Insurers are under pressure to adapt to new frameworks for reaching net zero — but regulators are pushing at an open door, according to S&P Global Market Intelligence.

To fully reflect the importance of the insurance market, consider it one the largest global industries with more than USD 6 trillion in world premium volume and 36 trillion in global assets under management.

As risk managers, risk carriers and investors, the insurance industry plays a key role in supporting the transition to a resilient net-zero emissions economy.

In order to support and engage with the challenge- insurers need to adapt a consistent approach, by addressing the need to set global benchmarks, standardised methodologies for measuring and disclosing greenhouse gases (GHG) emissions associated with Re/Insurance portfolios. To achieve this, a cohesive approach will be needed to manage climate risks and opportunities.

Driving greenhouse gas emissions from the world’s energy sector down to net zero is still possible thanks to the fast growth of clean energy technologies, according to the latest update of the International Energy Authority’s landmark Net Zero Roadmap.

But what are the ramifications for the insurance industry, as policymakers, regulators and activists around the world continue to push the CO2 reduction agenda?

Insurers on webinar Future Directions In The Race To Net Zero see challenges around mandatory reporting and disclosure requirements in the short term. But the inexorable transition will also create opportunities for well-prepared businesses.

The IEA published its landmark report Net Zero Emissions by 2050: A Roadmap for the Global Energy Sector. The report set out a narrow but feasible pathway for the global energy sector to contribute to the Paris Agreement’s goal of limiting the rise in global temperatures to 1.5 °C above pre-industrial levels.

The Net Zero Roadmap quickly became an important benchmark for policy makers, industry, the financial sector and civil society.

Since the report was released, many changes have taken place, notably amid the global energy crisis triggered by Russia’s invasion of Ukraine in February 2022. And energy sector carbon dioxide emissions have continued to rise, reaching a new record in 2022.

Yet there are also increasing grounds for optimism: the last two years have also seen remarkable progress in developing and deploying some key clean energy technologies.

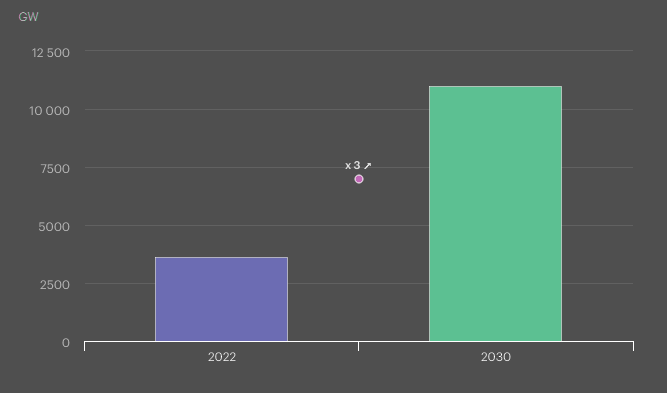

Global renewables power capacity

Ramping up renewables, improving energy efficiency, cutting methane emissions and increasing electrification with technologies available today deliver more than 80% of the emissions reductions needed by 2030.

The key actions required to bend the emissions curve sharply downwards by 2030 are well understood, most often cost effective and are taking place at an accelerating rate.

The scaling up of clean energy is the main factor behind a decline of fossil fuel demand of over 25% this decade in the NZE Scenario. But well-designed policies, such as the early retirement or repurposing of coal-fired power plants, are key to facilitate declines in fossil fuel demand and create additional room for clean energy to expand.

In the NZE Scenario, strong growth in clean energy and other policy measures together lead to energy sector CO2 emissions falling by 35% by 2030 compared to 2022.

