US life insurers are expected to report improving mortality results for the second quarter and field questions related to credit risk as concerns mount over the industry’s exposure to commercial real estate, according to S&P Global Market Intelligence data.

Credit risk was a hot-button issue for life insurers in the first quarter. Many life companies released commercial real estate disclosures in an attempt to quell investor anxiety, but scrutiny over exposure to the sector is likely to continue, particularly as worries around office space grow.

Credit losses and ratings migration impacts have been fairly modest for life insurers to date despite the uncertain macroeconomic environment

Ryan Krueger – Keefe Bruyette & Woods analyst

Most life insurers continue to return capital in normal course, and we don’t foresee meaningful credit impacts yet. Most of the leading US life insurers experienced a year-over-year drop in total revenues.

The life insurance protection gap

The mortality protection gap, defined as the disparity between the necessary resources required to maintain a household’s living standards and the available financial assets, life insurance coverage, and social security benefits, has reached an alarming all-time high in 2022, according to Swiss Re Institute’s Sigma Report.

The global mortality protection gap amounted to a staggering USD 406 billion in 2022, representing a 1.5% increase from the previous year and a USD 49 billion rise compared to a decade ago.

The mortality resilience index (I-RI) stands at 43.4%, reflecting a significant shortfall in household assets of approximately 57% (see Life Insurance Value Chain).

The widening gap is attributed to unfavourable economic conditions, including high inflation, eroding purchasing power, surging wages necessitating greater protection, and volatile financial markets depleting household assets.

The problems of Life Insurance industry

Traditional problems that have plagued the Life Insurance industry for decades—such as earnings sensitivity to external factors and opaque risks that investors are challenged to underwrite—will remain.

More recently, fundamental changes in industry structure have created significant competitive pressure.

According to Life Insurance Value Chain Report, the emergence of private capital–backed platforms—which have evolved their primary focus to include new sales as well as the acquisition of legacy blocks of business—has changed the game in new-product development, where such platforms have become leaders in several retail and institutional categories.

33% of life insurers outsource more than 50% of their assets to unaffiliated managers.

Life insurers with less than $10 billion of assets—which represent $267 billion of general account assets —may be prime early candidates on which to grow such businesses and to capture the capital-light, fee-based income they offer.

Investment income and risk transfer trends

Analysts expects to see improving mortality results in the second quarter, which would particularly favor names like Globe Life and Reinsurance Group of America (see How Life Insurers Prepare for the Future).

The industry is set to report “relatively normal” underwriting experience in the second quarter.

There continues to be some excess deaths in the US population, but at a much lower level than the pandemic.

Volatility in quarterly mortality will likely continue, but it’s challenging to predict.

Variable investment income in the second quarter remains a wildcard. Variable investment income had been a headwind for the last several quarters, but since markets have been higher in recent quarters it should boost fee-based businesses.

MetLife is expected to conduct its office revaluation in the second quarter and Prudential Financial is expected to undertake its annual actuarial assumption.

Prudential made “significant assumption updates” in 2022, and there will likely be fewer impacts for the overall life industry this year after the adoption of the long-duration targeted improvements, or LDTI, accounting standard.

Risk transfers are also expected to be a hot topic as a good chunk of the life insurance universe has sold itself or announced risk transfers over the past several months.

Piper Sandler – analyst John Barnidge

Just earlier this week, Prudential agreed to reinsure approximately $12.5 billion of reserves backing its guaranteed universal life policies with Somerset Reinsurance.

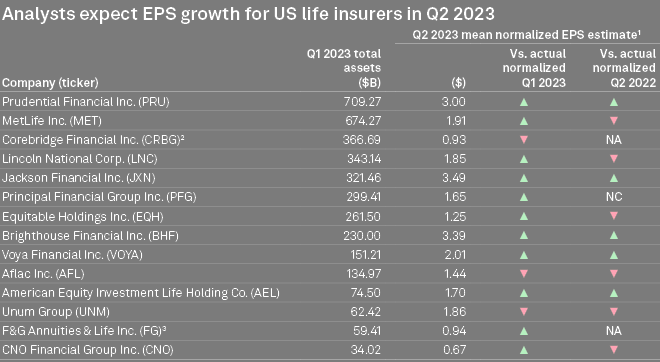

Life insurers earnings forecast

Earnings projections for the sector are mixed, with five of the top 15 publicly traded US life insurers for which analyst estimates are available expected to book year-over-year increases in earnings for the second quarter.

11 of the 15 insurers are projected to see earnings increase sequentially.

Life insurance leaders who take a deliberate, unbundled approach to their business—and double down on their strengths—will outperform in the decade ahead. Making this transition will not be easy, but failing to act will only result in further challenges.

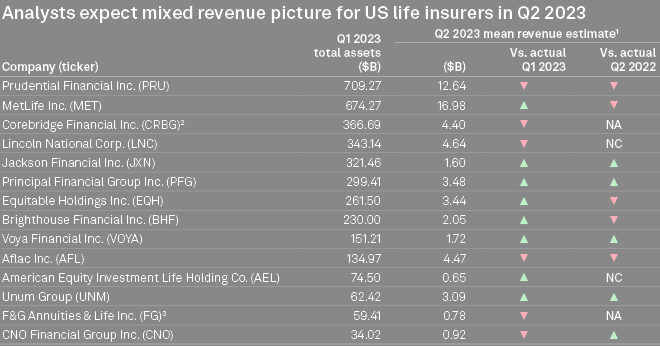

Revenue estimates for the group are evenly split, with half of the insurers for which analyst estimates are available expected to log stronger revenue figures on a year-over-year basis and the rest projected to see weaker revenue. Two insurers are expected to see no changes year over year.

According to McKensey, US life insurers also face drastic changes in other parts of the value chain. In general account asset management, a significant spread between top- and bottom-quartile performers has emerged as poorer performers struggle with dynamic asset allocation as well as investment performance within each allocation.

The majority of insurers in the group are estimated to book higher revenue when compared to the first quarter.

Beyond the retail annuity segment, these platforms are rapidly expanding their position in institutional categories, such as funding agreements and structured settlements, as well as in pension risk transfer, which has now surpassed $200 billion in assets alone (see Global Insurance Markets Trends and Forcasts for Life & Non-Life Insurance).

In the past decade, market positions on the life insurance side have drastically shifted, as well.

………………

AUTHORS: Hailey Ross, Jason Woleben – S&P Global Market Intelligence analysts.

QUOTES: Ryan Krueger – Keefe Bruyette & Woods analyst, Piper Sandler – analyst John Barnidge