At a macro level, investment managers are bullish about Artificial Intelligence’s potential to contribute to global economic growth over the coming years. Managers also anticipate positive impacts on a range of structural aspects across the market and investment backdrop, although risks and barriers to unlocking AI’s full potential remain at the forefront of managers’ thinking, according to Mercer’s AI integration survey.

Beinsure Media collected most responses from Mercer’s survey investment management, technology, and business development teams of asset management companies listed in GIMD.

While estimates of these impacts are wide ranging, on average, managers currently using AI expect a $14 trln boost to the global economy by 2030, broadly in line with other notable forecasts, and a 9% increase in global GDP over the same period

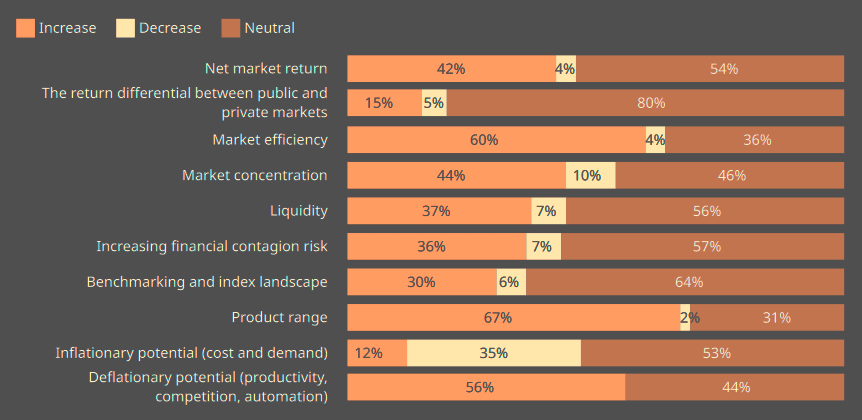

Interestingly, managers expect AI to increase market efficiency at the same time as increasing concentration in the market, a phenomenon typically resulting from inefficient herding mentality, according to Artificial Intelligence Integration in Investment report.

Plans for advancing AI capabilities

Managers currently using AI expect the integration of these capabilities to deliver positive economic benefits, both in terms of GDP growth and US$ contribution.

Mercer’s survey to build a more comprehensive snapshot of managers’ current use of AI technologies, advancing AI capabilities and expectations of the potential impacts of AI on investment strategies.

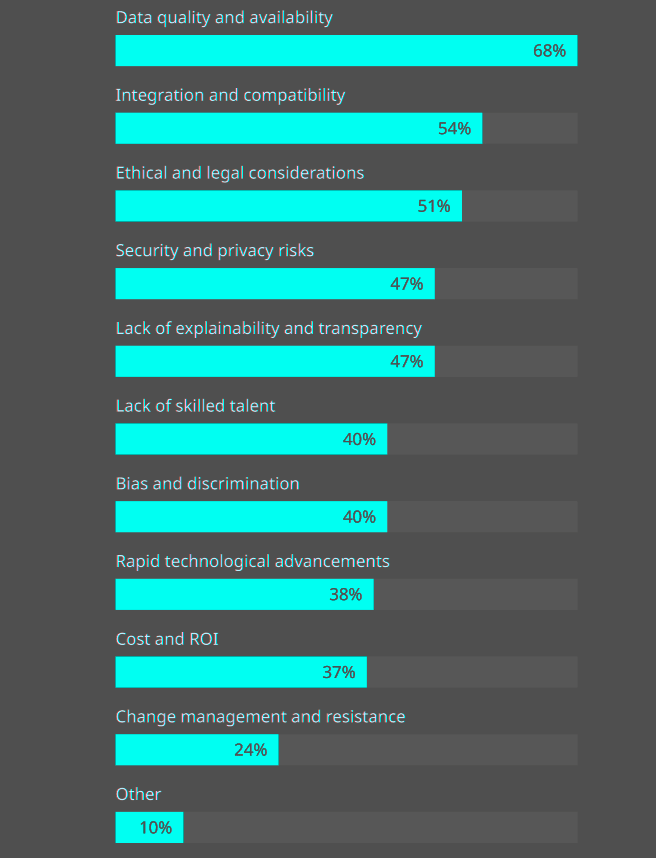

Among managers currently using AI, data quality and availability is the most-cited barrier to unlocking the technology’s full potential, followed by concerns around integration and compatibility and ethical and legal considerations.