Global renewables power capacity in the Net Zero Emissions by 2050

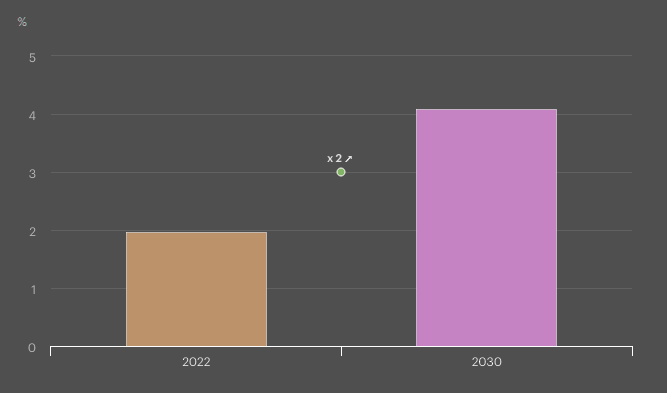

Global primary energy intensity improvements in the Net Zero Emissions by 2050 Scenario, 2022 and 2030

This 2023 update to our Net Zero Roadmap surveys this complex and dynamic landscape and sets out an updated pathway to net zero by 2050, taking account of the key developments that have occurred since 2021.

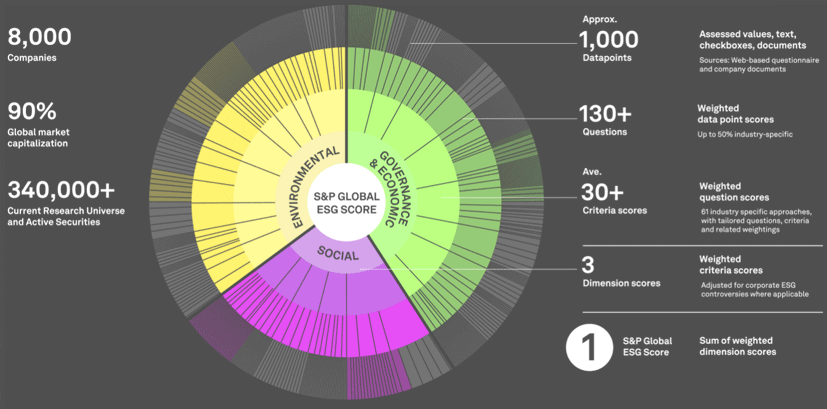

Climate-Related Financial Disclosures framework for Insurers

The Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD) framework for promoting informed investment, credit, and insurance underwriting decisions is the gold standard globally, said Nigel Brook, partner at the law firm Clyde & Co.

It is being adopted as the basis of mandatory disclosure regimes in many markets, especially the UK and Europe.

Insurers are responding to compliance differently, with some taking a minimal “tick box” approach whereas others consider it an integral part of their strategy planning.

Miqdaad Versi, partner at consultants Oxbow Partners

Overall, we see a direction of travel whereby the standards around disclosure and reporting will keep growing, he said.

Climate-related financial disclosures are moving up insurers’ agendas, but it is not yet clear how they will influence underwriters’ risk appetite, Ryan Bond, head of climate and sustainability insurance innovation at Marsh sayd.

Insurers must start engaging more closely with commercial clients to get a better understanding of how their future relationships might be impacted by climate risk disclosures. How well insurers communicate their intention will be paramount.

Importantly, the standards allow Convex to report against business opportunity as well as managing risk and effectively provide a framework for strategy, said Rachel Delhaise, group head of sustainability at Convex Insurance.

Insurers stay focused on net zero

The political attacks on the Net Zero Insurance Alliance are proving to be little more than a sideshow for insurers and their clients.

Unsurprisingly, the debate turned to the UN-convened NZIA, after more than half its founder members quit the group earlier this year amid concerns about breaching US antitrust laws.

The industry group responded in July by removing member obligations to set net-zero targets and publish their progress.

Despite exaggerated and well-publicised anti-ESG rhetoric from several US state attorneys general, there has been no slowdown in the number of requests from clients for advice on improving sustainability performance. Equally, insurers around the world will not loosen their focus on net zero as a big part of underwriting decision making.

Delhaise agreed by stating that more state regulators in the US are implementing NAIC coordinated disclosure surveys aligned with TCFD.

The overall direction of regulators towards more reporting from insurers and their clients will facilitate a path for the wider economy to reach net zero and ultimately create opportunities for insurers.

