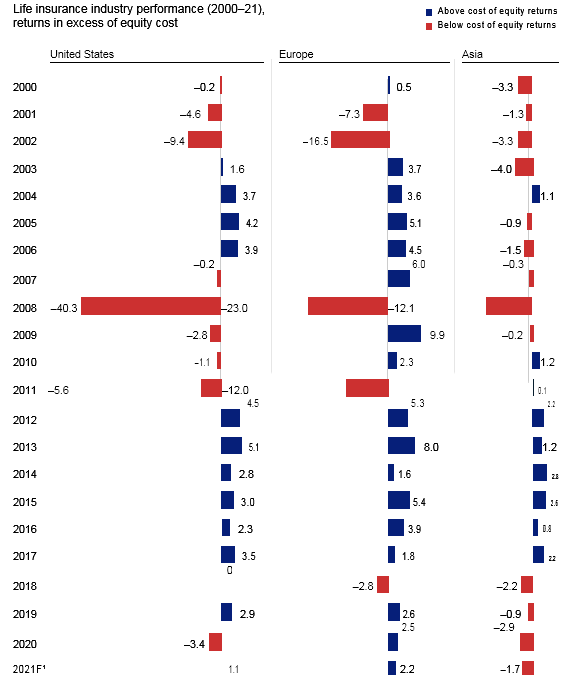

The industry has struggled to generate returns in excess of cost of capital. Over the same period, the industry struggled to generate profitable returns after the cost of capital.

Insurers have also struggled to change their performance relative to peers: of insurers that were in the bottom quintile of performance, nearly two-thirds remained in the bottom quintile ten years later (see Life Insurance Company Transformation Key to Sustainable Growth).

As an industry, life insurance has frequently offered returns below the cost of equity

Carriers have still not structurally addressed their cost base. Compared to other industries, life insurers have still not structurally addressed their cost base. Since 2003, costs as a share of revenues have increased by 23% for life insurers—compared to a 5% increase for P&C insurers—while other industries, including asset management, have been able to address costs. While these structural costs have been rising for two decades, the imperative to address them may have arrived.

Without targeted actions, the combined pressure of inflation and the talent shortage will likely drive up labor costs.

While some insurers have announced restructuring efforts over recent years to address cost, these programs have not yet reversed the global trend of rising cost ratios.

In our experience, some insurers have launched large, sustained programs to achieve productivity improvements of 10 to 20%. The most successful programs to date have combined growth initiatives as well as cost-reduction initiatives that have reinvested bottom-line savings to fund profitable growth (see about Life Insurance Digitalization).

However, many insurers find it difficult to predictably manage and execute growth efforts with the same rigor as expense initiatives.

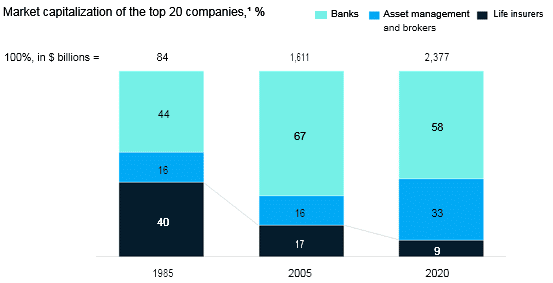

US life insurers have been experiencing declining relevance among investors

Life insurers’ relevance in capital markets has declined. The lack of returns after cost of capital, muted growth, high volatility in earnings, opacity of risks and sources of earnings and value, and lack of individual insurer performance mobility have caused the global life insurance industry to gradually lose its relevance with investors, particularly in the public markets.

This trend is most apparent in the United States, where the largest US life insurers’ share of market capitalization relative to other financial-services peers has decreased over the past 35 years—from 40% in 1985 to 17% in 2005 to only 9% in 2020.

This is according to McKinsey analysis of data on the TOP 20 life insurers, banks, and asset management and securities brokers in the United States.

Sources of value shifting

The value pools and sources of creation across the life insurance industry are not homogenous. Carriers face choices in products, components of the value chain, and geographies.

