US life insurers are expected to see a benefit to investment income amid high interest rates in 2024, but investors will likely still be watching for potential issues related to their commercial real estate portfolios, according to S&P Global Market Intelligence.

The 10-year Treasury yield, which serves as a benchmark for insurers’ new money yields, has been growing over the past couple of years.

As of Dec. 29, 2023, the 10-year Treasury yield sat at 3.88%, an increase from 1.63% at the start of 2022.

Analyst Josh Esterov pointed out that new money rates are “well ahead” of insurers’ portfolio book yields despite the potential for the Federal Reserve to start cutting rates this year. “That’s going to be a medium- to long-term kind of tailwind for the industry,” Esterov said.

Life insurers’ commercial real estate portfolios

Life insurers’ commercial real estate portfolios have been a hot topic, particularly as the market for office space saw challenges in 2023. Concerns over exposure persist even though company executives have used earnings calls to try and assure investors that any potential problems in commercial real estate are manageable.

Enhanced scrutiny of growing private-equity investment into the insurance space may also be on the docket in 2024.

In the Financial Stability Oversight Council’s 2023 annual report, the council noted the increasing influence of new entrants in the life insurance space including private equity and alternative asset managers.

“The Council recommends that [the Federal Insurance Office], along with the National Association of Insurance Commissioners (NAIC), work with member agencies to evaluate the potential impact of these trends on systemic risk and associated financial stability considerations,” the report said.

In 2024, the life insurance sector is facing challenges regarding a fiduciary rule proposed by the US Labor Department.

This rule intends to redefine what constitutes investment advice under the Employee Retirement Income Security Act, aiming to reduce what are termed as “junk fees” in retirement product investments.

Insurance industry trade groups have expressed strong opposition to this proposed rule in a hearing in December 2023. They argue that existing regulations are sufficient. Additionally, at least one insurance commissioner has shown disapproval of the proposed rule. The deadline for public comment on this rule was set for January 2.

Largest life insurance players

Regarding the market landscape, Metlife emerged as the largest life insurance company in the US and the seventh globally in 2023, despite its stock performance being second-worst in the US life insurance sector with a 7.5% decline.

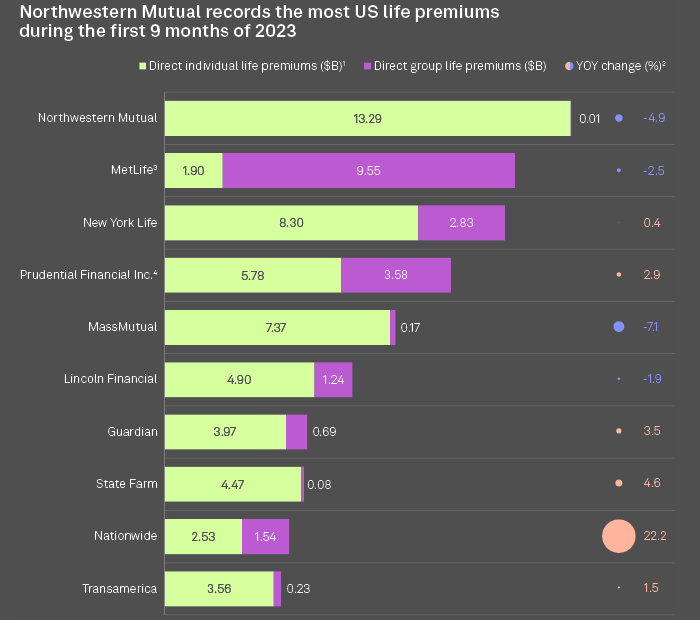

The largest US life insurers in terms of premiums were Northwestern Mutual Life Insurance, MetLife, and New York Life.

The majority of Northwestern Mutual’s $13.30 billion in direct premiums came from individual life business. Metlife recorded $11.45 billion in total direct premiums, with $9.55 billion from group life business. New York Life was close behind with $11.13 billion in total direct life premiums.