New insurance product and service development

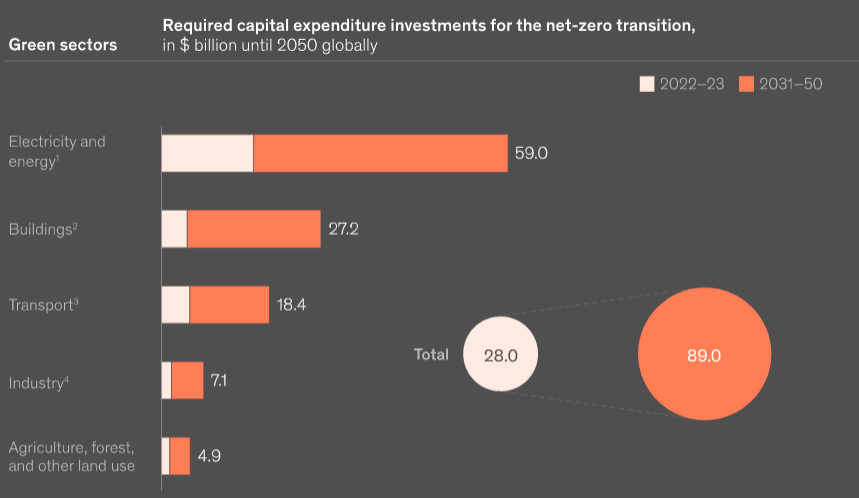

According to PwC research, considering the significance of net zero transition investments, you and your partners (including brokers, reinsurers and consultants) should identify opportunities to develop new products and services that facilitate low carbon growth.

This could include entering new markets like clean energy or climate tech, coverage enhancements for green buildings, establishing partnerships that offer embedded insurance, and offering climate risk management and emissions modeling services that support clients’ net zero transition.

Insurance Underwriting

Starting with your current underwriting portfolio, you should assess where you’re likely to have net new exposures arising from the transition to net zero that warrant underwriting action, including new underwriting guidelines and/or revision or clarification of risk appetite.

In some instances, climate-related exposures may warrant nonrenewal of accounts or withdrawing from certain markets altogether.

For example, more stringent emission reduction requirements and increasing public and government scrutiny of high-emitting sectors like oil and gas could increase liability risks — especially in the context of social inflation — for the insurers that cover them.

Insurance Pricing

You should assess net-zero-related risks and analyze available data to understand current pricing adequacy. Scenario analysis can help project the future claims environment and how to price coverages in order to meet target loss ratios.

This information can help you adjust pricing through the rate-filing process, where applicable, in order to cover new and emerging risks while maintaining profitability. Moreover, understanding emerging risks and how they could affect policyholders will enable you to advise them on risk mitigation.

Insurance Claims

To effectively categorize the claims that climate change affects, you should verify that existing claim type classifications are adequate to categorize emerging claims behavior and that existing systems can appropriately capture relevant data.

Examples of data fields are the portion of a property loss that can be attributed to climate change, and the materials required to repair a property to the extent they’re dictated by new green regulations. This will help you better understand the types of claims you’re likely to receive in the future and adjust processes and systems accordingly.

Risk management and mitigation

You should assess the appropriateness of existing risk mitigation strategies in the context of climate change. This should include analyzing current portfolio risk metrics and choosing relevant (e.g., emissions-related) metrics. You’ll need to take into account developing regulatory guidance from state departments of insurance and federal regulatory bodies, considering the location of risks and the jurisdictions where they’re underwritten.

Reinsurance structuring and purchasing

You should assess existing modeling of claims emergence and how claim distributions could change under different climate change scenarios. This can help you determine the adequacy of current reinsurance structures should future claims behavior change.

Net-zero underwriting in P&C insurance

P&C insurers need to position themselves to capture net-zero transition growth opportunities. Whether by setting net-zero commitments or responsibly steering the portfolio, the time to act is now, according to McKinsey Report.