Huge dispersion in growth hot spots. While overall industry performance has been disappointing, across the globe there are some notable pockets of growth and opportunity.

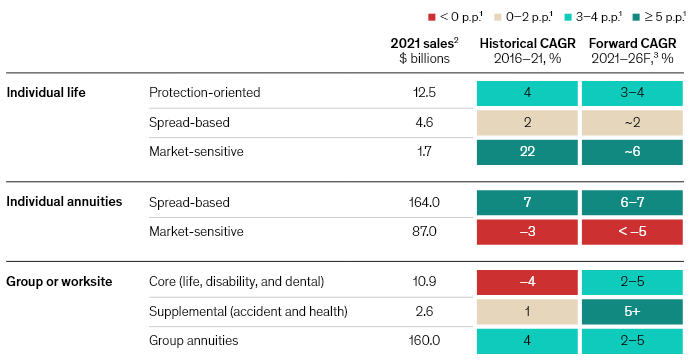

In the United States, market-oriented life products and spread-based annuities are forecast to experience high growth rates

In the United States, products that provide principal protection with some upside based on market performance (fixed and fixed-indexed annuities and variable universal life, for instance)—as well as simple, protection-oriented products (such as accident and health products distributed through worksite channels)—are expected to grow more than 5% between 2021 and 2026.

Over the same period, market-oriented annuity products where the customer bears most or all of the risk are expected to decline by more than 5%.

In Europe, unit-linked products show potential opportunity. The French market saw gross inflows increase by 51% between 2017 and 2021, while gross inflows decreased by 4% in general accounts.

In Asia, hot spots are both geographic and product-specific. Geographically, India and China are poised as long-term growth opportunities due to economic growth and demographic trends. In terms of products, Asian insurers have been focusing on addressing both high out-of-pocket expenses from private health insurance and growing retirement needs. Zeroing in on these hot spots of growth requires granular strategic thinking.

Value creation shifting to investment alpha. As interest rates have declined over the past two decades, the importance of investment alpha as a source of competitive advantage has increased. Despite near-term nominal tailwinds, low-for-long real rates will continue this shift toward investment alpha. Returns on conservative investment allocations have plummeted below the cost of holding traditional insurance liabilities, and in an environment in which it is cheap to raise capital, life insurers gain competitive advantage from growing high-yield assets. However, as insurers allocate to higher-yielding assets, they will have to prioritize risk concerns as they make investment decisions. That entails deliberately assessing their risk tolerance to ensure that their ability to manage those risks is aligned with the investments they’re making.

Carriers are now weighing the risks and fiscal costs to operate in developing economies. Companies have started to rethink what it means to be a “global insurer.”

Historically, life insurers looked toward markets that were similar to theirs—which also tend to be closer geographically—to expand market share and drive top-line growth.

As technological advancements accelerated the globalization process, insurers began to expand globally, particularly into Asia, to diversify their portfolios and increase valuations.

As the economics of the world have changed, insurers are weighing the risks and fiscal costs of operating in several regions.

Although many developing regions still present attractive growth opportunities, geopolitical risk, unfriendly regulations, and specific consumer demands have made insurers rethink their decision to enter new markets—or even to stay in ones where they already have a footprint.

As part of the ongoing cost-benefit analysis for entering or staying in certain markets, insurers now have to think about their ability to repatriate profits to their home country; assess whether economies of scale can

be or have been achieved; determine if valuations are giving sufficient credit for successful entry into these markets; and decide if entering these developing markets aligns with their overall strategic goals.

Big structural changes in motion

Entrants and new sources of capital are disrupting and pushing the structural evolution of the sector.

Private capital–backed platforms gaining relevance. The past decade has seen a continuous rise of private capital–backed platforms—typically fully or partially owned by alternative asset managers, which find the life insurance industry attractive for several reasons.

Primarily, they’re enticed by the opportunity to drive improvement in performance and by the potential to access “permanent” capital in the form of a stable pool of liabilities, which can be deployed into various asset strategies, from traditional fixed income to more structured products or alternatives.