- The rapid evolution of AI is of greater concern to managers that have yet to implement AI, highlighting the risks of AI advancement outpacing implementation across organizations.

- Divergent AI regulation is regarded as a significant risk factor by nearly half of managers.

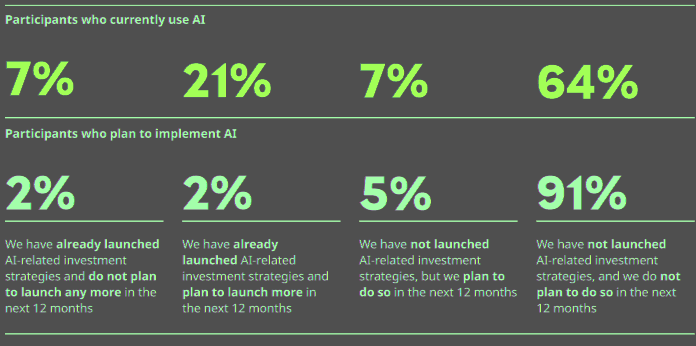

- Most managers that currently use AI have not launched AI-related most popular investment strategies and do not intend to do so in the next 12 months.

Among those already using AI, the technology sector naturally emerges as the most prominent area of opportunity for value creation, followed by healthcare, financial services and wealth management; legal services; banking and insurance.

Managers’ expectations of economic and industry impacts

Across the market and investment landscape at large, managers expect AI to drive a range of impacts over the next three years. At market level, 60% of managers expect AI to increase market efficiency, compared with 44% that expect it to increase market concentration.

The expanded application of AI may inevitably affect the efficiency of markets, though we are looking closely at the effects of AI on amplifying disinformation and momentum trading.

Julius Bendikas – European Head of Economics & Dynamic Asset Allocation at Mercer

The sheer scale of information and data being created — and regurgitated — risks creating new challenges that, somewhat ironically, could counteract some of the efficiencies realized through expanded applications of AI.

How do companies anticipate AI will impact?

More than half of managers (56%) expect AI to contribute to disinflationary forces in the economy, through productivity, automation and competition impacts driven by more widespread integration.

However, 42% of managers expect AI to deliver a net positive impact on market returns. Considering the effect of AI on the breadth of strategies and products, two-thirds of managers (67%) expect AI to increase their product range.

Risks and barriers to unlocking AI’s full potential

A significant proportion of managers cite multiple risks and barriers to successfully implementing AI to achieve a competitive advantage (see Artificial Intelligence Becomes an Unexpected Risk for Insurance).

Among managers currently using AI, data quality and availability is the most-cited barrier to unlocking AI’s full potential, identified by two-thirds of managers (68%). The prevalence of this concern is perhaps indicative of the focus of managers’ current AI applications, which center on expanding data analysis and idea generation.

More than half (54%) cite concerns around integration and compatibility, and ethical and legal considerations (51%).

Nearly half raise concerns around security and privacy risks (47%) and lack of “explainability” and transparency (47%). Lack of skilled talent (40%) and dangers of bias and discrimination (40%) are also prominent concerns.

For managers planning to use AI, the most-cited barriers are similar, with data quality and availability (61%) and ethical and legal considerations (52%) among the top concerns.

Are there any barriers or risks to achieving a competitive advantage through AI implementation?

Rapidly evolving technological advancements (52%), however, are also important among this group, highlighting the risks of AI advancement outpacing implementation across organizations yet to integrate AI (see about Generative AI Provides Great Opportunities for Insurers).

How significant do companies perceive the risks presented by divergent AI regulation to be?