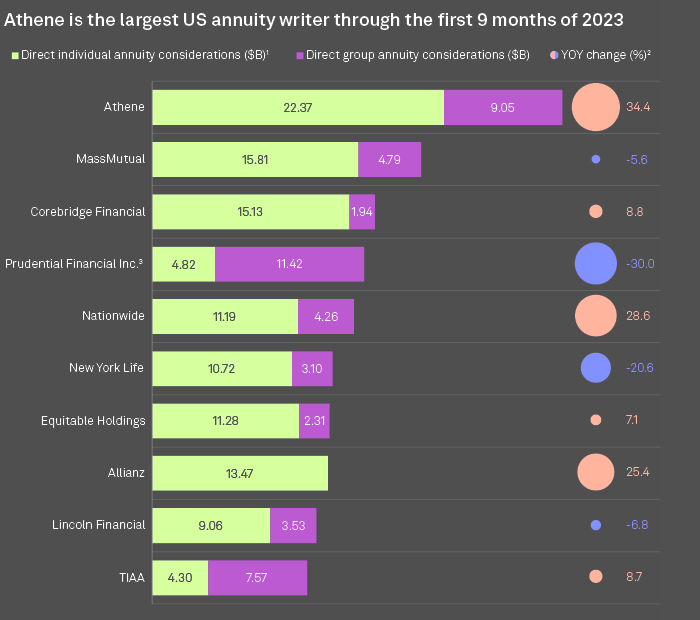

Meanwhile, Athene Holding Ltd. was the top US annuity writer with a total of $31.42 billion in combined direct individual and group annuity considerations reported in the first nine months of 2023. Athene also saw the largest year-over-year change with 34.4% growth in the same time period.

Massachusetts Mutual Life Insurance Co. and Corebridge Financial Inc. had the second- and third-highest amount of combined direct individual and group annuity considerations, reporting $20.6 billion and $17.07 billion in total considerations, respectively.

Moody’s Investor Services classified the US life sector as being “stable” for this year noting that the higher interest rates “support portfolio yields” as well as a “robust sales pipeline” for certain products such as fixed-rate deferred annuities.

“The influx of private capital in the sector will raise asset risk, and insurers will face credit deterioration over the next several years in their sizable commercial real estate portfolio,” Moody’s said.

Outlook for the U.S. life insurance industry in 2024

The outlook for the U.S. life insurance industry in 2024 is shaped by several key trends and transformations, as highlighted by various industry reports.

Strategic Mergers and Acquisitions (M&A)

The industry is expected to witness a ramp-up in strategic M&A activities. With the stabilization of interest rates, insurance companies are likely to shift from a passive acquisition approach to a more strategic one, focusing on divesting non-core businesses and acquiring firms that provide new capabilities, especially in the insurtech space. This trend is driven by the desire to improve competitive positions and drive growth.

Impact of Generative AI and Technology

The integration of Generative AI is set to transform operations and reduce costs in the insurance sector. This technology is anticipated to enhance communication with policyholders, streamline claims processing, and reduce fraud.

However, the adoption of AI also brings challenges, including algorithmic bias and privacy concerns, and requires navigational guidance due to a lack of regulatory clarity.

Talent Shortage and Skills Development

Addressing the talent shortage remains a critical focus. Finding employees with technology expertise is crucial for companies aiming to build customer-centric business models. As a result, there is an emphasis on attracting tech-savvy talent and upskilling current employees to adapt to the changing work environment.

Changing Distribution Landscape

The distribution landscape in the life insurance sector is experiencing significant changes. There has been considerable consolidation in the independent-advisor and broker-dealer channels, leading to fewer but larger distribution partners with increased influence.

Third-party distribution, which includes independent advisors, broker-dealers, and banks, has been growing at a rate higher than career agent channels. This growth is driven by customer preferences for a broader set of choices and more sophisticated products.

Technology and AI in Distribution

The use of new technologies like generative AI has the potential to greatly increase productivity across the insurance value chain, particularly in marketing and sales.

However, the industry’s broader distribution models and processes may still be in the early stages of transformation, and insurers not at the forefront of technological change risk being disrupted by more agile competitors.

Insurance Consumer Preferences

The U.S. consumer profile has evolved, with many individuals now seeking comprehensive advice and solutions that span various aspects of their financial well-being.

Younger consumers, in particular, are looking for advisors who can address their financial needs holistically. This shift is leading life and annuity carriers to rethink their distribution approaches and engage more effectively with their distribution partners.

In summary, the U.S. life insurance industry in 2024 is poised for transformation, driven by strategic M&A, the integration of advanced technologies like AI, addressing talent gaps, evolving distribution channels, and changing consumer preferences.

These factors underscore the need for the industry to remain agile and innovative to maintain competitiveness and relevance.

……………………

AUTHORS: Hailey Ross – insurance reporter with S&P Global Market Intelligence’s Global Insurance team, Kris Elaine Figuracion – Insurance Associate at S&P Global Market Intelligence