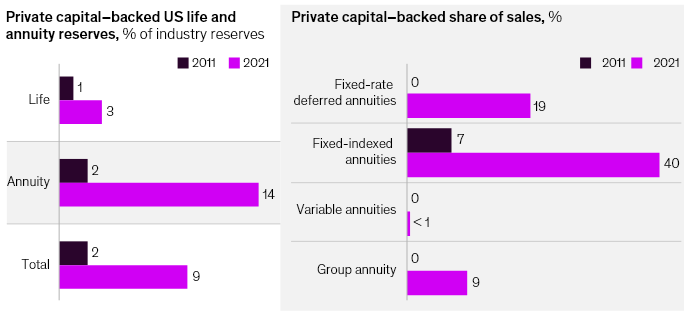

In turn, they can generate more predictable fee-based earnings streams while reducing the overall fundraising burden. In the United States alone, private capital–backed platforms account for almost $292 billion in general account reserves, making up about 9% of the industry stock, according to our analysis.

In the United States, private capital platforms own about 9% of industry reserves and have grown substantially in fixed annuities

These platforms also have significant market share in some categories of new business generation: among the leaders within each product line, private capital–backed platforms accounted for 40% of fixed-indexed annuities sales in 2021, up from 7% in 2011, and 19% of fixed-rate deferred annuities sales in 2021, up from zero a decade prior.

Structural shift toward more independent, third-party distribution. Distribution has been a source of outsize value creation for insurers that have wielded it successfully—that is, by staying ahead of both customer and adviser expectations.

Recent years have therefore seen within the distribution function significant innovation and structural shifts that have proven critical to competing with insurtechs—about 40% of which are focused on the marketing, sales, and distribution part of the insurance value chain.

A significant portion of this spending is directed at enhancing the digital tools, analytical capabilities, and technological connectivity that support a seamless end-to-end experience from manufacturer to distributor to customer.

In recognition of the power of earning streams from distribution, investors have tended to reward the capital-light earnings generation of pure-play distributors, such as brokerages, independent marketing organizations, and field marketing organizations.

Those players have generated 2.6 times the TSR of life insurance companies since 2010 and currently trade at nearly 2.8 times the price-to-earnings multiple of their life insurance counterparts.

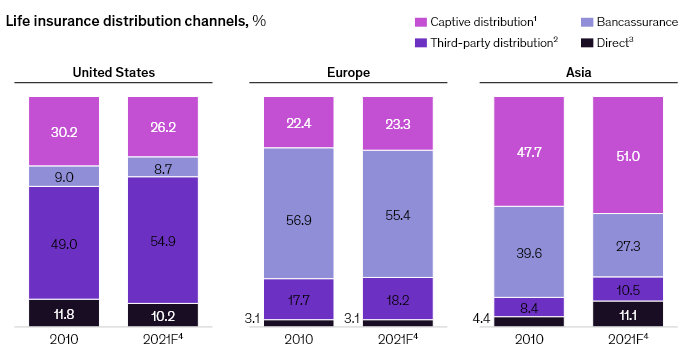

Beyond continued innovation and the shift in value toward distribution, the industry is also experiencing a structural shift toward more independent distribution.

Many companies have moved away from captive or affiliated distribution because of the increased commoditization of many insurance and annuity products and the increasingly open technology architecture and choice offered by insurance distributors.

In the United States, third-party distributors are increasingly becoming more dominant, expanding their share of the market from 49% in 2010 to a forecasted 55% in 2021; conversely, proprietary distribution networks are declining in prevalence, from 30% to 26% during the same time period.

In Europe and Asia, we can see a similar—although smaller—increase in third-party distributors. In the same time frame, Europe increased its market share from 17% to 18%, and Asia increased its share from 8% to 11%.

The United States, Europe, and Asia have seen a rise in third-party distribution networks in the past ten years

Within Asia, the share of third-party distribution is still low overall, and select insurers with high-quality, proprietary distribution will continue to see high value creation from this model.

