US Life insurers’ significant capital and short-term liquidity make them unlikely to be forced sellers of real estate assets at distressed valuations, any commercial real estate losses are expected to remain within ratings sensitivities, according to S&P Global Market Intelligence.

Commercial real estate has been a hot topic for life insurers to address this year and has contributed to many of the large US life insurers experiencing a decline in stock value year to date through the third quarter.

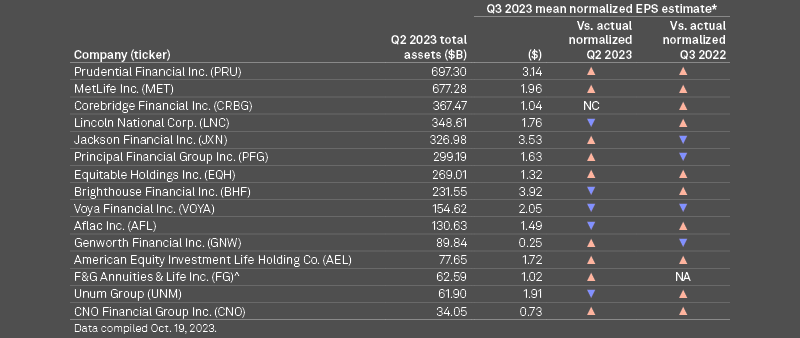

High EPS for most US life insurers in Q3 2023

Earnings projections for the sector lean positive, with 10 of the top 15 publicly traded US life insurers for which analyst estimates are available expected to book year-over-year increases in earnings for the third quarter. Of the 15 insurers, 9 are projected to see earnings increase sequentially.

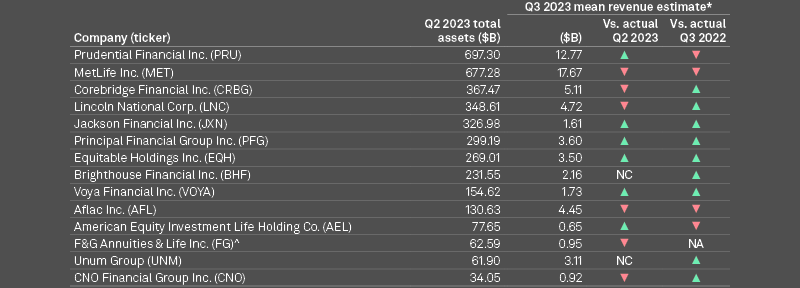

Revenue estimates for the group also skew toward growth, with more than half of the insurers for which analyst estimates are available expected to report stronger revenue figures on a year-over-year basis.

Revenue to increase for most US life insurers

US life insurers to see growth earnings

US life insurers are expected to see growth during third-quarter earnings while wrestling with the impact of higher interest rates, a dynamic annuities sector and the commercial real estate market’s effect on investment portfolios.

Life insurer positives include the higher interest rates in the quarter. The negatives are around weaker alternative investment returns and credit concerns given the higher asset leverage of the group and its CRE exposure.

Elyse Greenspan, Wells Fargo analyst

Although life insurers are expected to see some losses, particularly in the office portion of their commercial mortgage portfolios, those losses are not expected to be material and the group is largely projected to weather CRE deterioration due to the diversified and stable nature of their investment portfolios.

US life insurers feel impact of commercial real estate concerns

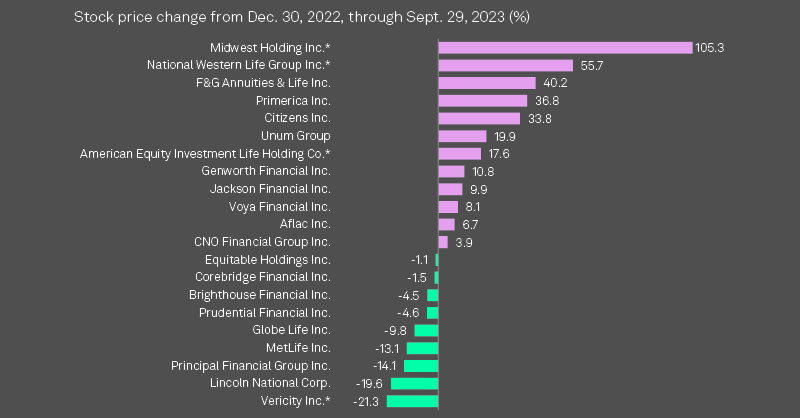

Shares of many large US life insurers underperformed leading indexes through the third quarter in contrast to some of their smaller peers.

Lincoln National, Principal Financial Group and MetLife were among those that experienced the steepest stock declines year to date, falling 19.6%, 14.1% and 13.1%, respectively.

By contrast, the S&P 500 posted an 11.68% gain through the third quarter, and the S&P 500 US Insurance Index grew 1.01%.

Several smaller life insurers experienced stock gains, such as Midwest Holding, F&G Annuities & Life and Unum Group.

Poor performance by some of the life market’s major players came amid investor concerns over the potential vulnerability of life insurers’ commercial real estate portfolios. Continued negative press surrounding the valuations of office buildings and certain other property types has persisted throughout the year as employers continue to evaluate their approach to remote working.

Large US life insurers underperform smaller peers

Barnidge noted that several of the big names trading down in 2023 had an “extremely strong stock” in 2022, pointing out that following up a strong year with another strong year can be difficult.

In terms of life insurers that have performed well during the year, many of them are getting acquired, which is causing them to trade higher.

Some of the major players faced individual challenges. For example, Lincoln’s $28 billion deal with Fortitude Re was supposed to close during the second quarter but did not, and it has faced difficulties with its mortality earnings and spread-based business that likely had an impact on the stock’s price as well.

Midwest Holding logged the greatest gain, with its stock growing 105.3% in 2023 through the third quarter. The company said in July that an affiliate of international investment firm Antarctica Capital would acquire Midwest for $27 per share in cash.

Strong diversification of insurer investment portfolios

Even with concerns surrounding commercial real estate, US life insurers are largely expected to weather commercial real estate deterioration as their investment portfolios are stable.

Similarly, most of the loans on their books were in good standing as of June 30, despite a spike in other-than temporary impairments on mortgages in the second quarter.

US life insurers have investment portfolios that are “fairly well diversified” in terms of geography and product type. I don’t think it will cause any of these companies to have significant overall losses or impair ratings or capital.

Mike Siegel, global head of the insurance asset management and liquidity solutions businesses at Goldman Sachs Asset Management

But there’s no doubt that there will be losses taken on the office part of the loan portfolio.

Insurers to see losses in the office portion of their commercial mortgage portfolios, but the impact is unlikely to be material overall.

Us life insurers to generally try to extend loans or restructure and reduce interest rates as they will likely be looking to avoid foreclosure and take on the responsibility of managing the real estate.

Whenever an insurer has to restructure a loan, it gets marked down to its market value, resulting in a loss.

……………

AUTHOR: Hailey Ross – insurance reporter with S&P Global Market Intelligence’s Global Insurance team