While progress related to portfolio emissions transparency and target setting varies by geographies and is a popular focus primarily of European insurers and NZIA members, the growth opportunity presented by the net-zero transition is a key strategic priority for insurers around the world.

Irrespective of public commitments and geography, those that take early steps toward technologies and sectors that support the net-zero transition are likely to generate a first-mover advantage—just as insurers that built early capabilities in renewable energies are now leading the market.

Investments in green sectors – new potential for insurers

P&C insurers aspiring to contribute to the net-zero transition need to take a comprehensive approach to sustainability. Underwriters should proactively seize the opportunities resulting from the transition and position themselves as strategic partners to sectors and technologies that support net-zero efforts.

Insurers can directly support the net-zero transition through risk transfer, prevention, and mitigation solutions.

On top of this, P&C insurers should understand their own underwriting portfolio emissions and evaluate levers to advance decarbonization across industry sectors.

Integrating the emissions perspective into underwriting will require substantial upgrades in technical and nontechnical capabilities, additional data, and a cultural shift to establish an additional “emissions perspective” in portfolio management and frontline underwriting decisions.

European sustainability directive

Insurers active in Europe need to gear up for yet more sustainability related compliance. The Corporate Sustainability Reporting Directive (CSRD) came into force in January 2023 and expands the scope of the non-financial reporting directive.

It is also intended to ensure that the information reported is consistent, relevant, comparable, reliable, and easy to access. CSRD extends beyond the TCFD since it creates “double materiality”.

Insurers will have to report on the impact they are having on the environment as well as the environmental risks they face; it applies right across the value chain and will be phased in by company size by 2029

The new rules will apply not only to EU companies but any company doing business in the region.

The concept of materiality is important, said Versi, as it could force insurers to gather more data from insureds around their emissions, for example. It follows that insurers will then take on a stewardship role in the wider economy. While generating more work for insurers, CSRD could potentially lead to new opportunities.

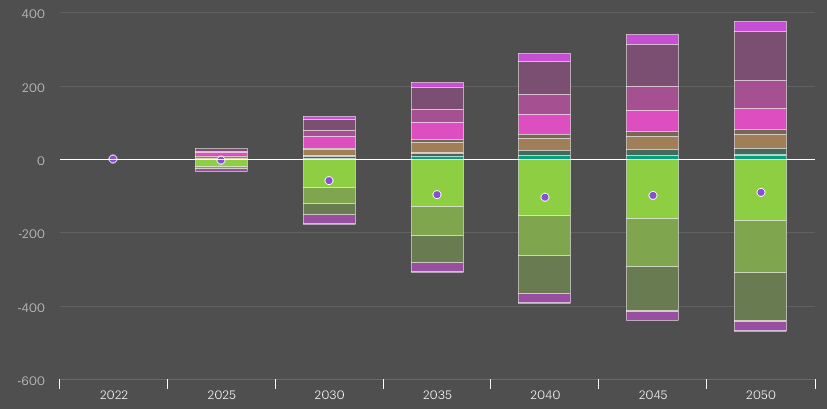

Changes in total energy supply by source in the Net Zero Scenario, 2022–2050

CSRD will have wide ramifications, up and down the value chain. Insurers would need to be proportionate in the disclosure demands they impose on clients right now, however, to reflect the progress they will make on sustainability over time.

Summing up, the panellists agreed that the coming few years will be challenging for insurers as they try to navigate emerging standards and expectations around the world’s markets. But, in line with the IEA’s bullish outlook on the demand for renewable energy, the commercial opportunities from this new environment are expected multiply.

…………….

QUOTES: Nigel Brook – partner at the law firm Clyde & Co, Miqdaad Versi – partner at consultants Oxbow Partners, Ryan Bond – head of climate and sustainability insurance innovation at Marsh, Rachel Delhaise – group head of sustainability at Convex Insurance

Contributed by PwC’s Xavier Crepon, Veronika Torarp, Graham Hall, Kyle Austin and Neha Srivastava