Fundamental reimagination of life insurance business model

Insurers will have a dizzying number of options available to them in the coming years—as will investors. In the balance of this report, we detail how insurance companies will shift their priorities in the near future and how different types of insurance models can help determine how best to meet the objectives of their investors.

The question is clear: what strategic strengths can insurers depend on to generate growth in the coming turbulence?

Four ‘unbundled’ business models to drive value creation

Traditionally, insurers have achieved profit and growth by identifying attractive products and markets, such as individual protection and annuities, and structuring their end-to-end value chain to support these products and markets.

Ownership of most of the value chain was important to simplify operations and maintain control over the end-customer experience.

Today, the industry is reconsidering this approach to the value chain in two notable ways: product bundling and functional unbundling.

When it comes to products, those that meet the needs of the same customer segments—such as retirement and wealth and asset management services or group and retail sales—are converging, which is pushing insurers into new territory.

Some insurers will even go so far as to branch into the health and protection ecosystems if there is demand from their customers.

Insurers are also expanding and evolving their product shelf, shifting the mix away from traditional and balance sheet–heavy products to capital-light products and combining distribution points to create a simpler, more integrated customer experience.

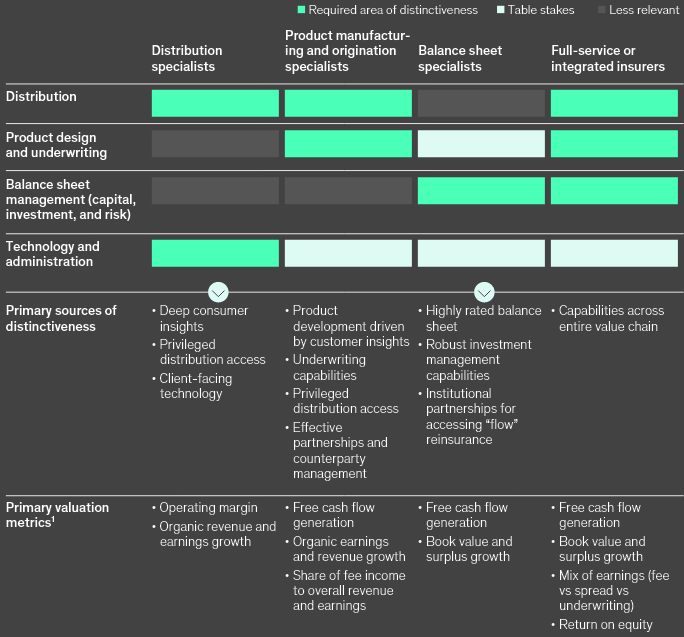

Looking ahead, insurers will increasingly “unbundle” their value chain and focus on sources of distinctive value creation while seeking partnerships or leaving the other parts of the value chain to those who are advantaged. Unbundling helps uncover value within the integrated business model and focuses on distinctiveness while creating new sources of growth and value.

Four insurance functions will take center stage during this change: product design and underwriting, balance sheet management, distribution, and technology and administration. Insurers can start by determining how the strengths of their business model map to these four functions.

‘Unbundled’ business models provide new pathways for value creation

Balance sheet specialists, for example, might consider finding a distribution partner, while distribution specialists tend to be best served by partners in product design and underwriting or balance sheet management. Those insurers can then use those strengths to differentiate themselves, achieve profitable growth, and appeal to investors.

Distribution specialists

Insurers that pursue this model will have distinctive distribution capabilities and privileged customer access and insights.

They will focus on advice and distribution of a broad range of insurance, wealth management, and other financial products taking a client-centric, technology-enabled approach.

They will have capital-light model with little to no product manufacturing and work with a broad range of partners for access to products.

This model will be attractive to public and privately owned insurers given the capital-light and fee-income-based earnings streams, which are typically more highly valued by investors.

Product manufacturing and origination specialists

Insurers that pursue this model will have privileged distribution access (proprietary or third-party), strong product development driven by customer insights, and distinctive underwriting capabilities.

While they may develop several products of varying capital efficiency, they will retain only the most capital-efficient products, such as simple protection, on their own balance sheets.