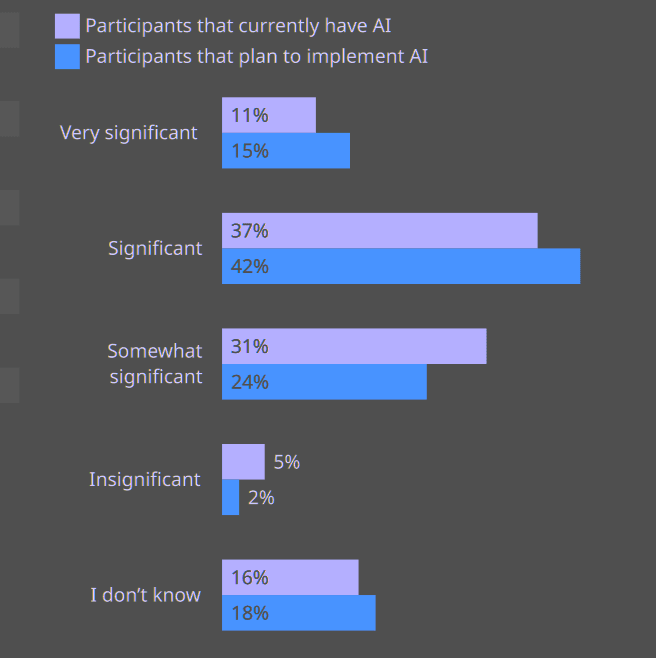

Divergent AI regulation is also regarded as a significant risk factor by many respondents. Among investment managers currently using AI, nearly half (48%) regard divergent regulation as a significant or very significant risk, rising to almost six in 10 (57%) among those that are yet to implement AI.

Have companies launched, or do they plan to launch, any AI-related investment strategies in the next 12 months?

“Managers’ evident concerns around the risks of divergent regulation reflect the broader challenge of evolving fiduciary obligations across different geographies and the critical role of expert advice — and breadth and depth of perspective — as all market participants assess the road ahead for AI regulation“, says Rich Dell, Senior Director Investment Research at Mercer.

Most managers have not launched AI-related strategies

At the level of product and strategy development, the majority of managers are yet to formalize AI-related investment strategies, though this may reflect differing interpretations or definitions of what constitutes an “AI-related strategy.”

Most managers that currently use AI (64%) have not launched AI-related investment strategies and do not intend to do so in the next 12 months, rising to 91% of managers planning to implement AI.

However, 36% of managers in the “currently use AI” cohort already have AI-related strategies or will within the next year. It is important to acknowledge the definitional challenges of “AI-related” strategies.

There is a broad spectrum of potential interpretations — and a universe of strategies ranging from fully autonomous processes driven by predictive AI to those that integrate AI capabilities to inform stock selection.

AI has long been used by quantitative and systematic managers, who have harnessed it in the execution of high-speed investment decisions, which has been invaluable for high-frequency trading strategies.

Alongside ongoing initiatives to enhance our evaluations of AI-related aspects of investment strategies, our manager research team remains focused on fundamental questions like, ‘Can the use of AI offer sustainable excess returns? And if so, how soon might these advantages be arbitraged away?

Simon Coxeter – Global Head of Multi-Asset Manager Research at Mercer

Merser’s findings highlight expanding adoption across a broader cohort of managers that is iterative and aims to augment existing investment capabilities.

Nevertheless, there is a key difference between implementing AI in this way and using it to develop new strategies from the product development phase onward. While some managers are embracing AI to the extent that they use it to build portfolios, uncertainty remains around their performance in the long term. With AI still in the early stages of development, managers are understandably cautious about using it to develop and fully implement investment strategies from the ground up.

………………..

AUTHORS: Joanne Holden – Global Head of Investment Research & Consulting at Mercer Investment Consulting, Ursula Niederberger – Strategic Investment Research at Mercer Investment Consulting, Julius Bendikas – European Head of Economics & Dynamic Asset Allocation at Mercer, Rich Dell – Senior Director Investment Research at Mercer, Simon Coxeter – Global Head of Multi-Asset Manager Research at Mercer