For more capital-intensive products, they can work with capacity providers via coinsurance, reinsurance, or white-labeling arrangements. Pursuing this model will help convert earnings streams that are more capital intensive to recurring fee-income earnings streams that are more capital efficient.

These insurers could also predominantly seek strong partnerships in investment management while selectively building capabilities in some asset classes. We anticipate many public insurers will gravitate toward this model given investor expectations of simpler business models and more stable, predictable, and capital-light earnings streams (such as funding agreements, pension risk transfer, and flow reinsurance) or inorganic sourcing (such as the acquisition and divestiture of legacy blocks).

Imperatives and priorities for life insurers

This shifting industry structure will create new opportunities for where and how life insurers create value, elevating the industry’s relevance to consumers and its attractiveness to investors. Insurers will have to chart a course through these shifts and choose their mode of value creation, which will be partly informed by their organizational goals and investor expectations.

In the life and retirement industry, six themes dominate the investment attraction agenda: top-line or market share growth, diversification (via geographies and products), societal and customer impact, low volatility of results and dividends, ROE, and capital generation.

Insurance companies are likely to focus on some combination of these themes based on their ownership type and specific owners.

Even within the broader classifications of insurers, however, individual insurers will have unique situations— and thus unique expectations. Below, we offer a simplified overview of how four broad insurance models could respond to organizational goals and investor expectations by using their strengths to differentiate themselves in the industry.

Insurers backed by private capital and alternative-asset-management players

These players’ strengths lie in their asset management and liability-restructuring capabilities. These strengths enable them to act as secure providers of capital for insurers divesting their closed books, as well as to expand and diversify their portfolios in a way that takes strategic advantage of their asset management capabilities.7 To fulfill their owners’ expectations, these insurers typically aim for a high ROE (typically in the high teens), combined with consistent growth trajectory.

As they look to the future, these insurers will want to proactively develop new growth vectors, such as more flow-based business beyond pure legacy M&A and international or geographic expansion.

Mutuals

Mutuals’ strengths lie in their reputation, high customer loyalty, strong captive distribution networks, low cost of capital, and potential for operational efficiencies at scale. Mutuals typically take a holistic approach to customer needs and aim to create a consistent, high-quality experience. Mutuals’ stakeholders can have a range of expectations but could typically prioritize customer and societal impacts and top-line and market share growth.

Stock-traded insurers

Stock-traded insurers’ strengths lie in their brand awareness, diversified business models, and governance clarity. They aim to deliver on their investors’ expectations, which typically include regular capital generation and cycle stability, resulting in low volatility in returns and dividends.

State-owned insurers

State-owned insurers’ strengths lie in distribution, low cost of capital, and their ability to make very long-term investments due to their role in society. Most state-owned insurers will typically aim to keep their premiums low while remaining financially stable and to be widely available for the residents of the state.

However, as demand for life products changes and becomes more specific for each consumer, these insurers should develop innovative products that are better suited to evolving customer needs.

They also need to keep up with the pace of digital transformation seen in the private sector, all while balancing these large investments with their solvency position. Finally, these insurers may have to address talent attraction—for example, to improve their underwriting capabilities and compete with insurers in the private sector.

Life insurers have responded to broader trends and industry shifts by reevaluating their traditional business models.

The industry will face persistent challenges in the coming years, such as returns after cost of capital and geopolitical risks, as well as new challenges and uncertainty, such as high inflation and volatile macroeconomic environments.

Nonetheless, there are pockets of optimism and opportunity for those who can identify, invest in, and capitalize on their distinctive capabilities to meet the expectations of their owners and stakeholders. Ultimately, a changing industry landscape can allow insurers to overcome current performance challenges by transforming both where and how they generate value.

………………….

AUTHORS: Vivek Agrawal – senior partner in McKinsey’s Minneapolis office; Ramnath Balasubramanian – senior partner in McKinsey’s New York office, Pierre-Ignace Bernard – senior partner in McKinsey’s Paris office, Bernhard Kotanko – senior partner in McKinsey’s Singapore office, Kristin Cummings Cook – consultant in McKinsey’s Stamford office.